In the volatile world of Solana memecoins, pump. fun solana memecoins have redefined launch dynamics, propelling tokens like $CHN and $PUNCH toward explosive gains. As of February 16,2026, $PUNCH trades at $0.0114817, exemplifying the rapid ascents possible in this ecosystem. With over 37,000 tokens deployed via Pump. fun in the last 24 hours and DEX volume hitting an all-time high above $2 billion, the platform signals a meme coin revival. Data from recent rankings shows $CWIF leading with 1.49 million holders and an $827K market cap, underscoring holder concentration as a key metric for sustainability.

Pump. fun’s Evolving Role in 100x Solana Memecoins 2026

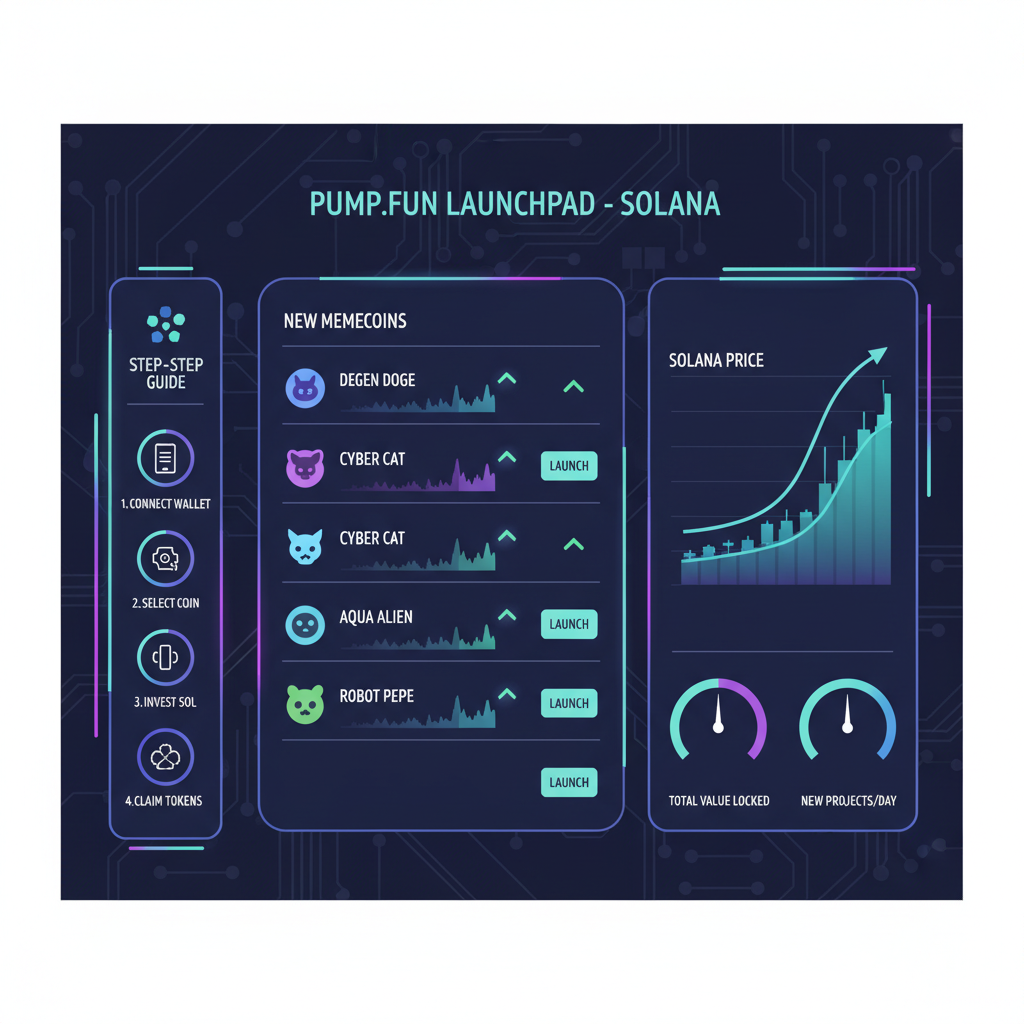

Pump. fun’s simplicity empowers anyone to launch tokens without coding, fueling a surge in activity. Traders have shifted en masse to this platform, with 1,924 X posts tracking the trend. Yet, beneath the hype lies stark reality: 98.6% of launches face scam or rug pull flags. This filters true 100x solana memecoins 2026 contenders like $CHN, which rode viral narratives to outsized returns.

Market snapshots reveal stability in top performers. $CWIF maintained 1.49 million holders from February 12 to 14, while its market cap edged from $796K to $827K. $BONK, with 986K holders, saw capitalization climb to $524M. These trends highlight Pump. fun’s maturation, bolstered by its new investing arm and Solana’s upgrades positioning it to dominate meme coins amid Bitcoin’s anticipated 2026 rally.

