The Solana All-In Summit 2025 in Da Nang, Vietnam, has emerged as a defining event for the blockchain’s ecosystem, capturing industry attention with its blend of technical breakthroughs and market optimism. As Solana’s price holds strong at $202.76, up 4.19% in the last 24 hours, the summit’s announcements have amplified both excitement and scrutiny across DeFi, gaming, and tokenized asset sectors.

Alpenglow Protocol: Redefining Transaction Speed on Solana

Perhaps the most consequential reveal came from Anza’s research team: the Alpenglow protocol. This upgrade targets one of blockchain’s perennial challenges – transaction finality. With ambitions to cut finality time to 100-150 milliseconds and boost throughput to 10,000 transactions per second, Alpenglow positions Solana at the vanguard of real-time decentralized applications. For context, these figures rival traditional finance rails and are set to outpace most competing L1s.

This technical leap isn’t just about speed; it forms the backbone for next-generation dApps in gaming, payments, and high-frequency trading. As Anatoly Yakovenko emphasized in his keynote (which drew a standing-room-only crowd), “If crypto is going to compete with NASDAQ or Visa, we need to be faster than both. ” The market appears receptive – SOL has maintained momentum above $200 since these details went public.

Tokenized Equities: Superstate and Kraken Lead Financial Innovation

The intersection of traditional finance and blockchain was another summit highlight. Superstate’s Opening Bell platform, launched during the event, enables seamless issuance and trading of tokenized equities directly on Solana. This move is complemented by Kraken’s announcement of tokenized stocks and a custom Ledger Flex hardware wallet tailored specifically for Solana users – a clear nod toward mainstream adoption.

The implications are profound: by bridging compliant equity products with low-latency settlement on-chain, Solana is carving out a niche as a serious infrastructure layer for global capital markets. These launches come amid growing institutional interest in real-world asset (RWA) tokenization – an area where speed and cost-efficiency are paramount.

Key Product Launches at Solana All-In Summit 2025

-

Alpenglow Protocol by Anza Research: Announced as a breakthrough for Solana, Alpenglow aims to reduce transaction finality to 100-150 milliseconds and boost throughput to 10,000 transactions per second, further enhancing Solana’s scalability and speed.

-

Superstate’s Opening Bell Platform: Superstate unveiled Opening Bell, a platform enabling tokenized equities on Solana, allowing users to access and trade traditional equity assets on-chain for the first time within the Solana ecosystem.

-

Kraken Tokenized Stocks & Ledger Flex for Solana: Kraken announced support for tokenized stocks and introduced a custom Ledger Flex hardware wallet, specifically tailored for Solana users, enhancing both asset diversity and security.

