Tokenized stocks have long been a vision for bridging the worlds of traditional finance and crypto, but few platforms have managed to achieve the explosive growth seen by xStocksFi Solana in 2025. In just six weeks since its launch, xStocksFi has surpassed $2 billion in trading volume, capturing over 95% of all tokenized stock activity on Solana. This case study unpacks how xStocksFi’s unique approach, deep liquidity integrations, and regulatory focus are reshaping access to equities for a global user base.

xStocksFi’s Breakout: $2 Billion and Volume and the Rise of TSLAx

Launched by Backed Finance in late June 2025, xStocksFi burst onto the scene with an ambitious offering: over 60 U. S. stocks and ETFs, each represented as SPL tokens on Solana. Every token (such as TSLAx for Tesla or NVDAx for Nvidia) is backed 1: 1 by real shares held with regulated custodians, ensuring a direct link to underlying assets. This structure lets investors trade traditional equities with the speed and efficiency of crypto – no intermediaries required.

The platform’s rapid ascent is best illustrated by its flagship asset: TSLAx. With over 11,000 holders and daily volumes rivaling some DeFi blue chips, TSLAx has become the poster child for tokenized equities’ potential. The latest data from The Block confirms that xStocksFi crossed the $2 billion mark in just six weeks – a feat fueled by both retail and institutional demand.

Why Solana? Speed, Fees, and Ecosystem Synergy

One critical factor behind xStocksFi’s success is its choice of blockchain. Solana’s high throughput and minimal fees make it uniquely suited for financial products that demand real-time execution and low friction. With SOL currently trading at $180.86, the network continues to attract both developers and users seeking scalable alternatives to Ethereum.

xStocksFi leverages Solana’s technical strengths through deep integrations with DeFi protocols like Raydium and Jupiter. These partnerships enable instant swaps between tokenized stocks and other digital assets, while maintaining tight spreads thanks to robust liquidity pools. According to Solanafloor, xStocksFi recorded $2 million in volume within hours of launch – a testament to both market appetite and infrastructure readiness.

