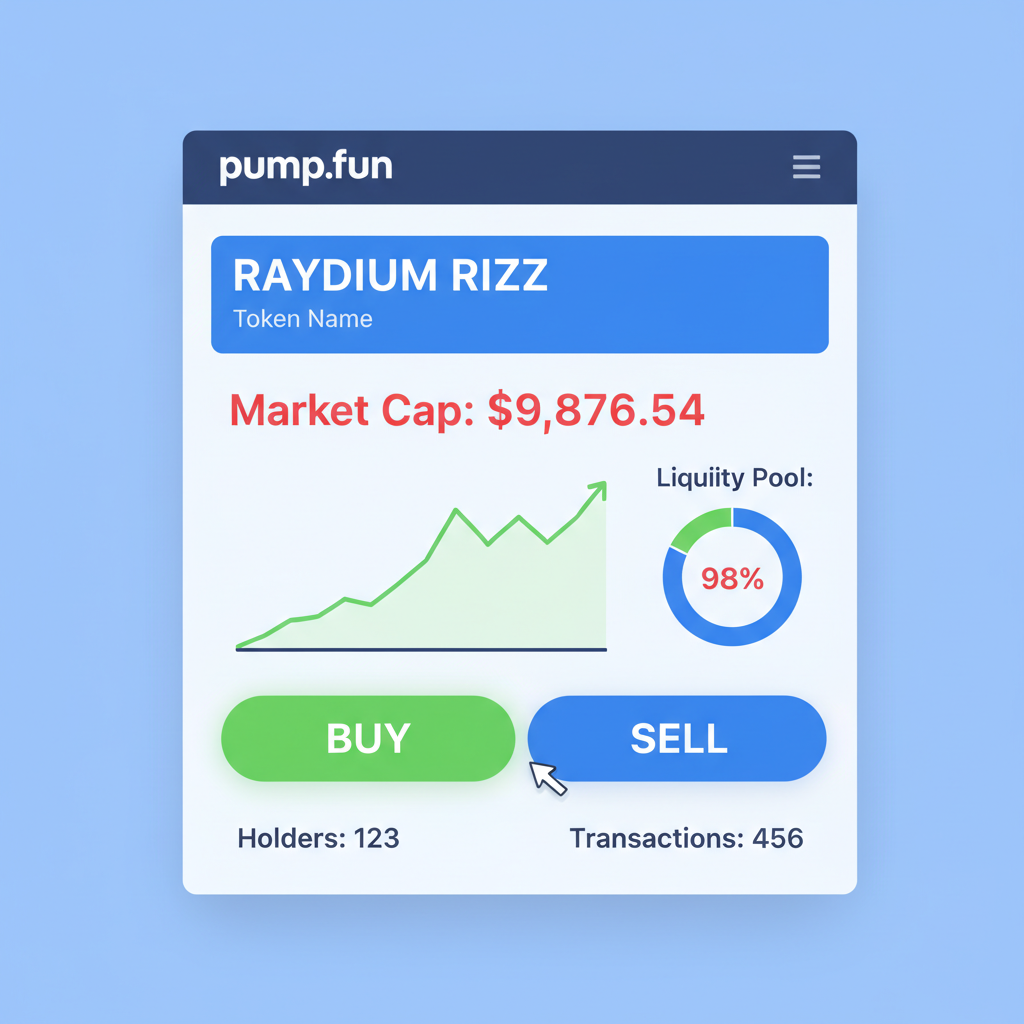

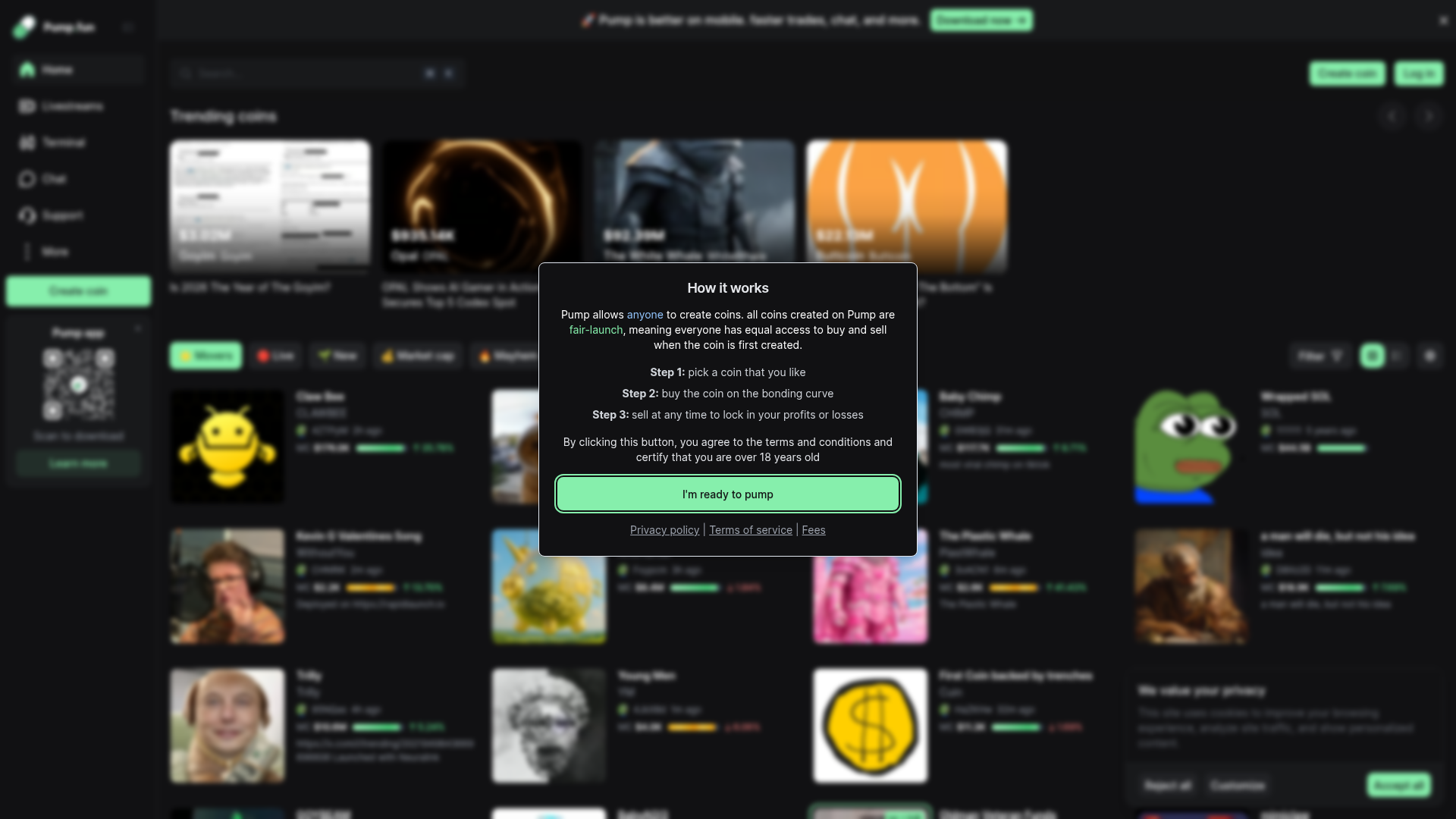

Solana’s memecoin frenzy is back with a vengeance in 2026, fueled by Pump. fun’s explosive growth. On January 6, the platform shattered records with $2.03 billion in daily decentralized exchange volume, pushing weekly totals past $6 billion. This resurgence crowns Pump. fun as Solana’s second-largest DEX, while its native PUMP token has climbed 60% over the past month. With Binance-Peg SOL trading at $84.10, up a modest $0.0200 in the last 24 hours between $83.10 and $87.60, the ecosystem hums with volatility ripe for 1000x pump. fun solana memecoins.

Traders chasing solana memecoins 1000x 2026 gems know timing is everything. Pump. fun’s no-code launchpad democratizes token creation, spawning thousands of memecoins daily. Yet, as Galaxy Research notes, Solana dominates chains, Pump. fun rules Solana, and a tiny fraction of launches deliver outsized returns. The rest? Quick fades. My volatility background screams opportunity here: high-speed launches mean asymmetric bets where early entry turns pennies into fortunes.

