Solana’s validator landscape is about to undergo its most consequential transformation yet. The SIMD-0357 Alpenglow Epochs proposal, now overwhelmingly approved by 99% of validators, signals a seismic shift in how network security, performance, and governance will function. With Binance-Peg SOL (SOL) trading at $201.25 as of October 14,2025, the market is already pricing in the impact of this upgrade. But what exactly is changing, and why does it matter for the future of the Solana ecosystem?

Alpenglow: From TowerBFT to Votor – The New Security Paradigm

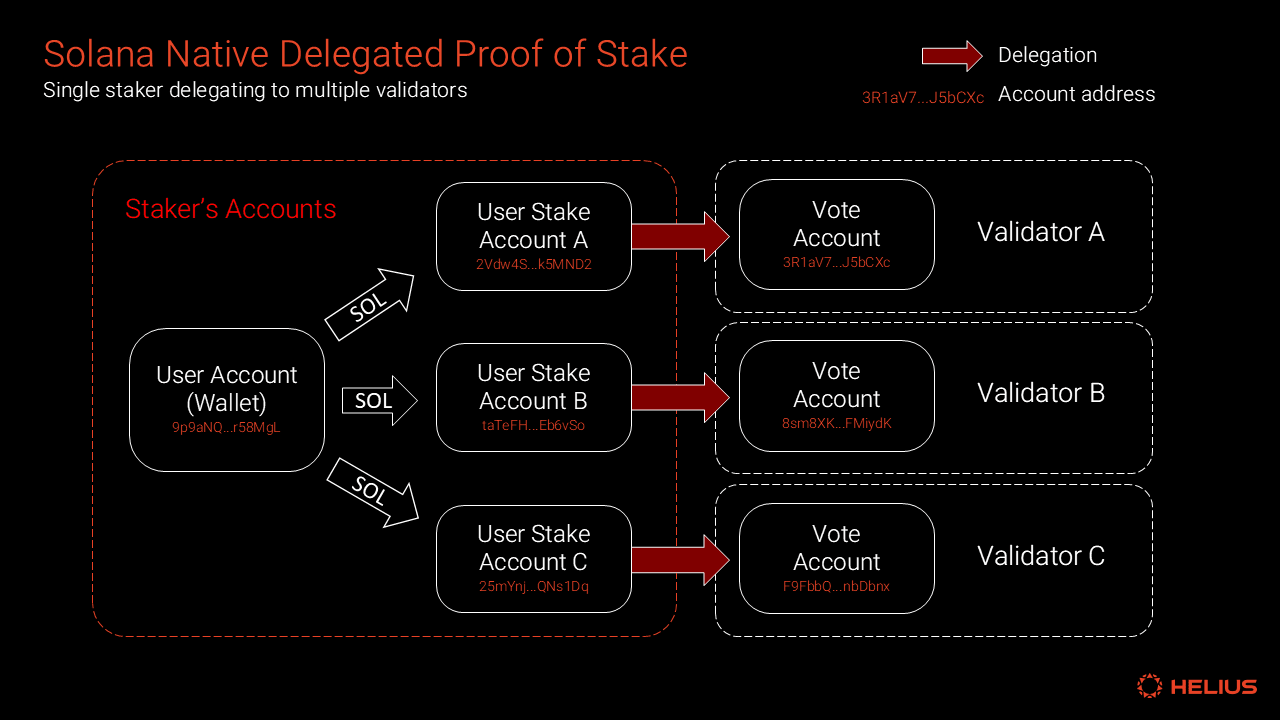

The core of SIMD-0357 is the introduction of Alpenglow epochs, which replace Solana’s legacy Proof-of-History (PoH) and TowerBFT consensus with a radically different architecture. The new system centers on Votor, a direct-vote finality engine that slashes block finalization times from 12.8 seconds down to an astonishing 100,150 milliseconds. This isn’t just a performance boost – it’s a fundamental overhaul of how validators interact with the chain.

By moving validator voting off-chain, Alpenglow reduces bandwidth overhead across the network. Validators now submit their votes through a new mechanism that is both faster and more scalable, directly addressing previous bottlenecks in network throughput and latency. This change also aligns with broader efforts to make Solana competitive with high-frequency financial markets and real-time gaming applications.

