Solana’s emergence as a premier blockchain for institutional capital is no longer theoretical. The headline-grabbing pivot of Brera Holdings, a European soccer company, into Solmate – a Solana Digital Asset Treasury (DAT) powerhouse with $300 million in backing – marks a new phase in how treasuries are managed, staked, and leveraged within the Solana ecosystem. This transition, fueled by heavyweights like ARK Invest and UAE-based firms, is more than just a corporate rebrand; it’s an inflection point for the entire digital asset landscape.

Solmate’s $300 Million Bet on Solana: A Game Changer for Digital Treasuries

The numbers are impossible to ignore. With Binance-Peg SOL (SOL) trading at $239.26, Solmate’s war chest puts it among the largest single holders of SOL outside of core DeFi protocols. Their strategy is multidimensional: not only is Solmate accumulating and staking SOL, but it’s also building out critical infrastructure including the first dedicated Solana validator in Abu Dhabi. This move gives Middle Eastern investors direct access to native yield and cements Abu Dhabi as a regional crypto hub.

Backing from ARK Invest (who doubled down with an additional $162 million in shares), RockawayX, Pulsar Group, and the Solana Foundation signals deep institutional conviction. The market has responded accordingly, with Brera/Solmate shares soaring on Nasdaq and secondary markets.

Institutional Capital Floods Into Solana Treasuries

Solmate isn’t alone. The pace of Solana institutional investment has accelerated rapidly through 2025. Upexi Inc. , for example, has amassed 1.9 million SOL since April (a position now valued at approximately $320.4 million), fully staked at an 8% annual yield. DeFi Developments Corp made its own splash with 1,182,685 SOL purchased at an average price of $137.07 – holdings now worth nearly $198.9 million at current prices.

