Jito is not just another cog in the Solana machine – it’s the engine quietly powering validator profitability, network health, and the next phase of Solana’s institutional adoption. As Solana surges with 3,248 active validators and a network valuation at $85.7 billion (as of June 2025), understanding JITO’s role is no longer optional for anyone serious about Solana’s future.

JITO’s MEV Edge: Why 93% of Validators Can’t Afford to Ignore It

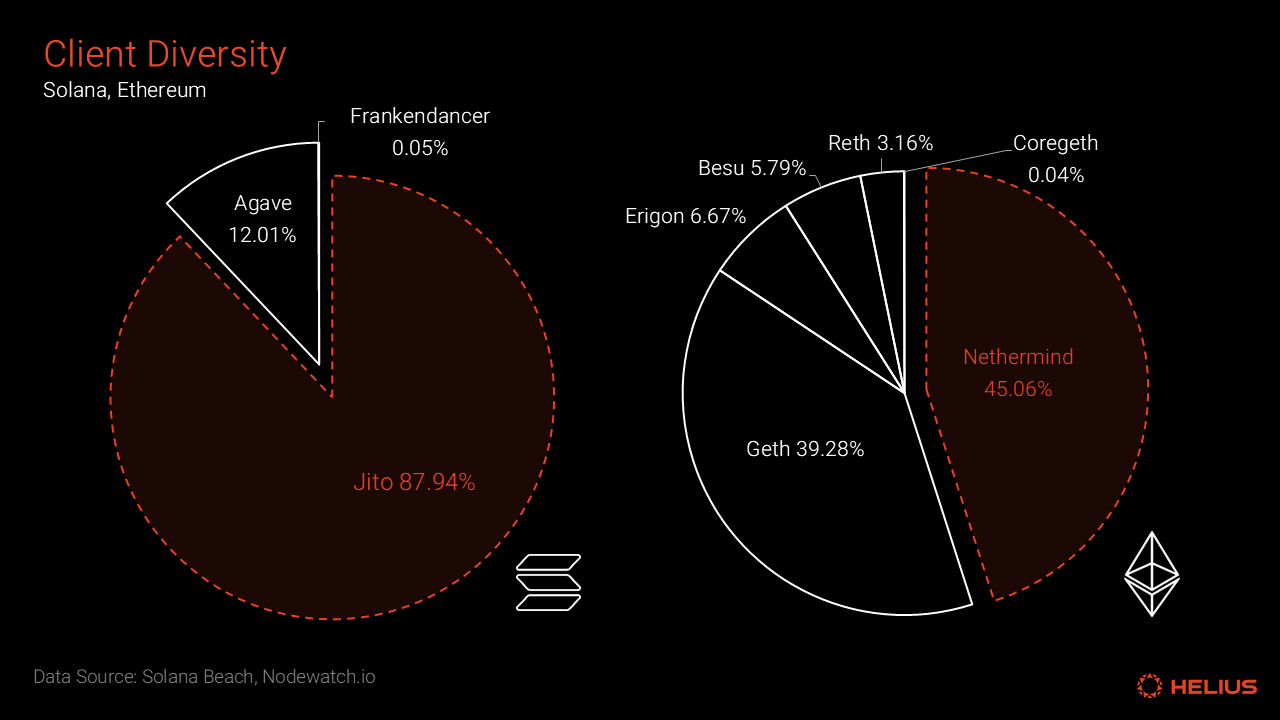

The numbers speak volumes. Over 93% of Solana validators now run Jito’s software, according to Cointelegraph. This is not accidental adoption; it’s a direct response to Jito’s ability to unlock Maximum Extractable Value (MEV) for node operators. By enabling validators to prioritize high-fee transactions, Jito has turbocharged their earnings.

