As Solana’s native token hovers at $93.43 following a modest 24-hour dip of $-5.20, on-chain prediction games are capturing the imagination of traders and degens alike. These platforms turn volatile SOL price swings into strategic bets, blending casino thrills with real economic forecasts. With projections eyeing $105.86 by mid-February 2026 and bullish paths toward $250-$300 later in the year, now’s the moment to explore top Solana prediction games like MetaFortuva for SOL price bets and casino wins.

Solana’s blockchain, renowned for its blistering transaction speeds and negligible fees, has birthed a ecosystem where prediction markets thrive without the friction of legacy finance. Games here aren’t just gambles; they’re on-chain oracles of market sentiment, letting users wager SOL on precise price movements, dice rolls, or coin flips. This fusion of DeFi precision and casino adrenaline positions Solana ahead of rivals, especially as SOL price predictions from sources like CoinCodex and Benzinga signal sustained upside from today’s $93.43 base.

Solana (SOL) Price Prediction 2027-2032

Realistic forecasts based on current market data ($93.43 as of Feb 2026), on-chain growth in prediction games and casinos, technical analysis, and expert sources like Changelly, Benzinga, and CoinCodex

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $120 | $220 | $350 |

| 2028 | $180 | $320 | $500 |

| 2029 | $250 | $450 | $700 |

| 2030 | $350 | $600 | $950 |

| 2031 | $450 | $800 | $1,300 |

| 2032 | $600 | $1,000 | $1,600 |

Price Prediction Summary

Solana (SOL) is expected to experience steady growth from 2027 to 2032, with average prices rising from $220 to $1,000, fueled by booming on-chain gaming and casino adoption. Minimum prices reflect bearish regulatory or market downturns, while maximums capture bullish scenarios from tech upgrades and mass adoption. Projections assume 40-60% CAGR in bullish cycles, tempered by competition and volatility.

Key Factors Affecting Solana Price

- Explosive growth in Solana-based on-chain prediction games (e.g., Fortuva) and casinos (e.g., Solcasino, Luck.io), driving transaction volume and SOL demand

- Technological improvements like Firedancer upgrades enhancing scalability and attracting more DeFi/gaming dApps

- Favorable market cycles post-Bitcoin halvings, with SOL outperforming ETH in speed/cost metrics

- Regulatory developments supporting crypto gambling and clearer U.S. policies boosting institutional inflows

- Competition from ETH L2s and potential market cap constraints, influencing bearish minimums

- Macro factors: global adoption trends, ETF approvals, and SOL’s path to $100B+ market cap in bull runs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Solana Prediction Games Ride the SOL Momentum Wave

At $93.43, SOL sits at a pivotal juncture, with recent lows testing $90.10 and highs brushing $101.50. Prediction platforms amplify this volatility into playable formats. MetaFortuva leads as the gold standard for solana prediction games, enabling users to bet on hourly or daily SOL trajectories via intuitive up/down mechanics. Its smart contracts, powered by robust oracles, settle outcomes transparently, distributing SOL rewards instantly. Traders love how it mirrors broader forecasts, like InvestingHaven’s call for a breakout above $190 en route to $300.

Beyond price bets, these games layer in casino elements. Metafortuva solana shines with hybrid modes blending SOL forecasts and provably fair dice rolls, offering multipliers that can turn small stakes into substantial wins. In a market where Kraken models project $102.67 by 2027, such platforms democratize alpha generation.

MetaFortuva and Gamba: Precision Betting Meets High-Octane Action

MetaFortuva sets the benchmark with its focus on SOL price prediction game mechanics. Users lock SOL into pools predicting if the token exceeds or falls below key thresholds from the current $93.43. Payouts scale with accuracy and pool size, often yielding 1.5x-5x returns on correct calls. Its edge? Fully on-chain execution, eliminating counterparty risk and ensuring every bet is verifiable.

