Solana has rapidly emerged as the blockchain backbone powering a new era of global investments. In 2025, its influence is visible everywhere from institutional portfolios to retail trading apps, with daily transaction volumes and user counts setting records across the decentralized finance (DeFi) landscape. As of September 2025, Solana’s price sits at $202.42, reflecting a robust market presence and explosive growth over the past year.

Solana’s Market Momentum: $2.5 Trillion in Global Investment Flows

The numbers are nothing short of staggering. Solana’s total ecosystem market capitalization reached $263 billion in 2025, with decentralized exchange volumes surpassing $1 trillion. This surge is not an isolated event, it’s part of a broader trend where tokenization, high-speed trading, and institutional adoption converge on Solana as their platform of choice. Major financial players like HSBC, Bank of America, and the Monetary Authority of Singapore have all integrated Solana’s blockchain into asset tokenization strategies through partnerships with R3 (source).

What does this mean for investors? The migration of traditional assets onto Solana’s rails opens up new opportunities for fractional ownership, 24/7 trading, and global access to markets previously limited by geography or regulation. The filing of a Solana-based ETF by Franklin Templeton (source) underscores this shift, institutions are now treating Solana not just as a speculative asset but as critical infrastructure for the next generation of investment products.

Visualizing Solana’s Ecosystem Growth in 2025

The scale and diversity of activity on Solana are best appreciated through visual statistics:

Solana’s 2025 Key Visual Stats at a Glance

-

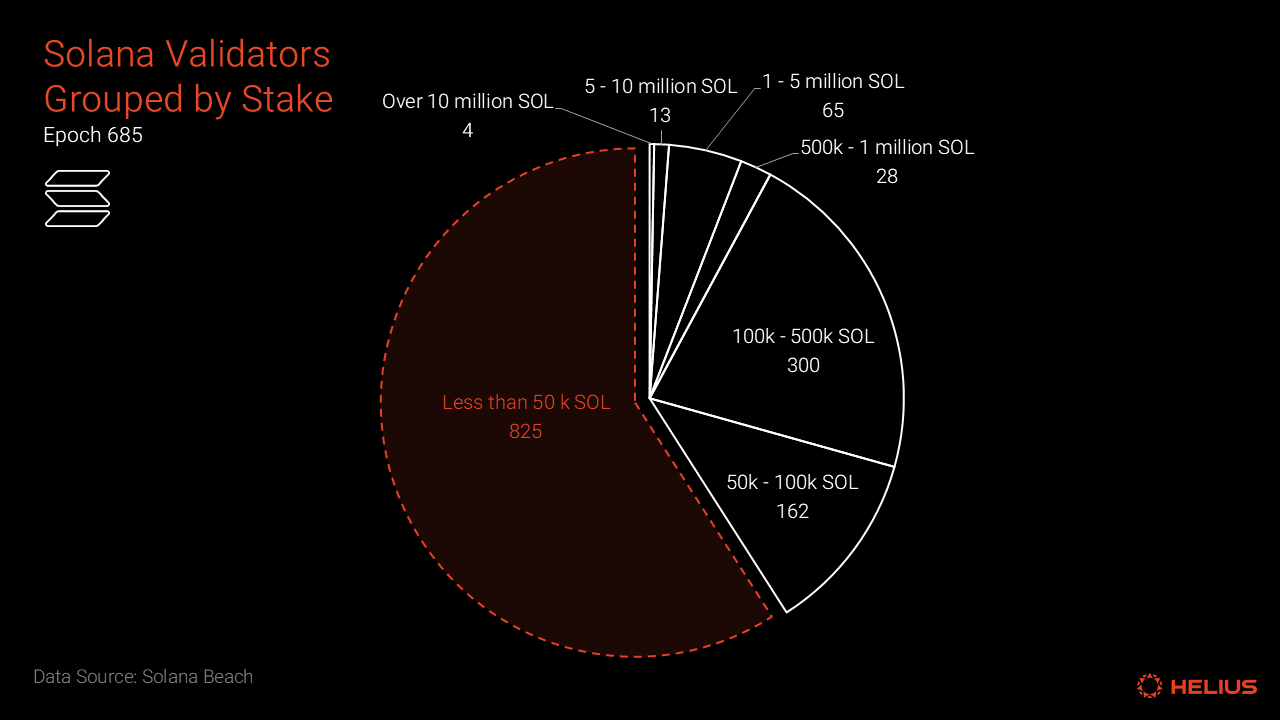

Validator Count: Over 2.2 million daily active validators secure the Solana network in 2025, reflecting its robust decentralization and network health.

