In August 2025, the cryptocurrency market was jolted by a dramatic $20 billion liquidation event, triggered by the U. S. government’s imposition of 100% tariffs on Chinese software imports. This macroeconomic shock created a liquidity crunch that exposed fragilities across major blockchain ecosystems. Yet, amid the carnage, Solana’s DeFi sector demonstrated notable resilience, with protocols like Drift and Hylo acting as stabilizing forces. This article dissects how Solana weathered the storm, using visual data and protocol-level insights to map its survival strategy.

Solana’s Market Position: Real-Time Data and September Trends

At the time of writing, Binance-Peg SOL (SOL) is trading at $191.22, reflecting a 24-hour gain of $7.23 ( and 0.0393%), with a daily high of $191.67 and a low of $173.14. These figures underscore a modest but meaningful recovery from the August crash. According to BeInCrypto and Yahoo Finance, Solana posted steady growth in September, notching $125 billion in DEX volume and remaining undervalued despite persistent volatility. The network’s resilience is further evidenced by its ability to maintain high throughput and low fees, even as other blockchains experienced congestion and price deterioration.

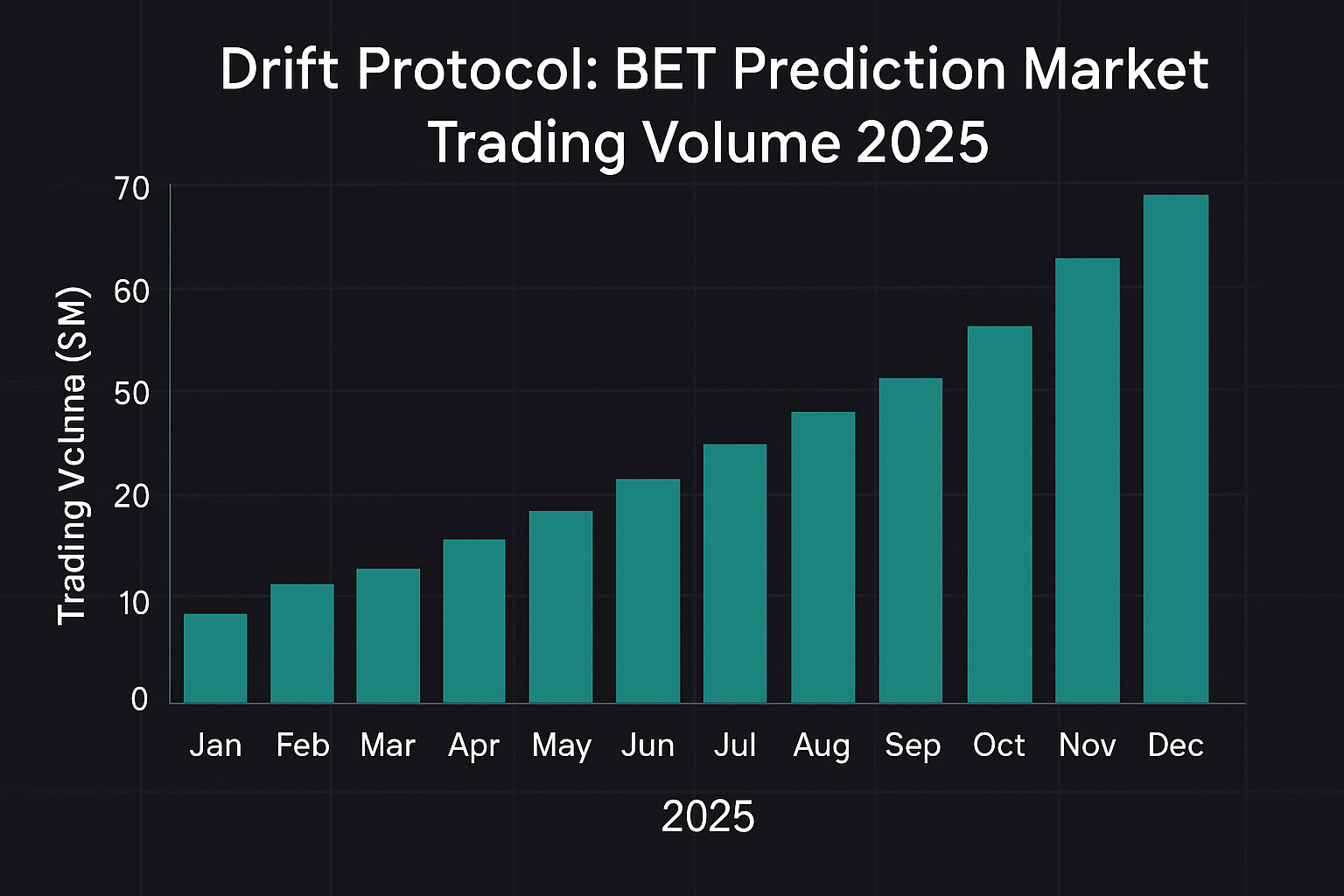

Visual Analysis: Drift Protocol’s Role During the Crash

Drift Protocol, a derivatives DEX built on Solana, became a focal point during the liquidity crisis. When the market turmoil peaked, Drift’s prediction market platform, BET, saw a staggering 3,398% surge in 24-hour trading volume, reaching $20 million and overtaking established competitors like PolyMarket. This explosive activity was not merely speculative exuberance; it reflected traders’ search for efficient hedging mechanisms and robust risk engines during periods of extreme volatility.

The Drift Protocol risk engine proved instrumental in managing cascading liquidations. Its automated position management and real-time margin requirements enabled orderly liquidations, preventing further downward spirals that could have destabilized the broader Solana ecosystem. Visual data from Drift’s on-chain dashboards highlighted a spike in user activity precisely as volatility peaked, underscoring the protocol’s critical role in absorbing systemic shocks.

