In 2025, the intersection of traditional finance and blockchain is no longer theoretical, it’s happening on Solana. The arrival of tokenized stocks on this high-performance network is fundamentally changing how investors access and trade equities. With the current price of Binance-Peg SOL (SOL) at $149. 08, Solana’s robust, low-fee infrastructure is proving to be a powerful engine for this new asset class.

Tokenized Stocks: The Bridge Between Wall Street and Crypto

Tokenized stocks are digital representations of real-world equities, such as Apple, Nvidia, or Tesla, issued and settled on a blockchain like Solana. Each token mirrors the value and performance of its underlying share, but with added benefits, fractional ownership, 24/7 trading, and seamless integration with decentralized finance (DeFi) tools.

The surge in demand for Solana tokenized assets is fueled by recent launches from major players:

Key Platforms Offering Tokenized Stocks on Solana

-

Kraken xStocks: Kraken launched xStocks in May 2025, enabling global clients to trade over 50 tokenized U.S. equities and ETFs—such as Apple, Tesla, and Nvidia—directly on the Solana blockchain, with 24/7 access and no traditional intermediaries.

-

Backed Finance (xStocks): Backed Finance introduced its xStocks product on Solana, offering tokenized versions of more than 60 major stocks and ETFs, including Apple, Microsoft, and the Core S&P 500 ETF, across both centralized exchanges and DeFi protocols.

-

Ranger Spot: Ranger now provides tokenized trading of leading U.S. stocks—such as Apple, Nvidia, and Tesla—on the Solana network, integrating with xStocksFi for seamless swaps and DeFi access.

-

Step Finance: Following its acquisition of Remora in December 2024, Step Finance enables users to buy and sell tokenized shares of companies like Nvidia and Tesla directly on Solana, enhancing portfolio diversification and reducing settlement times.

-

Opening Bell (Upexi Initiative): Opening Bell is the platform chosen by Nasdaq-listed Upexi to tokenize its SEC-registered shares on Solana, reflecting the trend of public companies leveraging blockchain for equity tokenization.

This push is not just about accessibility, it’s about creating programmable equity that can be used as collateral in DeFi protocols, staked for yield, or swapped instantly with other crypto assets.

Major Launches Shaping the Tokenized Stock Market in 2025

The last six months have seen a flurry of activity around trade equities on Solana. Here are some pivotal developments:

- Kraken’s xStocks Launch: In May 2025, Kraken introduced xStocks, a suite of over 50 U. S. -listed securities (including Apple and Nvidia): on Solana. Non-U. S. clients can now trade these assets around the clock without relying on Wall Street’s opening bell. (source)

