Solana Stablecoins Hit $13.4B: Visual Analysis of 2025’s All-Time High Growth

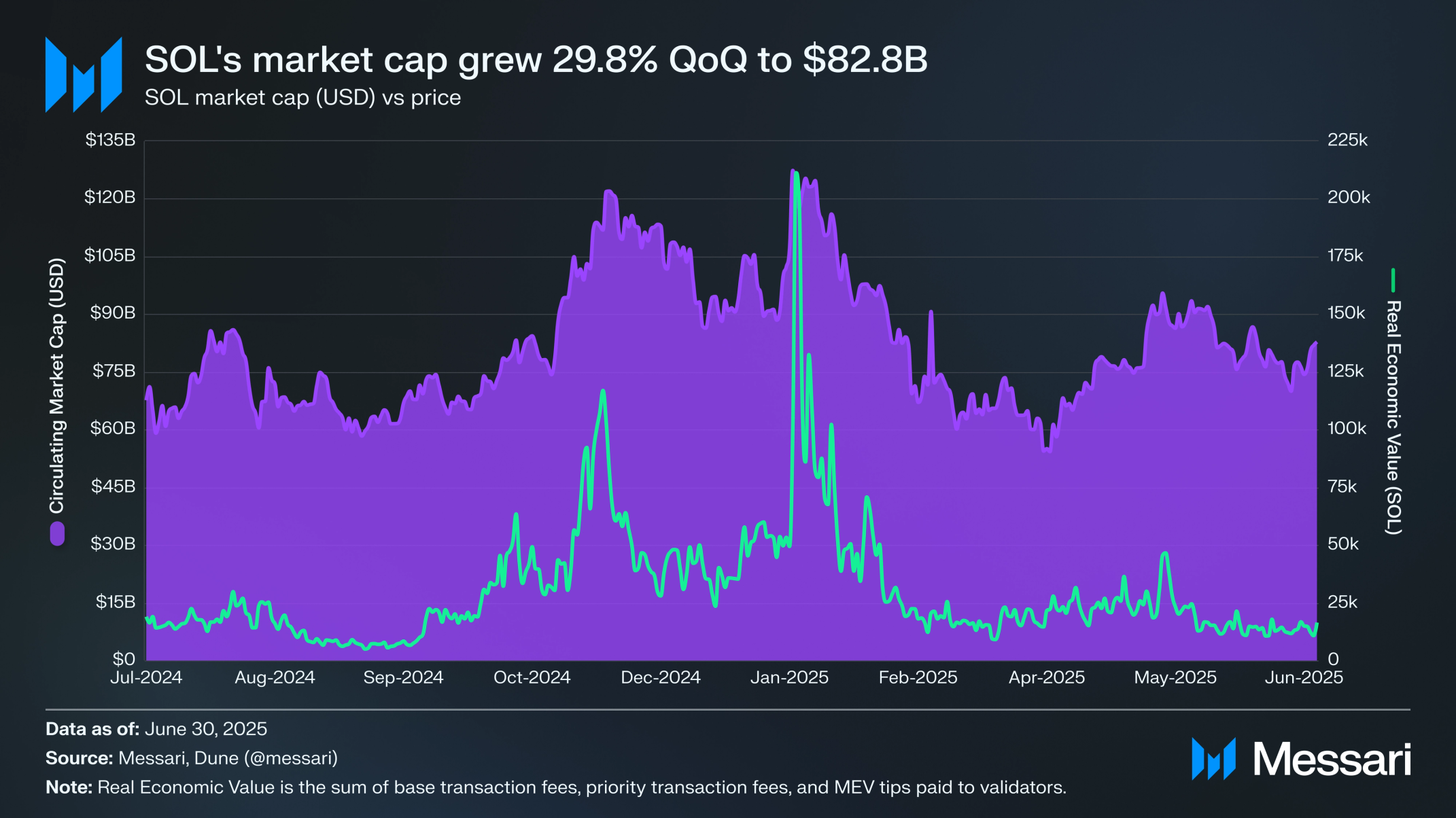

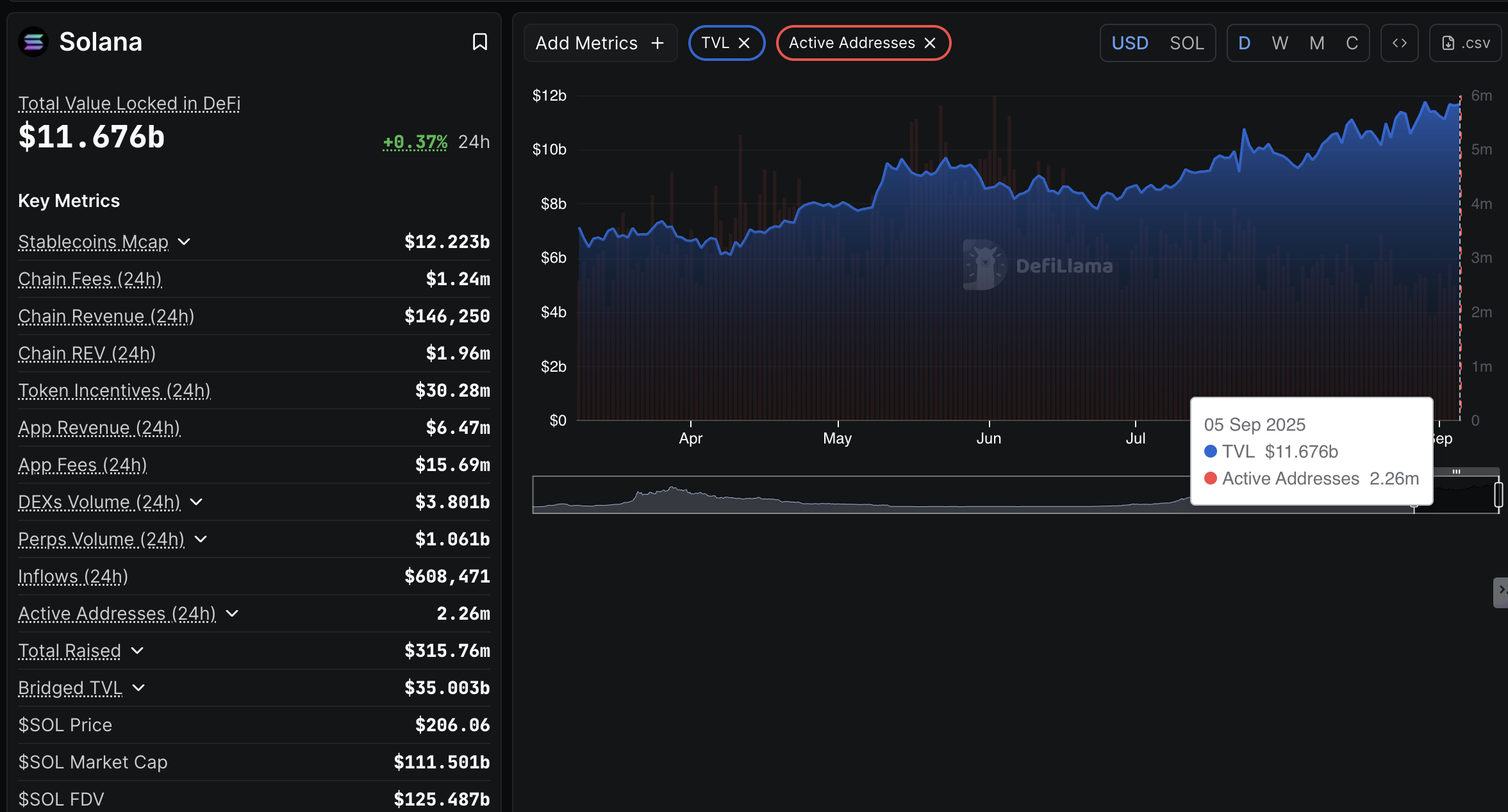

Solana’s stablecoin ecosystem is rewriting the rules of growth in 2025, with its market cap surging to an all-time high of $13.4 billion as of September. This explosive 154% year-to-date increase, up from $5.1 billion at the start of the year, is not just a headline – it’s a signal that Solana has secured its place as a premier venue for stablecoin innovation and capital flows. The network’s unmatched efficiency and cost structure, paired with growing institutional trust, have made it a magnet for both established issuers and new entrants.

