Stablecoins are the backbone of decentralized finance, and in 2025 Solana has emerged as a powerhouse for high-yield stablecoin strategies. With its lightning-fast settlement and low fees, Solana’s DeFi ecosystem is drawing in both retail and institutional capital at unprecedented speed. The total value locked (TVL) on Solana now exceeds $8.81 billion, with stablecoin supply surging throughout the year. For yield-seekers, three actionable strategies stand out: leveraging Kamino Finance for PYUSD rewards, deploying capital with Squads’ stablecoin suite, and lending directly to Brazil via Solana-native protocols.

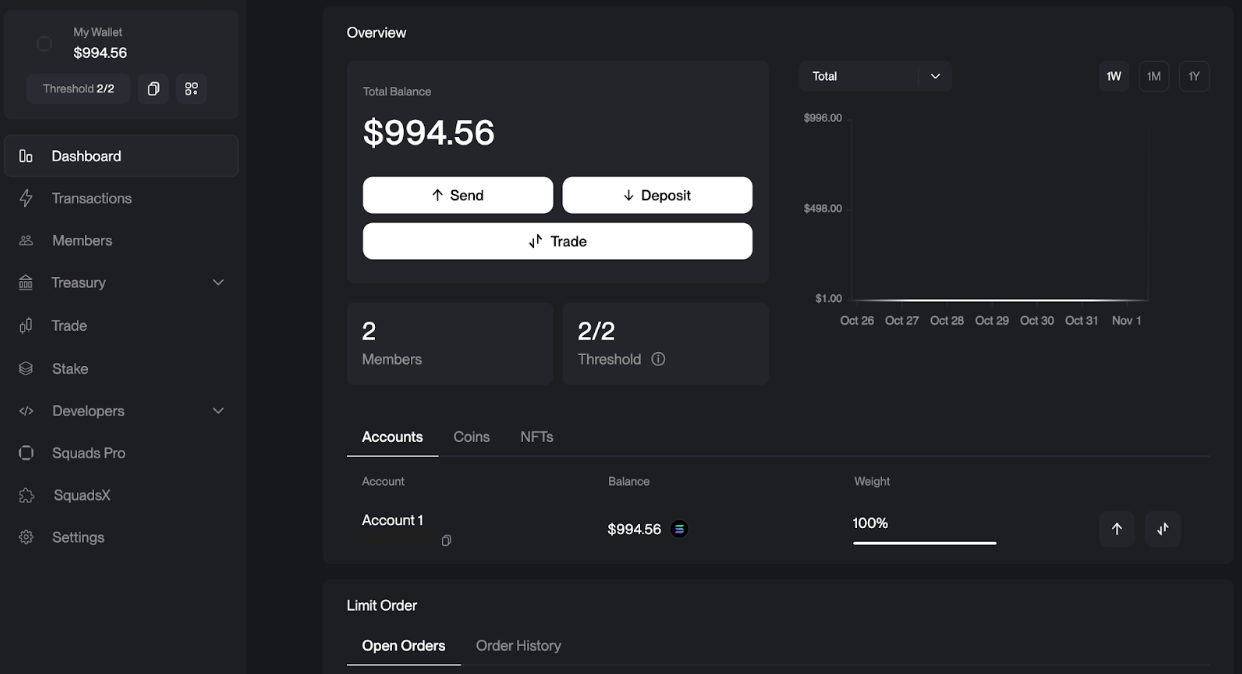

Kamino Finance: Boosted Yields with PYUSD Rewards

Kamino Finance has rapidly become the go-to platform for conservative yet lucrative stablecoin yields on Solana. As of August 2025, Kamino boasts a TVL exceeding $950 million (source), underpinned by its robust risk management and innovative yield products.

The core strategy is simple: deposit PYUSD or USDC into Kamino’s lending pools to access base yields plus weekly PYUSD rewards. According to Kamino’s latest figures, users are collectively earning around $100,000 per week in PYUSD incentives on top of lending yields. For those seeking higher returns without excessive risk, Kamino’s integration of SyrupUSDC now allows access to institutional-grade USDC yields near 6.5% (source). More aggressive users can tap into Kamino’s Multiply feature to leverage positions even further.