-

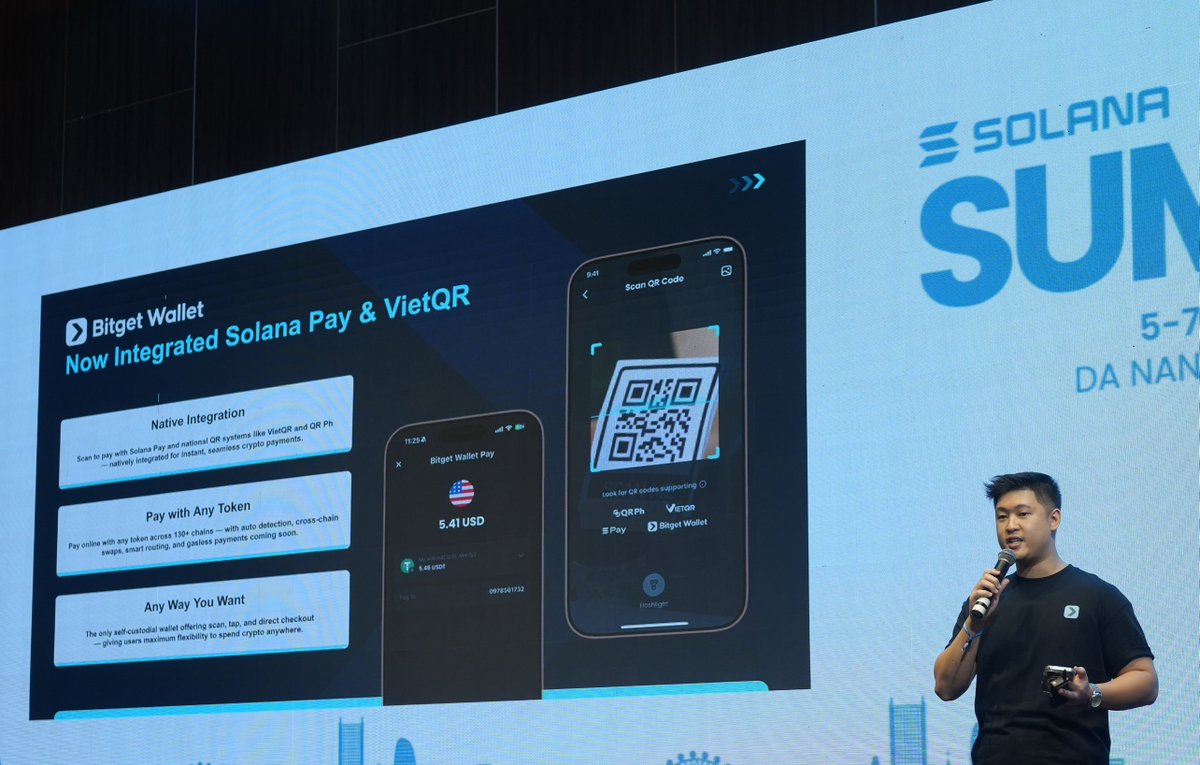

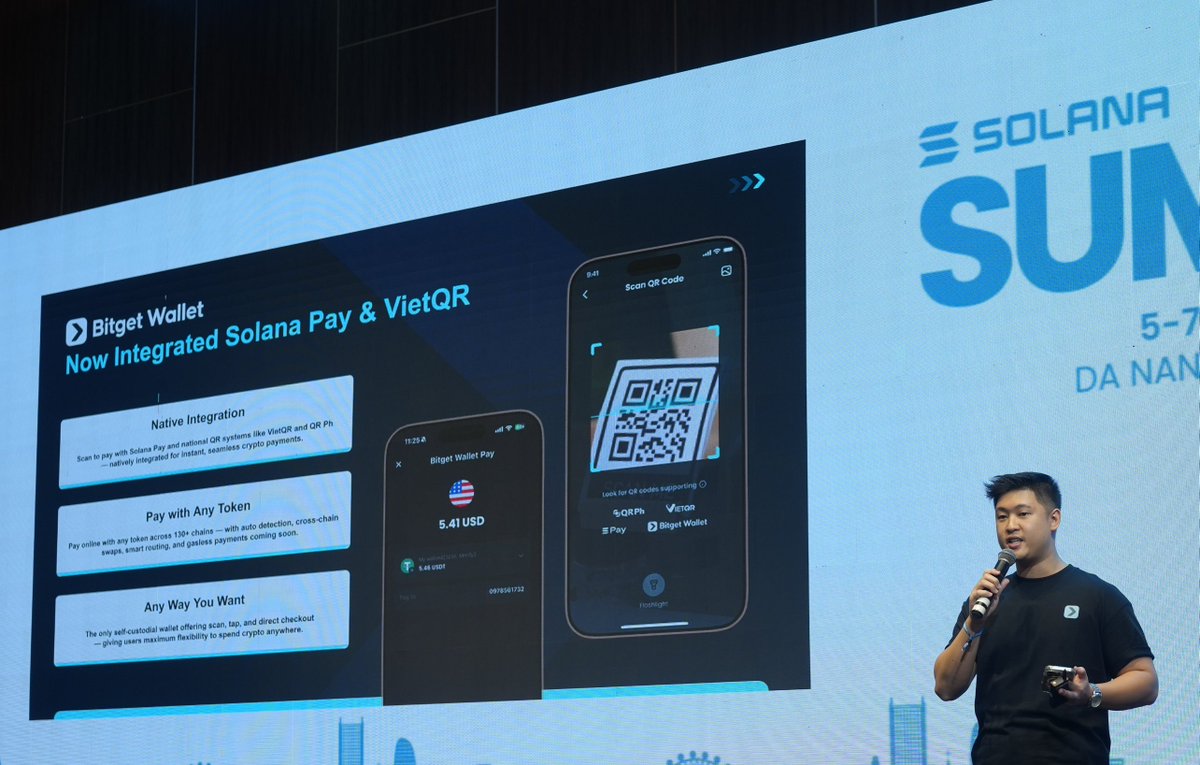

Bitget Wallet QR-Based Payments with Solana Pay: Bitget Wallet launched QR-based payment integrations, including seamless support for Solana Pay, streamlining real-world crypto transactions for merchants and consumers.

-

Solana Mega Report V2 Release: The Solana Mega Report V2 was presented, offering comprehensive insights into the blockchain’s recent technical advancements, ecosystem growth, and future roadmap.

Real-World Payments: Bitget Wallet Integrates QR-Based Crypto Transactions

A persistent criticism of crypto has been its limited real-world usability. Bitget Wallet addressed this head-on by rolling out QR-based payment integrations at the summit – including native support for Solana Pay. This enables frictionless point-of-sale transactions using SOL and SPL tokens across participating merchants globally.

This integration signals a broader trend: as infrastructure matures, user experience improves dramatically. Lowering barriers for everyday crypto spending could accelerate adoption beyond speculative trading into genuine economic activity.

