Solana’s validator landscape is getting a serious shakeup, and it’s all thanks to DoubleZero’s ambitious new program. With a jaw-dropping 3 million SOL (that’s about $537 million at today’s price of $208.16) staked under the DZSOL ticker, DoubleZero is putting decentralization front and center for Solana in 2025. But what does this mean for the network, and why should every Solana builder, staker, or memecoin degenerate care? Let’s break it down.

Why DoubleZero Is Betting Big on Decentralization

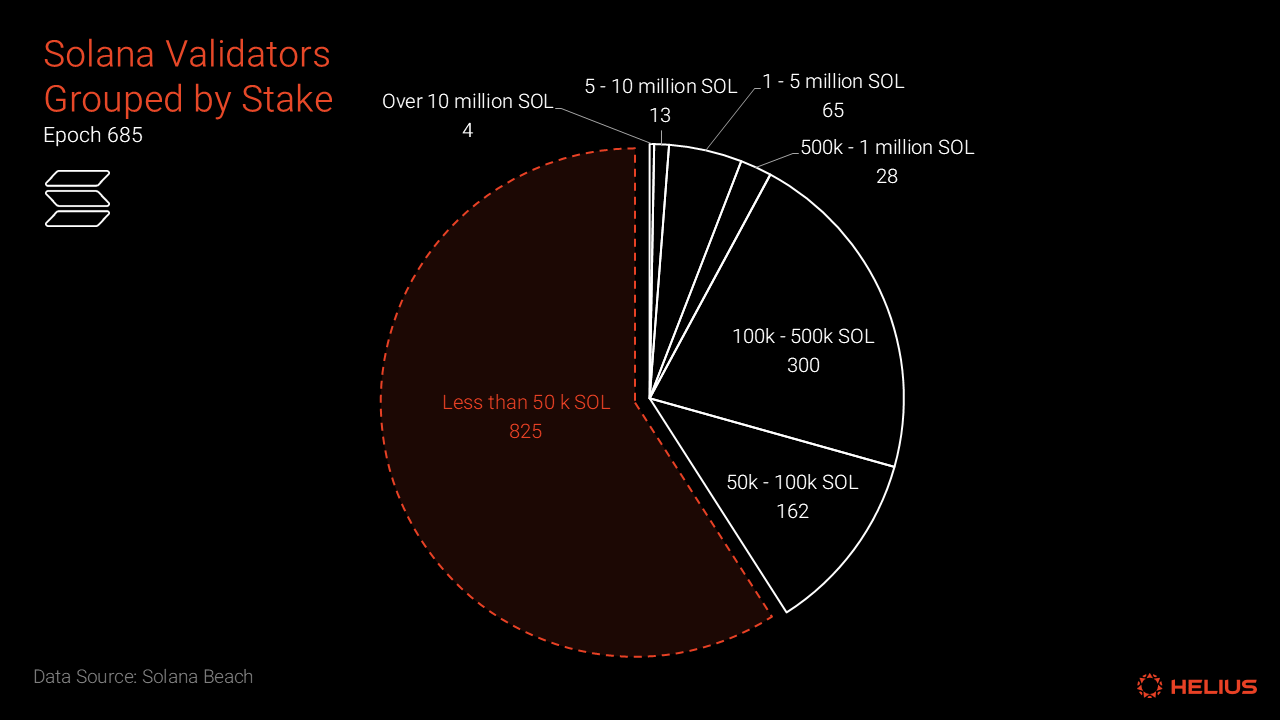

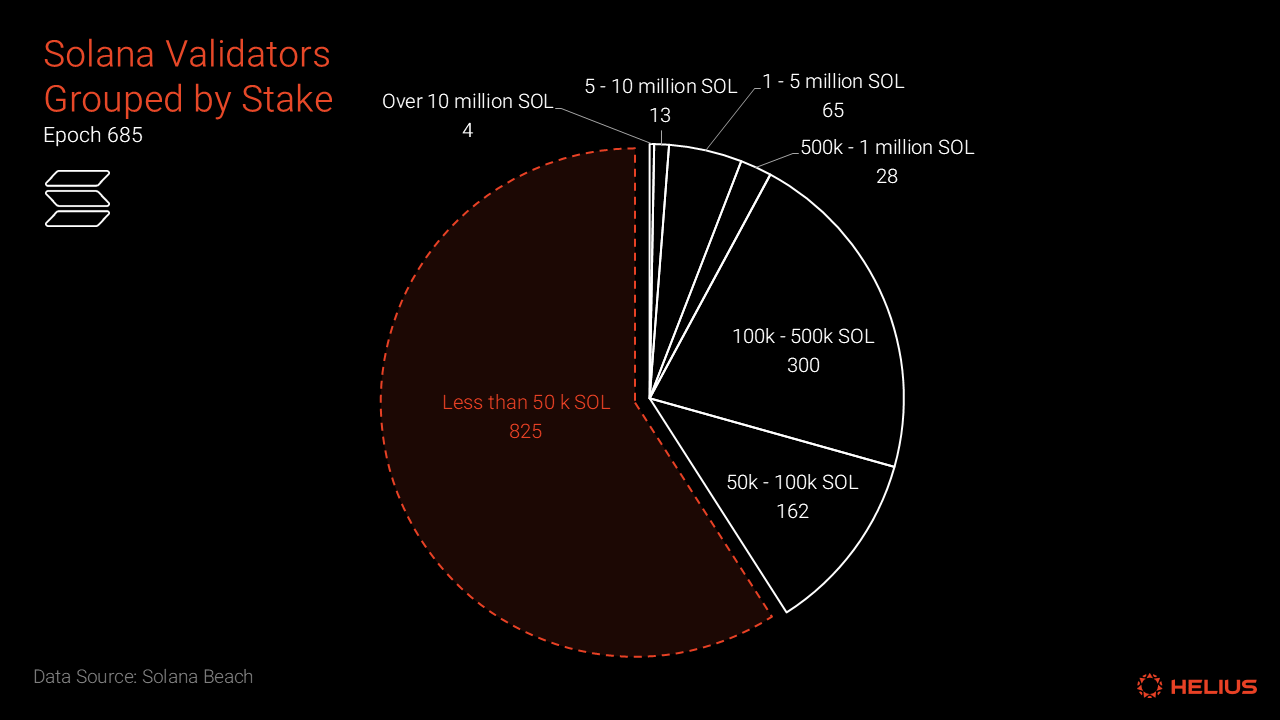

The Solana ecosystem has always been about speed and scale, but true decentralization hasn’t always kept up. Enter DoubleZero: a protocol laser-focused on making validator onboarding not just accessible but genuinely competitive. Their 3 million SOL delegation pool is designed to turbocharge validator participation by giving smaller and emerging operators access to capital that would otherwise be locked away by whales or legacy players.