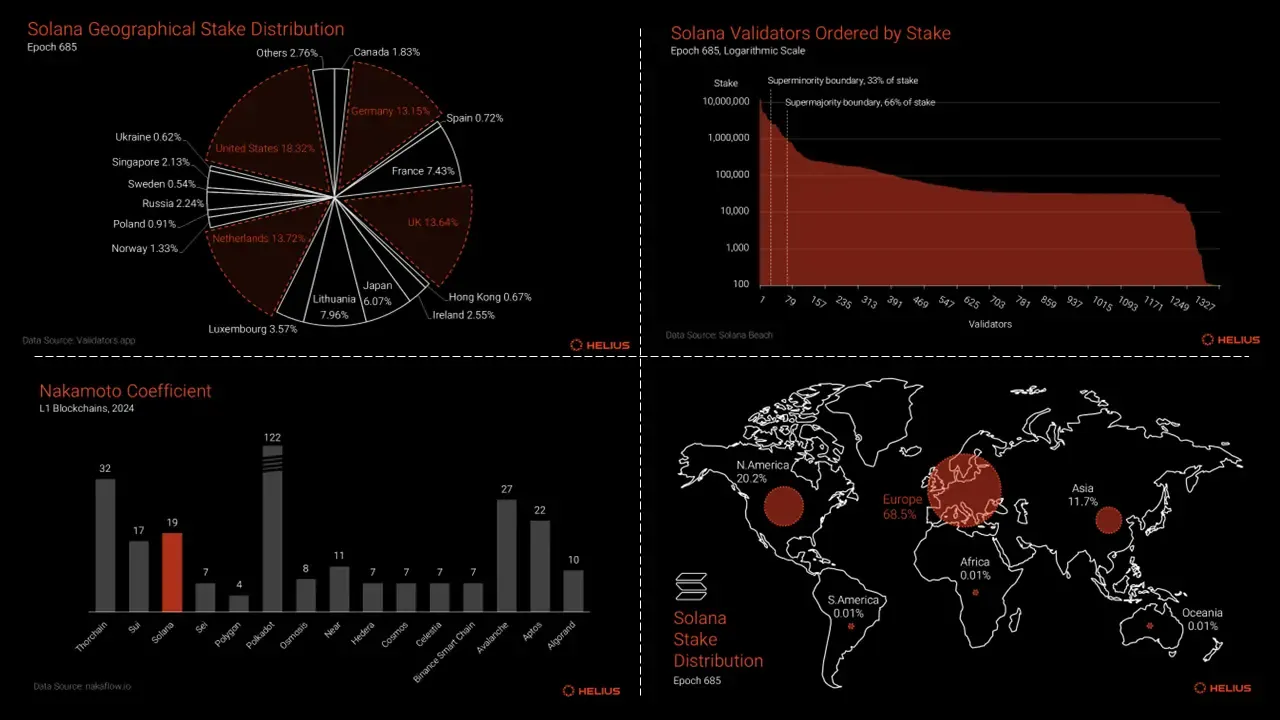

This wave of institutional buying isn’t just about speculation; it’s about active participation in network security and governance via staking and validator operations. As more treasuries integrate staking strategies, they reinforce both decentralization and liquidity across the ecosystem.

Solana (SOL) Price Prediction 2026-2031

Forecasts based on institutional adoption, market cycles, and regulatory trends as of September 2025.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $195.00 | $265.00 | $340.00 | +10.8% | High institutional staking demand and ETF launches drive growth; possible volatility from macroeconomic shifts. |

| 2027 | $230.00 | $330.00 | $420.00 | +24.5% | Maturing DeFi protocols and further ETF adoption fuel upward momentum; potential correction mid-year. |

| 2028 | $260.00 | $380.00 | $500.00 | +15.1% | Solana solidifies position as a top-three DeFi platform; continued inflows from treasuries and global investors. |

| 2029 | $300.00 | $440.00 | $600.00 | +15.8% | Wider global adoption and improved scalability; risk from new competitors and potential network forks. |

| 2030 | $340.00 | $510.00 | $720.00 | +15.9% | Mainstream financial integration, cross-chain solutions; regulatory clarity boosts large-scale institutional entry. |

| 2031 | $390.00 | $580.00 | $850.00 | +13.7% | Solana becomes core infrastructure for Web3 and tokenized assets; market matures, volatility moderates. |

Price Prediction Summary

Solana’s price outlook remains robust through 2031, underpinned by strong institutional adoption, new treasury vehicles, and increasing DeFi activity. Average prices are projected to rise steadily, with short-term volatility but a clear long-term uptrend. Bullish scenarios reflect continued ETF approvals, regulatory clarity, and expanding use cases, while bearish outcomes account for macro shocks and competitive threats.

Key Factors Affecting Solana Price

- Sustained institutional accumulation and staking (e.g., Solmate, Upexi, DeFi Developments)

