Solana has long been lauded for its speed, but the unveiling of the Alpenglow upgrade in 2025 marks a decisive leap forward. With transaction finality times slashed from an average of 12.8 seconds to a jaw-dropping 150 milliseconds, Solana is not just iterating – it’s reimagining what ultra-low latency means for blockchains. The ramifications for blockchain gaming and DeFi are profound, with the entire ecosystem poised on the brink of a new era defined by certainty, speed, and resilience.

Why Transaction Finality Matters: From Seconds to Milliseconds

In traditional finance or gaming, latency is measured in milliseconds. Until now, blockchains lagged far behind, with even the fastest networks requiring several seconds – or more – to finalize transactions. This lag has been a persistent barrier for real-time applications like competitive multiplayer games or high-frequency DeFi trading.

The Solana Alpenglow upgrade changes the equation. By achieving deterministic finality in about 150ms, Solana unlocks new possibilities: on-chain actions that settle faster than human perception, real-time auctions where every bid counts instantly, and DeFi order books that rival centralized exchanges in speed. For developers and users alike, this isn’t just an incremental improvement, it’s a qualitative shift in what blockchain can deliver.

“Alpenglow’s 100x reduction in finality time is more than a technical milestone, it’s a paradigm shift for Web3 user experience. “

The Mechanics: Votor and Rotor Redefine Consensus

This leap forward is powered by two key innovations: Votor, a streamlined voting mechanism utilizing off-chain BLS signatures, and Rotor, an optimized data dissemination system that replaces Turbine. Votor enables blocks to be finalized in one or two rounds without on-chain vote transaction fees, reducing ledger bloat and cutting validator costs by approximately $5,000 per month. Rotor leverages stake-weighted, geography-aware routing to minimize network hops – reducing latency by about 40% compared to Turbine.

The result? Not only are transactions confirmed at lightning speed but network efficiency improves dramatically. This architectural simplification also eliminates Proof of History from Solana’s stack, making the protocol more robust and easier to maintain.

The Ripple Effect: Real-Time Gaming and DeFi Unlocked

The implications for blockchain gaming are immediate and dramatic. Near-instantaneous finality means that every move in a multiplayer game can be reflected on-chain with no perceptible delay – critical for fairness and immersion in competitive environments. Live auctions become genuinely live; digital asset transfers happen as quickly as players can act.

