Solana’s DeFi landscape is evolving fast, with stablecoin yield strategies at the bleeding edge. If you want to maximize your returns in 2025, you need to understand how to harness Kamino and ONyc. This guide will break down the mechanics, risks, and visual workflows for squeezing every drop of yield from your Solana stablecoins, no fluff, just actionable alpha.

Why ONyc on Kamino is a Game-Changer for Solana Yield Farmers

On August 5,2025, ONyc officially launched on Kamino, Solana’s largest DeFi money market. What makes this move seismic? ONyc is a yield-bearing asset from OnRe that taps into real-world risk, think tokenized real estate and credit markets, offering a base yield of around 14%. Unlike most DeFi yields that are tightly correlated with crypto volatility, ONyc’s returns are uncorrelated and designed for stability. Add Kamino’s composability and instant liquidity, and you’ve got a new paradigm for stablecoin farming.

Current Market Data: As of now, Binance-Peg SOL (SOL) trades at $222.63, down -0.0714% in the last 24 hours, a reminder that true stability in DeFi comes from smart strategy, not just chasing token price pumps.

Core Mechanics: How Kamino and ONyc Yield Stacking Works

The workflow is refreshingly direct:

- Deposit USDC or other stablecoins into Kamino.

- Borrows generate USDG or Ethena incentives, reducing your net borrow cost (sometimes even flipping it negative).

- Looping strategies: Use borrowed funds to buy more ONyc or supply more liquidity, amplifying your exposure and APY.

- Payouts are instant and onchain, so there’s no waiting for redemption windows or off-chain settlements.

This composability means you can stack yields: ONyc’s base yield (~14%) and Kamino incentives and external rewards = some of the highest risk-adjusted returns in Solana DeFi right now.

The Visual Guide: Step-by-Step to Maximum Stablecoin Yields

If you’re new to these tools or want a refresher on best execution practices, here’s what you need to know:

- KYC? Not required. All actions are fully onchain via your Solana wallet.

- You can exit positions at any time, ONyc is liquid 24/7 thanks to its integration with Kamino’s money markets.

- You can use ONyc as collateral for borrowing/lending strategies across the Solana ecosystem (including margin trading).

- The entire process takes minutes, not days, and settles instantly on Solana’s high-speed rails.

Pro Tip: Track incentive campaigns like SyrupUSDC and Ethena, they often push net yields above 20% when combined with looping strategies. But always monitor borrow rates; they can flip quickly based on market demand.