- SEC regulatory clarity and ETF approvals for liquid staking products

- Growth in Solana’s DeFi TVL and ecosystem innovation

- Global adoption driven by Abu Dhabi and UAE-based infrastructure

- Potential competition from other L1 blockchains and evolving market cycles

- Technological upgrades improving scalability and security

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

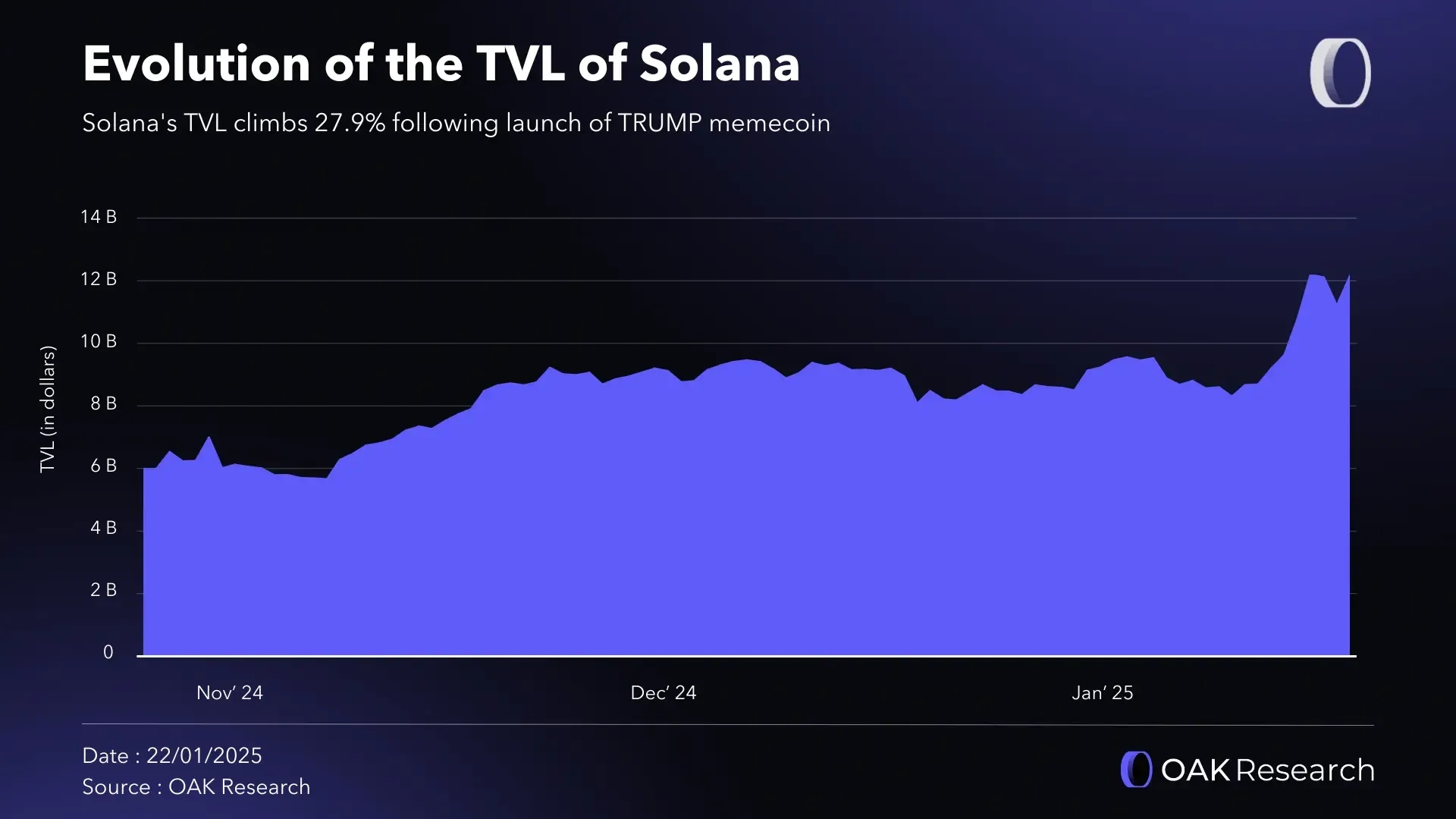

Total Value Locked Surges as Regulatory Clarity Arrives

The impact is measurable: Total Value Locked (TVL) on Solana stands at $12.1 billion as of September 9,2025, up 15% over the past month alone (source). Major DeFi protocols like Jupiter, Jito, and Kamino are leading this growth – but it’s the influx of over $1.6 billion from institutions into treasuries and staking that truly sets this cycle apart.

The regulatory backdrop has also shifted favorably: SEC guidance confirming that liquid staking tokens aren’t securities by default paved the way for new ETF products backed by staked assets like JitoSOL (details here). VanEck and Jito wasted no time filing for innovative ETFs that further legitimize Solana as an institutional-grade blockchain.

The New Playbook: Why Institutions Are Choosing Solana DATs Over Traditional Treasuries

The shift toward Solana Digital Asset Treasuries isn’t happening in isolation or by accident. Yield generation through native staking (currently around 8%), transparent on-chain management, instant settlement times, and composable DeFi infrastructure all make SOL treasuries fundamentally more dynamic than their fiat or even Bitcoin/Ethereum counterparts.