The Validator Admission Ticket (VAT): Raising the Bar for Network Security

A standout feature of SIMD-0357 is the introduction of the Validator Admission Ticket (VAT). To join each epoch’s active set, validators must pay a fee of 1.6 SOL per epoch. Crucially, this fee isn’t redistributed as rewards – it is burned, directly offsetting inflation and tightening economic incentives. This mechanism serves two purposes:

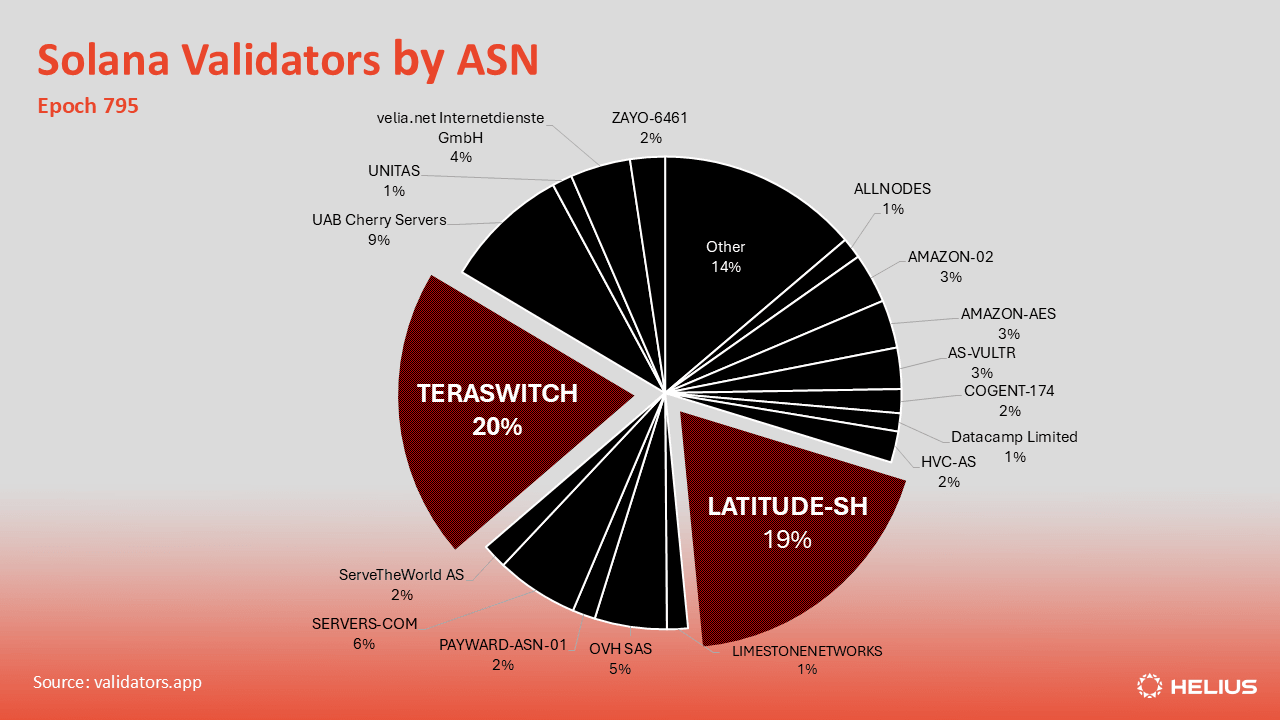

- Discourages Sybil attacks: By raising the cost to participate, VAT makes it economically infeasible for malicious actors to spin up large numbers of validators.

- Incentivizes professionalization: Only validators committed to running reliable infrastructure will consistently pay the fee, raising overall network security.

The VAT system has sparked debate in developer forums and social channels. Some see it as a necessary evolution for long-term sustainability; others worry about barriers for smaller operators. But with nearly unanimous approval in recent governance rounds (source), it’s clear that the majority believes this trade-off is worth it for greater resilience.

Epoch Dynamics: How Alpenglow Changes Validator Set Rotation

The epoch structure itself is getting an upgrade. Under Alpenglow, entry into the active validator set is no longer automatic or solely stake-based. Instead, each epoch acts as a discrete admission window, enforced by VAT payments. This approach:

- Makes validator rotation predictable and auditable

- Lowers churn risk, since only those who have paid VAT are considered for selection

- Simplifies slashing logic, since validator misbehavior can be tied directly to epoch participation records

This predictability increases transparency for delegators and protocol developers alike – an actionable improvement over previous systems where validator churn could introduce subtle attack vectors or degrade performance during periods of volatility.