-

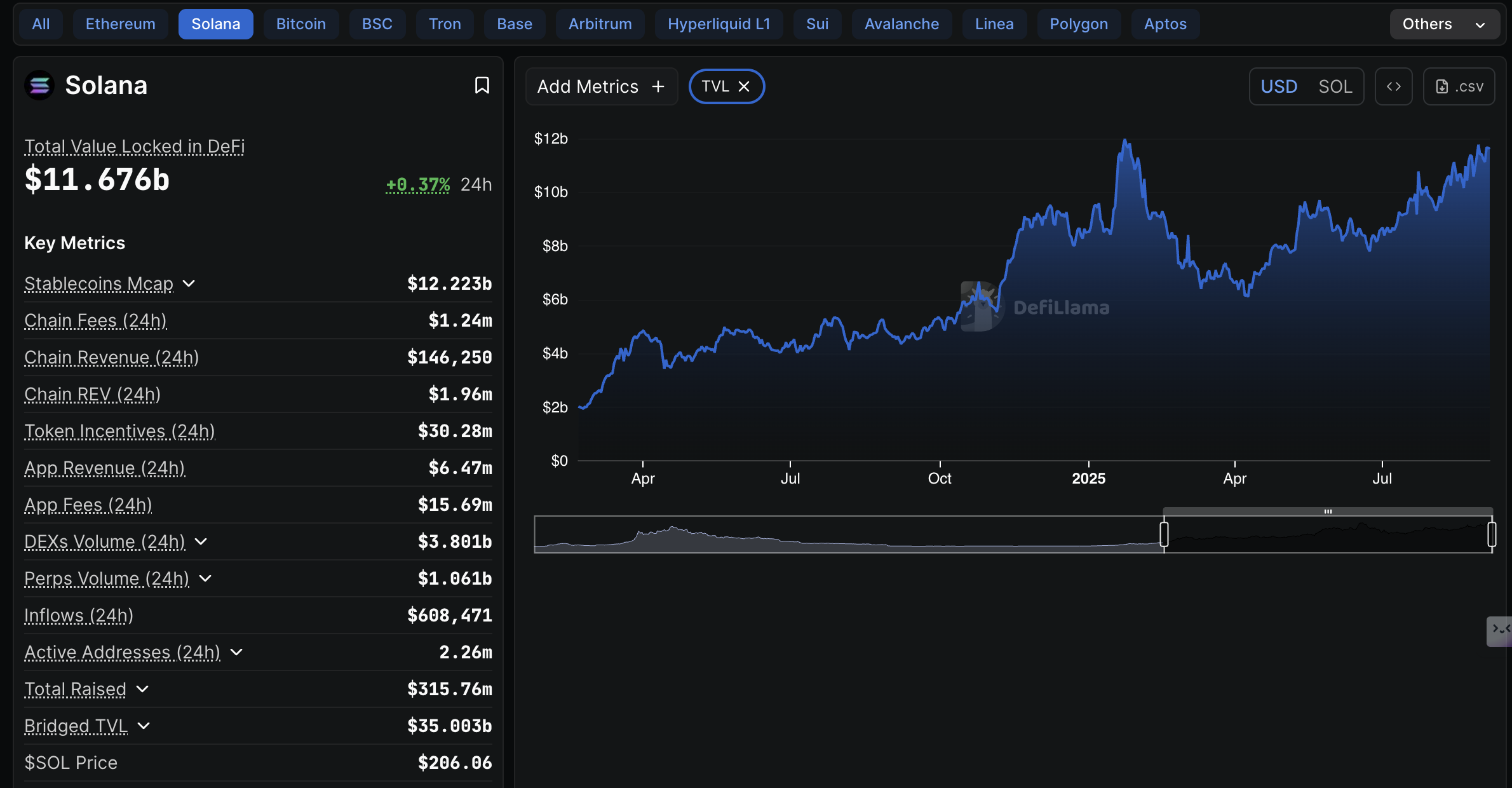

DeFi Total Value Locked (TVL): Solana’s DeFi ecosystem boasts a $85.7 billion TVL as of March 2025, nearly doubling from the previous year and showcasing explosive growth in decentralized finance.

