The financial landscape for Solana is entering a new phase as SOL Strategies Inc. prepares to debut on the Nasdaq Global Select Market under the ticker STKE on September 9,2025. This move is not just another listing – it is a pivotal moment for institutional access to the Solana ecosystem. For years, Solana’s rapid technical progress and developer activity have outpaced traditional investor on-ramps. The STKE Nasdaq listing directly addresses this gap, offering regulated exposure and liquidity for pension funds, hedge funds, and other major players previously sidelined by compliance hurdles.

SOL Strategies (STKE) Stock Price Prediction 2026-2031

Forecasts incorporate Nasdaq listing impact, institutional adoption, and Solana ecosystem developments.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $18.00 | $23.50 | $31.00 | +17% | First full year post-Nasdaq; institutional flows drive strong price discovery. |

| 2027 | $21.00 | $27.50 | $38.00 | +17% | Continued validator expansion and Solana ETF momentum sustain growth. |

| 2028 | $24.00 | $31.80 | $44.50 | +16% | Potential share tokenization and DeFi integration amplify investor access. |

| 2029 | $27.50 | $36.30 | $52.00 | +14% | Ecosystem maturity; regulatory clarity attracts conservative capital. |

| 2030 | $30.00 | $40.10 | $58.00 | +10% | Growth moderates as market saturates; focus shifts to yield and dividends. |

| 2031 | $32.00 | $43.50 | $63.00 | +8% | STKE becomes a benchmark for on-chain equity; steady institutional inflows. |

Price Prediction Summary

SOL Strategies (STKE) is positioned for robust growth following its Nasdaq debut in late 2025. The listing is expected to unlock institutional capital, enhance liquidity, and drive the stock’s valuation as Solana adoption accelerates. Price forecasts reflect a progressive uptrend, with potential for volatility around regulatory and industry milestones. Average annual price growth is projected at 10-17% through 2031, with upside tied to successful execution of validator expansion, share tokenization, and broader DeFi integration.

Key Factors Affecting SOL Strategies Stock Price

- Institutional adoption and increased capital inflows post-Nasdaq listing

- Expansion of Solana validator operations and staking demand

- Potential approval of a US spot Solana ETF

- Strategic partnerships for tokenization of shares and DeFi products

- Broader blockchain adoption in traditional finance

- Regulatory developments affecting digital asset equities

- Macroeconomic conditions impacting tech and blockchain sectors

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

SOL Strategies’ Nasdaq Listing: The Institutional Gateway Solana Needed

With Binance-Peg SOL (SOL) trading at $203.05, the market is already pricing in the significance of this event. Recent price action shows consolidation above key support levels, with traders eyeing a breakout towards the $240 mark – a sentiment amplified by institutional anticipation around STKE’s public launch (source). The Nasdaq listing is expected to:

- Boost liquidity for Solana-related assets via regulated markets

- Attract new capital inflows from risk-averse institutions seeking transparent investment vehicles

- Enhance credibility and stability across DeFi protocols built on Solana

This is more than symbolic. As noted in AInvest’s coverage, institutional adoption has always hinged on compliant infrastructure – something that STKE delivers at scale.

$500 Million War Chest: Fueling Validator Growth and On-chain Expansion

SOL Strategies isn’t just riding market momentum; it’s scaling aggressively to meet demand. Backed by a $500 million convertible note facility from ATW Partners, the company has already deployed an initial tranche of $20 million, acquiring 122,524 SOL tokens at an average price of $148.96 (source). This capital injection enables:

- Validator expansion: More nodes mean improved network security and performance for Solana apps.

- Staking infrastructure: Meeting surging demand as SOL rallies above $200 in 2025.

- M and A activity: Potential acquisitions of smaller staking providers or tech partners.

The ripple effect? Enhanced staking yields and deeper liquidity pools across Solana DeFi protocols – critical factors driving both retail and institutional adoption as we head into Q4 2025.

SOL Strategies (STKE) Stock Price Prediction 2026-2031

Forecast scenarios reflect the impact of SOL Strategies’ Nasdaq listing and integration with the Solana ecosystem, incorporating both bullish and bearish outcomes.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Projected YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $18.00 | $25.50 | $34.00 | +26% | Initial year post-listing. Increased liquidity and institutional inflows drive steady growth; volatility remains as market digests new listing. |

| 2027 | $20.50 | $29.90 | $43.00 | +17% | Expansion of validator operations and tokenization initiatives; regulatory clarity improves, attracting more funds. |

| 2028 | $22.00 | $35.50 | $51.00 | +19% | Potential Solana ETF approval and wider DeFi adoption; SOL Strategies solidifies as a core institutional vehicle. |

| 2029 | $25.00 | $41.00 | $59.00 | +15% | Sustained ecosystem maturity and cross-market integration; increasing revenue diversification. |

| 2030 | $28.00 | $46.50 | $67.00 | +13% | Market enters consolidation; further integration with traditional finance and growth in tokenized assets. |

| 2031 | $32.00 | $53.00 | $79.00 | +14% | Long-term institutional adoption peaks; new product launches and global expansion drive valuation. |

Price Prediction Summary

SOL Strategies’ Nasdaq listing is expected to be a transformative catalyst, enhancing institutional access to Solana and accelerating the company’s growth trajectory. The stock is forecasted to experience significant appreciation over the next six years, with average prices rising from $25.50 in 2026 to $53.00 by 2031 under base case assumptions. Bullish scenarios could see the stock reaching as high as $79.00 by 2031, while downside risks remain if market or regulatory headwinds materialize.