Pump. fun’s Record-Breaking Momentum Signals Fresh 1000x Potential

February 17,2026, marks a pivotal moment. Pump. fun’s surge isn’t hype; it’s infrastructure meeting cultural mania. CoinMarketCap predicts Solana’s upgrades and Pump. fun leadership will dominate memecoins this year, amplified by Bitcoin rallies spilling into altcoin pumps. Top performers like BONK, WIF, and MEW from Webopedia’s watchlist underscore this, but the real alpha lies in early pump. fun calls solana.

Pump. fun sets volume record as Solana memecoins roar back.

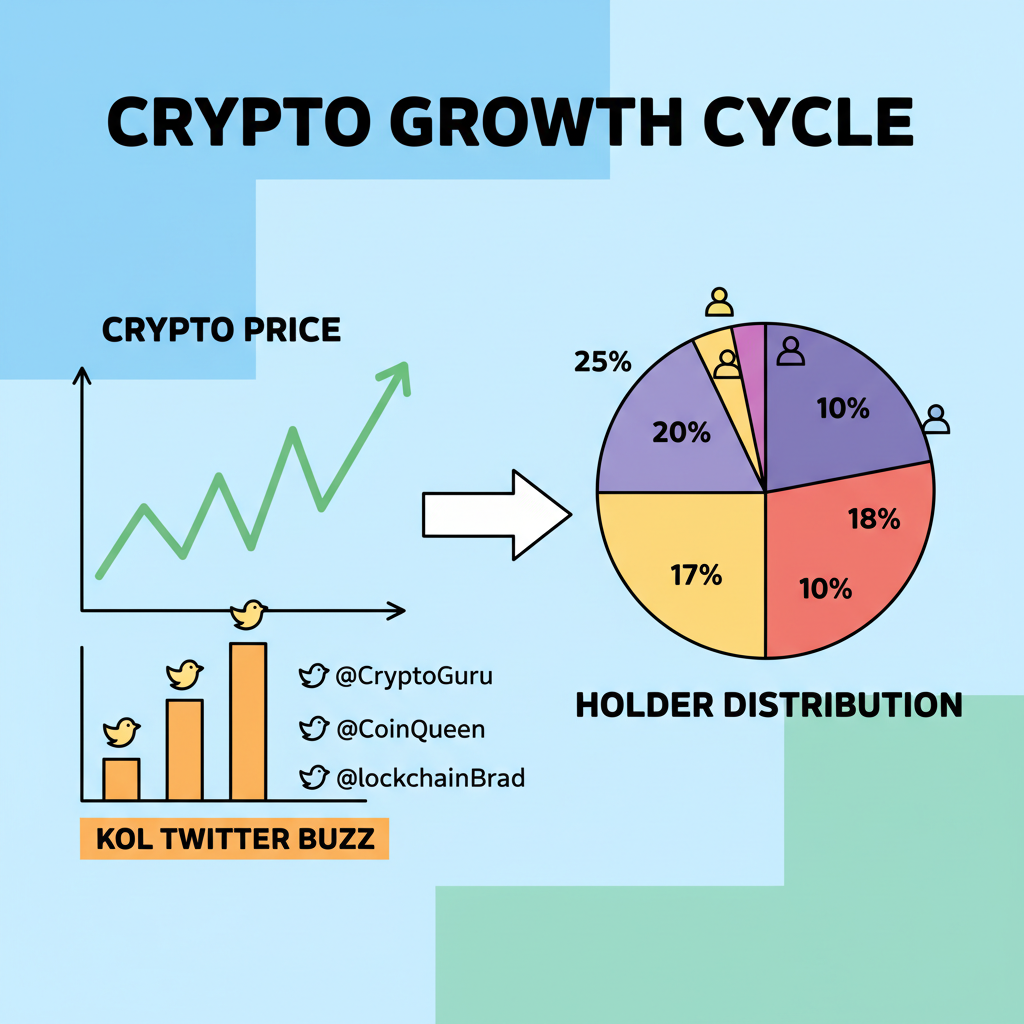

James Wynn’s Pepe call sparked a 34% jump, proving influencers still move markets. Reddit’s r/solana echoes this: best strategy is launch participation for insider edges. With SOL at $84.10, liquidity flows freely, but rugs abound. Sophisticated investors hedge with options-like thinking: position small, exit fast on momentum breaks.