Gamba complements this with a broader casino arsenal on Solana. Specializing in solana casino games like coin flips and crash variants tied to SOL volatility, it draws volume through anonymous play and instant liquidity. Picture flipping a virtual coin where outcomes influence mini-predictions on SOL’s next hourly close; wins here stack SOL faster than traditional DEX trades. Gamba’s strength lies in its liquidity incentives, pulling in users chasing earn solana playing games opportunities amid forecasts like Finst’s €84.74 for 2026.

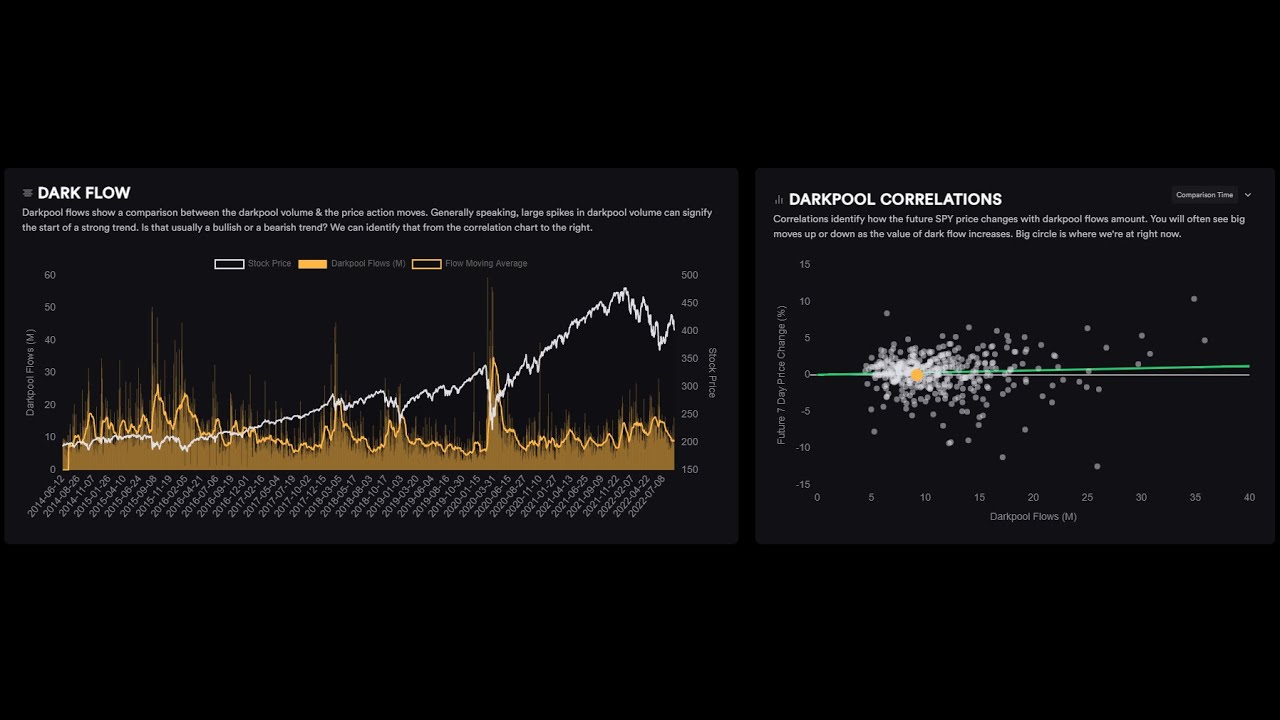

DarkPool and Hedgehog Markets: Institutional-Grade Tools for Retail Degens

DarkPool elevates on-chain solana betting with privacy-focused pools, ideal for high-conviction SOL bets without front-running. Here, aggregated liquidity funds predictions on extended timeframes, syncing with Token Metrics’ views on SOL outpacing ETH and BTC. From $93.43, a bet on reclaiming $101.50 daily highs could net amplified rewards as sentiment shifts.

