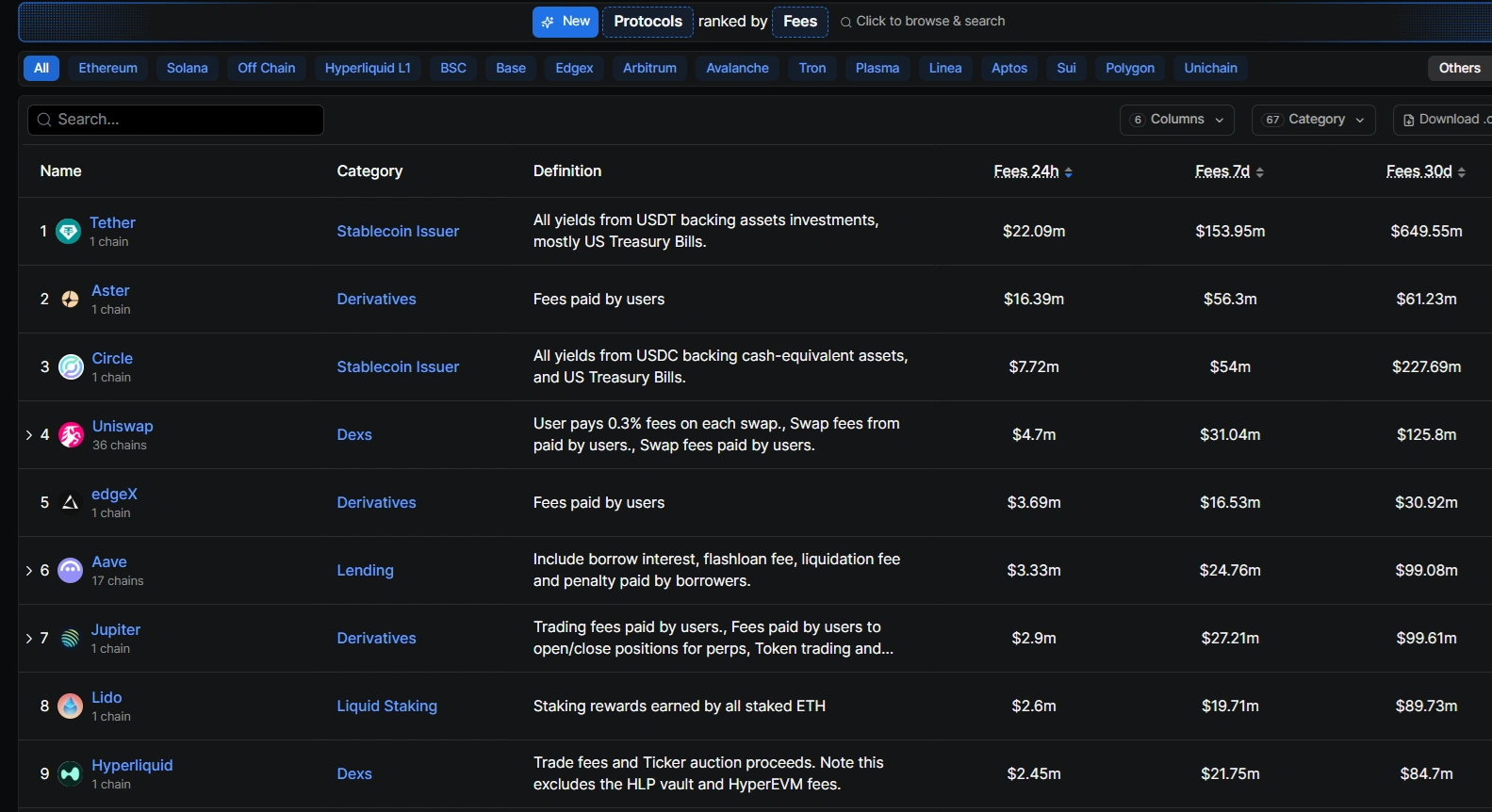

In 2025, few DeFi projects on Solana have captured the market’s attention quite like Aster. Its rapid ascent is not just about innovation or tokenomics, but about the raw numbers: with an annualized fee run-rate now exceeding $30 million, Aster is rewriting what’s possible for airdrop hunters and on-chain traders alike. This surge has placed Aster at the center of the next major Solana airdrop opportunity, drawing in both seasoned DeFi strategists and newcomers eager to capitalize on its momentum.

Aster’s $30M Fee Run-Rate: The New Benchmark for Solana DEXs

Let’s talk facts. Since March 2025, Aster has generated over $137 billion in cumulative perpetuals trading volume, contributing to a total of $149.13 billion since inception. But what truly sets it apart is its current $30 million annualized fee run-rate, an 87.5% year-to-date growth that signals both robust platform health and deep user engagement. This figure isn’t just a headline – it directly shapes how much value will be distributed in upcoming airdrops and how competitive leaderboard farming has become.