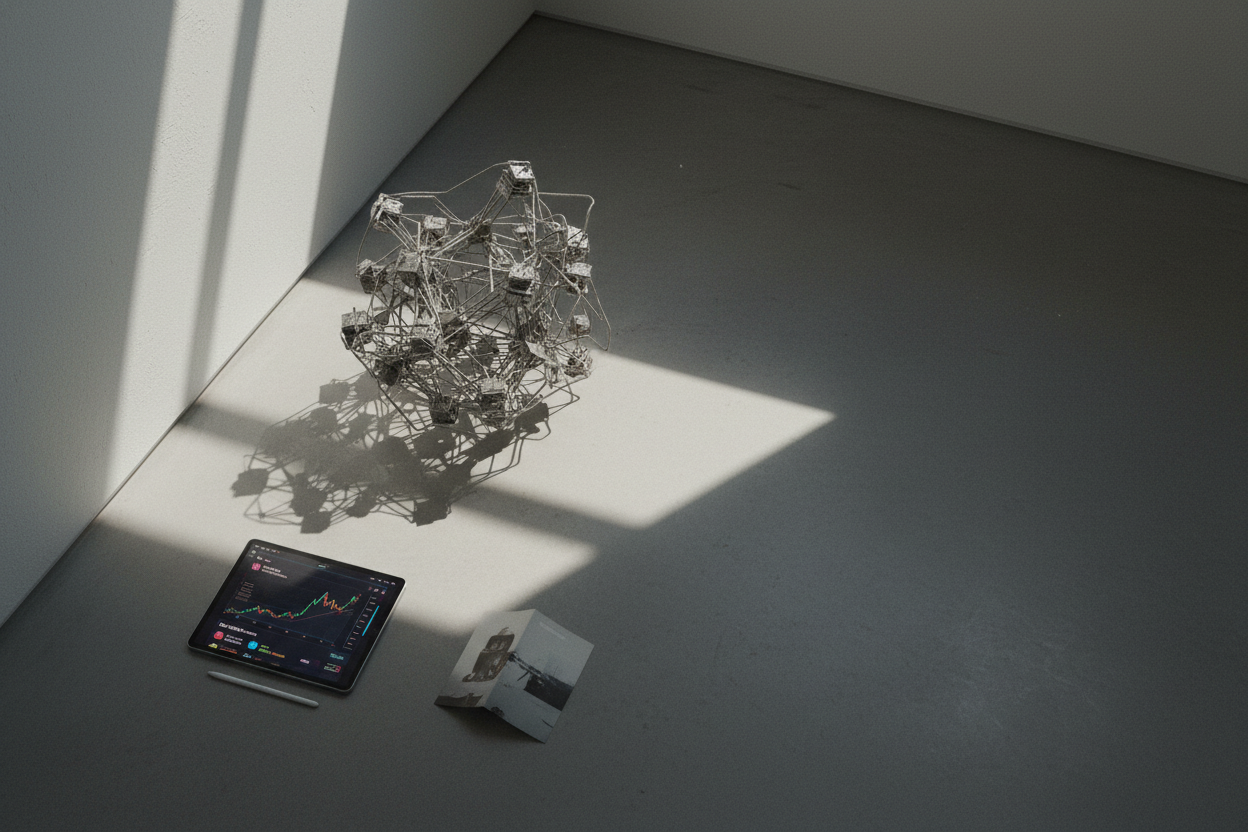

Solana Technical Analysis Chart

Analysis by Graham Hensley | Symbol: BINANCE:SOLUSDT | Interval: 1h | Drawings: 8

Technical Analysis Summary

Draw a steep downtrend line from the high near $252.50 on September 18, 2025, to the low at $219.95 on September 22, 2025. Mark horizontal support at $219.95 and $217.50, and resistance at $227.50 and $240.36. Use rectangles to highlight the sharp breakdown and subsequent consolidation zone between $219.95 and $223.20. Place a vertical line at the time of the breakdown on September 22, 2025. Annotate potential entry for aggressive longs near $220 with callouts. Place stop-loss markers just below $217.50. Mark profit targets at $227.50 and $240.36. Use arrows to indicate potential bounce scenarios from the current oversold zone.

Risk Assessment: high

Analysis: Price action is extremely volatile post-breakdown, with risk of further downside if $219.95 fails. However, aggressive reversal setups offer compelling reward if reclaimed levels hold.

Graham Hensley’s Recommendation: Scalp aggressively only with tight stops below $217.50. If SOL reclaims $227.50, size up and trail stops for a run at $240.36. Stay nimble, and don’t overstay any position—algorithmic liquidity is hunting both sides.

Key Support & Resistance Levels

📈 Support Levels:

-

$219.95 – Major recent low and bounce zone

strong -

$217.5 – Wick low, potential liquidity trap and last-ditch support

moderate

📉 Resistance Levels:

-

$227.5 – Previous minor support, now flipped resistance after breakdown

moderate -

$240.36 – 24h high and upper resistance zone

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$220 – Aggressive reversal entry after capitulation and bounce signal

high risk

🚪 Exit Zones:

-

$227.5 – First resistance, logical partial take-profit

💰 profit target -

$240.36 – Full reversal target if momentum continues

💰 profit target -

$217.5 – Stop-loss below key wick low to protect against breakdown continuation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume likely spiked during the breakdown and bounce; use callouts to annotate volume clusters at capitulation and rebound.

Capitulation and rebound volume signals potential exhaustion and reversal attempt.