Hedgehog Markets brings quantitative rigor, mimicking hedge fund strategies in game form. Users deploy SOL into structured bets on SOL price corridors, dice outcomes, or coinflip ladders. Its algorithmic pools adjust odds dynamically, rewarding sharp plays aligned with Binance’s near-term $96.95 targets. For those eyeing 2026’s bullish outlook, Hedgehog turns macro predictions into micro wins, much like my motto: see the big picture, seize the small wins.

Drift Predict channels the power of Solana’s Drift protocol into bite-sized prediction arenas, where users stake SOL on granular SOL price paths. From the current $93.43, bettors forecast if SOL rebounds past the 24-hour high of $101.50 within minutes or holds above the low of $90.10. What sets it apart in solana prediction games is perpetual-style mechanics, allowing leveraged positions without liquidation fears, perfect for riding short-term waves toward CoinCodex’s $105.86 February target.

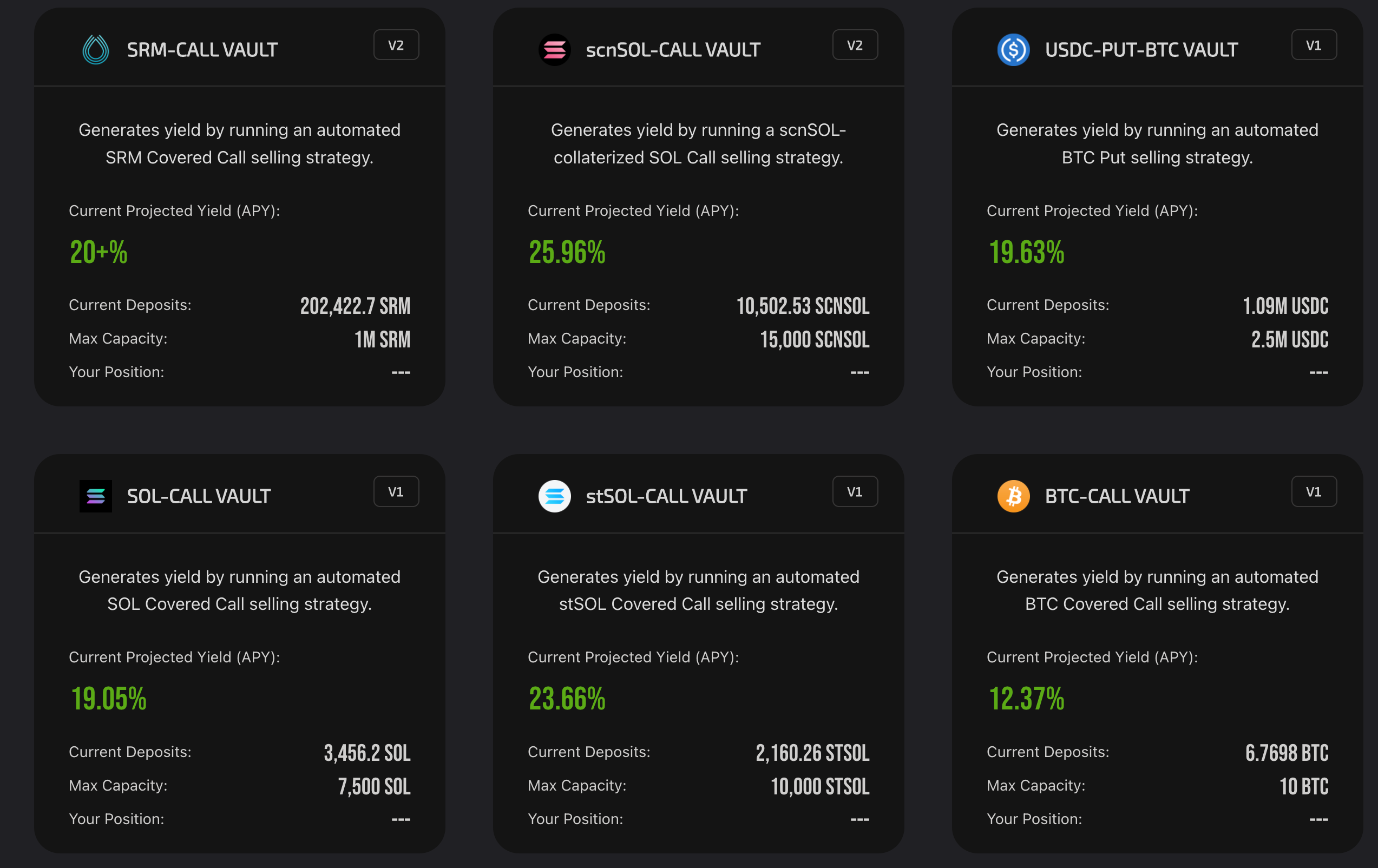

PsyOptions layers in options flair, transforming SOL volatility into callable bets akin to sol price prediction game contracts. Trade calls or puts on SOL hitting milestones like Benzinga’s $250-$300 2026 range, with dice-infused variants for casino kicks. Its on-chain settlement via Psyop primitives ensures zero slippage, appealing to quants who blend solana dice coinflip randomness with structured forecasts from Changelly’s $364 outlook.