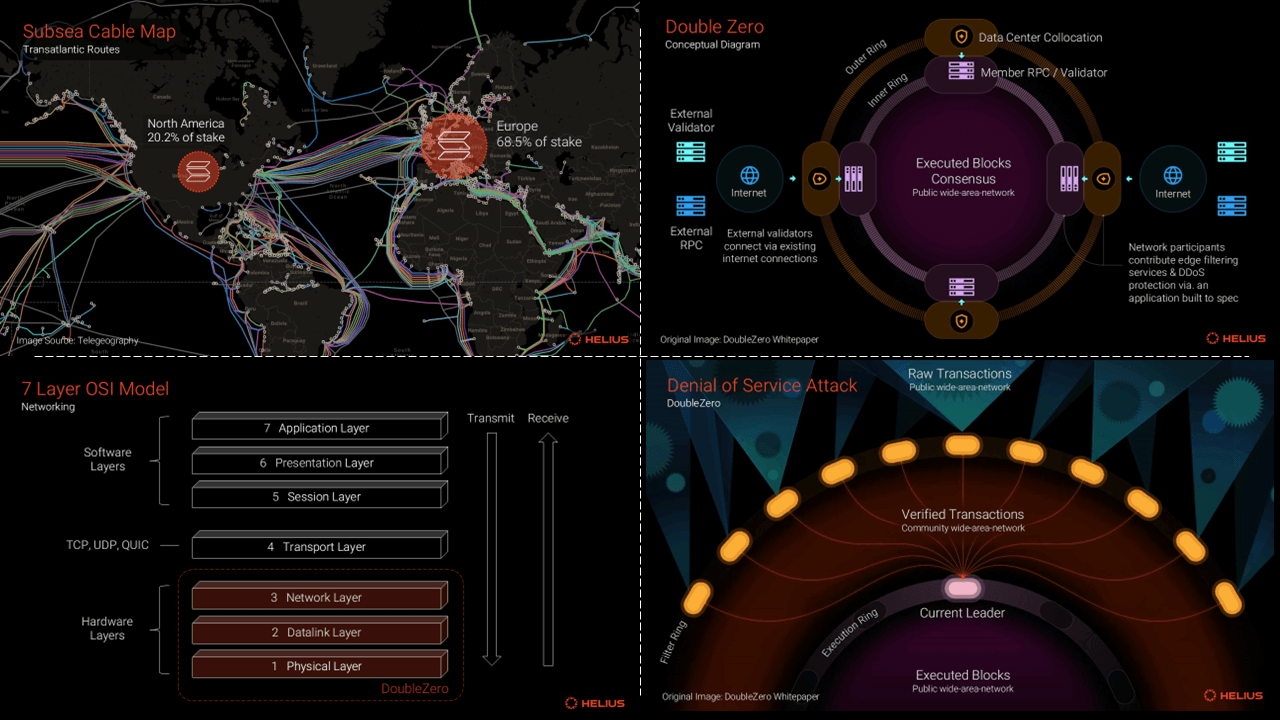

This isn’t just another staking pool. DoubleZero integrates private and dark fiber paths into a high-performance mesh network, letting validators communicate through lightning-fast, congestion-free routes instead of relying on the public internet. The result? Lower latency, higher resilience, and a fairer playing field for everyone running a node.

The Mechanics: How the DoubleZero Delegation Program Works

Here’s where things get spicy for anyone eyeing the next wave of Solana validator onboarding:

- Initial Delegation: Early participants on the DoubleZero testnet are already receiving their initial allocation from the massive 3M SOL stake pool.

- Mainnet Ambitions: The program is laying groundwork for global mainnet-beta decentralization later this year.

- Validator Criteria: To qualify, you need to run a Solana mainnet validator that meets performance benchmarks – no free rides here!

- Fee Structure: Validators pay a 5% fee on consensus-related revenue to access the premium fiber network – think of it as paying for express lanes on the data highway.

- Anti-Spam Measures: Token burns are now part of the system to keep spammy or centralized actors at bay.

Austin Federa (founder of DoubleZero and ex-Solana Labs strategy chief) summed it up perfectly: “Faster is better, but faster alone is not enough. Faster must include the ability for everyone on the network to have the same access to data as everyone else. ” (source)