The platform’s expansion into spot markets and 24/7 stock perpetuals further cements its ambition to be more than just another DEX. With over $350 million in TVL spread across seven EVM chains and Solana, Aster is positioning itself as a hub for multi-chain liquidity and innovation.

How Aster’s Volume Fuels the Next Big Solana Airdrop

The numbers underpinning Aster’s growth aren’t just vanity metrics – they’re central to its unique approach to community rewards. In Stage 1 of its ongoing airdrop campaign, over 527,000 unique wallets participated, generating more than $37.7 billion in trading volume over just 20 weeks. This activity helped Aster capture nearly 20% of the perpetual DEX market share by monthly trading volume – a feat rarely seen for such a young protocol.

The upcoming Token Generation Event (TGE) on September 17,2025 will unlock 8.8% of the total $ASTER supply (704 million tokens). With more than half of all tokens earmarked for community distribution (and unclaimed tokens recycled into future campaigns), this is shaping up to be one of the largest and most equitable Solana airdrops yet.

Airdrop Farming: Strategies and What Sets Aster Apart

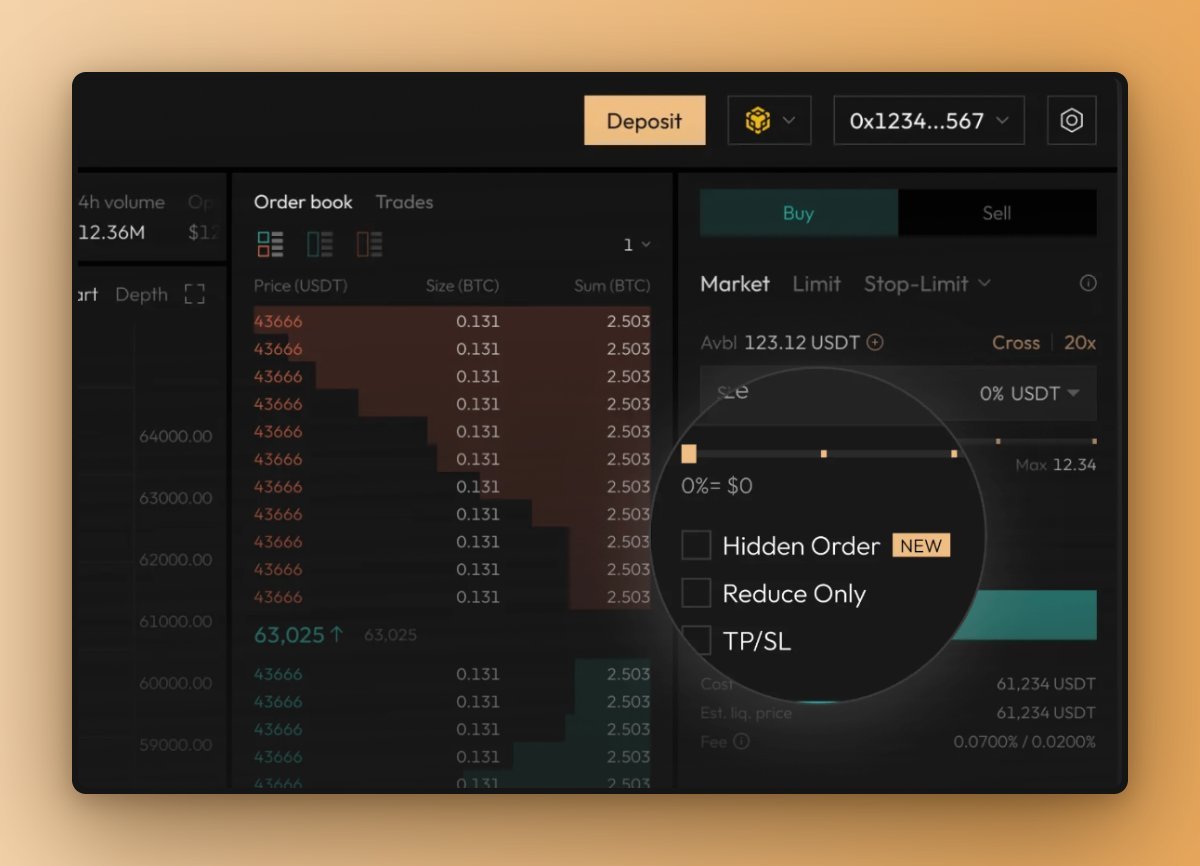

If you’re chasing underfarmed opportunities or aiming for leaderboard dominance, understanding how Aster structures its campaign mechanics is crucial. Stage 2 introduces an evolved points system rewarding not only high trading volumes but also position holding time, realized P and L, referrals, and usage of native liquid staking assets like asBNB or USDF as collateral.