Solana Stablecoins: Visualizing Historic Growth in 2025

The numbers demand attention. In January 2025 alone, Solana processed $1.6 trillion in stablecoin transfers (source), outpacing nearly every competitor except Ethereum by raw volume but outshining all in terms of speed and cost per transaction. The area chart below (see

) makes this clear: since late 2022, supply has grown parabolically, with inflections around major integrations and the launch of new assets like World Liberty Financial’s USD1.

USDC, issued by Circle, remains the bedrock of Solana’s stablecoin ecosystem – accounting for about 77% of total supply on-chain (source). But the narrative is evolving rapidly with USD1’s arrival in April 2025, reaching a $2.2 billion cap by September. This diversification signals more than just retail speculation; it points to growing regulatory clarity and appetite for transparent, asset-backed digital dollars within DeFi.

Why Solana? Efficiency Meets Institutional Confidence

The rise is not accidental. Solana’s architecture delivers what legacy blockchains struggle to provide: sub-second finality and transaction fees measured in fractions of a cent. These technical strengths translate directly into user confidence – both for everyday DeFi participants and large-scale liquidity providers searching for reliable rails to move capital.

This confidence is quantifiable: Solana’s total value locked (TVL) hit $8.9 billion in H1 2025, an 85.4% year-over-year increase, even as Ethereum maintains a larger TVL overall (source). The network’s revenue story is equally compelling – Solana generated $1.25 billion YTD in blockchain revenue according to CoinTrust, cementing its status as the most profitable public blockchain this year.

Solana (SOL) Price Prediction 2026-2031

Professional outlook based on 2025’s stablecoin growth, market cycles, and Solana’s evolving DeFi leadership.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $170.00 | $230.00 | $295.00 | +12% | Potential for continued DeFi expansion; moderate volatility as market digests 2025 highs. |

| 2027 | $185.00 | $265.00 | $345.00 | +15% | Renewed institutional adoption, stablecoin supply growth, and new protocol launches. |

| 2028 | $210.00 | $312.00 | $410.00 | +18% | Bullish cycle peak possible; global regulatory clarity boosts network adoption. |

| 2029 | $195.00 | $280.00 | $380.00 | -10% | Typical post-bull market correction; increased competition and profit-taking. |

| 2030 | $220.00 | $340.00 | $450.00 | +21% | New DeFi primitives and cross-chain integrations spark another growth phase. |

| 2031 | $250.00 | $390.00 | $520.00 | +15% | Wider enterprise and government use cases; stablecoin TVL exceeds $30B on Solana. |

Price Prediction Summary

Solana is poised for continued growth, leveraging its leading position in stablecoins and DeFi. After a period of consolidation post-2025 highs, SOL is expected to resume its uptrend, with new all-time highs likely by 2028-2031 as adoption and utility increase. Volatility remains high, but the long-term outlook is positive, especially as regulatory frameworks mature and new use cases emerge.

Key Factors Affecting Solana Price

- Explosive growth of stablecoin market cap and TVL on Solana

- Increasing adoption of USDC and new stablecoins (e.g., USD1)

- Solana’s superior transaction speed and low fees attracting DeFi projects

- Potential for further institutional investment and enterprise partnerships

- Competition from Ethereum, Layer-2s, and emerging blockchains

- Regulatory changes impacting stablecoin and DeFi sectors

- Technological upgrades improving scalability and security

- Market cycles (bull/bear) influencing investor sentiment and price action

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diversification Accelerates: Beyond USDC Dominance

The arrival of USD1 has injected new energy into the conversation around compliance and transparency within DeFi on Solana. Unlike algorithmic or loosely collateralized peers that have faced regulatory scrutiny elsewhere, USD1 offers full asset-backing and regular attestations – features that appeal to institutional treasurers as well as risk-conscious retail users.