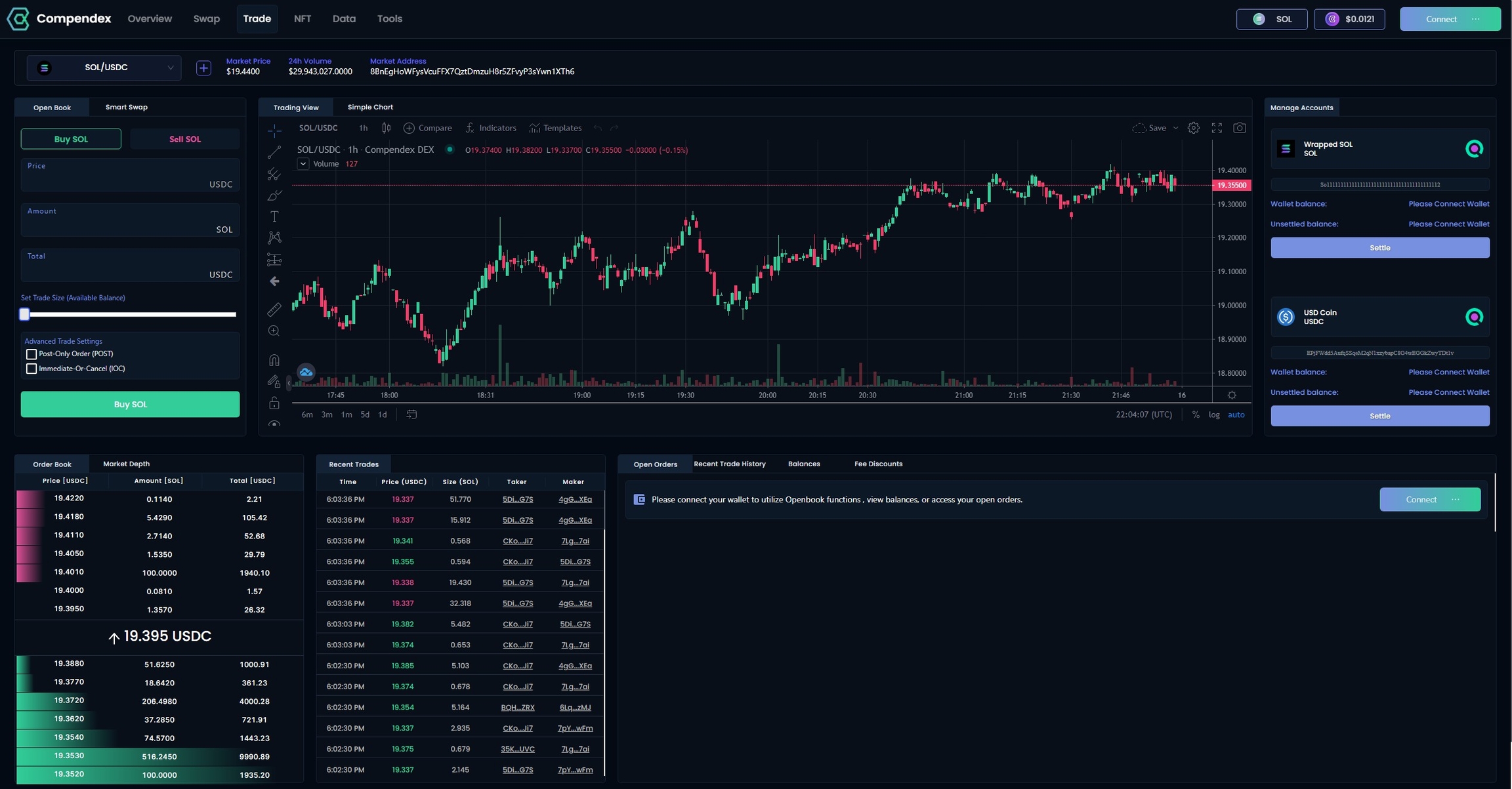

For DeFi protocols built atop Solana’s new consensus layer, this upgrade enables on-chain Central Limit Order Books (CLOBs) with matching speeds previously reserved for centralized exchanges. Streaming payments become viable at scale; payment processors can execute transactions almost as quickly as they’re initiated.

Key Benefits of Alpenglow for Developers and Users

-

Ultra-fast Transaction Finality (≈150ms): Alpenglow slashes Solana’s average block finality from 12.8 seconds to approximately 150 milliseconds, enabling near-instant settlement for all on-chain activities.

-

Real-Time Blockchain Gaming: The upgrade allows for real-time, on-chain interactions—crucial for multiplayer games, live auctions, and in-game asset transfers that require sub-second confirmation.

-

High-Speed DeFi and On-Chain Order Books: With deterministic finality, DeFi platforms can offer on-chain Central Limit Order Books and order matching speeds rivaling centralized exchanges, improving user experience for traders and liquidity providers.

-

Lower Validator Costs: The new Votor mechanism eliminates on-chain vote transaction fees, reducing validator operational costs by about $5,000 per month and minimizing ledger bloat.

-

Reduced Network Latency and Improved Efficiency: Rotor optimizes data dissemination with a single-layer relay and stake-weighted, geography-aware routing, cutting latency by roughly 40% compared to the previous Turbine protocol.

-

Enhanced Network Resilience: Alpenglow’s 20+20 fault tolerance model lets Solana withstand up to 20% adversarial stake and 20% non-responsive stake, boosting overall network stability and uptime.

-

Simplified Architecture: By removing the Proof of History mechanism and streamlining protocol components, Alpenglow makes Solana’s infrastructure more robust and easier for developers to build on.

-

Potential for Broader Adoption and Ecosystem Growth: The transformative performance improvements position Solana as a leading platform for next-generation DeFi, gaming, and social dApps, potentially increasing demand for SOL, which currently trades at $182.85 (as of August 19, 2025).

This isn’t just theory, early community feedback underscores how much pent-up demand exists for these capabilities across both sectors.

Price Context: SOL at $182.85 Amid Upgrade Momentum

As of August 19,2025, Solana’s native token (SOL) trades at $182.85, reflecting market anticipation around Alpenglow’s transformative potential despite a modest daily dip of 0.98%. It’s worth noting that while price action often lags fundamental upgrades like this one, the ecosystem-wide improvements set the stage for future growth as adoption accelerates.