Decoding the Data: Where 1000x Gems Hide on Pump. fun

A vanishingly small fraction of Pump. fun tokens moon, per Galaxy. Coinspeaker ranks TRUMP, BONK, WIF by market cap, but best solana memecoin launches 2026 emerge from obscurity. BingX highlights top watches, yet my scan favors social sentiment spikes and bot-detectable patterns. Ledger’s ecosystem tokens like JUP, Jito, Raydium provide rails, but memecoins ride the rails to glory.

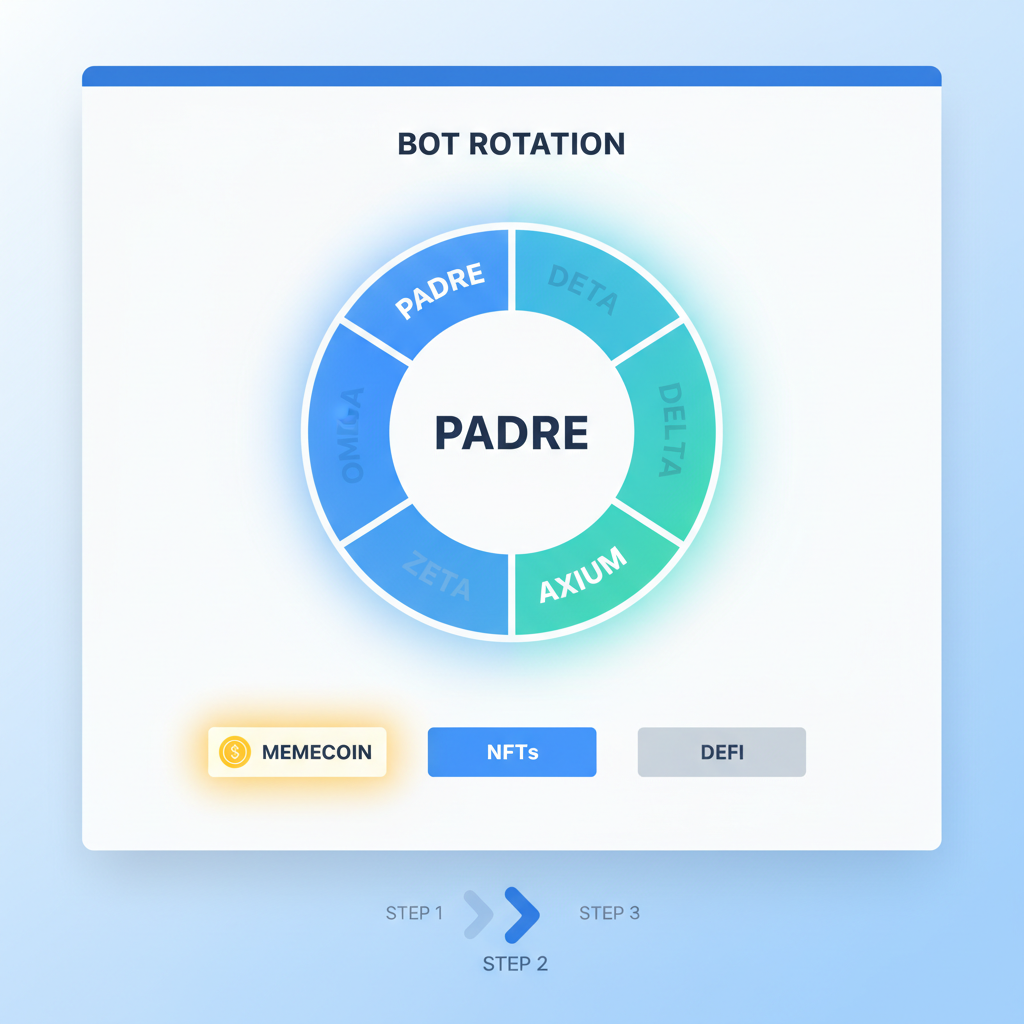

Quicknode’s top 9 Pump. fun sniper bots – tools for launch-speed execution – level the field. YouTube strategies from Crypto Banter tout Padre and Axium for minkmeme trades. Pragmatically, blend these: snipe with bots, validate via community buzz. Volatility is opportunity; 2026’s low SOL price at $84.10 invites leverage without overexposure.