Top Strategies to Maximize Your $ASTER Airdrop

-

Boost Trading Volume on Aster DEX: The airdrop rewards are closely tied to your cumulative trading volume on Aster DEX. Trading both perpetuals and spot markets increases your eligibility and potential rewards.

-

Hold Positions for Longer Durations: The Stage 2 points system rewards users for the time their positions remain open. Longer holding periods can earn you more points, especially on volatile assets like BTC or SOL.

-

Leverage Aster’s Native Liquid Staking Tokens: Using asBNB and USDF as collateral on Aster DEX grants additional points. These tokens are native to Aster and offer unique multipliers for airdrop eligibility.

-

Refer New Users to Earn Rh Points Multipliers: The referral program allows you to invite others to Aster, earning Rh Points multipliers for both you and your referees. This can significantly boost your airdrop allocation.

-

Engage in Backpack Hedge Arbitrage Strategies: Advanced users can maximize rewards by employing arbitrage between Aster and Backpack Exchange, as highlighted by BlockBeats. This strategy can increase both trading volume and realized PnL, impacting your points.

-

Monitor Realized Profit and Loss (PnL): The airdrop points calculation factors in your realized PnL. Actively managing trades to realize profits (or minimize losses) can positively influence your airdrop eligibility.

-

Stay Active Until the TGE Deadline: The Token Generation Event (TGE) is set for September 17, 2025. Remaining active throughout the final campaign days ensures you accumulate the maximum possible points before the snapshot.

This multi-factor approach discourages wash trading while rewarding genuine engagement – meaning that savvy traders can optimize their activity far beyond simple volume spamming. Advanced guides recommend leveraging up to 25x-50x on volatile pairs like BTC or SOL (with caution), participating in referral programs for Rh points multipliers, and holding positions longer to maximize point accrual rates.

A Complete Guide to Aster Airdrop Farming (Bitget) offers step-by-step tactics that can help both new users and veterans fine-tune their approach as the final days before TGE tick down.

The Competitive Edge: Why This Is Not Just Another Solana Campaign

Aster has already outpaced established players like Hyperliquid during peak periods – at one point achieving $25.77 billion in 24-hour volume, thanks partly to Binance support and strategic token migration events (AInvest coverage here). For those watching Solana ecosystem trends closely, this signals more than hype; it suggests that active participation now could yield outsized rewards compared with traditional DeFi launches or retroactive drops elsewhere.

With the airdrop campaign set to conclude on October 5,2025, and only 11 days remaining, time is running out to secure a spot among the top $ASTER earners. The final stretch often sees a surge in competitive farming tactics, but Aster’s nuanced points system means there are still “underfarmed” angles for those willing to dig deeper. For instance, using native collateral assets like asBNB and USDF not only diversifies your exposure but also earns extra reward multipliers, a strategy overlooked by many casual participants.

Which Aster airdrop farming strategy do you find most effective?

Aster’s Stage 2 airdrop rewards users based on trading volume, position holding time, realized P&L, referrals, and using asBNB or USDF as collateral. With the TGE set for September 17, 2025, and over 50% of $ASTER reserved for the community, which strategy has worked best for you so far?

What truly distinguishes Aster from other Solana trading platforms is its commitment to transparency and community empowerment. The protocol’s decision to recycle unclaimed tokens into future campaigns ensures long-term alignment with its user base, rather than favoring early whales or insiders. This design choice, paired with the staggering $30 million annualized fee run-rate, creates fertile ground for sustainable growth and ongoing engagement.

Leaderboard Farming: The New Solana Status Game

The rush for leaderboard spots has become its own meta-game within DeFi circles. On Aster, leaderboard farming isn’t just about bragging rights; it’s about maximizing your share of one of the largest Solana airdrops ever allocated. As trading volume swells, recently surpassing $137 billion since March 2025: the competition intensifies, but so does the potential payout for those who can maintain high activity and strategic risk management.

Importantly, the platform’s cross-chain integration (spanning seven EVM chains plus Solana) means that liquidity is deep and slippage remains low even during periods of high volatility. This allows sophisticated traders to execute complex strategies, such as hedge arbitrage or multi-leg positions, without being penalized by thin order books or excessive fees.

Looking Ahead: Aster’s Impact on Solana Trading Volume in 2025

Aster’s meteoric rise has already left an imprint on Solana trading volume in 2025. By capturing nearly 20% of the perpetual DEX market share, it has forced competitors to rethink their own incentive structures and user experience models. If current trends hold, we may see a new standard set for what constitutes a “fair” and impactful airdrop in the ecosystem.

“Aster isn’t just rewarding speculation, it’s incentivizing real participation and innovation across DeFi, ” says one prominent trader in the community Discord.

The upcoming TGE will be watched closely by both retail participants and institutional players looking for signals on where value will accrue next within Solana’s rapidly evolving landscape. For those who’ve positioned themselves well, this could be more than just another claim drop, it could mark entry into an elite cohort shaping DeFi’s next wave.