Key Factors Affecting SOL Strategies Stock Price

- Nasdaq listing increases institutional access and liquidity.

- $500M convertible note facility enables aggressive expansion of SOL holdings and validator operations.

- Potential U.S. spot Solana ETF approval may further boost demand for Solana-linked equities.

- Strategic partnerships (e.g., Superstate) and share tokenization initiatives.

- Continued growth in DeFi and blockchain-based financial products.

- Regulatory clarity and evolving compliance standards.

- General macroeconomic trends and risk appetite among institutional investors.

- Solana network performance and adoption metrics.

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

The Tokenization Frontier: Bridging TradFi and DeFi on Solana Rails

SOL Strategies’ ambitions extend beyond traditional equity markets. Through a partnership with Superstate, the company is actively exploring tokenizing its shares directly on the Solana blockchain (source). If successful, this would mark one of the first instances of a Nasdaq-listed firm’s equity being mirrored as a digital asset – opening up programmable finance possibilities such as instant settlement, automated dividends, and cross-border transferability without legacy friction.

This move could set a precedent for other public companies seeking to blend traditional finance (TradFi) with decentralized finance (DeFi), further cementing Solana’s role as an institutional-grade blockchain in global capital markets.

SOL Strategies (STKE) Stock Price Prediction: 2026-2031

Forecast scenarios following Nasdaq listing and evolving Solana financial ecosystem

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $16.00 | $22.00 | $29.00 | +18% | Initial post-listing volatility; increased institutional inflow; Solana ETF speculation |

| 2027 | $18.50 | $25.50 | $34.00 | +16% | Validator expansion; tokenization progress; broader ETF adoption |

| 2028 | $20.00 | $28.00 | $38.00 | +10% | Maturing institutional presence; increasing Solana DeFi integration |

| 2029 | $21.00 | $30.00 | $43.00 | +7% | Stable growth; potential regulatory headwinds; global macro influences |

| 2030 | $22.50 | $32.50 | $48.00 | +8% | Innovative product launches; further blockchain-finance convergence |

| 2031 | $24.00 | $35.00 | $53.00 | +8% | Sustained institutional adoption; Solana ecosystem achieves scale |

Price Prediction Summary

SOL Strategies (STKE) is positioned for sustained growth following its Nasdaq debut, driven by increasing institutional adoption of Solana, strategic partnerships, and a robust financial position. Price forecasts reflect initial volatility post-listing, followed by progressive growth as the company leverages its Nasdaq presence and the broader blockchain finance trend. Risks include regulatory developments and broader market cycles, but the long-term outlook remains bullish given the company’s integration with the Solana ecosystem and ongoing innovation.

Key Factors Affecting SOL Strategies Stock Price

- Nasdaq listing enabling institutional access and liquidity

- $500M ATW Partners facility supporting expansion and SOL accumulation

- Potential approval of U.S. spot Solana ETF catalyzing capital inflow

- Progress in tokenizing shares and integrating blockchain with traditional finance

- Broader acceptance of blockchain-based financial products

- Regulatory shifts affecting digital assets and listed companies

- Solana network performance and adoption trends

- Overall macroeconomic environment and risk appetite

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

As the September 9,2025, debut of SOL Strategies (STKE) on Nasdaq approaches, the market’s response is already visible in Solana’s price structure. With SOL trading at $203.05, sustained accumulation above $200 signals that large players are positioning for the next phase of growth. This is not just a technical breakout setup; it’s a structural shift in how capital can access Solana’s ecosystem.

Institutional Flows and Solana’s Financial Maturity

What does this mean for Solana’s broader financial ecosystem in 2025? First, SOL Strategies’ Nasdaq listing provides a compliant vehicle for institutions to gain exposure to Solana without direct crypto custody risks. This aligns with the growing appetite among pension funds, endowments, and family offices for digital asset strategies that meet regulatory and operational due diligence standards.

Second, as more regulated products like STKE come online, they create an anchor for additional financial innovation. The potential approval of a U. S. spot Solana ETF by October 2025 could act as a compounding force, deepening liquidity and driving further price discovery (source). The interplay between listed equity products and on-chain assets will likely accelerate the institutionalization of Solana’s DeFi stack.

Key Ways STKE Listing Strengthens Solana

-

Unlocks Institutional Access: SOL Strategies’ Nasdaq debut under the ticker STKE provides a regulated, liquid gateway for institutional investors—such as pension funds and hedge funds—to gain exposure to Solana’s ecosystem, addressing previous barriers around compliance and transparency.

-

Drives Capital Inflow: The listing is expected to attract significant new capital into Solana, as evidenced by SOL Strategies’ $500 million convertible note facility from ATW Partners, with an initial $20 million tranche acquiring 122,524 SOL at an average price of $148.96 (current SOL price: $203.05).