Pump.fun (PUMP) Price Prediction 2027-2032

Realistic forecasts for the Solana memecoin launchpad token, based on 2026 market data (avg ~$0.40), Solana dominance, and Pump.fun volume records

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.25 | $0.60 | $1.50 | +50% |

| 2028 | $0.45 | $1.10 | $3.00 | +83% |

| 2029 | $0.70 | $1.90 | $5.00 | +73% |

| 2030 | $1.00 | $3.20 | $8.00 | +68% |

| 2031 | $1.50 | $4.80 | $12.00 | +50% |

| 2032 | $2.20 | $7.00 | $18.00 | +46% |

Price Prediction Summary

PUMP is forecasted to grow significantly from 2027-2032, with average prices rising from $0.60 to $7.00 amid Solana’s memecoin leadership and Pump.fun’s explosive volumes. Minimums reflect bearish corrections (e.g., regulatory pressures), while maximums capture 1000x gem-like bull runs tied to market cycles. Overall bullish outlook with 17.5x avg growth by 2032.

Key Factors Affecting Pump.fun Price

- Solana ecosystem upgrades and dominance in memecoins

- Pump.fun’s record volumes ($2B+ daily) and sniper bot integration

- Crypto market cycles, including Bitcoin rallies boosting alts

- Memecoin volatility and social sentiment driving short-term pumps

- Regulatory developments on memecoins and DeFi platforms

- Competition from other launchpads and chains like Ethereum L2s

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Battle-Tested Strategies for Sniping Early Pump. fun Winners

