Bitcoin’s journey across blockchains has reached a new milestone: as of September 17,2025, the supply of Bitcoin on Solana has surged past $1 billion. This landmark not only underscores Solana’s growing relevance as a cross-chain hub but also signals a deeper shift in how users want to interact with digital assets. With Bitcoin (BTC) currently trading at $116,230.00, the appetite for wrapped BTC on Solana is more than a speculative play, it’s a strategic move by both retail and institutional actors to access faster, cheaper decentralized finance (DeFi) rails.

Bitcoin Migration: Why Solana Became the Go-To DeFi Highway

For years, Ethereum was the default home for wrapped Bitcoin. But rising gas fees and network congestion have driven users to seek alternatives. Enter Solana: boasting sub-second finality and transaction costs measured in fractions of a cent, it offers an irresistible value proposition for anyone wanting to put their Bitcoin to work in DeFi protocols.

The result? An explosive increase in cross-chain activity. According to KuCoin, over $1 billion worth of BTC is now secured on Solana’s blockchain via wrapped tokens, a figure that reflects both whale inflows and a groundswell of retail adoption.

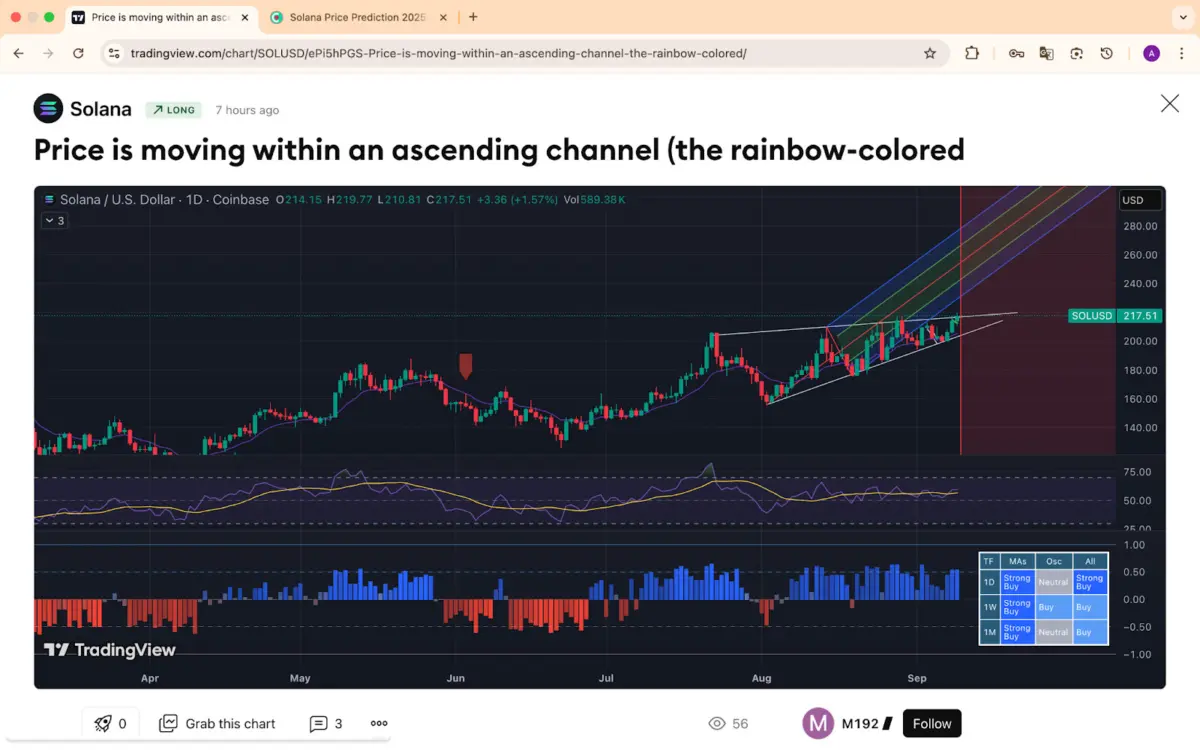

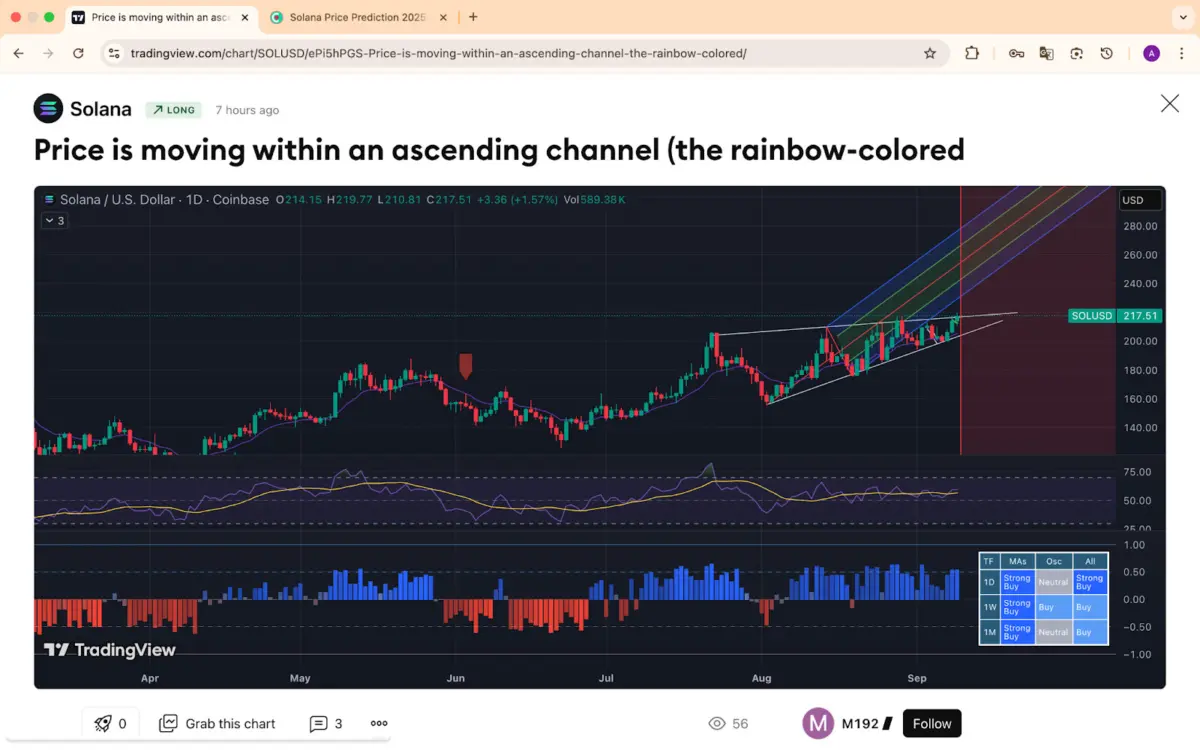

Visualizing the Surge: Blockchain Data Tells the Story

The numbers are staggering. In just twelve months, total value locked (TVL) across Solana DeFi protocols leaped from under $4 billion to over $12.4 billion, with Bitcoin supply accounting for nearly 10% of that growth. On-chain explorers reveal thousands of unique addresses holding wrapped BTC, participating in lending pools, liquidity farms, and even NFT marketplaces, all without ever leaving the Solana ecosystem.

Key Visual Stats: Bitcoin Flows Into Solana DeFi

-

Over $1 Billion in Bitcoin Now on SolanaAs of September 17, 2025, the supply of Bitcoin on the Solana blockchain has surpassed $1 billion (KuCoin), marking an all-time high and highlighting Solana’s emergence as a major cross-chain hub for Bitcoin and DeFi.

-

Solana Total Value Locked (TVL) Hits $12.4 BillionSolana’s DeFi ecosystem reached a new all-time high TVL of $12.4 billion in September 2025, reinforcing its position as a leading blockchain for decentralized finance activity.

-

500% Surge in Solana Transaction VolumesDriven by large whale movements and increased DeFi activity, Solana’s transaction volumes have soared by 500% in 2025, reflecting heightened user engagement and liquidity inflows.

-

Wrapped Bitcoin Fuels Cross-Chain UtilityThe majority of Bitcoin entering Solana DeFi is via wrapped Bitcoin (like soBTC and renBTC), enabling users to leverage Bitcoin’s value while accessing Solana’s fast, low-fee dApps.

-

Institutional Interest: $1.4 Billion Solana Treasury SurgeMajor institutional moves, including a $1.4 billion Solana treasury surge and ETF approvals, signal growing confidence in Solana’s DeFi infrastructure and its integration with Bitcoin liquidity.