-

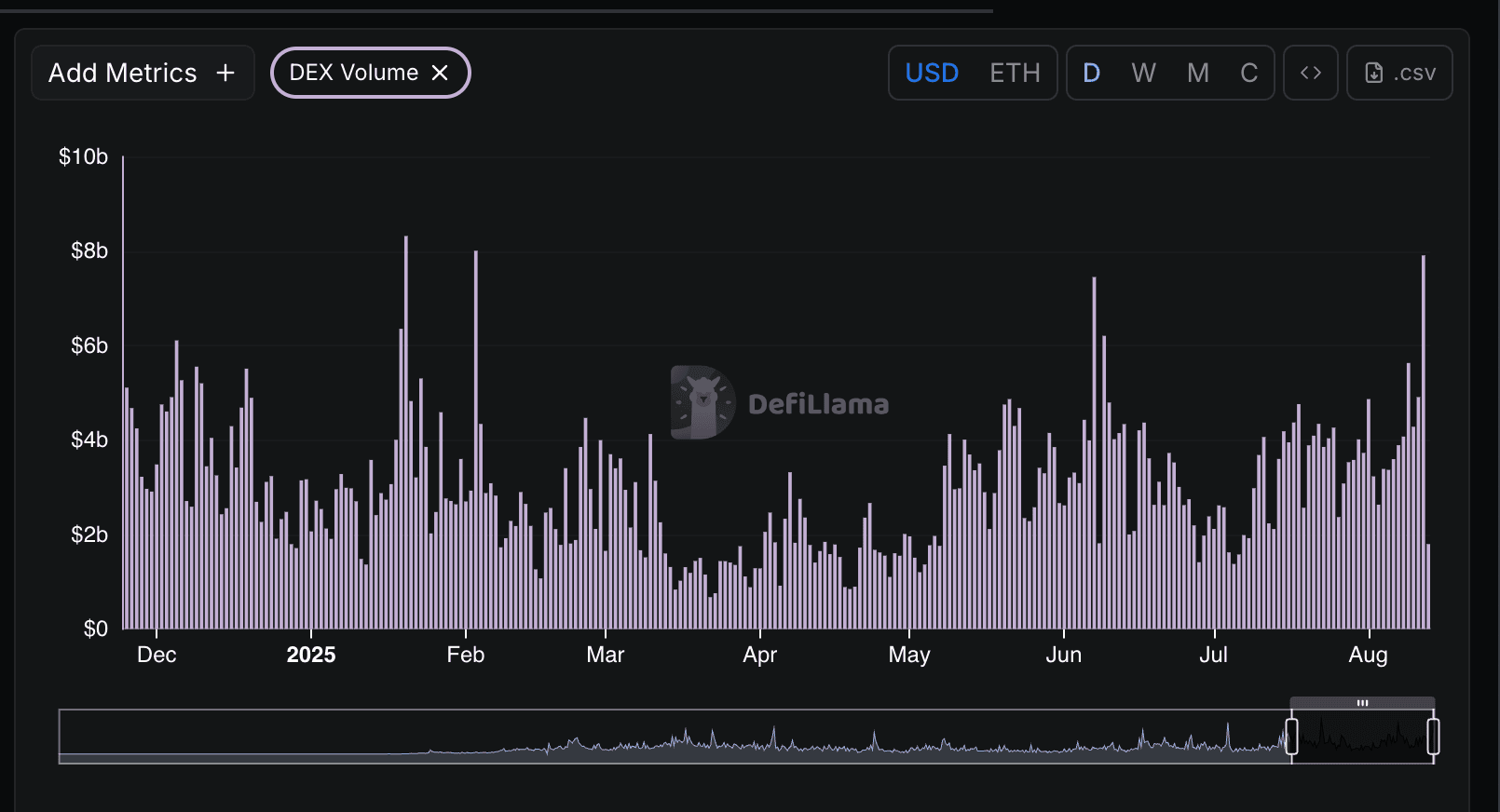

Decentralized Exchange (DEX) Volume: Cumulative DEX trading volume on Solana has exceeded $1 trillion in 2025, driven by high-speed transactions and increased institutional participation.