📈 MACD Analysis:

Signal: MACD likely deeply oversold and beginning to curl, setting up for a potential bullish cross if price holds above $220.

Watch for MACD bullish divergence to confirm aggressive long setups.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Graham Hensley is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

The Real-World Yield Edge: Why Uncorrelated Returns Matter in Solana DeFi 2025

The killer feature here isn’t just high APY, it’s diversification. Most crypto-native yields move together; when SOL drops, so do yields across the board. With ONyc tapping into external asset classes via OnRe, you get exposure that doesn’t care if SOL is at $222.63 or $120. This makes it an ideal core holding in any advanced Solana yield farming stack.

Solana (SOL) Price Prediction 2026-2031

Projections factoring in ONyc’s DeFi integration, real-world yield, and evolving market conditions

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-Over-Year Change (Avg) |

|---|---|---|---|---|

| 2026 | $185.00 | $240.00 | $320.00 | +8% |

| 2027 | $170.00 | $275.00 | $410.00 | +15% |

| 2028 | $160.00 | $315.00 | $520.00 | +14% |

| 2029 | $200.00 | $370.00 | $650.00 | +17% |

| 2030 | $250.00 | $420.00 | $800.00 | +14% |

| 2031 | $300.00 | $480.00 | $1,000.00 | +14% |

Price Prediction Summary

Solana is poised for steady growth over the next six years, driven by continued DeFi innovation, including the ONyc-Kamino integration which brings real-world yield to the Solana ecosystem. While the market may experience cyclical volatility, the average price is projected to nearly double by 2031, with significant upside potential if adoption accelerates. Bearish scenarios reflect possible macroeconomic headwinds or regulatory challenges, while bullish outcomes consider mass adoption and further technological advances.

Key Factors Affecting Solana Price

- ONyc and Kamino integration driving new stablecoin yield strategies and DeFi growth on Solana.

- Sustained developer activity and network upgrades enhancing scalability and user experience.

- Expansion of real-world asset tokenization and uncorrelated yield sources.

- Global regulatory clarity for stablecoins and DeFi platforms influencing investor confidence.

- Potential for increased competition from other Layer 1 and DeFi ecosystems.

- Overall market cycles, including possible corrections and renewed bull runs.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With ONyc and Kamino, you’re not just chasing the latest farm – you’re building a yield engine that’s robust to crypto market swings. The ONyc base yield of 14% is already strong, but stack on Kamino’s incentives (like those from USDG or Ethena) and you’re looking at net yields reaching 18-22% in optimal conditions. That’s not theoretical: SyrupUSDC campaigns have pushed total returns over 21% for power users who loop and compound effectively.

But let’s be clear: risk management is non-negotiable. Leverage amplifies both gains and liquidations. Always monitor your health factor on Kamino and set alerts for sudden shifts in borrow rates or collateral ratios. ONyc’s real-world backing adds stability, but DeFi remains a dynamic environment where incentives can dry up or rates can spike with little warning.

Kamino x ONyc: Strategy Checklist for Maximum APY

The best Solana yield farmers are relentless optimizers. Here are advanced tactics worth considering:

- Looping with discipline: Don’t just max out leverage; use incremental loops, monitoring net APY after each cycle.

- Collateral swaps: Rotate between ONyc, USDC, and other supported assets to respond to changing incentive programs.

- Auto-compounding: Use automation tools or scripts to harvest rewards and redeploy them instantly for compounding gains.

- Diversify across platforms: While Kamino and ONyc is top-tier now, keep tabs on competitors like MarginFi or Meteora for shifting opportunities.

Frequently Asked Questions About Solana Stablecoin Yield Stacking

If you’re serious about maximizing your Solana stablecoin yields in late 2025, integrating ONyc via Kamino should be at the core of your strategy. With SOL currently at $222.63, the opportunity cost of sitting idle is massive compared to what these new DeFi primitives offer. Stay nimble, automate where possible, monitor incentive updates closely – and always respect the power (and risk) of leverage in this new era of real-world DeFi yield farming.