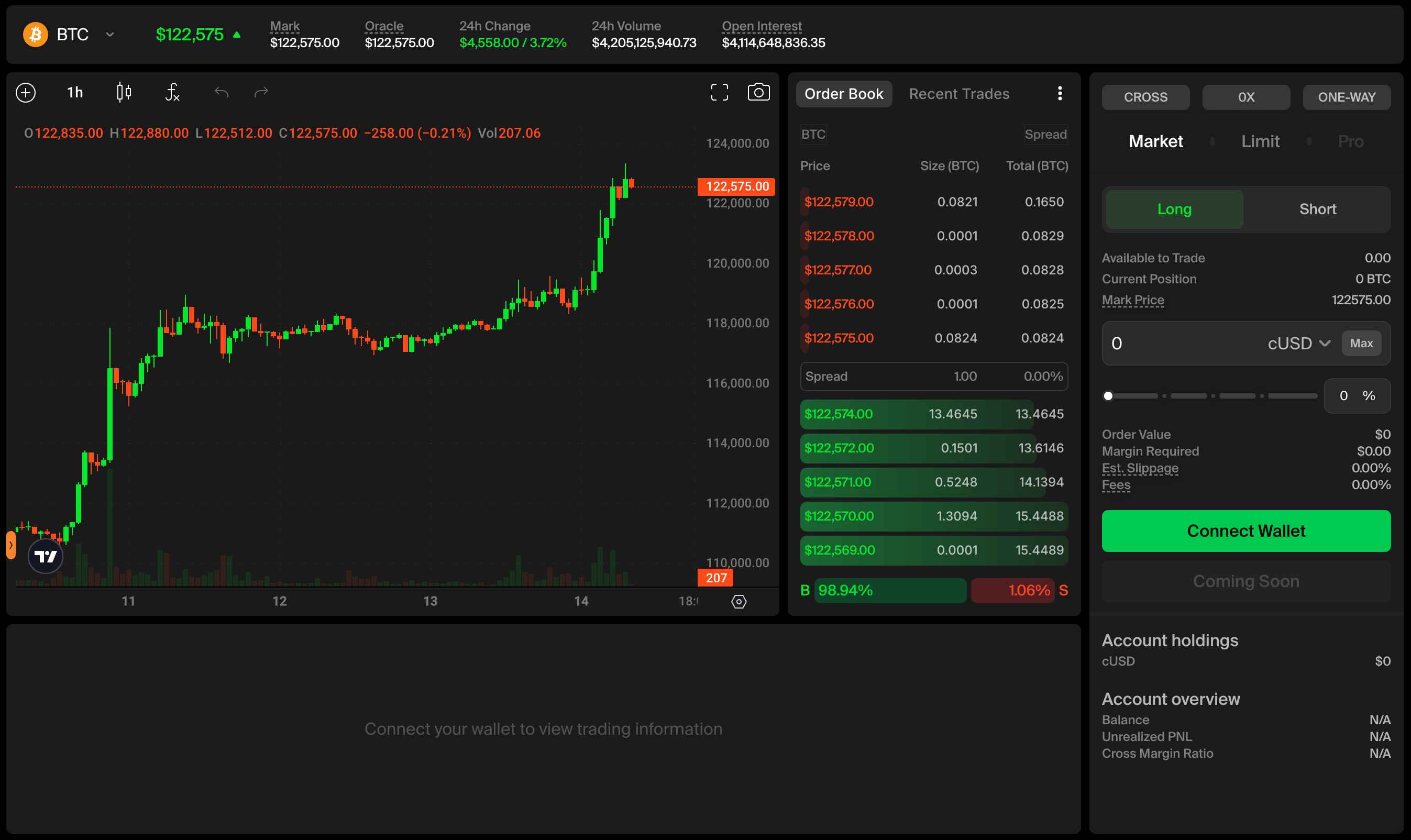

Solana (SOL) Price Prediction 2026-2031

Forecast Based on Post-All-In Summit 2025 Developments and Current Market Data ($202.76 as of August 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $145.00 | $215.00 | $320.00 | +6% | Volatility expected as adoption of new protocols matures; regulatory clarity needed for tokenized assets. |

| 2027 | $170.00 | $265.00 | $400.00 | +23% | Bullish scenario if tokenized equities and Solana Pay gain traction; bear case if macro headwinds persist. |

| 2028 | $210.00 | $340.00 | $500.00 | +28% | Major expansion in DeFi and AI-powered dApps could drive growth; competition from L2s remains a factor. |

| 2029 | $250.00 | $420.00 | $650.00 | +24% | Increased institutional participation; scaling solutions like Alpenglow fully realized. |

| 2030 | $280.00 | $510.00 | $800.00 | +21% | Widespread adoption of tokenized assets and real-world payments; regulatory integration advances. |

| 2031 | $310.00 | $600.00 | $950.00 | +18% | Solana cements leadership in high-throughput blockchain; global macro and tech cycles impact upside. |

Price Prediction Summary

Solana’s price outlook for 2026-2031 is bullish with strong upside potential, driven by major technological advancements (like Alpenglow), real-world adoption in tokenized assets and payments, and growing institutional interest. However, price volatility remains, with regulatory and market cycle risks affecting the range of outcomes. The average price could nearly triple by 2031 from current levels, assuming continued ecosystem growth and mainstream adoption.

Key Factors Affecting Solana Price

- Adoption of Alpenglow protocol and increased transaction throughput.

- Growth in tokenized equities and real-world payment solutions (e.g., Solana Pay, Opening Bell).

- Regulatory developments impacting tokenized assets and DeFi.

- Competition from other high-throughput blockchains and Layer 2 solutions.

- Institutional interest and integration of Solana into mainstream finance.