-

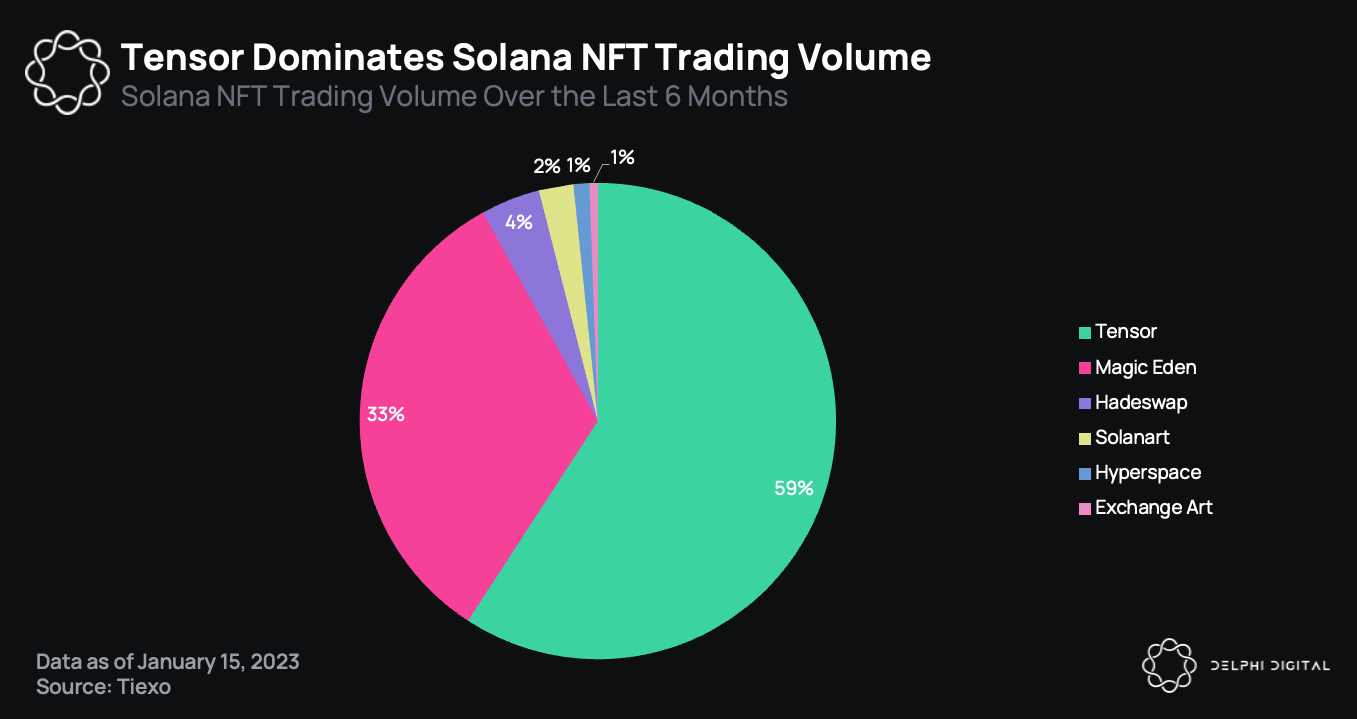

NFT Sales: Solana’s NFT market continues to thrive, with cumulative NFT sales surpassing $5 billion by early 2025 and new collections gaining significant traction.

Validator counts have soared past previous records while DeFi Total Value Locked (TVL) continues to climb, evidence that developers and users alike trust Solana for both speed and security. NFT sales on the network surpassed $5 billion by early 2024 and continue to grow in 2025 as new collections gain traction.

Solana’s appeal is further amplified by its technical upgrades and low transaction costs. With over 2.2 million daily active users, it has become the go-to platform for both high-frequency traders and long-term crypto investors seeking exposure to cutting-edge DeFi protocols.

Price Performance: Real Returns and Institutional Inflows

This momentum is reflected in price action: SOL delivered an impressive and 43% annualized return so far in 2025 (source). The current price level at $202.42 is supported by strong fundamentals, most notably $1.72 billion in institutional capital inflows by Q3 2025 thanks to products like the first staking ETF (SSK) (source). These inflows are not just numbers; they represent real confidence from some of the world’s largest asset managers.