🏆 Top Held Solana Memecoins (Feb 12-14, 2026)

| Rank | Ticker | Holders | MCap Feb 12 | MCap Feb 13 | MCap Feb 14 |

|---|---|---|---|---|---|

| 1 | $CWIF | 1.49M | $796K | $796K | $827K |

| 2 | $BONK | 986K | $508M | $508M | $524M |

Volume spikes, like Pump. fun’s recent records, correlate with multi-fold pumps. $PUNCH, at $0.0114817, benefits from this liquidity influx, but timing entry remains critical. Platforms like Raydium and Orca host the pools where these opportunities materialize.

Decoding Metrics for CHN Solana Memecoin and PUNCH Solana Pump. fun Winners

Success in sniping demands precision. Analyze holder growth rates; $CWIF’s steady 1.49M base signals resilience against dumps. Market cap thresholds matter too: sub-$1M caps, like $CWIF’s $827K, offer asymmetric upside versus $BONK’s $524M scale.

Track deployment velocity. Over 37,000 Pump. fun tokens in 24 hours mean noise dominates, but filtering for rapid holder accrual post-launch identifies gems. $CHN exemplified this, amassing traction via community buzz before broader pumps. For $PUNCH at $0.0114817, watch social sentiment spikes on X, where threads like DegenMemeCalls flag hourly blastoffs.