The Impact: What This Means for Solana in 2025

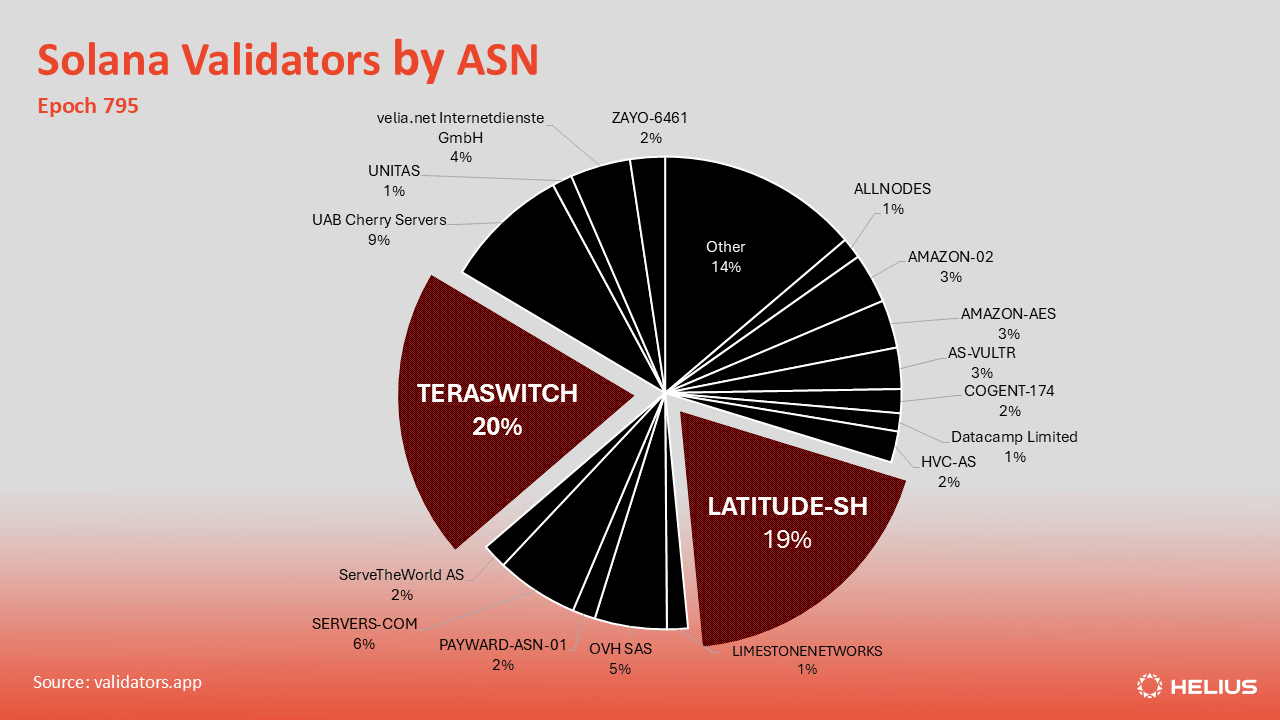

This isn’t just about numbers – though connecting 142 nodes (already accounting for 3.29% of all SOL staking) is impressive by itself (source). The real story is how this move disrupts old power structures in staking and opens up new opportunities for global participation. Smaller validators get real skin in the game without being drowned out by incumbents or big-money interests.

The focus on underrepresented geographies (see Prague-based validators with RockawayX) means this isn’t just theoretical – it’s already happening on testnets worldwide. And with plans to expand further this fall, expect even more diversity in who gets to secure Solana’s future blocks.

Solana (SOL) Price Prediction 2026-2031

Professional outlook based on DoubleZero’s decentralization initiative, current market trends, and projected adoption cycles.

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $160.00 | $225.00 | $315.00 | +8% | Post-DoubleZero mainnet expansion boosts validator participation; minor volatility from regulatory reviews |

| 2027 | $180.00 | $265.00 | $385.00 | +18% | Sustained DeFi/enterprise growth; potential new ATH if global adoption accelerates |

| 2028 | $210.00 | $310.00 | $470.00 | +17% | Layer 1 competition intensifies but Solana’s performance edge and validator network expansion drive growth |

| 2029 | $240.00 | $360.00 | $560.00 | +16% | Network upgrades and tokenomics improvements spur institutional inflows |

| 2030 | $275.00 | $415.00 | $670.00 | +15% | Mainstream adoption in payments/gaming; periodic corrections amid macro uncertainty |

| 2031 | $310.00 | $475.00 | $800.00 | +14% | Solana cements its position as a top-3 smart contract platform; bullish scenario if ecosystem matures |

Price Prediction Summary

Solana (SOL) is projected to see moderate, steady growth through 2031, driven by technological advancements, increased network decentralization from initiatives like DoubleZero, and expanding real-world use cases. While volatility remains due to market cycles and regulatory risks, the long-term trajectory is upward, with average prices potentially more than doubling from current levels by 2031.