-

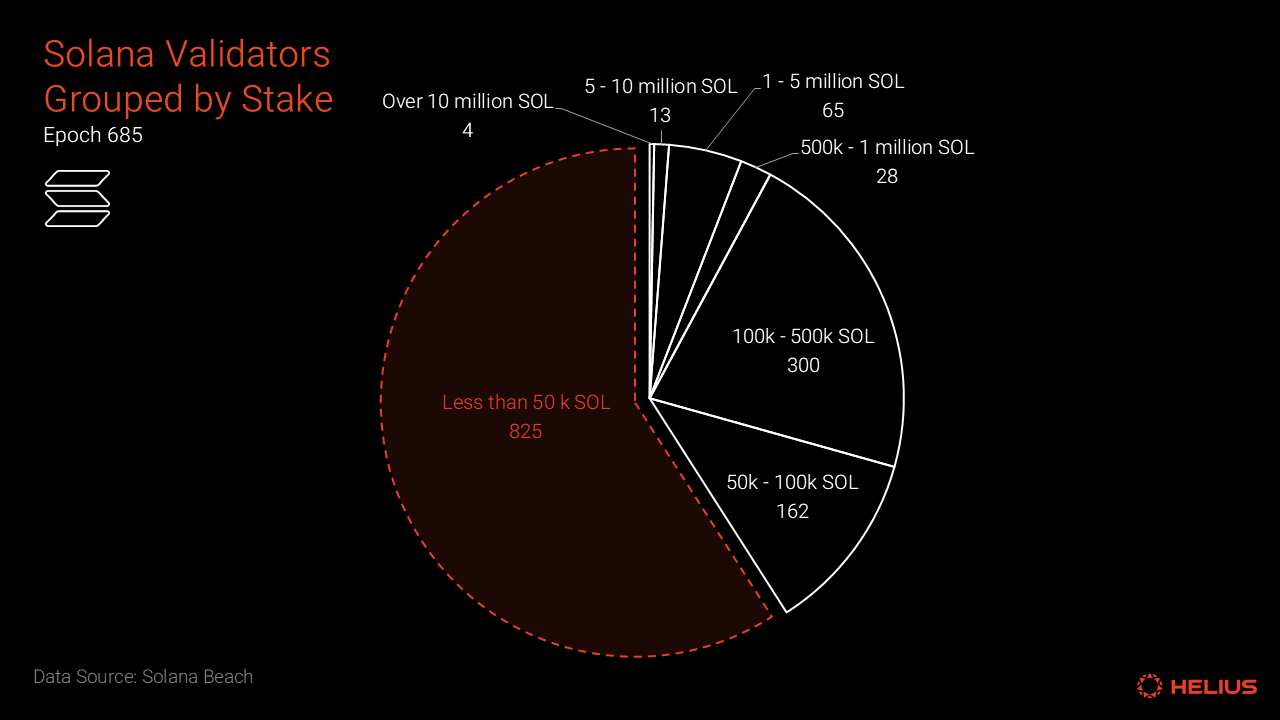

Expands Validator Operations: Increased funding enables SOL Strategies to scale its Solana validator infrastructure, supporting the network’s security, decentralization, and throughput as demand for staking surges.

-

Boosts Ecosystem Credibility: Nasdaq listing enhances Solana’s reputation in traditional finance circles, encouraging other financial entities to explore integrations and further legitimizing Solana as a foundation for institutional-grade products.

-

Enables Financial Innovation: SOL Strategies is exploring tokenizing its shares on the Solana blockchain in partnership with Superstate, paving the way for new on-chain financial products that bridge traditional and decentralized finance.

Validator Economics: Scaling Beyond Retail

The validator layer is foundational to any proof-of-stake chain, and SOL Strategies’ $500 million war chest directly targets this bottleneck. By rapidly expanding its validator footprint and staking infrastructure, STKE will help decentralize block production while supporting higher throughput applications.

For investors tracking network health metrics, watch for:

- Rising total value staked, particularly from institutional wallets

- Lower average block times, indicating improved network efficiency

- Increased validator participation rates, signaling distributed trust

These trends not only support price action but also reinforce Solana’s reputation as an enterprise-ready blockchain, essential for onboarding traditional finance partners at scale.

Looking Ahead: Catalysts Beyond the Listing Date

The narrative doesn’t end with STKE going live on Nasdaq. The real test will be how quickly capital flows into both the stock and associated on-chain products, and whether this triggers a virtuous cycle of validator expansion, DeFi growth, and further TradFi integrations.

If early indicators hold, especially if spot ETF approval follows, the probability increases for SOL to challenge new highs above $203.05 in Q4 2025. Watch closely as other asset managers assess similar listings or tokenization pilots; precedent matters in institutional finance.

The bottom line: SOL Strategies’ Nasdaq listing is more than a headline event, it is an actionable inflection point for both traders and long-term allocators within the Solana ecosystem. As always, disciplined risk management remains paramount in fast-moving markets. But with compliant gateways opening up and validator economics strengthening, the case for institutional adoption of Solana has never been clearer.