The bullish sentiment is echoed across social media channels:

Solana (SOL) Price Prediction 2025–2030

Comprehensive end-of-year price outlook based on current market data, adoption trends, and key industry developments.

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg.) | Key Scenario/Note |

|---|---|---|---|---|---|

| 2025 | $185.00 | $235.00 | $420.00 | +16% (from current price) | Institutional inflows, ETF launches, continued DeFi/NFT growth |

| 2026 | $210.00 | $325.00 | $750.00 | +38% | On-chain activity peaks, global tokenization accelerates, regulatory clarity improves |

| 2027 | $200.00 | $410.00 | $900.00 | +26% | Tech upgrades, Layer 1 competition intensifies, cyclical volatility |

| 2028 | $195.00 | $480.00 | $1,050.00 | +17% | Mainstream adoption, integration with TradFi, possible market cool-off |

| 2029 | $220.00 | $580.00 | $1,200.00 | +21% | Wider institutional use, macroeconomic shifts, scalability enhancements |

| 2030 | $250.00 | $665.00 | $1,300.00 | +15% | Mass adoption potential, mature DeFi/TradFi integration, new use cases |

Price Prediction Summary

Solana is poised for significant long-term growth driven by institutional adoption, technological innovation, and global investment integration. While short-term volatility and competition remain, the network’s robust ecosystem, ETF developments, and expanding real-world use cases support a bullish trajectory through 2030. Price predictions reflect both high-upside scenarios and conservative support levels, making SOL a high-risk, high-reward asset for diversified portfolios.

Key Factors Affecting Solana Price

- Institutional adoption (ETFs, tokenized assets)

- Regulatory clarity and global crypto policy

- Scalability and network upgrades (e.g., Firedancer, zk-tech)

- Competition from Ethereum and other L1s/L2s

- Macro market cycles and investor sentiment

- DeFi, NFT, and RWAs (real-world assets) growth on Solana

- Integration with traditional finance (TradFi)

- Potential for new killer apps and developer ecosystem expansion

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This convergence of technological innovation, regulatory progress, and capital inflows positions Solana at the heart of crypto investment trends, and sets the stage for even greater milestones as we move toward a $2.5 trillion tokenized economy built on its rails.

But Solana’s influence isn’t solely measured in price appreciation or institutional headlines. The ecosystem’s vibrancy comes from its grassroots developer community, relentless pace of innovation, and the sheer diversity of applications being built on-chain. From gaming guilds and NFT marketplaces to next-generation DeFi protocols, Solana’s composability and low-latency architecture have enabled a creative explosion that few blockchains can match.