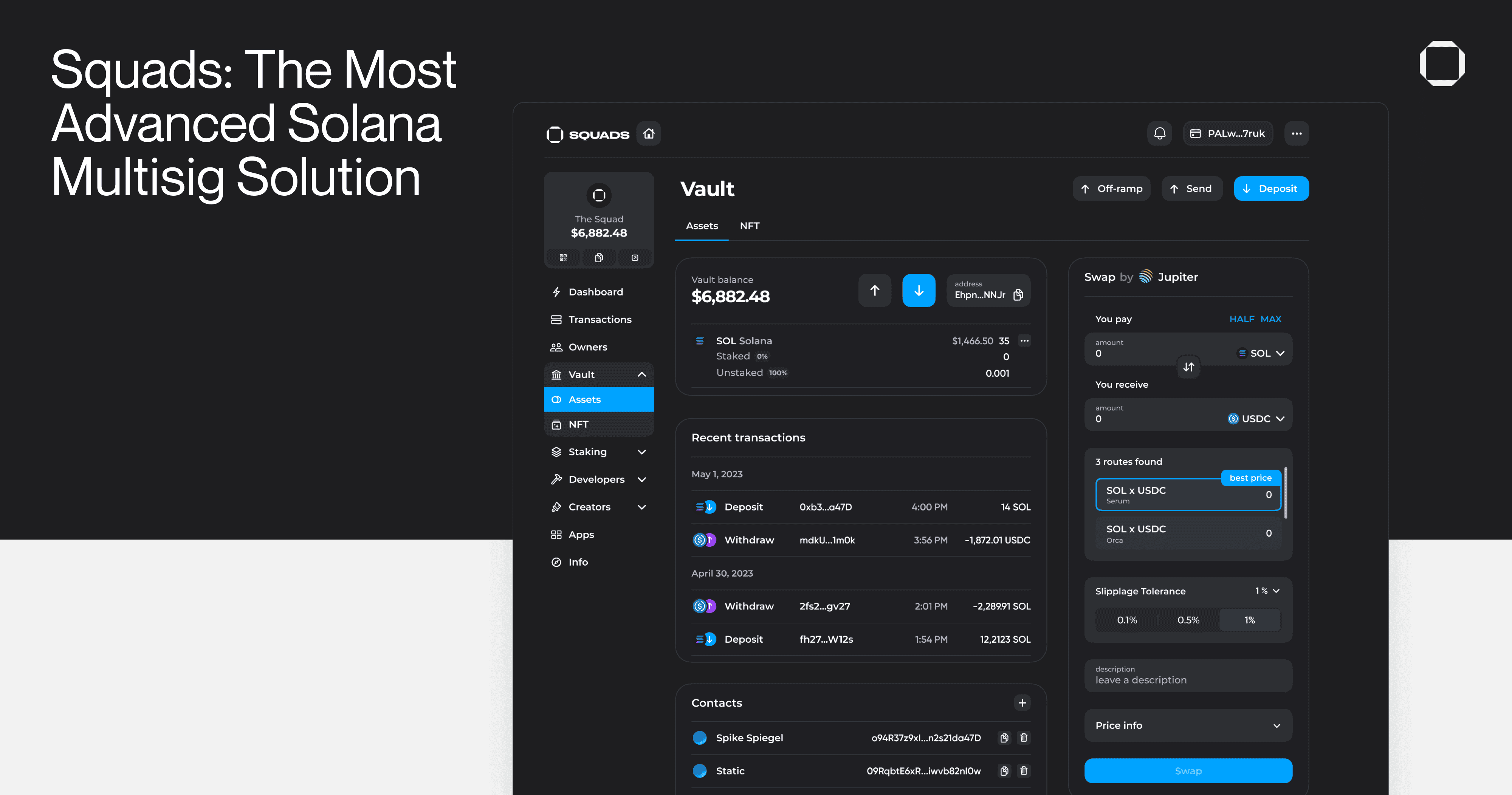

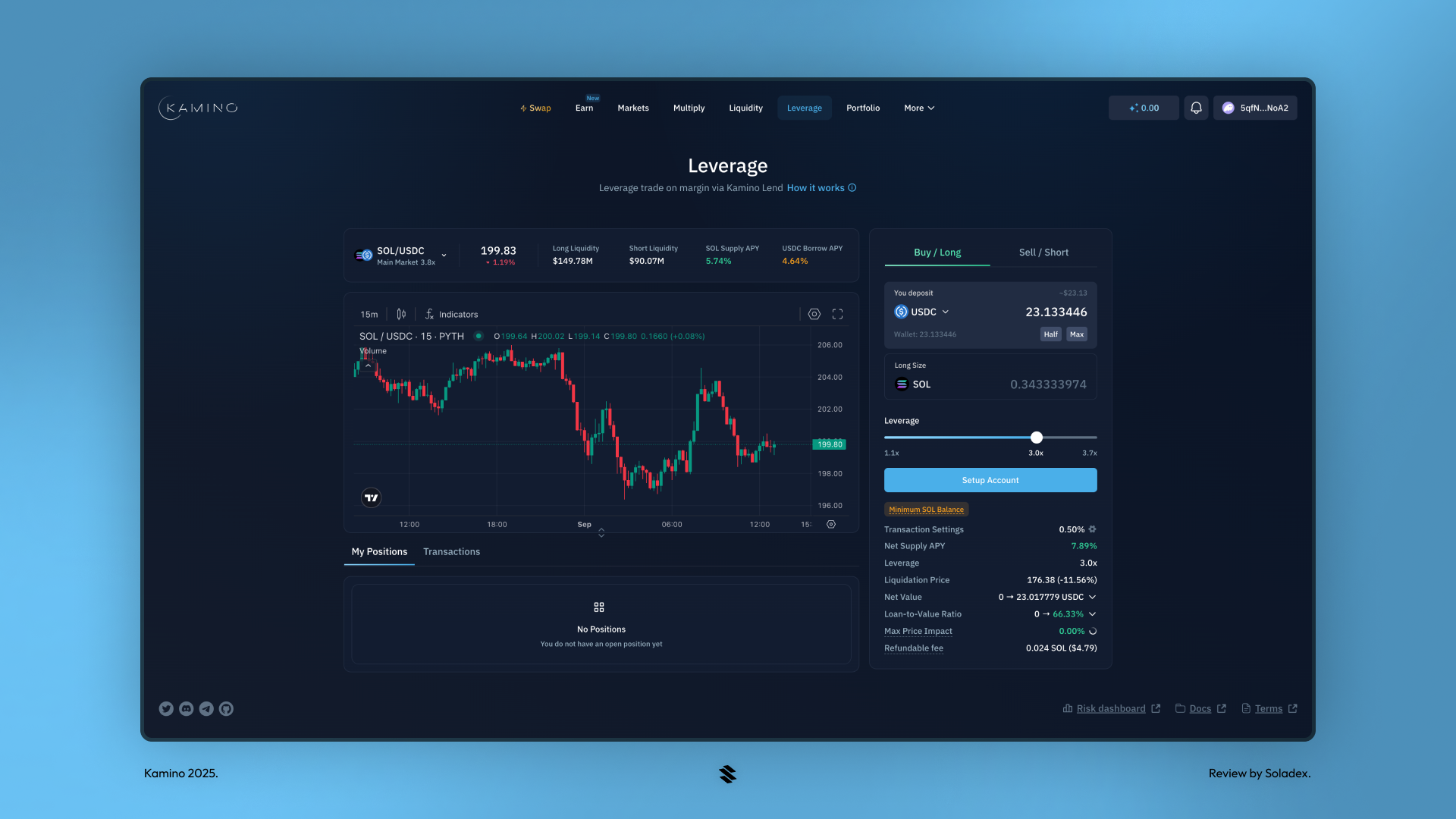

Diversified Yield with Squads Stablecoin Suite

Squads, long known for its multisig infrastructure, has expanded into automated DeFi products that simplify yield generation for individuals and teams alike. The Squads stablecoin suite provides access to diversified yield strategies curated by professionals, think of it as a one-stop shop for earning passive income while benefiting from institutional-grade risk controls.

This suite automates allocation across multiple protocols and pools within the Solana ecosystem, balancing risk while targeting competitive APYs. For DAOs or global payroll managers who need steady returns with minimal operational overhead, Squads’ approach offers transparency and efficiency that rivals TradFi alternatives.