Solana (SOL) Price Prediction Post-Alpenglow Upgrade (2026–2031)

Forecast based on current price ($201.25) and anticipated impact of the SIMD-0357 Alpenglow upgrade on Solana’s security, scalability, and adoption.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $170.00 | $240.00 | $325.00 | +19.2% | Initial post-upgrade volatility; rapid adoption in DeFi/NFTs, but macro uncertainty. |

| 2027 | $210.00 | $295.00 | $410.00 | +22.9% | Ecosystem growth, more Layer-2s, regulatory clarity improves sentiment. |

| 2028 | $230.00 | $360.00 | $530.00 | +22.0% | Bullish cycle; institutional adoption rises, competition with Ethereum intensifies. |

| 2029 | $250.00 | $420.00 | $670.00 | +16.7% | Potential market correction; robust use cases sustain higher average prices. |

| 2030 | $275.00 | $480.00 | $800.00 | +14.3% | Mass adoption phase; Solana cements role in DeFi, gaming, and tokenization. |

| 2031 | $310.00 | $550.00 | $950.00 | +14.6% | Mature market; SOL considered a blue-chip asset, but faces new challengers. |

Price Prediction Summary

Solana’s successful implementation of the Alpenglow upgrade is expected to dramatically improve validator security, reduce transaction finality times, and enhance scalability. These improvements should strengthen Solana’s position in the blockchain ecosystem, driving increased adoption from developers and institutions, especially in DeFi and NFTs. While price volatility remains likely, the long-term outlook is bullish, with SOL potentially reaching new all-time highs by 2031 if the network continues to innovate and attract usage.

Key Factors Affecting Solana Price

- Alpenglow upgrade drastically reduces transaction finality time to ~150ms, improving user experience.

- Validator Admission Ticket (VAT) system introduces deflationary mechanics (fee burn), potentially reducing supply.

- Overwhelming validator and community support (99% approval) strengthens network security and decentralization.

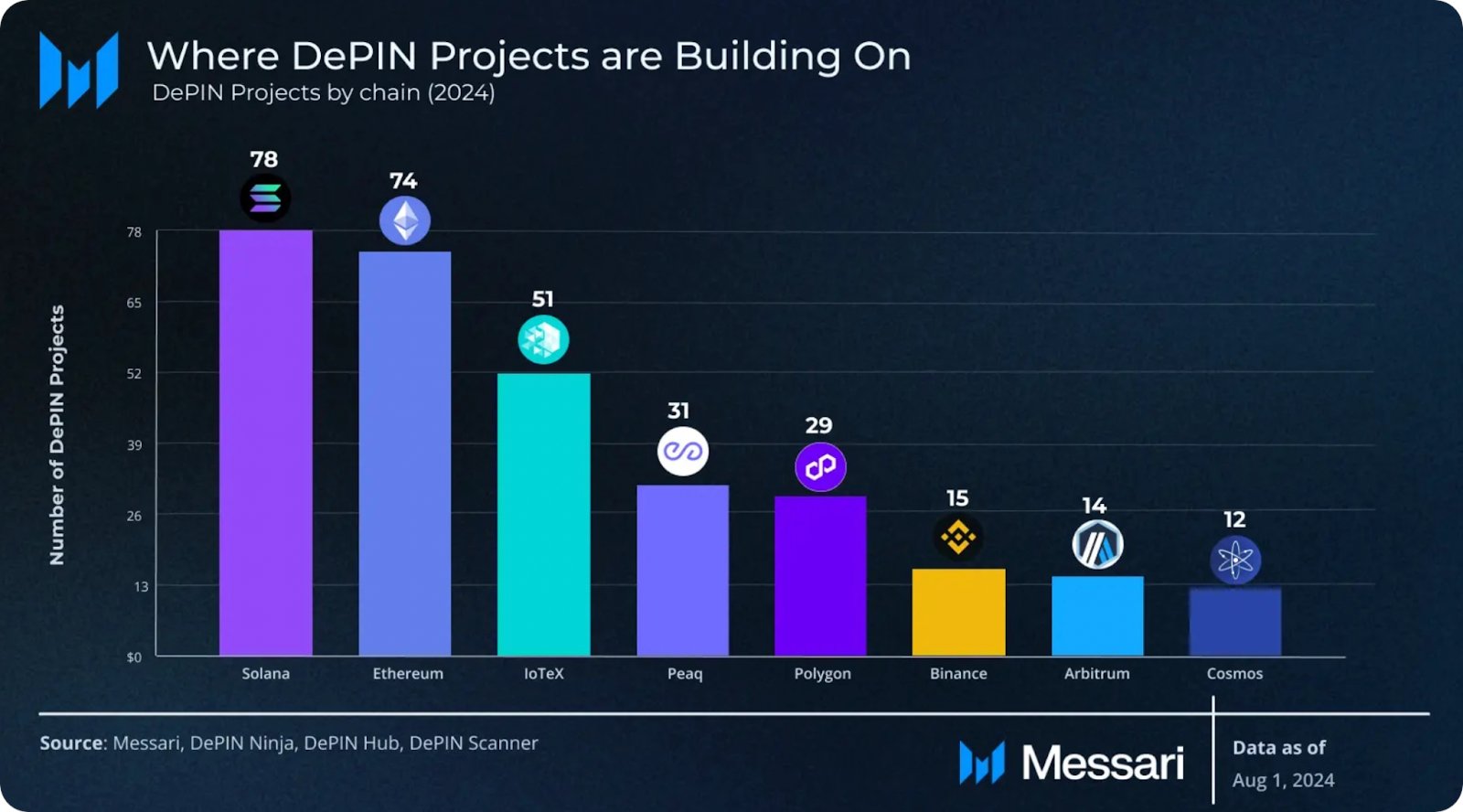

- Potential for new DeFi, NFT, gaming, and institutional use cases as throughput and reliability increase.