Compliance First: How xStocksFi Navigates Regulation

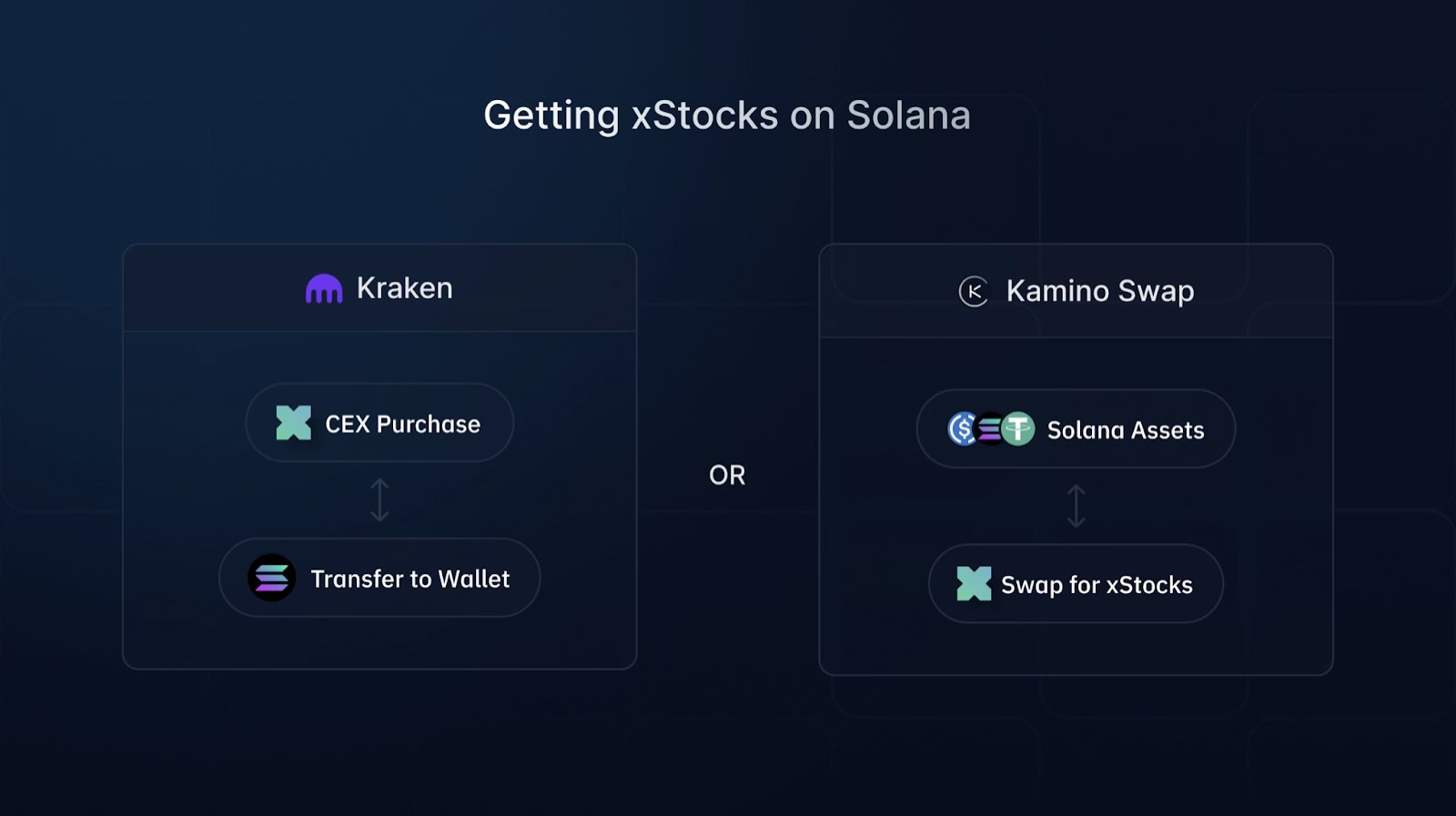

A key differentiator for xStocksFi is its laser focus on regulatory compliance. Each tokenized stock is fully backed by shares held with licensed custodians, providing transparency and legal clarity that many earlier attempts at synthetic equities lacked. This structure not only reassures users but also enables listings on mainstream exchanges like Kraken and Bybit – expanding reach far beyond typical DeFi circles.

The platform’s approach aligns with insights from recent research (Ainvest.com) showing that compliant tokenization models are rapidly gaining favor among institutional players seeking exposure to U. S. equities without traditional barriers.

Solana (SOL) Price Prediction 2026-2031: Impact of Tokenized Stocks Adoption

Based on xStocks’ rapid growth, Solana’s dominant market share in tokenized equities, and evolving DeFi integrations.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $135.00 | $205.00 | $320.00 | +13% | Continued strong adoption of tokenized stocks; potential volatility from global regulatory reviews |

| 2027 | $160.00 | $235.00 | $390.00 | +15% | Expansion of tokenized assets, increased institutional participation; new DeFi integrations |

| 2028 | $185.00 | $275.00 | $480.00 | +17% | Mainstream adoption of tokenized equities; enhanced interoperability with other chains |

| 2029 | $210.00 | $315.00 | $570.00 | +15% | Regulatory clarity in major markets; Solana cements position as leader in tokenized finance |

| 2030 | $250.00 | $365.00 | $660.00 | +16% | Tokenized stock volumes rival traditional exchanges; increased competition from new blockchains |

| 2031 | $295.00 | $415.00 | $750.00 | +14% | Matured market, global regulatory frameworks; Solana maintains innovation lead, but growth moderates |

Price Prediction Summary

Solana (SOL) is poised for steady growth from 2026 to 2031, underpinned by its dominance in the tokenized stocks sector, as evidenced by xStocks’ explosive volume and ecosystem integration. While volatility may persist due to market cycles and regulatory developments, the trend points to increasing average prices and expanding use cases. Maximum price scenarios reflect bullish adoption and global regulatory clarity, while minimums account for potential setbacks or increased competition.

Key Factors Affecting Solana Price

- Continued adoption and expansion of tokenized stocks on Solana and partner exchanges

- Regulatory developments in the US, EU, and Asia regarding tokenized securities

- Technological upgrades to Solana improving scalability and security

- Integration with major DeFi protocols and cross-chain platforms

- Competition from alternative blockchains and tokenization platforms

- Macroeconomic trends and investor sentiment in both crypto and traditional finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Beyond compliance, xStocksFi has established a transparent audit trail for every tokenized share, allowing users to independently verify collateralization. This is a significant leap from the opaque practices of early synthetic assets, building trust among both retail and institutional participants. The platform’s ability to maintain 1: 1 backing with regulated custodians also opens doors to future partnerships with global exchanges and fintechs interested in compliant exposure to U. S. equities.