This shift isn’t just about optics; it materially impacts liquidity depth across decentralized exchanges (DEXs), lending protocols, and payment rails built atop Solana’s robust infrastructure. As more regulated entities enter the fray, expect competition between USDC and USD1 to drive further innovation – not only in product design but also in cross-chain interoperability strategies.

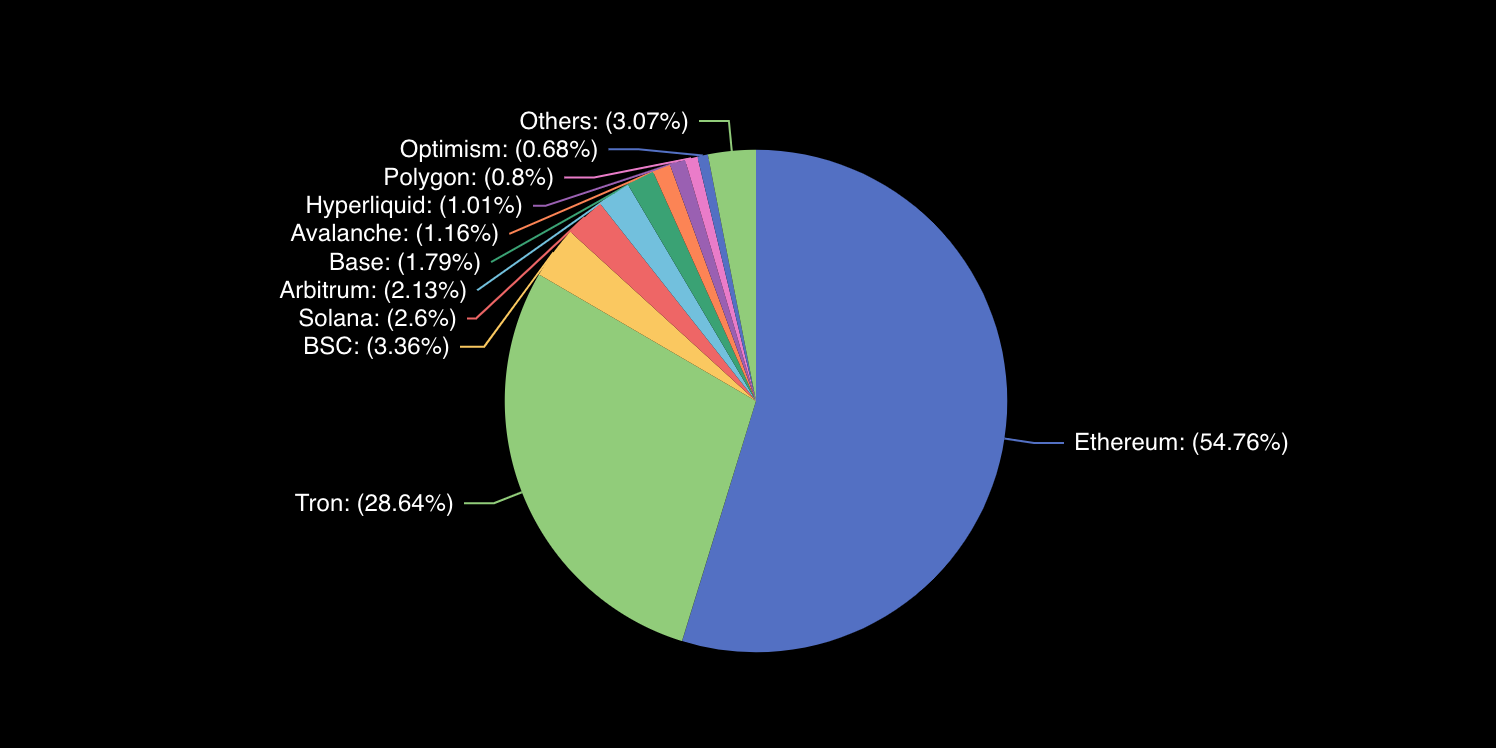

Solana’s ascent in the stablecoin sector is a case study in how technical advantages can reshape market structure. With $13.4 billion in stablecoins now circulating on Solana, the platform is no longer just an alternative to Ethereum or BNB Chain, it’s a core pillar of the global stablecoin market. As of September 2025, Solana commands a significant share of the total stablecoin market cap, which recently surpassed $295 billion (source), with its year-to-date growth rate eclipsing all major competitors.

Solana vs BNB and Ethereum: Competitive Dynamics in 2025

While Ethereum remains the TVL heavyweight, Solana is rapidly closing the gap in both transaction throughput and user engagement. BNB Chain, which once dominated low-fee DeFi, has seen its stablecoin growth stall as Solana’s ecosystem matures. The key differentiator? Speed and cost efficiency. Solana’s average transaction fee hovers well below $0.01, making it attractive for high-frequency trading, automated market makers (AMMs), and payment apps that require rapid settlement.

The introduction of USD1 has also shifted competitive dynamics. Unlike BNB Chain’s reliance on USDT and algorithmic coins, Solana now hosts a more diversified set of asset-backed stablecoins with robust compliance features. This not only attracts new capital but also reduces systemic risk across DeFi protocols operating on Solana.

Ecosystem Effects: Games, Payments, and DeFi Innovation

The surge in stablecoin liquidity is already fueling second-order effects across the broader Solana ecosystem. Game developers are integrating USDC and USD1 as default currencies for NFT marketplaces and play-to-earn economies, removing friction for fiat onramps and cross-border transactions. Payment startups are leveraging Solana’s speed to roll out instant settlement solutions for e-commerce merchants globally.