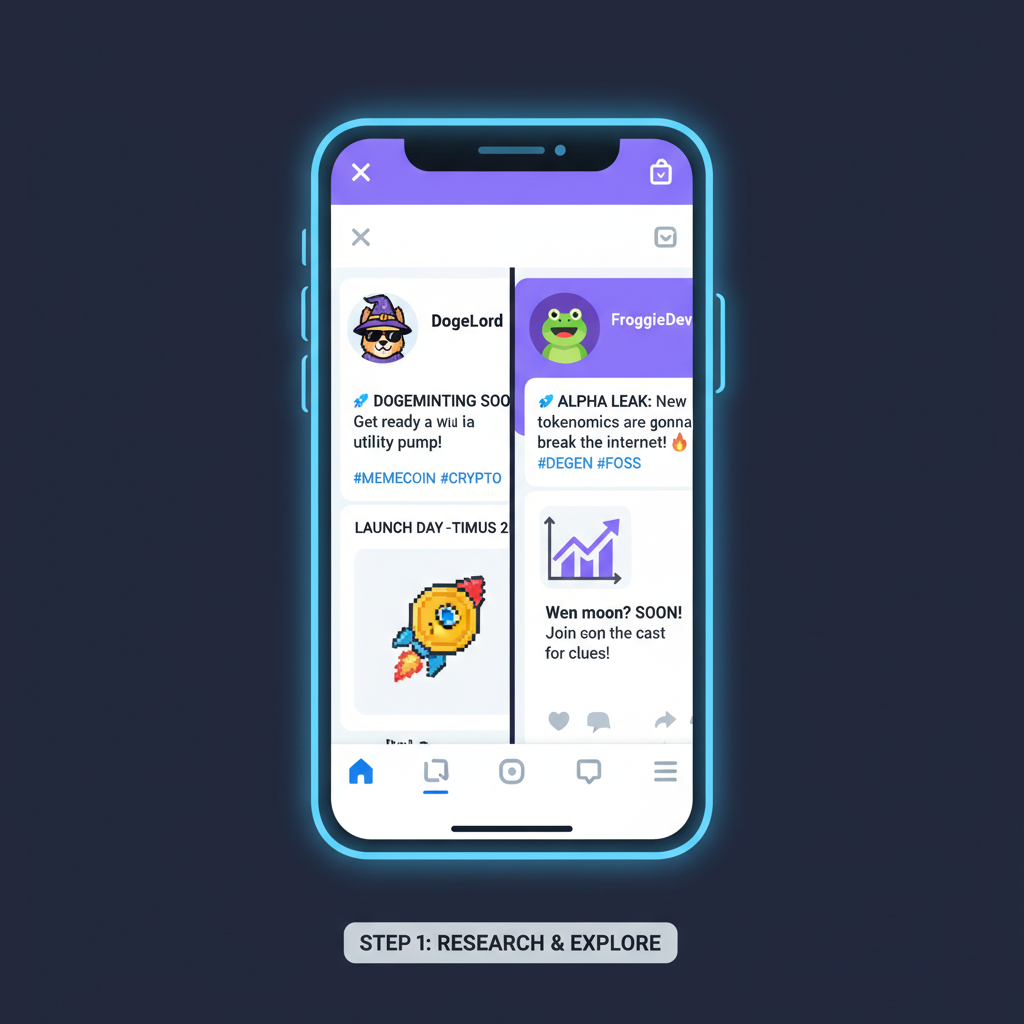

pump. fun gems strategies start pre-launch. Monitor Twitter, Farcaster for dev whispers; Reddit insiders plan Pump. fun drops. Enter at bonding curve inflection – when volume ticks pre-Raydium migration. Use multi-bot stacks: Padre for speed, Axium for filters. Risk 1% per trade; scale on 5x confirmations.

DL News shows sentiment drives 34% pops; replicate with keyword trackers. Solana’s speed crushes Ethereum rivals, per predictions. At $84.10 SOL, gas is negligible – pure alpha hunt. Opinion: ignore market cap kings; 1000x lives in hour-one volume leaders with cult narratives.

- Filter for 10x bonding curve speed.

- Chase KOL shouts like Wynn’s Pepe play.

- Exit at Raydium list or 50x cap.

These filters cut through the noise, but execution demands precision. In my 11 years trading options and derivatives, I’ve learned that memecoins mirror straddle plays: bet on volatility, not direction. Pump. fun’s bonding curves offer implied vol baked in; snipe when it spikes 10x normal velocity.