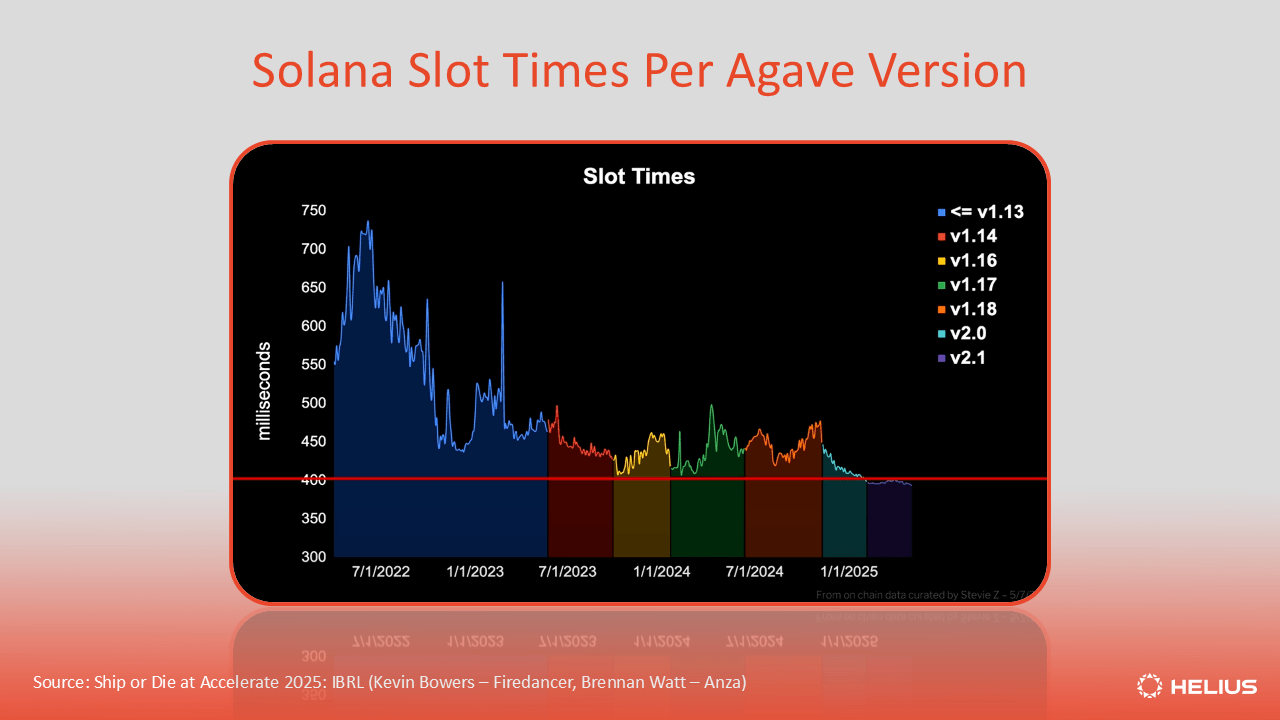

In November 2024 alone, Jito-powered validators hit a record monthly income of approximately $210 million, reflecting an average monthly growth rate of 32% through the year (source). For context: this growth helped Solana validators surpass Ethereum in MEV earnings for the first time ever. The result? A seismic shift in how institutional players and retail stakers view validator economics on Solana.

Revenue Dynamics: JITO DAO Doubles Down on Validator Profitability

The recent approval by Jito DAO to double its revenue share is more than governance theater – it signals a new era for validator incentives (SolanaFloor). With current market data showing Binance-Peg SOL at $231.07, up 0.75% on the day, and JITO revenues scaling rapidly, the economic model underpinning validator operations is being rewritten in real time.

Here’s why this matters: currently, Solana validators capture about 40% of total MEV value while block builders retain the rest. Compare that to Ethereum, where validators pocket up to 95%. If upcoming protocol upgrades push Solana’s validator share even up to 80%, we could see a 56% boost in MEV-derived revenue. That would fundamentally alter both validator ROI and network security – making running a validator node not just sustainable but highly competitive versus other L1s (VanEck analysis).

$JITO: Market Impact and Why Undervaluation Is a Strategic Opportunity

The disconnect between fundamentals and token price is striking. Despite generating billions in revenue and running over 90% of validator infrastructure, $JTO remains flat while “hype coins” pump around it. As Kyle Chassé points out on X, $JITO is “criminally undervalued” given its actual economic impact.

If you’re looking at the best Solana coins for 2025 with real utility, ignoring $JTO means missing out on the backbone that makes validator rewards possible.