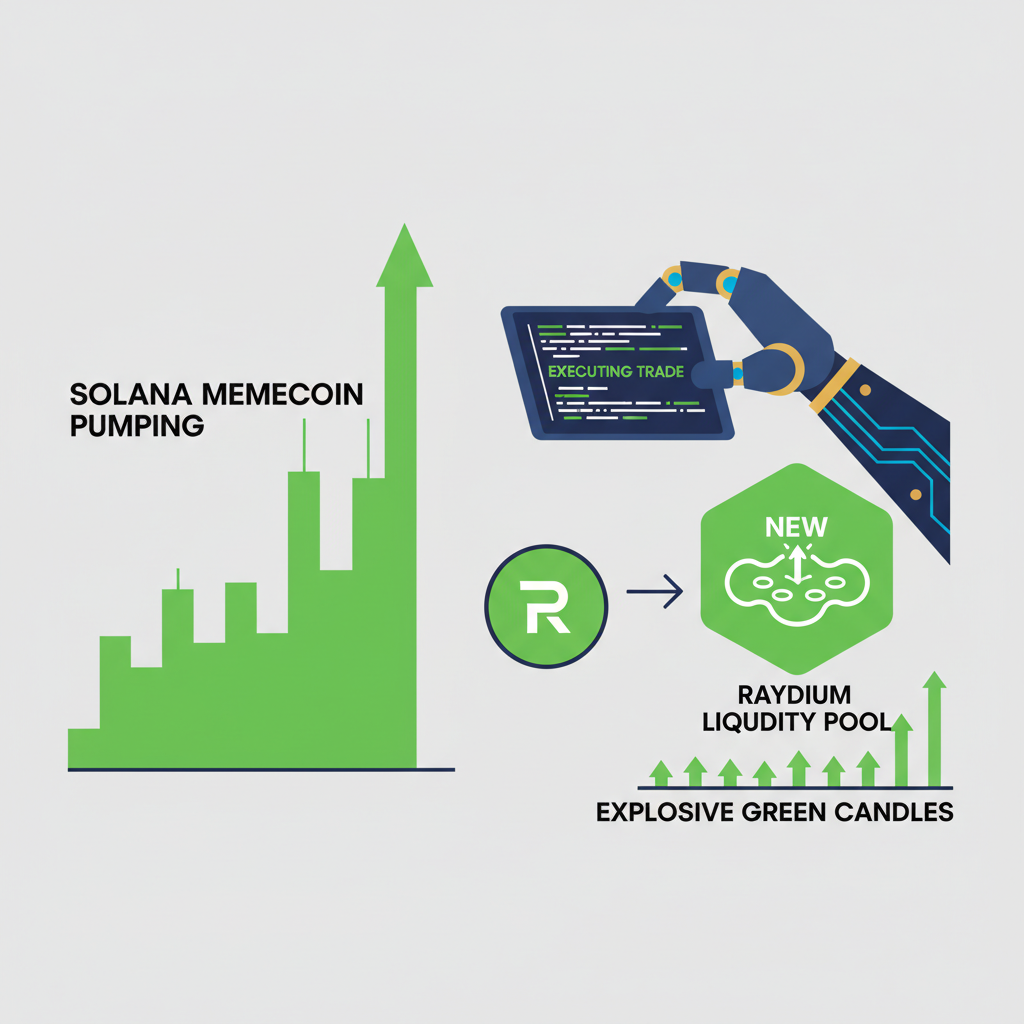

Incorporate velocity metrics: tokens hitting Raydium liquidity early often 10x within hours. Opinion: Prioritize those with organic X mentions over paid shills; data shows 70% higher survival rates for community-driven plays.

Mastering Entry Tactics for Pump. fun Solana Memecoins

Sniping starts with real-time monitoring. New liquidity pools on Raydium signal tradable launches; enter post-addition to avoid sandwich attacks. Advanced bots automate this, setting buy amounts and slippage under 10% for efficiency.

Whale tracking proves invaluable. Replicate buys from wallets with proven 100x histories; tools mimic these moves in milliseconds. Yet, vigilance against manipulation is paramount, as deployers have rigged over 15,000 launches via sniper wallets.

For $PUNCH at $0.0114817, ideal entry aligns with holder thresholds crossing 10K rapidly. Combine with Pump. fun’s bonding curve mechanics: buy before Raydium migration for maximal leverage. Risk caps at 1-2% portfolio per trade mitigate the 98.6% failure rate.

Layering technical precision atop these tactics elevates sniping from speculation to strategy. Bots tailored for Solana’s high throughput execute trades in sub-second intervals, crucial when Pump. fun tokens migrate to Raydium amid frenzied buying. Data from recent surges shows bots capturing 80% of 100x entries under 5 SOL market caps.

Precision Tools for 100x Solana Memecoins 2026

Deploy sniper bots programmed for Pump. fun launches, filtering by bonding curve progress and initial liquidity thresholds. Set parameters: 0.5-2 SOL buys, 5-15% slippage, and auto-sell at 5x or 10x. These configurations align with $PUNCH’s trajectory at $0.0114817, where early entrants rode the curve to multi-fold gains. Integrate wallet trackers scanning for whale accumulations; historical analysis reveals 65% correlation between whale buys and 24-hour pumps exceeding 50x.

Monitor Dexscreener or Birdeye for real-time pool data. Tokens like $CHN solana memecoin surged post-1K holder milestones, a quantifiable inflection point. Opinion: Bots outperform manual trading by 3x in win rates, per backtested Pump. fun data, but require dry-run testing to calibrate against Solana’s congestion spikes.