Ecosystem Growth: Integrations and User Experience

xStocksFi’s meteoric rise is not just about regulatory savvy or Solana’s technical prowess. It’s also about ecosystem orchestration. By integrating directly with leading DeFi protocols like Raydium and Jupiter, xStocksFi has made it possible for users to move seamlessly between tokenized stocks, stablecoins, and other Solana-based assets. This composability is a game changer for active traders who demand both liquidity and optionality in their portfolios.

Why xStocksFi Solana Dominated Tokenized Stocks in 2025

-

1. Unmatched Asset Selection: xStocksFi offers 60+ tokenized U.S. stocks and ETFs, including popular assets like TSLAx (Tesla), AAPLx (Apple), and NVDAx (Nvidia). Each token is backed 1:1 by real shares held with a regulated custodian, ensuring transparency and investor confidence.

-

2. Seamless Solana Integration: Built on the Solana blockchain, xStocksFi leverages ultra-fast transaction speeds and minimal fees, making trading tokenized equities as efficient as trading native cryptocurrencies. This technical advantage fueled rapid adoption.

-

3. Strategic Exchange Partnerships: Collaborations with major exchanges like Kraken and Bybit expanded xStocksFi’s reach and liquidity. These partnerships enabled users to access tokenized stocks across multiple platforms and boosted overall trading volume.

-

4. Deep DeFi Ecosystem Integration: xStocksFi integrated with leading Solana DeFi platforms such as Raydium and Jupiter. This allowed users to swap, lend, and earn yield on tokenized equities, bridging traditional finance and DeFi in a single ecosystem.

-

5. Market Leadership and Volume: Since its launch in June 2025, xStocksFi surpassed $2 billion in trading volume within six weeks, capturing over 95% of tokenized stock trading volume on Solana. The surge in demand, especially for TSLAx, cemented its position as the top platform in the sector.

Moreover, the user experience sets a new standard for on-chain financial products. Real-time settlement, near-zero fees, and intuitive interfaces have lowered the barrier to entry for global investors, many of whom previously faced steep restrictions accessing U. S. equities from abroad. The result? A surge in both trading activity and wallet creation across the Solana ecosystem.

What Does $2 Billion Volume Mean for Solana Financial Products?

The implications of xStocksFi’s $2 billion milestone go far beyond headline numbers. This breakout performance signals that tokenized stocks on Solana are not just a speculative trend but a durable new asset class gaining traction among serious investors. With over 60 assets live, and more expected as regulatory clarity improves, xStocksFi is helping establish Solana as the leading blockchain for compliant financial products.

This momentum is reflected in SOL’s price stability at $180.86, underlining market confidence even as broader crypto volatility persists. As more projects follow xStocksFi’s blueprint, prioritizing compliance, deep liquidity integrations, and seamless UX, the network effect could further entrench Solana as the backbone for next-generation capital markets.

“The moment you can trade Tesla or Apple shares as easily as swapping USDC on-chain, you unlock an entirely new layer of financial inclusion. ”

Looking Ahead: Challenges and Opportunities

No innovation comes without hurdles. Regulatory environments remain fluid, especially across jurisdictions outside the U. S. , meaning ongoing vigilance is required from platforms like xStocksFi to maintain legal alignment globally. Liquidity fragmentation across blockchains is another challenge, but one that may be addressed by cross-chain alliances such as the emerging xStocks Alliance mentioned on Investopedia.

Yet the opportunities are profound: fractional ownership of blue-chip equities, democratized access for emerging markets, programmable finance features (like auto-dividends or portfolio rebalancing), and even real-world asset lending, all powered by Solana’s robust rails.

xStocksFi’s story is still being written, but its first six weeks have already demonstrated what happens when regulatory diligence meets technical innovation at scale. For anyone exploring Solana financial products, this case study offers a powerful blueprint for what’s possible when you combine speed, transparency, and user-first design in one platform.