Jito (JTO) Price Prediction Table: 2026-2031

Professional forecast reflecting validator growth, MEV dynamics, and Solana ecosystem expansion

| Year | Minimum Price (Bearish) | Average Price (Consensus) | Maximum Price (Bullish) | Estimated % Change (YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.25 | $1.70 | $2.20 | +9% | Sustained validator adoption, moderate market growth, regulatory clarity improving |

| 2027 | $1.50 | $2.10 | $2.80 | +24% | Solana validator MEV share increases, Jito upgrades, wider DeFi use |

| 2028 | $1.85 | $2.60 | $3.50 | +24% | Ecosystem expansion, higher institutional interest, potential Solana ETF approval |

| 2029 | $2.10 | $3.10 | $4.10 | +19% | Jito’s MEV capture rivals Ethereum, global crypto adoption grows |

| 2030 | $2.40 | $3.60 | $4.80 | +16% | Solana network valuation exceeds $150B, Jito protocol enhancements, competition rises |

| 2031 | $2.70 | $4.00 | $5.30 | +11% | Mature validator market, MEV optimizations maximize revenue, regulatory headwinds possible |

Price Prediction Summary

Jito (JTO) is poised for steady growth as the backbone of Solana’s validator ecosystem. With over 93% validator adoption and increasing revenue capture from MEV, the outlook for JTO remains bullish—especially if Solana validators can claim a larger share of MEV revenue. The price trajectory anticipates both bullish and bearish market cycles, reflecting regulatory developments, competition, and technological advances in the Solana ecosystem.

Key Factors Affecting Jito Price

- Validator adoption rate and MEV revenue capture improvement

- Solana network growth and transaction volume

- Regulatory clarity and global crypto acceptance

- Technological upgrades to Jito and Solana

- Competition from alternative validator software and L1 chains

- Institutional investment and DeFi ecosystem expansion on Solana

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This undervaluation isn’t just an academic point – it reflects market inefficiency that can be strategically exploited by forward-looking investors as protocol upgrades approach and revenue splits improve.

Jito’s unique positioning as the MEV orchestrator for Solana validators gives it a rare blend of technical moat and economic leverage. The network effect is self-reinforcing: as more validators join Jito, the MEV auction becomes richer, block rewards grow, and validator loyalty deepens. This virtuous cycle is now being recognized by both institutional and retail players looking for exposure to undervalued Solana tokens with real cash flow potential.

Why JITO Powers Solana Validator Economics in 2025

-

Unmatched Validator Adoption: Over 93% of Solana validators now run Jito’s software, making it the de facto standard for maximizing block rewards and MEV extraction across the network.

-

Record-Breaking Validator Revenue: In November 2024, Jito-enabled validators reached a peak monthly income of approximately $210 million, with average monthly growth of 32% throughout the year, directly boosting validator profitability.

-

MEV Optimization and Market Leadership: Jito’s advanced MEV strategies enabled Solana validators to surpass Ethereum in MEV earnings for the first time in 2024, solidifying Solana’s competitive edge in the blockchain space.

-

Direct Impact on Network Valuation: The widespread use of Jito has contributed to Solana’s network valuation surge to $85.7 billion in June 2025, reflecting both institutional adoption and increased validator incentives.

-

Ongoing Revenue Growth Potential: With Solana validators currently capturing about 40% of MEV value (compared to Ethereum’s 95%), Jito’s ongoing protocol upgrades could boost validator MEV share to 80%, potentially increasing MEV-derived revenue by 56% and further enhancing network economics.

Recent protocol developments make this even more compelling. With the Jito DAO’s move to double revenue share, validators are not just earning more, they’re seeing their operational risk reduced as revenue streams diversify beyond inflationary staking rewards. This is critical in a landscape where token emissions are tightening and sustainable yield is king.