Solana (SOL) Price Prediction Post-Alpenglow Upgrade (2026–2031)

Forecast reflects the transformative impact of Solana’s Alpenglow consensus protocol, factoring in adoption trends, technology upgrades, and market cycles.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $145.00 | $210.00 | $320.00 | +15% | Increased DeFi and gaming adoption as Alpenglow stabilizes; possible volatility from broader crypto market corrections. |

| 2027 | $190.00 | $285.00 | $420.00 | +36% | Wider institutional interest and new gaming/DeFi dApps drive growth; regulatory clarity improves sentiment. |

| 2028 | $220.00 | $340.00 | $500.00 | +19% | Mainstream use in real-time payments and on-chain order books; competition from other L1s tempers upside. |

| 2029 | $200.00 | $310.00 | $470.00 | -9% | Market consolidation and macro headwinds; network upgrades continue but overall crypto cycle enters correction. |

| 2030 | $255.00 | $390.00 | $620.00 | +26% | Renewed bull market, further adoption of instant finality in gaming/DeFi; Solana cements role as a top L1. |

| 2031 | $300.00 | $470.00 | $800.00 | +21% | Mature ecosystem, mass adoption in high-frequency apps; scalability and security upgrades sustain long-term growth. |

Price Prediction Summary

Solana’s Alpenglow upgrade is expected to catalyze significant ecosystem growth, particularly in blockchain gaming and DeFi, by enabling near-instant transaction finality and reducing operational costs. After an initial period of volatility and adjustment, SOL may experience steady appreciation as new use cases and institutional adoption accelerate. However, macroeconomic factors and competition from other smart contract platforms may introduce periods of consolidation or correction. Overall, the outlook for SOL is bullish over the long term, with substantial upside potential if adoption trends continue.

Key Factors Affecting Solana Price

- Alpenglow upgrade enables 100x faster transaction finality (100–150 ms), unlocking new real-time applications.