On the DeFi front, DEXs like Orca and lending protocols such as MarginFi have reported record volumes in Q3 2025 as new stablecoins deepen liquidity pools and unlock novel yield strategies. The result? A virtuous cycle where increased capital efficiency drives user growth, and vice versa.

Key Drivers of Solana’s Stablecoin Surge in 2025

-

Unmatched Transaction Efficiency: Solana’s high-speed, low-cost network processed $1.6 trillion in stablecoin transfers in January 2025 alone, making it a top choice for DeFi users and institutions seeking rapid, affordable transactions.

-

Dominance of Circle’s USDC: USDC accounts for approximately 77% of Solana’s $13.4 billion stablecoin supply, reflecting strong institutional and retail trust in this regulated, widely-used stablecoin.

-

Launch of New Stablecoins like USD1: The introduction of World Liberty Financial’s USD1 in April 2025, which reached a $2.2 billion market cap by September, diversified Solana’s stablecoin ecosystem and attracted new users.

-

Explosive Year-Over-Year Growth: Solana’s stablecoin market cap soared 154% year-to-date, rising from $5.1 billion to $13.4 billion, signaling robust adoption and confidence from both retail and institutional players.

-

Expanding DeFi Total Value Locked (TVL): Solana’s DeFi TVL reached $8.9 billion in H1 2025, up 85.4% year-over-year, indicating a thriving ecosystem that fuels stablecoin demand and utility.

Risks and Forward-Looking Trends

No explosive growth comes without risks. Regulatory clarity around asset-backed versus algorithmic stablecoins will remain a moving target into 2026. However, Solana’s proactive embrace of compliance-focused issuers like World Liberty Financial positions it ahead of chains that rely primarily on offshore or opaque models.

The next phase will likely see further integration between traditional finance rails and permissioned DeFi platforms built atop Solana, especially as institutional players seek reliable venues for settlement outside legacy systems.

Bottom line: With SOL currently trading at $205.18, down from its January peak but still up dramatically from prior cycles, the network’s fundamentals appear stronger than ever (source). The historic rise to a $13.4 billion stablecoin market cap signals not just short-term speculation but deep-rooted confidence from both crypto-native and institutional participants.