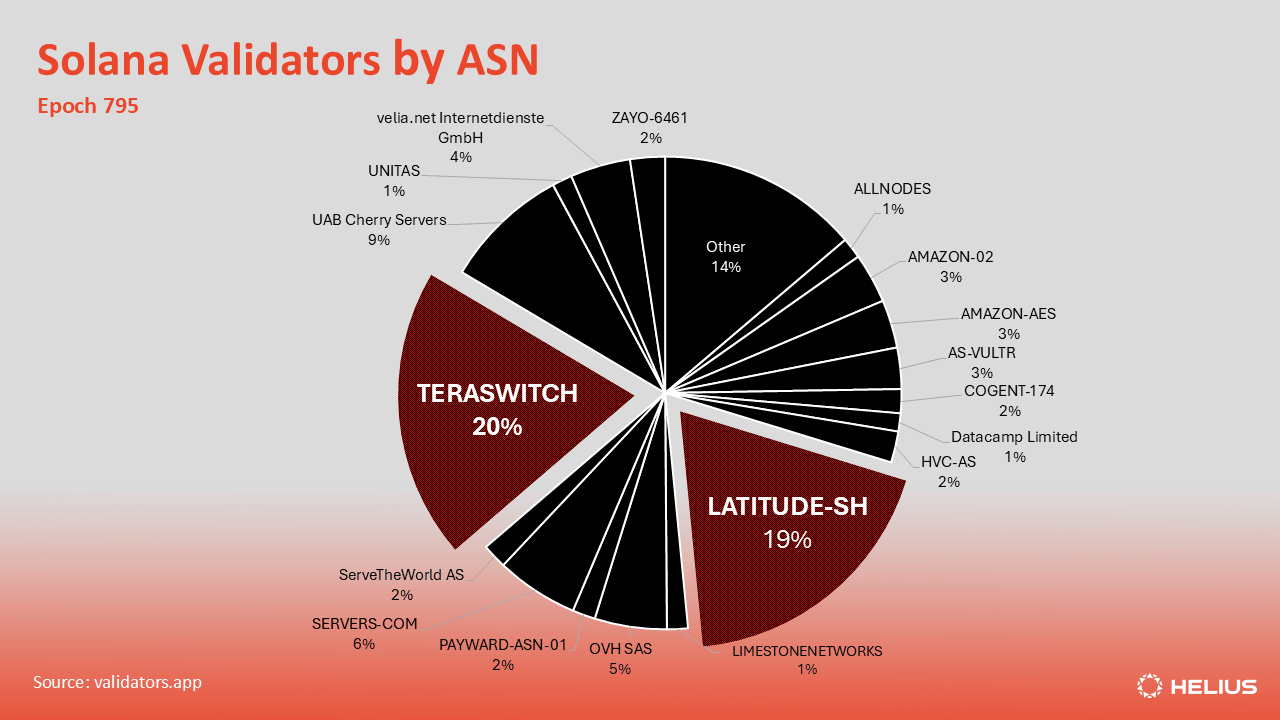

Moreover, Solana’s validator count, now at 3,248 active nodes, underscores growing decentralization and security. But it also means competition among node operators is fierce. Jito’s software suite provides a clear edge, letting validators extract maximum value from every block while aligning with network health goals.

Looking Ahead: What Could Unlock $JTO’s True Value?

The most obvious catalyst? An upgrade to Solana’s MEV distribution model that boosts validator capture rates closer to Ethereum’s 95%. If implemented, this could send validator revenues, and thus Jito’s economic throughput, soaring by over 50%. The knock-on effect for $JTO holders would be profound: greater protocol fees routed back to token stakers or governance participants, and a re-rating of $JTO among the best Solana coins 2025.