Key Benefits of Squads’ Automated Stablecoin Yield Suite

-

Diversified, Automated Yield Strategies: Squads’ stablecoin suite enables users to access a range of yield-generating strategies across the Solana ecosystem, automatically allocating funds to top-performing protocols and pools for optimized returns.

-

Institutional-Grade Risk Management: The platform employs rigorous risk assessment and automated rebalancing, helping users minimize exposure to protocol-specific risks while maximizing stablecoin yield potential.

-

Effortless Passive Income: With Squads’ automation, users can earn competitive yields on stablecoins like USDC and PYUSD without manual intervention, making it easy for both individuals and teams to benefit from Solana’s expanding DeFi opportunities.

Lending Stablecoins to Brazil: Sovereign Debt Meets DeFi

The most headline-grabbing opportunity in 2025 is the ability to lend stablecoins directly to the Brazilian government via new Solana-native protocols. This isn’t just another DeFi experiment, these platforms enable users worldwide to purchase tokenized Brazilian sovereign debt using USDC or other major stables.

The result? Annual percentage yields (APYs) up to 37%, far outstripping traditional government bonds or bank deposits anywhere else in the world. While this carries unique geopolitical risks, it represents a bold step in connecting emerging market debt with global crypto liquidity, an innovation only possible on fast-moving chains like Solana.

For investors accustomed to single-digit yields on US or European treasuries, the allure of 37% APY on tokenized Brazilian debt is hard to ignore. These protocols have introduced a new era of borderless fixed income, with settlement and redemption handled entirely on-chain. It’s an example of how Solana is bridging real-world assets and DeFi, unlocking access for both retail and institutional players who would otherwise be excluded from these markets.

Risk management is essential here. While yields are eye-popping, lending to emerging market governments carries distinct risks, currency volatility, regulatory shifts, and macroeconomic shocks can impact returns. Users should review the underlying legal structure of these tokenized securities and consider position sizing accordingly. However, for those with a strong risk appetite and a desire to diversify beyond crypto-native yields, this sector offers a glimpse into DeFi’s future as a global capital market.

Comparing the Three Strategies

Each of these high-yield stablecoin strategies serves a different investor profile:

Top Stablecoin Yield Strategies on Solana (2025)

-

Deposit PYUSD or USDC into Kamino Finance to access boosted stablecoin yields and weekly PYUSD rewards. Kamino’s integrated lending and liquidity pools offer yields ranging from 3.5% to 7% APY for stablecoins, with additional rewards distributed in PYUSD, totaling nearly $100,000 per week as of September 2025.

-

Utilize Squads’ stablecoin suite to access diversified, automated yield strategies and institutional-grade risk management. Squads simplifies treasury management for teams and DAOs, automating yield generation across Solana DeFi protocols while prioritizing security and compliance.

-

Lend stablecoins to the Brazilian government via Solana-native protocols to earn up to 37% APY on sovereign debt. This innovative DeFi opportunity allows users to gain exposure to real-world yields by participating in tokenized Brazilian government bonds, leveraging Solana’s speed and cost-efficiency.

If you prioritize safety and simplicity, Kamino Finance remains the top choice, especially with weekly PYUSD rewards adding significant upside to base lending rates. For those managing group funds or seeking set-and-forget diversification, Squads’ stablecoin suite automates yield farming while minimizing operational risk. And if you’re willing to embrace sovereign risk for outsized returns, lending to Brazil via Solana-native protocols could be your next frontier.

The rapid growth in Solana’s stablecoin supply, now exceeding $8.81 billion in TVL, reflects rising confidence in both the network’s infrastructure and its DeFi innovation (source). As more real-world assets become accessible through tokenization and as platforms like Kamino and Squads refine their offerings, yield-seekers will find an expanding toolkit at their disposal.

Final Thoughts: Navigating Opportunity and Risk in 2025

The landscape for Solana stablecoin yield has never been richer or more diverse than it is today. Whether you’re after consistent returns with Kamino’s PYUSD rewards, automated portfolio management via Squads’ suite, or high-risk/high-reward exposure through lending to Brazil’s government on-chain, there are options tailored for every risk profile.

As always: Do your own research (DYOR), monitor protocol developments closely, and size positions according to your personal risk tolerance. The future of decentralized yield is here, and it’s being built on Solana.