Key Factors Affecting Solana Price

- Success and adoption of DoubleZero’s 3M SOL stake pool and validator network decentralization

- Broader institutional and developer adoption of Solana for DeFi, NFTs, and payments

- Competition from other high-performance Layer 1s (e.g., Ethereum, Sui, Aptos)

- Regulatory clarity in major markets (US, EU, Asia)

- Macro-economic conditions, including global liquidity cycles

- Continued technical improvements (scalability, security, tokenomics)

- Potential network outages or security incidents

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For Solana stakers, this shift is more than just a technical upgrade. It’s a chance to support a network that actually lives up to the ethos of decentralization, where validator rewards aren’t hoarded by a few, and where anyone with the skills and hardware can compete on equal footing. The DoubleZero Solana delegation program could well be the template other chains look to as they try to balance speed, security, and openness.

Let’s not gloss over the economics either. With 3 million SOL (valued at $208.16 per SOL) in play, this program is injecting serious capital into the ecosystem. That means more robust staking yields for participants who previously might have been sidelined, plus fresh incentives for operators in regions that have historically been underrepresented in crypto infrastructure.

How To Get Involved: Steps for Aspiring Validators

If you’re thinking about jumping into the action, here’s your playbook:

The process is transparent but competitive, run a reliable mainnet validator, hit performance targets, and keep up with network upgrades. The reward? Access to both capital and cutting-edge networking tech that could give you an edge as Solana’s staking ecosystem heats up.

What Sets DoubleZero Apart?

- Equitable onboarding: No more gatekeeping by legacy whales, newcomers have real access.

- Geographic diversity: Focus on expanding validator presence beyond traditional hubs (think Prague, Southeast Asia, South America).

- Sustainable economics: Fee structure and token burns help keep incentives aligned long-term.

- Network resilience: Private/dark fiber mesh reduces risk of outages or congestion attacks.

Key Benefits of DoubleZero’s Solana Delegation Program

-

Massive Staking Pool Backing: DoubleZero’s 3 million SOL stake pool—valued at approximately $537 million—provides significant capital support for validators and stakers, boosting both security and network confidence.

-

Enhanced Network Performance: Validators gain access to DoubleZero’s high-speed fiber network, enabling faster, more reliable validator-to-validator communication and reducing congestion from public internet routes.

-

Lower Barriers for New Validators: The program covers voting costs for new validators during their first year, making it easier for newcomers to join and contribute to Solana’s decentralization.

-

Decentralization and Global Reach: With 142 nodes already connected and plans for global mainnet expansion, DoubleZero is actively distributing stake and infrastructure to promote a more decentralized and resilient Solana network.

-

Equitable Data Access: The protocol ensures all participants enjoy equal access to network data, leveling the playing field for both large and small validators.

-

Spam and Centralization Mitigation: By implementing token burns and a 5% fee on consensus revenue, DoubleZero discourages spam and reduces centralization risks for stakers and validators alike.

If you’re bullish on Solana decentralization in 2025, this is one of the most important stories to watch. The blend of technical innovation (fiber mesh!), economic firepower (3M SOL at $208.16 each), and community-first values could set a new standard not just for Solana but for all high-throughput chains aiming to remain credibly neutral.

The next few months will be pivotal as mainnet-beta decentralization ramps up and more nodes join the DoubleZero-powered mesh. Whether you’re running a validator or just stacking SOL for yield, keep an eye on how this experiment unfolds, it’s shaping up to be one of the defining moves in blockchain infrastructure this year.