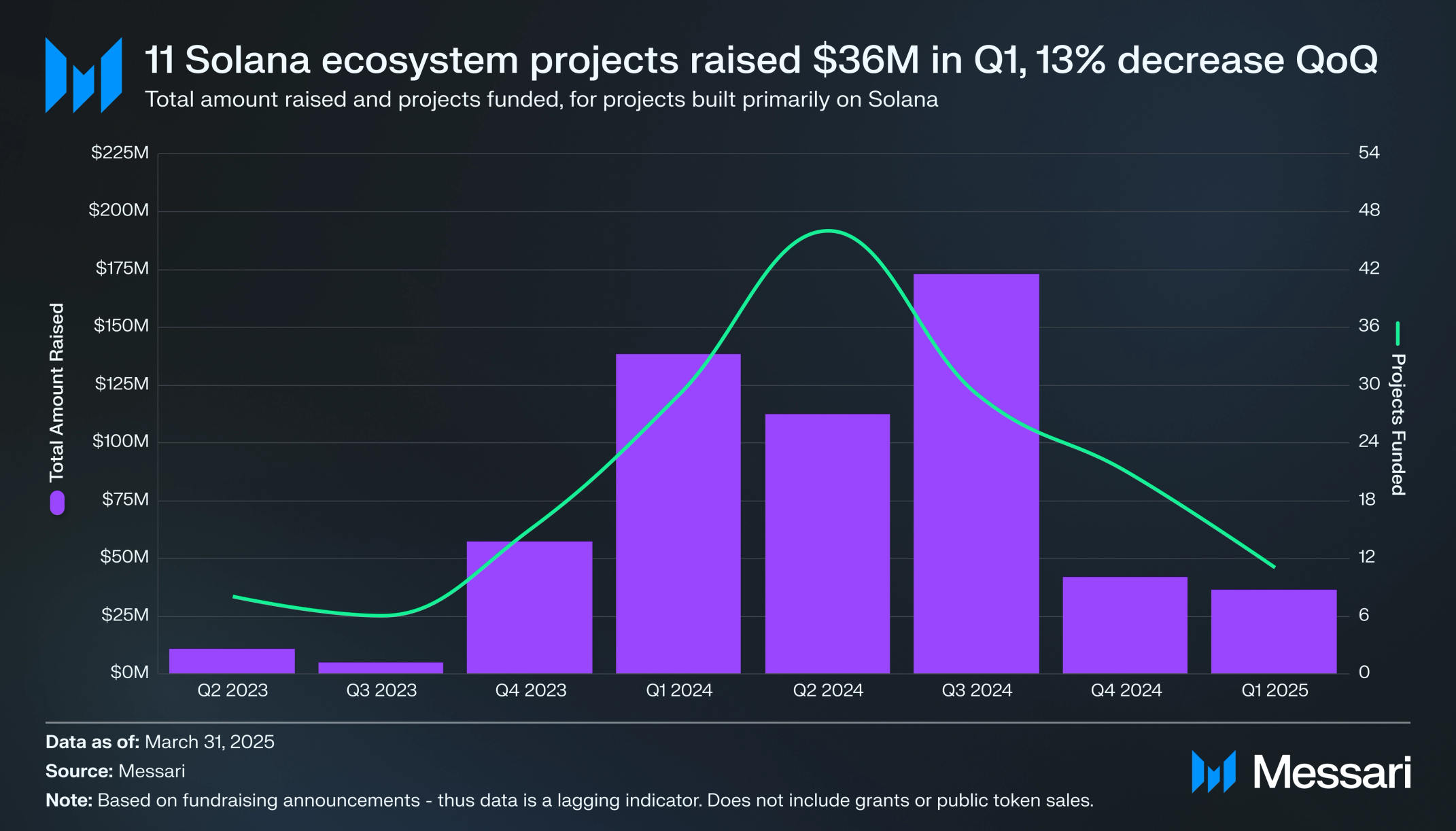

Add in institutional adoption trends (with daily transactions topping 200 million), and it becomes clear why market analysts see room for significant price appreciation from today’s levels. Yet with $JTO trading sideways despite these tailwinds, the market continues to offer asymmetric opportunity for those who understand the mechanics under the hood.

The Strategic Playbook for Investors

If you’re seeking exposure to genuine network infrastructure plays, not just speculative narratives provides $JTO should be on your radar. Watch for:

- Protocol upgrades that shift MEV splits

- DAO proposals impacting fee structures or buybacks

- Validator growth metrics outpacing other L1s

- Sustained increases in daily transaction volume

The bottom line: Solana validators are only as profitable as their tools allow. In 2025, that tool is overwhelmingly Jito. As upgrades unlock new revenue streams and market recognition catches up with fundamentals, $JTO stands poised not just as an essential infrastructure asset but as one of the most undervalued opportunities in crypto right now.