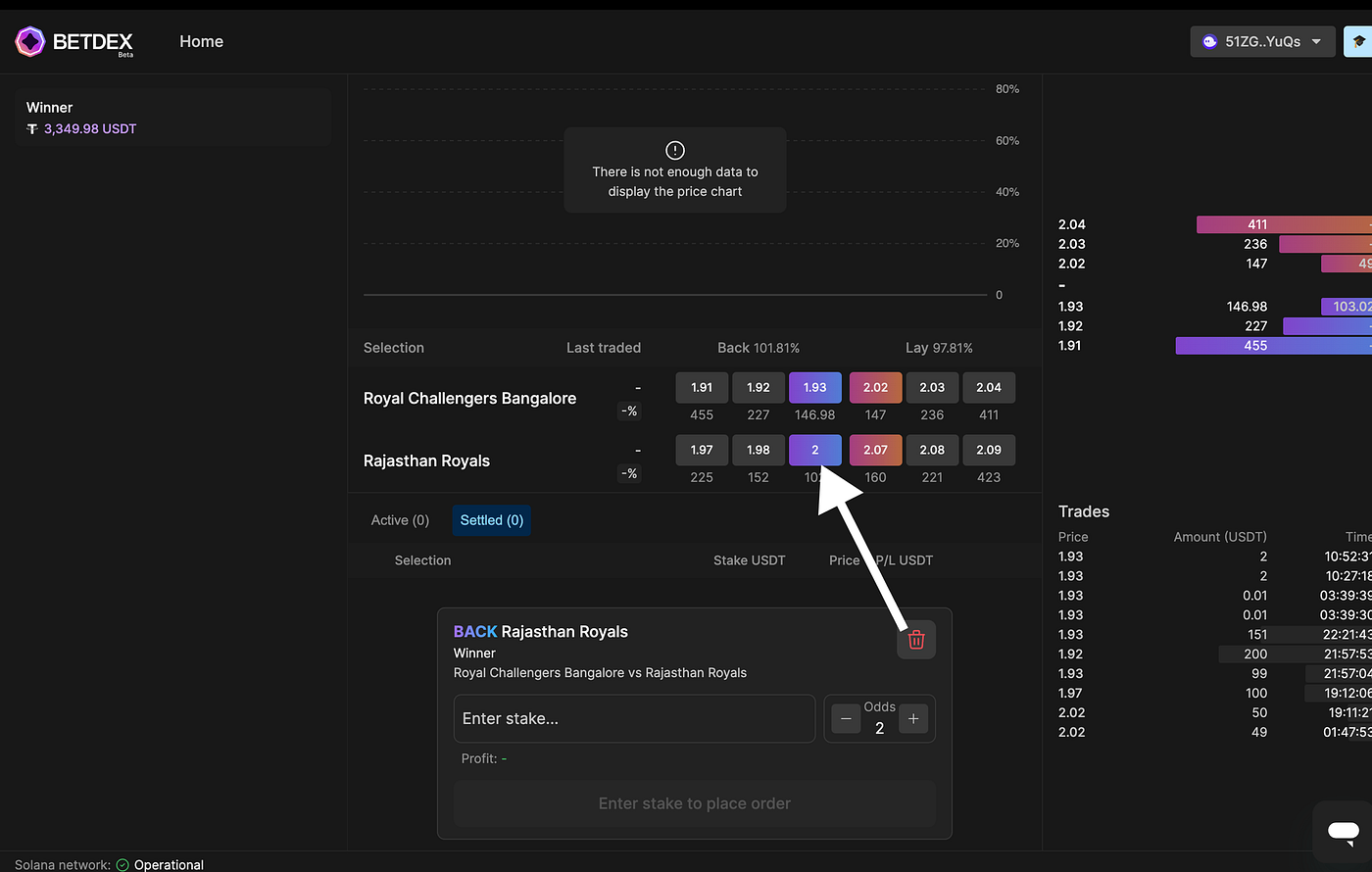

BetDEX: Order Book Betting for the Masses

BetDEX rounds out the pack as a decentralized exchange for predictions, pitting users against each other in peer-to-peer SOL wagers. Focus on on-chain solana betting shines through limit orders for custom odds on SOL trajectories, crash games, or coin flips. At $93.43, liquidity providers earn yields backing bets eyeing InvestingHaven’s $300 breakout, while takers snag edges on mispriced lines. No house cut means pure efficiency, echoing Solana’s edge in speed over Ethereum’s clunkier markets.

Across these platforms, earn solana playing games isn’t hype; it’s engineered through Solana’s sub-second finality. MetaFortuva’s oracle precision, Gamba’s crash adrenaline, DarkPool’s stealth, Hedgehog’s algos, Drift Predict’s leverage, PsyOptions’ derivatives, and BetDEX’s P2P depth form a constellation where retail traders extract value from macro noise. Kraken’s steady climb to $102.67 by 2027 underscores the asymmetric upside: small, frequent wins compound as SOL ascends.

Top 7 Solana Prediction Games

-

MetaFortuva: On-chain up/down SOL price oracles for precise predictions, enabling bets on short-term movements with automated payouts.

-

Gamba: High-speed crash games and coin flips with SOL bets, provably fair mechanics for casino-style wins.

-

DarkPool: Private liquidity pools for discreet SOL price bets, minimizing slippage in prediction markets.

-