This isn’t just about holding assets; it’s about activating them within a high-performance ecosystem where volatility equals opportunity – not just risk.

What sets Solmate and its peers apart is their willingness to embrace the full spectrum of Solana’s capabilities. By actively staking SOL and operating validators, these treasuries aren’t just passive asset vaults. They are integral to the network’s security, consensus, and ongoing innovation. The result: a self-reinforcing flywheel where institutional capital deepens liquidity, attracts more sophisticated protocols, and increases overall network resilience.

For institutional allocators, the calculus has shifted decisively. The combination of robust yield (with SOL staked at 8%), regulatory green lights for staking-enabled ETFs, and a rapidly expanding DeFi layer makes Solana DATs a compelling alternative to legacy treasury management models. Unlike traditional corporate treasuries or even Bitcoin-centric strategies, Solana DATs offer programmable cash flow, real-time auditability, and seamless integration with lending, options, and structured products.

“Volatility is opportunity” has never been truer than in this new digital treasury landscape. Institutions are not only hedging macro risk, they’re extracting value from it through active participation in emerging on-chain primitives.

How Solmate’s Model Is Reshaping the Solana Ecosystem

The ripple effects extend well beyond headline AUM figures. By launching the first dedicated Solana validator in Abu Dhabi, Solmate is catalyzing a regional shift, giving Gulf investors direct access to native yield while setting new standards for compliance and transparency. This model is already inspiring copycats: expect more public companies and sovereign funds to experiment with similar DAT structures before year-end.

Key Benefits of Solana Digital Asset Treasuries for Institutions

-

Attractive Yield Generation via Staking: Institutions can stake SOL holdings—currently priced at $239.26—to earn an 8% annual yield, as demonstrated by Upexi Inc. and DeFi Developments Corp. This provides a reliable passive income stream while supporting network security.

-

Enhanced Liquidity and Portfolio Diversification: Integrating SOL into treasuries offers exposure to a high-growth digital asset. With Solana’s total value locked (TVL) at $12.1 billion and a 15% monthly increase, institutions benefit from deep liquidity and access to a vibrant DeFi ecosystem.

-

Access to Institutional-Grade Infrastructure: Solutions like Solmate, backed by ARK Invest and the Solana Foundation, provide secure, scalable platforms for managing and staking SOL. Solmate’s Abu Dhabi validator also gives regional investors direct access to Solana’s yield opportunities.

-

Regulatory Clarity and ETF Opportunities: The SEC’s clarification on liquid staking tokens has paved the way for products like the JitoSOL-backed ETF (filed by VanEck and Jito), enabling compliant and flexible exposure to Solana’s staking rewards for institutional portfolios.

-

Strengthened Network Security and Decentralization: Large-scale institutional staking enhances Solana’s security and decentralization, making the network more robust and attractive for future institutional adoption.

The real test will be sustainability, can these treasuries maintain strong yields as more capital floods in? If recent TVL growth (now at $12.1 billion) is any indicator, network effects are compounding rapidly (see data). With SOL priced at $239.26, even modest appreciation or increased staking rewards could make these strategies dominant components of modern portfolio construction.

Looking Ahead: What Comes Next?

The next phase will likely see further convergence between digital asset treasuries and advanced DeFi protocols, think automated risk management tools, on-chain derivatives tied directly to treasury balances, and cross-chain interoperability with other major ecosystems. Regulatory clarity around liquid staking has removed one of the last major barriers; now it’s about execution and scale.

For investors watching from the sidelines, these developments aren’t just technical milestones, they’re signals that traditional finance is being reimagined from the ground up. As more companies follow Solmate’s lead and integrate Solana Digital Asset Treasuries, expect both volatility, and opportunity, to accelerate across the ecosystem.