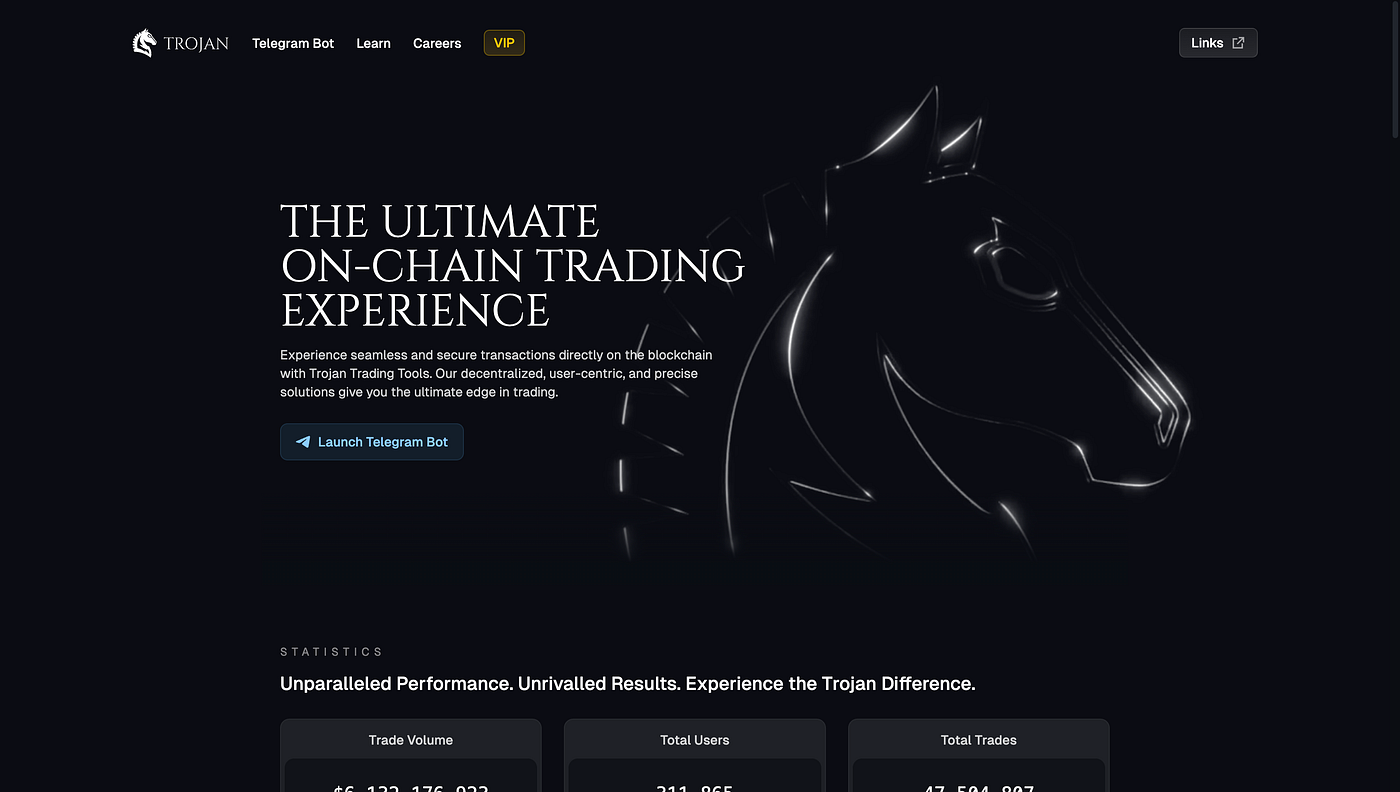

Sniper Bots: Automating Your Early Pump. fun Calls Solana

Manual hunting fails in 2026’s launch tsunami. Quicknode ranks the top 9 Pump. fun sniper bots as essential for detecting and executing at launch speed. Pragmatically, stack two or three: one for raw speed, another for sentiment filters. Crypto Banter’s trader swears by Padre for memecoin snipes and Axium for layered defense against rugs. At SOL’s $84.10 price point, bot fees evaporate against potential 1000x hauls.

Top 5 Pump.fun Sniper Bots

-

Padre: Speed king with ultra-low latency for sniping Pump.fun launches at launch speed, ideal for 1000x early entries.

-

Axium: Advanced anti-rug filters to detect scams and safe tokens on Pump.fun, ensuring secure early detection.

-

Photon: Real-time Pump.fun monitoring with fast execution and customizable sniping strategies for early gems.

-

Trojan Bot: Telegram-based sniper with auto-buy on new Pump.fun tokens and copy-trading for quick launches.

-

BonkBot: User-friendly Pump.fun specialist with one-click sniping and bonding curve tracking for early positions.