- Global macroeconomic conditions and crypto market cycles.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Mega Report V2: Mapping Solana’s Technical Trajectory

No major conference is complete without a landmark research release. The unveiling of the Solana Mega Report V2 offered an analytical deep dive into network performance metrics, ecosystem growth data, and upcoming engineering milestones. For developers and institutional allocators alike, this report provides actionable insights into what sets Solana apart technically – from parallel processing via Sealevel VM to innovations in fee markets.

Beyond the headline announcements, the All-In Summit 2025 was a showcase of Solana’s community-driven ethos and rapid pace of experimentation. The ecosystem’s diversity was on full display, with panels dissecting everything from memecoin culture and AI-powered dApps to Asia-Pacific’s surging participation in Solana development. This convergence of technical depth and grassroots creativity is a defining feature of Solana’s current cycle.

SOL Ecosystem Momentum: Market Sentiment and On-Chain Activity

The summit’s impact is already visible in both market sentiment and on-chain data. SOL continues to trade robustly at $202.76, reflecting not just speculative optimism but also real user engagement. Daily active addresses have climbed steadily since June, while DeFi TVL on Solana has reached new 2025 highs as protocols like MarginFi, Kamino, and Jito attract liquidity from both retail and institutional players.

Meanwhile, NFT volume remains resilient despite broader market rotation toward tokenized RWAs. The continued success of gaming projects such as Star Atlas and Aurory – both of which had a strong presence at the summit – underscores Solana’s multi-sector appeal.

What Sets This Cycle Apart?

Unlike previous bull runs that were driven primarily by speculation or isolated narratives, the current momentum around Solana is underpinned by tangible infrastructure upgrades and cross-sector adoption. The Alpenglow protocol is not just theoretical – it is slated for phased mainnet rollout over the coming months, with early benchmarks already demonstrating sub-150ms finality in test environments.

Similarly, tokenized equity products are moving beyond pilots into live trading with regulated partners, offering a blueprint for other blockchains seeking institutional relevance. Bitget Wallet’s QR integration is already seeing pilot deployments in Southeast Asian retail chains – an early signal that digital assets are inching closer to everyday commerce.

Photos That Captured the Moment

The energy in Da Nang was palpable, from Anatoly Yakovenko’s keynote to late-night hackathons and impromptu community meetups along My Khe Beach. These moments were immortalized by attendees across social media – a testament to Solana’s vibrant grassroots culture.

Top 5 Most-Shared Photos from Solana All-In Summit 2025

-

Anza Research Team Unveils Alpenglow Protocol: The moment the Anza team announced the Alpenglow protocol, promising 100-150ms transaction finality and 10,000 TPS, became an instant highlight across crypto media.

-

Superstate Launches Opening Bell for Tokenized Equities: A widely-shared photo captured the Superstate team introducing Opening Bell, a platform set to bring tokenized equities to Solana.

-

Kraken Announces Tokenized Stocks and Ledger Flex Integration: The on-stage reveal by Kraken of tokenized stocks and a custom Ledger Flex for Solana users was a top trending visual moment.

-

Bitget Wallet Demonstrates QR-Based Solana Pay Integration: A dynamic photo of the Bitget Wallet team showcasing QR-based payments with Solana Pay highlighted real-world crypto adoption.

-

Release of the Solana Mega Report V2: The unveiling of the Solana Mega Report V2, summarizing the blockchain’s progress and technical achievements, was widely circulated among attendees and on social media.

Looking Ahead: Risks, Catalysts, and the Road to $250 SOL?

While the outlook remains bullish, prudent investors will note several variables ahead. Network upgrade execution risk persists; any delays or security incidents could dampen sentiment. Regulatory clarity around tokenized equities remains a work in progress globally. Yet if current trends hold – particularly around real-world asset adoption and payment integration – SOL could plausibly test higher resistance levels in Q4 2025.

The All-In Summit made it clear: Solana is not just chasing headlines; it is building foundational infrastructure for decentralized finance, gaming, and beyond. As always, let the numbers tell the story – but this year’s narrative feels more sustainable than ever before.