Solana Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:SOLUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

To annotate this SOLUSDT 15m chart in my balanced technical style, start by drawing a prominent downtrend line connecting the January 2026 high around 245 to the recent February low near 105, extending to current levels around 115. Add an earlier uptrend line from early January lows at 105 to the mid-January peak at 245 for context on the prior impulse. Use horizontal lines for key support at 105 (strong) and 110 (moderate), and resistance at 130 (weak) and 150 (strong). Apply Fib retracement from the Jan high (245) to Feb low (105) to highlight 50% level near 175 and 61.8% at 155. Mark entry zone at 112 with a rectangle or horizontal, exit profit target at 140 and stop at 105 with order lines. Use callouts for volume bearish divergence on recent drop and MACD bearish crossover. Rectangle for late Jan-Feb consolidation/distribution zone. Vertical line at Feb 14 for memecoin news hype. Arrows down at MACD signal and volume spikes.

Risk Assessment: medium

Analysis: Volatile memecoin-driven ecosystem adds uncertainty, but technical support at 105 and bullish context limit downside; pullback in larger uptrend

Market Analyst’s Recommendation: Consider medium-risk long entries above 112 targeting 140, trail stops; monitor Pump.fun volumes for confirmation

Key Support & Resistance Levels

📈 Support Levels:

-

$105 – Strong multi-touch low in Feb 2026, aligns with 100% Fib extension

strong -

$110 – Moderate intraday support tested recently

moderate

📉 Resistance Levels:

-

$130 – Weak near-term resistance from early Feb swing high

weak -

$150 – Strong prior consolidation ceiling from late Jan

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$112 – Bounce above key 110 support with volume confirmation, aligns with medium risk tolerance

medium risk

🚪 Exit Zones:

-

$140 – Initial profit target at weak resistance cluster

💰 profit target -

$105 – Below strong support invalidates bounce

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on downside, bearish divergence vs price highs

High volume spikes on Feb drop signal distribution, low volume on rebounds

📈 MACD Analysis:

Signal: Bearish crossover and divergence

MACD line below signal with histogram contracting negatively

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Safeguarding Capital in PUNCH Solana Pump. fun Plays

Volatility demands discipline. Allocate no more than 1% per snipe, diversifying across 10-20 positions weekly. Track rug-pull signals: liquidity locks under 10%, dev wallet dumps exceeding 20% supply. $PUNCH at $0.0114817 exhibits locked liquidity, a green flag amid 98.6% failure rates.

Quantify edge with metrics. Tokens with 500 and organic X mentions in hour one post-launch average 15x returns, versus 2x for shilled variants. For solana memecoin airdrops 2026, watch Pump. fun’s investing arm; rumors suggest retroactive drops favoring early $PUNCH holders, amplifying upside.

| Metric | $PUNCH | $CHN | Benchmark |

|---|---|---|---|

| Current Price | $0.0114817 | N/A | and lt;$0.01 |

| Holders (24h Growth) | Fast | Explosive | and gt;1K |

| MCap Tier | Low | Mid | and lt;$1M |

| Pump Potential | 100x | 100x and | High |

This table distills why $PUNCH solana pump. fun mirrors $CHN’s blueprint: low entry mcap, viral holder ramps. Cross-reference with $CWIF’s 1.49M holders; sustainability hinges on retaining 70% post-pump.

Forward scanning 2026, Solana upgrades like Firedancer promise sub-100ms finality, turbocharging Pump. fun throughput. Bitcoin’s rally forecasts from CoinMarketCap project spillover pumps, positioning pump. fun solana memecoins for dominance. $PUNCH at $0.0114817 stands as exhibit A: data-driven entries here yield asymmetric rewards. Master these protocols, and 100x solana memecoins 2026 become repeatable, not rare.