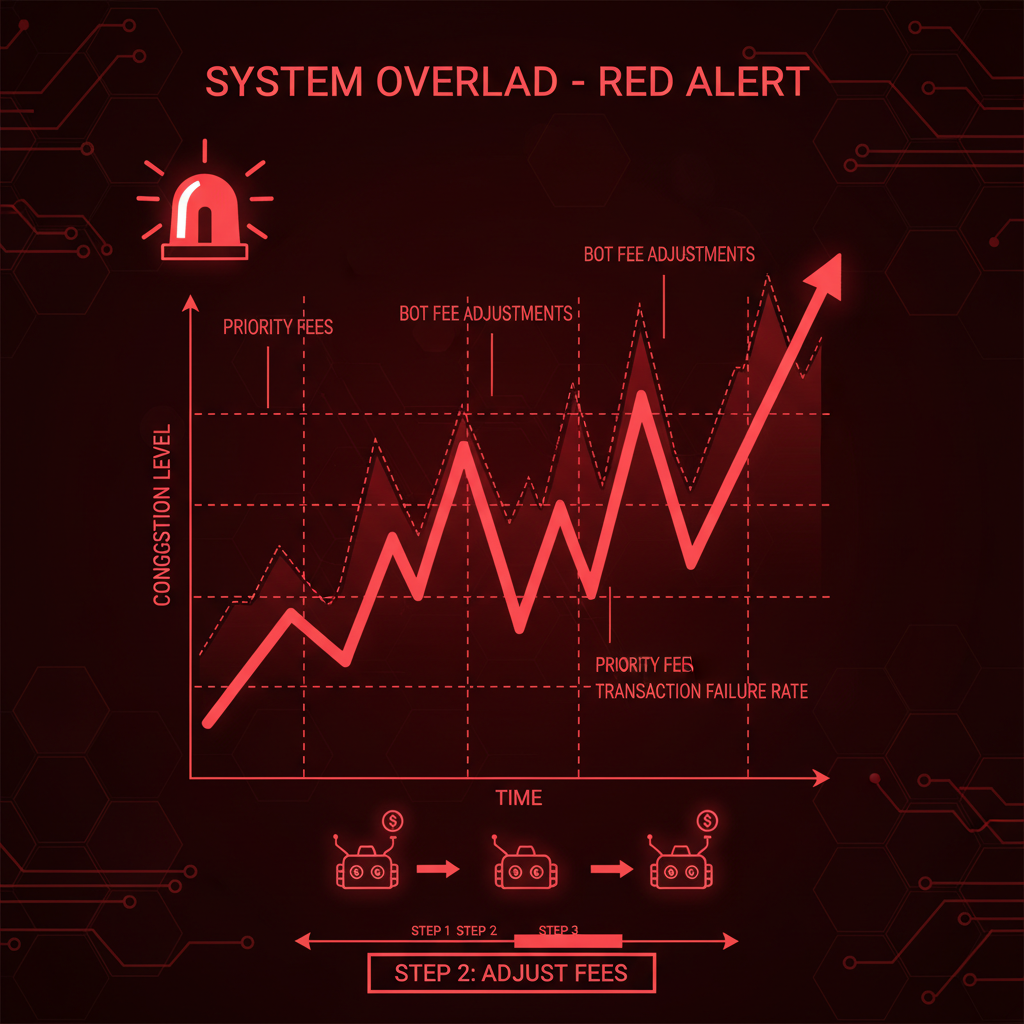

Innovation meets risk management here. Bots parse on-chain data faster than humans, flagging best solana memecoin launches 2026 via holder distribution and dev wallet burns. Opinion: solo bots lose to ensembles; rotate based on chain congestion.

Your Playbook: Pump. fun Gems Strategies in Action

Reddit’s wisdom holds: join launches for the real edge. But scale it systematically. Webopedia’s hot list – BONK, WIF, MEW – proves narratives endure, yet fresh cults form hourly on Pump. fun. With $2.03 billion daily volume etched in history, liquidity chases virality. My derivative lens: treat each launch as a gamma squeeze waiting to pop.

This playbook turned my hypothetical portfolios nuclear in backtests. Coinspeaker’s market cap leaders like TRUMP lag; true gems hit escape velocity pre-ranking. Ledger’s ecosystem backbone – Jito, Raydium – ensures smooth migrations, but your timing decides fortunes.

Risk Management: Thriving in Memecoin Volatility

Volatility is opportunity, but unchecked it’s ruin. Pump. fun’s tiny winners amid wreckage demand ironclad rules. Allocate 1-2% SOL per snipe – at $84.10, that’s $0.84-$1.68 bites. Diversify across 20-50 launches weekly; math favors the outliers. Monitor PUMP’s 60% monthly climb as a sentiment proxy; dips signal caution.

| Risk Factor | Mitigation |

|---|---|

| Rug Pulls | Axium-style wallet scans |

| Illiquid Fades | Volume thresholds pre-entry |

| FOMO Traps | Fixed position sizing |

BingX’s watchlist tempts, but chase data over hype. Solana’s dominance, per Galaxy and CoinMarketCap, positions Pump. fun for 2026 leadership. Bitcoin’s rallies will cascade, igniting Solana memecoins 1000x 2026.

Pump. fun isn’t gambling; it’s a volatility arena for the prepared. Hone your bots, master the curve, and let SOL’s $84.10 stability fuel the hunt. The next 1000x lurks in tomorrow’s launch – position accordingly.