- Ongoing competition from Ethereum, Sui, and other high-throughput chains could cap upside if Solana’s execution falters.

- Further upgrades (e.g., Firedancer, SIMD-0370) may unlock additional scalability and performance gains.

- Macro factors: global regulatory trends, crypto market cycles, and risk appetite will affect SOL’s price trajectory.

- Adoption by major enterprises and integration with TradFi infrastructure could drive demand in later years.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Community Pulse: What Are Validators Saying?

The SIMD-0357 proposal has galvanized discussion across Reddit, X (formerly Twitter), and developer forums. Many see it as an existential upgrade – not just for speed but for trustlessness at scale. As one Redditor put it: “This isn’t just about milliseconds. It’s about making sure Solana survives its own success. ” The near-unanimous vote reflects broad alignment among stakeholders on the need for proactive security measures as Solana’s DeFi and NFT volumes continue to surge.

While technical consensus has been reached, the real test will be in execution and monitoring. The shift to Votor and VAT fundamentally alters validator incentives and operational requirements. Validators must now weigh the cost of VAT against expected rewards and network health, introducing a new calculus for infrastructure providers. This also means that validator operators who previously relied on low-cost setups or minimal oversight may find themselves priced out or forced to professionalize. The net effect is a more robust, attack-resistant validator set primed for institutional-level reliability.

Ecosystem Impact: What Alpenglow Means for Solana’s Future

Alpenglow is poised to redefine the competitive landscape for smart contract platforms. By slashing block finality to 100-150 milliseconds and tightening validator requirements, Solana positions itself as the lowest-latency, high-throughput blockchain for real-time applications. This is especially relevant for DeFi protocols that require sub-second settlement and NFT marketplaces where user experience hinges on instant confirmation. The upgrade also sets the stage for further innovations such as dynamic block sizing, as discussed in the upcoming SIMD-0370 Firedancer proposal (source).

Key Takeaway: The Alpenglow upgrade, anchored by SIMD-0357, marks a paradigm shift in both security and performance. Validators are incentivized to deliver enterprise-grade uptime, while users benefit from near-instant transaction finality.

Key Benefits of Alpenglow Epochs for Solana Validator Security

-

Ultra-Fast Finality with Votor: Alpenglow epochs introduce the Votor direct-vote finality engine, reducing block finalization times to just 100–150 milliseconds—a dramatic improvement from the previous 12.8 seconds. This rapid finality minimizes the window for potential attacks and increases network resilience.

-

Off-Chain Validator Voting: By moving validator voting off-chain, Alpenglow reduces bandwidth overhead and mitigates network congestion. This architectural change makes it harder for malicious actors to disrupt consensus, strengthening overall validator security.

-

Validator Admission Ticket (VAT) System: Validators must now pay a 1.6 SOL fee per epoch (currently $201.25 per SOL) to participate, with fees burned to offset inflation. This economic barrier discourages Sybil attacks and ensures only committed participants secure the network.

-

Community-Driven Security Improvements: The 99% validator approval for Alpenglow underscores broad community support, aligning incentives and reducing the risk of centralized decision-making or malicious collusion.

-

Enhanced Network Efficiency: The shift to Alpenglow epochs optimizes resource usage, leading to higher throughput and reduced attack surfaces—especially critical for DeFi and NFT applications where security and speed are paramount.

For delegators and token holders, these technical changes mean more than just speed. They represent a maturing ecosystem where governance proposals are not just debated but rigorously vetted and implemented with overwhelming community support. With SOL trading at $201.25, the market is signaling confidence in Solana’s ability to innovate while maintaining security at scale.

Actionable Steps: How Validators Should Prepare

If you operate a validator or are considering entering the active set, here’s what you need to do:

- Budget for VAT fees: Ensure your operation can sustainably pay 1.6 SOL per epoch, no exceptions.

- Upgrade infrastructure: Latency and uptime matter more than ever; invest in hardware and monitoring tools.

- Engage with governance: Stay current on proposals like SIMD-0370 that may further impact validator economics.

The SIMD-0357 Alpenglow upgrade is more than an incremental update, it’s an inflection point that will define Solana’s validator landscape through 2025 and beyond. As always, disciplined risk management remains paramount for operators navigating this new era.