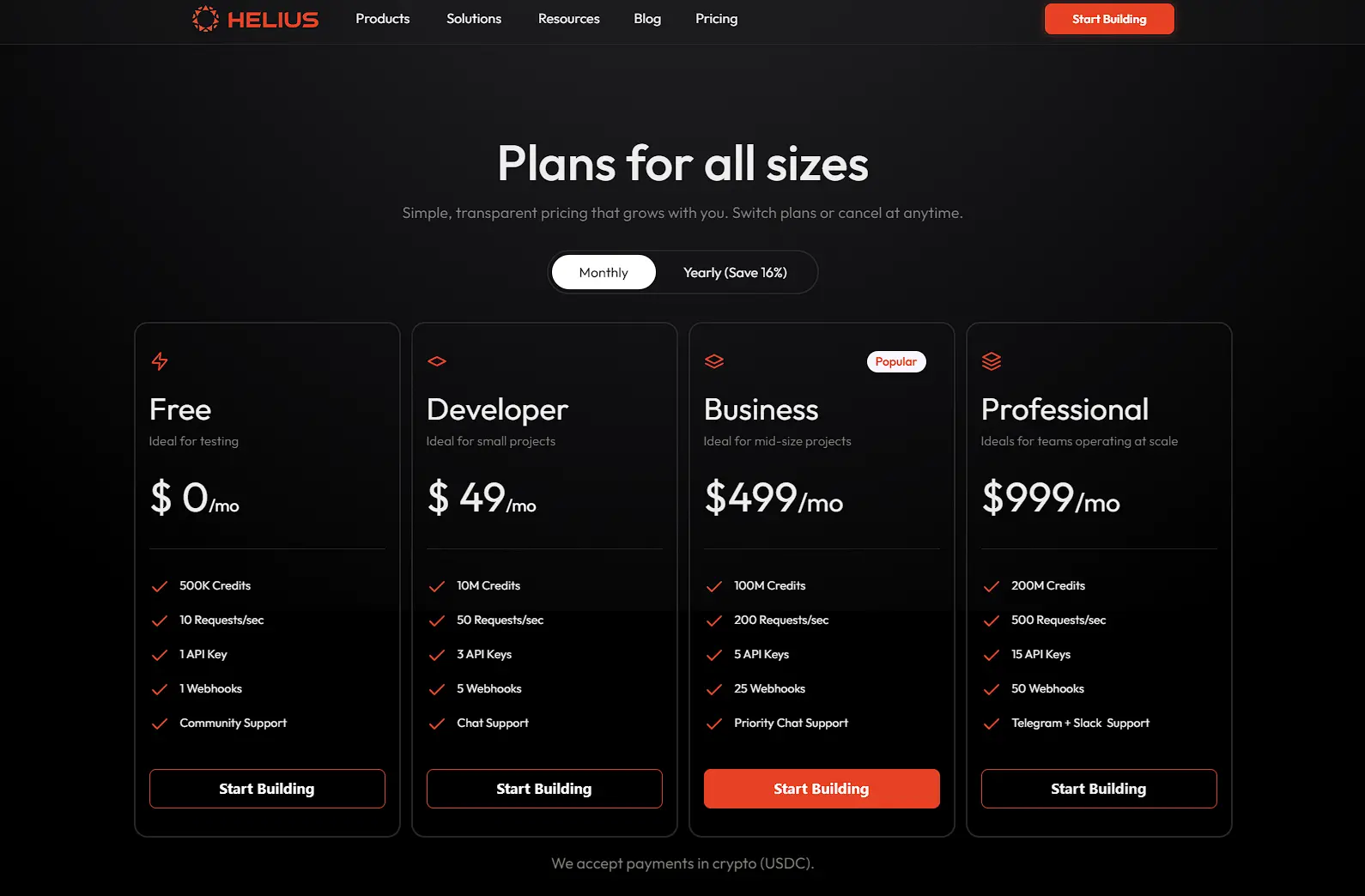

- Reduced validator costs and increased network resilience attract more developers and users.

- Growth in blockchain gaming and DeFi due to instant settlement and on-chain order books.

- Potential for increased institutional adoption as network reliability and scalability improve.

- Regulatory developments and global crypto policy changes could influence sentiment and price.

- Competition from Ethereum, Avalanche, and other L1s may impact Solana’s market share.

- Macro market cycles (crypto bull/bear markets) will affect price volatility and growth rates.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Network resilience is another underappreciated dimension of the Alpenglow upgrade. By introducing the “20 and 20” fault tolerance model, Solana can now withstand up to 20% adversarial stake and an additional 20% non-responsive stake. This provides a greater buffer against outages and targeted attacks, making the network more reliable for mission-critical applications in both gaming and DeFi. For developers, this translates to fewer interruptions and a more predictable environment in which to build high-stakes products.

What’s striking is how these technical changes have a direct human impact. In competitive blockchain games, milliseconds matter: player actions, asset transfers, and in-game economies are all synchronized with unprecedented precision. For DeFi users, the ability to execute trades or move assets with near-zero settlement risk brings on-chain finance closer to parity with traditional systems, while preserving decentralization.

Ecosystem Evolution: A New Foundation for Builders

The broader Solana ecosystem stands to benefit from this foundational shift. With validator operational costs dropping by roughly $5,000 per month thanks to off-chain voting, network participation becomes more accessible and sustainable for smaller operators. This could foster greater decentralization over time, a crucial metric for long-term network health.

Additionally, the architectural simplification that comes from removing Proof of History and streamlining consensus means faster iteration cycles for core developers. Builders can focus on user experience rather than wrestling with protocol complexity or workarounds for latency limitations.

The upshot? We’re likely to see an explosion of novel dApps, games with real-time PvP battles settled entirely on-chain, decentralized exchanges offering sub-second trade confirmations, and payment rails that finally make sense for everyday commerce. The Solana upgrade 2025 isn’t just about keeping pace with competitors; it’s about setting new standards that others will chase.

Looking Ahead: Solana’s Place Among Ultra-Low Latency Blockchains

With its current price at $182.85, SOL sits at a pivotal juncture as the market absorbs what ultra-low latency truly means for adoption curves. While short-term price movements may be muted as traders await post-upgrade metrics, long-term investors should note how infrastructure improvements like Alpenglow often precede waves of innovation, and capital inflows, in Web3 ecosystems.

The coming months will test whether Solana’s bet on deterministic speed pays off in developer mindshare and user growth. But if history is any guide, protocol upgrades that materially enhance user experience tend to reshape competitive dynamics across the entire crypto landscape.