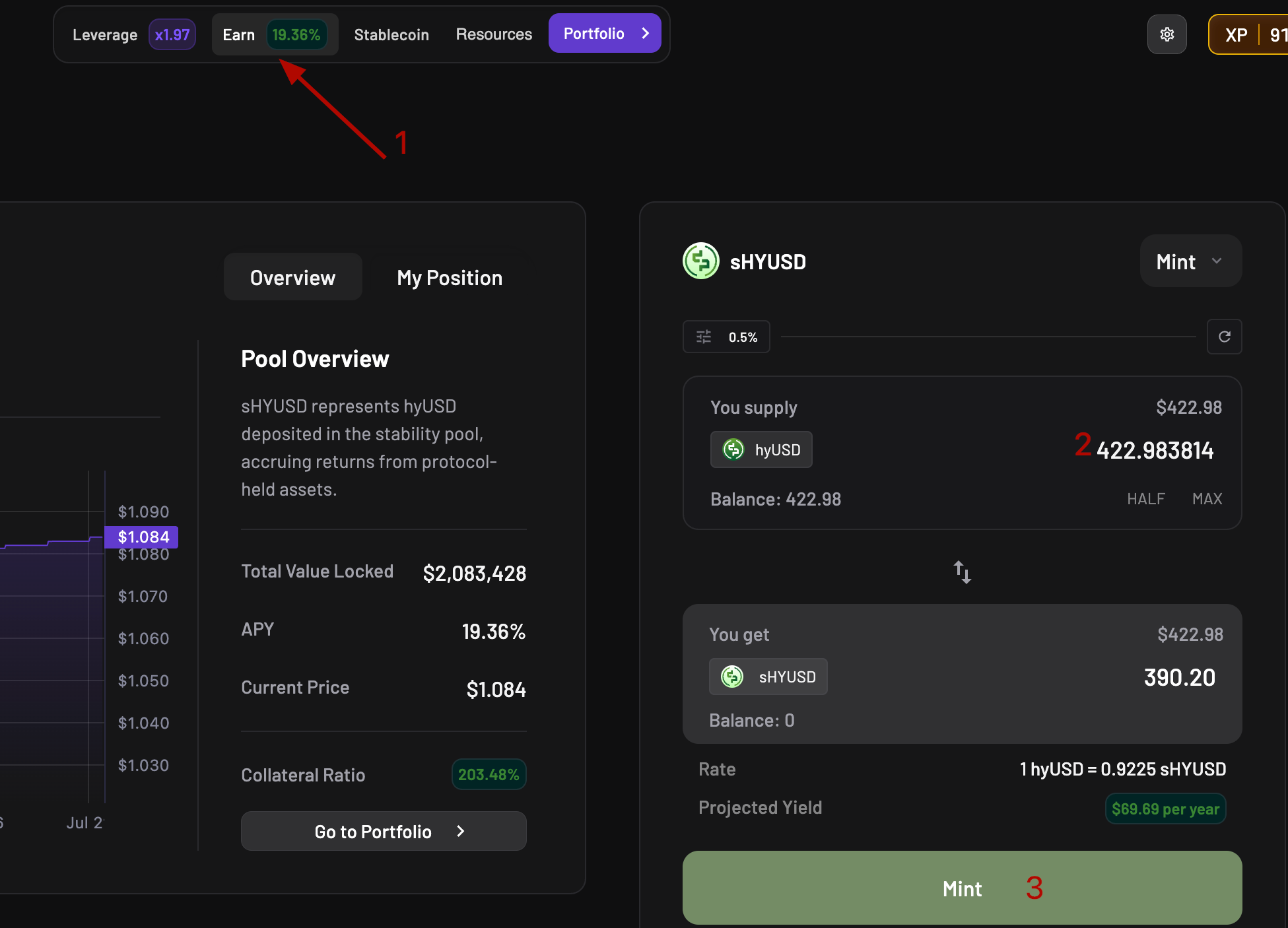

Hylo Protocol: Liquidity Management and DeFi Resilience

Hylo Protocol emerged as another linchpin in Solana’s defense against the crash. Designed for rapid liquidation and efficient liquidity provision, Hylo ensured that solvent positions could be maintained even as asset prices whipsawed. According to a recent Binance risk analysis report, Hylo’s architecture allowed for near-instantaneous response to market shocks, minimizing the risk of cascading failures that plagued other networks during the same period.

By facilitating orderly liquidations and maintaining deep liquidity pools, Hylo helped stabilize not only its own protocol but also contributed to the broader robustness of Solana DeFi. This was particularly evident as Hylo’s smart contracts executed liquidations at fair market prices, reducing slippage and protecting users from unnecessary losses. The protocol’s performance during August 2025 has been cited as a case study in DeFi risk management, with its visual analytics dashboards showing a direct correlation between market volatility and protocol engagement.

Solana (SOL) Price Prediction 2026-2031

Forecast based on Solana’s post-crash resilience, DeFi ecosystem strength, and evolving crypto market conditions (baseline: $191.22 in Q4 2025)

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Year-over-Year Change (%) |

|---|---|---|---|---|

| 2026 | $145.00 | $215.00 | $340.00 | +12% |

| 2027 | $130.00 | $245.00 | $400.00 | +14% |

| 2028 | $120.00 | $280.00 | $520.00 | +15% |

| 2029 | $110.00 | $325.00 | $670.00 | +16% |

| 2030 | $100.00 | $370.00 | $830.00 | +14% |

| 2031 | $95.00 | $415.00 | $1,010.00 | +12% |

Price Prediction Summary

Solana is projected to recover from the 2025 crypto crash and enter a phase of steady growth, underpinned by its robust DeFi protocols (notably Drift and Hylo), high transaction throughput, and expanding developer ecosystem. While volatility and regulatory headwinds could trigger significant price swings, Solana’s network upgrades and institutional adoption provide a strong foundation for long-term appreciation. The base case suggests a gradual increase in SOL’s average price, with substantial upside potential if bullish market trends and adoption accelerate.