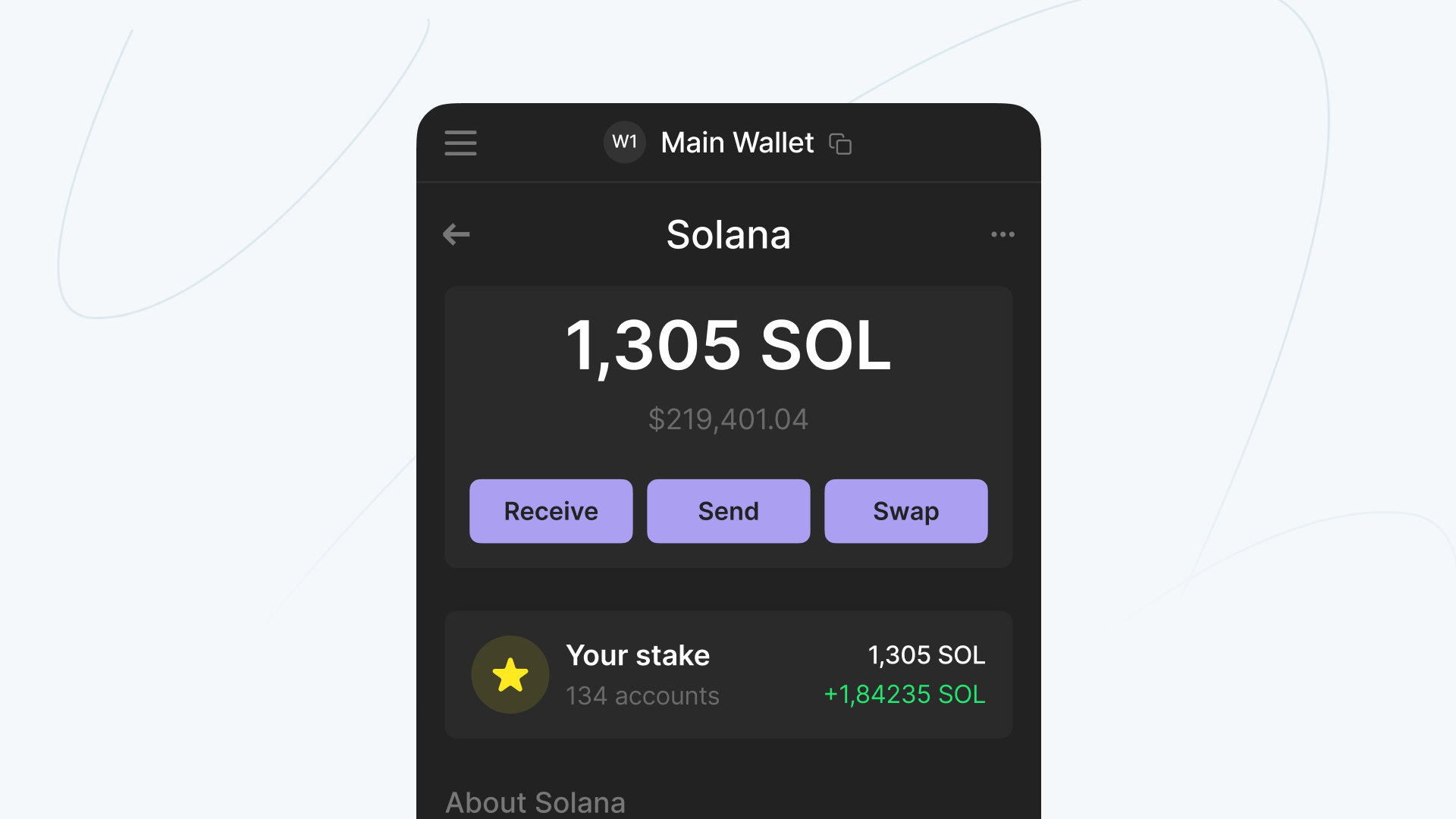

Solana Investment Platforms: Accessibility and Democratization

One of the most profound shifts in 2025 is the democratization of global investing. With Solana-based platforms, retail investors now access products previously reserved for hedge funds or accredited institutions. Fractionalized real estate tokens, yield-generating synthetic assets, and borderless ETFs are available with just a few clicks, often at fees far below traditional brokers. This accessibility is not hypothetical: daily active user metrics have surged past 2.2 million, reflecting how mainstream adoption is no longer a future aspiration but a current reality.

Developers are leveraging Solana’s speed to create seamless user experiences for everything from instant swaps to advanced AI-driven trading bots. As a result, the network has become a launchpad for both established fintech brands and experimental Web3 startups alike.

Top 5 Solana Investment Platforms in 2025

-

Jupiter: As Solana’s leading decentralized exchange (DEX) aggregator, Jupiter enables investors to access the best token swap rates across the entire Solana ecosystem. In 2025, Jupiter surpassed $1 trillion in cumulative trading volume, reflecting its central role in DeFi on Solana.

-

Marinade Finance: Marinade Finance is Solana’s largest liquid staking protocol, allowing users to stake SOL and receive mSOL, a liquid token used across DeFi. Marinade has been pivotal in onboarding institutional capital, especially following the launch of Solana’s first staking ETF.

-

Drift Protocol: Drift Protocol is a premier decentralized derivatives exchange on Solana, offering perpetual futures and spot trading with high liquidity and low fees. In 2025, Drift attracted significant trading volumes from both retail and institutional investors seeking advanced trading tools.

-

Tensor: Tensor is Solana’s top NFT marketplace, known for its high-speed trading and advanced analytics. By 2025, Tensor played a key role in the $5 billion+ Solana NFT sales milestone, making it a hub for digital asset investors and collectors.