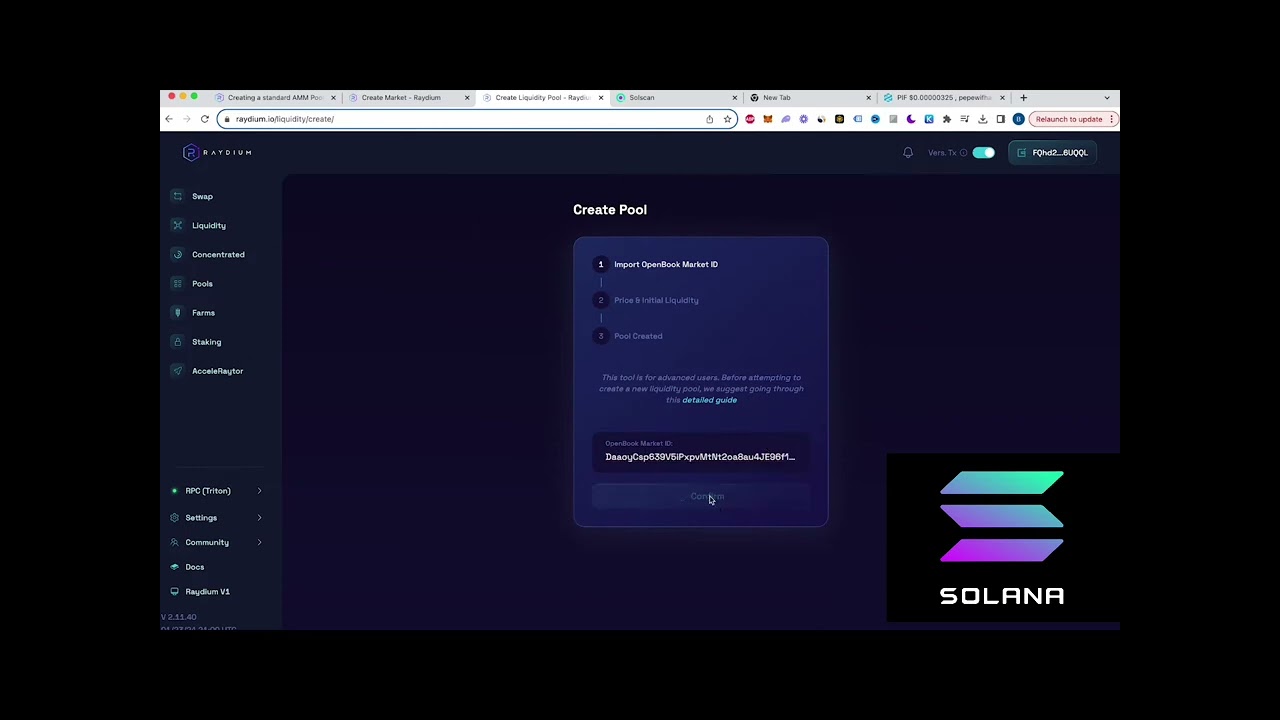

- Backed Finance Expansion: Backed Finance’s xStocks product went live across Bybit, Kraken, and DeFi-native protocols like Raydium and Jupiter. Investors gain exposure to more than 60 tokenized stocks and ETFs, including Microsoft and the Core S and P 500 ETF, directly within their crypto wallets.

- Ranger Spot Solana Integration: Ranger Spot now lists xStocksFi tokens for direct swaps between tokenized equities and major cryptocurrencies, a feature that streamlines portfolio management for active traders.

- Nvidia Tokenization Milestone: Starting July 1st, Nvidia shares are tradable as tokens on Solana via Kraken and Bybit, a first for a major tech stock in this format.

The cumulative effect? Investors can now build diversified portfolios containing both crypto assets and traditional stocks, all secured by Solana’s lightning-fast settlement layer.

The Technical Edge: Why Solana Leads Tokenization

The appeal of xStocksFi review products lies not just in their market coverage but also in their technical underpinnings. With transaction fees often less than a cent, and block times measured in milliseconds, Solana enables instant settlement without the bottlenecks typical of legacy financial rails.

This cost efficiency directly benefits users: trades execute rapidly at minimal cost compared to traditional brokerages or other blockchains. Moreover, integration with DeFi means these tokens can be deposited into pools or used as loan collateral within seconds, a level of composability previously unseen in finance.

What Makes Tokenized Stocks Unique?

- No Traditional Barriers: No minimum account sizes or geographic restrictions, anyone with a wallet can participate.

- Around-the-Clock Trading: Markets never close; liquidity is always available through automated market makers (AMMs) like Jupiter or Raydium.

- Diversification Within Crypto: Blend exposure to both volatile crypto coins and stable blue-chip equities within one ecosystem.

- Simplified Settlement: Trades finalize instantly, no waiting two days for clearinghouses or custodians.

This convergence isn’t just theoretical anymore; it’s live today across platforms like Backed Finance’s xStocks (see details here) and Ranger Spot (source). As we move deeper into “Solana Summer, ” expect even more innovation at this intersection of TradFi and DeFi.