Hedgehog Markets: Algorithmic price corridors for structured SOL forecasts, ideal for strategic range-bound bets.

-

Drift Predict: Perpetual prediction markets on SOL perps, allowing leveraged bets on continuous price action.

-

PsyOptions: Options-based bets on SOL price trajectories, offering calls/puts for advanced prediction strategies.

-

BetDEX: P2P orderbook for SOL price and event predictions, with deep liquidity and non-custodial trading.

Strategic Plays in a $93.43 SOL Landscape

Navigating these games demands more than luck; it’s about anchoring bets to on-chain data and macro signals. From $93.43, favor platforms like Hedgehog Markets for corridor bets hugging the $90.10-$101.50 range until momentum confirms Binance’s $96.95 push. Gamba and BetDEX suit high-volume flippers chasing hourly edges, while PsyOptions fits for those positioning on Finst’s €84.74 2026 floor turning into Token Metrics’ outperformance narrative.

Solana’s prediction ecosystem thrives because it mirrors the chain’s DNA: fast, cheap, transparent. Yet volatility cuts both ways; the same tech enabling 5x payouts devours overleveraged stacks. Stake what you can lose, diversify across MetaFortuva’s short bets and Drift Predict’s longs, and track sentiment via platform volumes. As SOL eyes $250-$300, these games aren’t distractions, they’re the front lines where foresight meets fortune. Position now, and the small wins stack into portfolio-defining hauls.