-

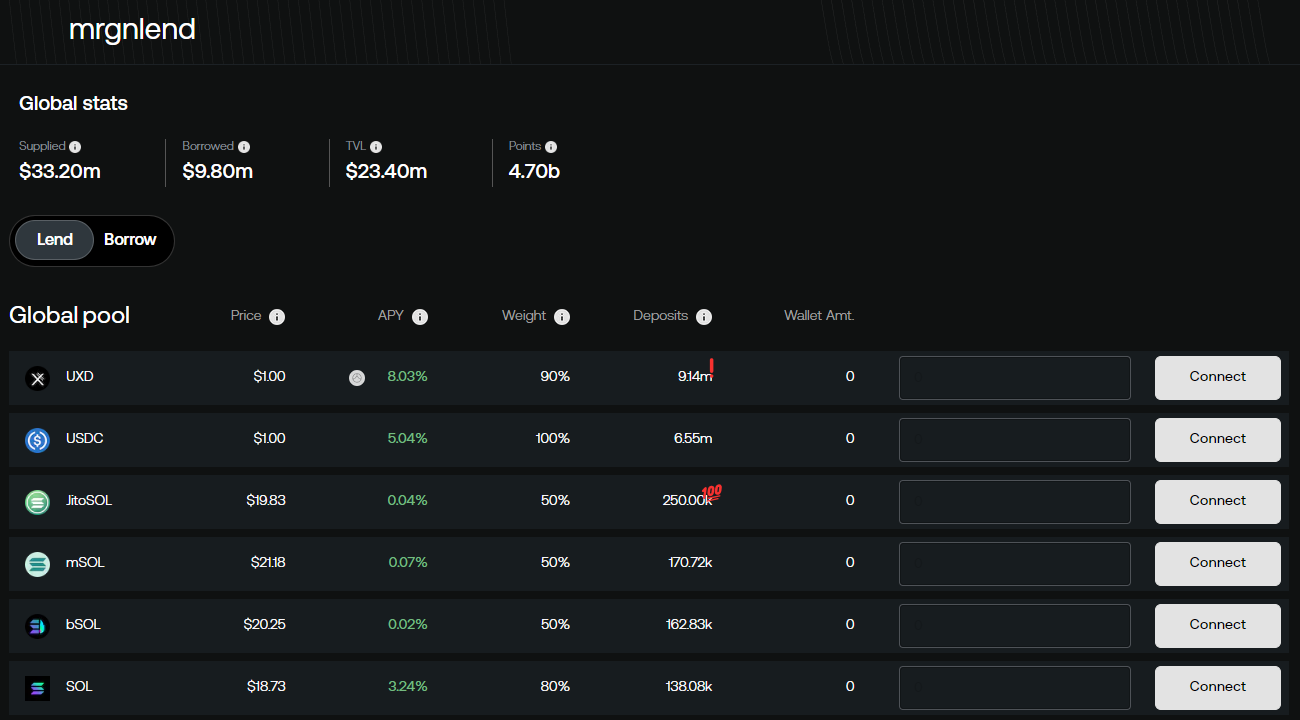

Solend: Solend is the largest lending and borrowing protocol on Solana, enabling users to earn yield on their assets or access liquidity instantly. Solend’s robust risk management and deep liquidity pools have made it a staple for both individual and institutional investors in 2025.

Risks, Resilience, and What’s Next

No discussion of crypto investment trends would be complete without addressing risk. Volatility remains an ever-present factor, SOL’s price at $202.42 is impressive but not immune to market corrections or regulatory headwinds. However, what sets Solana apart in 2025 is its resilience: uptime has improved dramatically following past outages, security audits are now routine across major protocols, and ecosystem governance has matured with greater community participation.

The interplay between institutional capital and retail enthusiasm creates a dynamic environment where innovation thrives but caution is still warranted. For investors considering exposure to the Solana ecosystem growth, diversification across different asset types, staking tokens, NFTs, DeFi LPs, remains prudent strategy.

Key Takeaways for Global Investors

- Solana’s $202.42 price point reflects robust fundamentals supported by both institutional inflows and retail demand.

- The platform’s technical edge, speed, low fees, scalability, continues to attract developers building next-gen financial products.

- Ecosystem growth is visualized through record validator counts, surging DeFi TVL, multi-billion dollar NFT sales, and explosive DEX volumes.

- Risks remain but are increasingly managed through improved infrastructure and governance mechanisms.

The coming years will test whether Solana can sustain this pace as competition intensifies across Layer 1 protocols. Yet if current trends persist, with tokenized assets proliferating and user numbers climbing, the vision of a $2.5 trillion global investment platform may soon be realized on its rails.