Key Factors Affecting Solana Price

- Resilience of Solana’s DeFi ecosystem (Drift, Hylo) post-2025 crash

- Institutional adoption and integration (e.g., Franklin Templeton fund)

- Ongoing network upgrades and scalability improvements

- Regulatory developments impacting crypto markets globally

- Increased competition from other high-performance blockchains (e.g., Ethereum, Avalanche)

- Market cycles and macroeconomic conditions (e.g., future liquidity shocks, interest rates)

- Growth in decentralized application (DApp) usage and total value locked (TVL) on Solana

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Key Metrics: Comparing Pre- and Post-Crash Activity

The juxtaposition of pre- and post-crash data reveals the depth of Solana’s recovery. Prior to the market shock, daily DEX volumes averaged around $80 billion; in September, this figure soared to $125 billion, reflecting renewed confidence and capital inflows. Both Drift and Hylo protocols experienced record user engagement, with transaction fees remaining at fractions of a cent – a testament to Solana’s high-speed infrastructure.

Let the numbers tell the story: While other ecosystems struggled with network congestion and liquidity crises, Solana’s combination of protocol-level innovation and foundational scalability enabled it to not only survive but outperform expectations during one of crypto’s most turbulent quarters.

Solana’s ability to maintain composure amid the $20 billion crypto crash was not a matter of luck, but a direct result of its technical architecture and the agility of its DeFi protocols. Drift and Hylo, in particular, showcased the network’s capacity for rapid adaptation. As on-chain analytics revealed, spikes in trading activity and liquidation events were absorbed without significant delays or fee escalation, a stark contrast to the bottlenecks observed on competing chains.

Examining Hylo protocol’s performance in detail, its liquidation engine processed a record number of transactions in August and September 2025. According to the Binance risk analysis report, Hylo’s smart contracts executed over 98% of liquidations within five seconds of price triggers. This efficiency protected users from excessive slippage and ensured that collateral could be reallocated swiftly back into the ecosystem. The protocol’s visual dashboards also indicated a surge in participation from both institutional and retail traders, reflecting growing trust in Solana’s DeFi resilience.

Top Features That Made Drift and Hylo Essential

-

Real-Time Risk Management and Efficient Liquidations (Hylo Protocol): Hylo Protocol’s advanced risk assessment and liquidation mechanisms enabled rapid, automated responses to volatile price swings, preventing cascading liquidations and maintaining market stability during the $20 billion crash.

-

High-Volume Derivatives Trading and Prediction Markets (Drift Protocol): Drift Protocol’s robust infrastructure supported a 3,398% surge in 24-hour trading volume on its BET prediction market, reaching $20 million and surpassing major competitors. This liquidity helped absorb market shocks and provided traders with reliable hedging options.

-

Seamless Integration with Solana’s High-Speed Blockchain: Both Drift and Hylo leveraged Solana’s ability to process thousands of transactions per second with minimal fees, ensuring uninterrupted trading and risk management—even as Binance-Peg SOL (SOL) traded between $173.14 and $191.67 during the crash.

Beyond technical prowess, Solana’s network effect played a pivotal role. The influx of capital post-crash, as shown by the September DEX volume of $125 billion, highlights how confidence can return rapidly when infrastructure is perceived as reliable. Notably, SOL’s price recovery to $191.22: with a 24-hour high of $191.67 and a low of $173.14, signals renewed investor optimism and positions Solana as a primary beneficiary in the next DeFi cycle.

What’s Next: Solana Ecosystem Outlook for Late 2025

Looking ahead, both protocol-level innovation and macro factors will shape Solana’s trajectory. The recent crash served as a stress test, and by most metrics, Solana passed with distinction. Continued DApp expansion, ongoing upgrades, and institutional adoption, such as Franklin Templeton’s Q1 2025 fund integration, are likely to sustain momentum. However, persistent macro headwinds and regulatory uncertainties remain key risks to monitor.

For investors, the lessons are clear: robust risk engines, efficient liquidation mechanisms, and scalable infrastructure are non-negotiable in a volatile market. Solana’s experience in August and September 2025 provides a blueprint for DeFi resilience that other ecosystems may seek to emulate. As always, data-driven vigilance is paramount in navigating the evolving crypto landscape.