Beyond the technical leap, tokenized stocks on Solana are catalyzing a new era of financial inclusion. The ability to buy fractional shares, participate in global markets without intermediaries, and access equities with only a smartphone is redefining what it means to be an investor in 2025. This democratization is particularly impactful for users outside established financial hubs, who can now access blue-chip stocks like Apple and Nvidia as easily as they trade SOL or USDC.

DeFi Synergy: Unlocking New Use Cases for Tokenized Equities

Perhaps the most transformative aspect of this shift is how tokenized stocks integrate directly into DeFi protocols. On Solana, holders can:

Top DeFi Use Cases for Tokenized Stocks on Solana

-

24/7 Trading of U.S. Equities: Platforms like Kraken and Ranger Spot now enable round-the-clock trading of tokenized stocks such as Apple, Tesla, and Nvidia on Solana, removing traditional market hour constraints.

-

Collateralization in DeFi Protocols: Tokenized stocks from Backed Finance (xStocks) can be used as collateral on Solana-based DeFi platforms, allowing users to borrow stablecoins or other assets while maintaining equity exposure.

-

Portfolio Diversification Within the Crypto Ecosystem: With Step Finance’s acquisition of Remora, Solana users can seamlessly manage and diversify portfolios by holding both crypto assets and tokenized traditional equities in a single dashboard.

-

Access to Global Investors and Fractional Ownership: Initiatives like Upexi’s share tokenization on Solana allow for fractionalized, borderless ownership of U.S.-listed equities, broadening access to retail and international investors.

For example, you might stake tokenized Tesla shares in a liquidity pool on Raydium or use your xAAPL tokens as collateral to borrow USDC instantly through Kamino. This composability creates powerful new strategies for yield generation and risk management, without ever leaving the blockchain.

Risks, Regulation, and What to Watch

While the promise is huge, investors should remain aware of evolving regulatory frameworks around crypto stocks 2025. Jurisdictions differ on how tokenized equities are classified and what rights they confer. Platforms like Backed Finance and Ranger Spot have prioritized compliance by working with licensed custodians and ensuring their products reflect real share ownership where possible. Still, due diligence remains essential: always confirm that your tokens are backed by real assets and understand the platform’s legal structure before investing.

Market volatility is another consideration. While Solana’s network has proven resilient, SOL is currently priced at $149. 08: tokenized assets can still be affected by both crypto market swings and traditional equity price movements. Diversification and risk management tools within DeFi can help mitigate these risks but don’t eliminate them entirely.

“Tokenization isn’t just about replicating Wall Street on-chain, it’s about reimagining finance as open, programmable, and accessible to all. ”

The Road Ahead: Where Tokenized Stocks Go From Here

The momentum behind Solana tokenized assets shows no signs of slowing down. With over 60 major equities now live across platforms like Bybit, Kraken, Raydium, Jupiter, Kamino, and Ranger Spot (source), we’re witnessing a genuine convergence of TradFi scale with DeFi speed and flexibility.

This trend will likely accelerate as more public companies explore direct tokenization (as seen with Upexi’s SEC-registered shares) and as institutional players enter the space seeking real-world asset (RWA) exposure within crypto rails. The coming months could bring innovations such as automated dividend distribution via smart contracts or even governance rights embedded into equity tokens themselves.

Final Thoughts: Why Investors Should Pay Attention

If you’re evaluating new opportunities in crypto for 2025, keep a close eye on how tokenized stocks Solana are evolving:

- Bigger portfolios: Blend traditional equities with high-growth crypto assets in one wallet.

- Simpler access: No legacy account hurdles, just connect your wallet and trade.

- Programmable finance: Use your equity holdings in ways never possible before, from staking to instant swaps to borrowing against your portfolio.

The ecosystem is still young but growing rapidly, and the lines between Wall Street and Web3 are blurring faster than anyone expected. For both seasoned traders and newcomers alike, Solana’s tokenized stock revolution offers a compelling glimpse into the future of investing.