This migration isn’t just about speed or cost; it’s about composability. On Solana, users can deploy their Bitcoin in complex strategies, staking it as collateral for stablecoins or leveraging it for yield farming, without friction or prohibitive fees. Visual dashboards from leading analytics platforms show daily transaction volumes up 500%, with whale moves often coinciding with protocol launches or major governance votes.

Institutional Momentum: The $1 Billion Signal

The influx isn’t limited to individual traders. Institutional players are making waves by injecting large tranches of liquidity into Solana-based treasuries and DeFi platforms. Reports indicate that recent whale activity, sometimes single transactions exceeding $100 million, has catalyzed further adoption by demonstrating confidence in both wrapped BTC infrastructure and Solana’s security model.

This institutional stampede is reinforced by macro trends: ETF approvals from regulators like the SEC have legitimized cross-chain assets, while funds like Pantera are raising over $1 billion specifically earmarked for Solana treasuries (Gate.com). The message is clear, the market views Solana not just as an alternative chain but as a core pillar of crypto’s future financial stack.

Bitcoin (BTC) Price Prediction on Solana: 2026-2031

Forecasts based on Solana’s DeFi surge, Bitcoin adoption, and cross-chain integration through Q4 2031.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,500 | $125,400 | $158,000 | +7.9% | Potential correction after 2025 highs; Solana DeFi integration stabilizes BTC flows |

| 2027 | $110,000 | $138,200 | $176,500 | +10.2% | Renewed institutional interest; further cross-chain adoption; ETF expansion |

| 2028 | $120,300 | $152,000 | $198,500 | +10.0% | Layer 2 scaling, regulatory clarity, and new DeFi products boost BTC utility |

| 2029 | $133,000 | $167,200 | $223,000 | +10.0% | Global adoption accelerates; possible macroeconomic tailwinds |

| 2030 | $145,600 | $184,000 | $250,000 | +10.1% | Bitcoin becomes mainstream collateral in DeFi; Solana/BTC bridges mature |

| 2031 | $158,000 | $202,500 | $278,000 | +10.1% | Wider cross-chain interoperability, institutional DeFi adoption, and new BTC-based financial products |

Price Prediction Summary

Bitcoin’s presence on Solana is expected to grow steadily, with average prices projected to rise from $125,400 in 2026 to $202,500 by 2031. Minimum prices reflect possible market downturns or regulatory headwinds, while maximum prices capture the upside from technological and institutional breakthroughs. The integration of Bitcoin with Solana’s DeFi ecosystem is likely to provide additional utility and liquidity, supporting a progressive price increase.

Key Factors Affecting Bitcoin Price

- Solana’s sustained growth as a leading DeFi and cross-chain hub

- Rising institutional adoption of Bitcoin and DeFi products

- Further regulatory clarity, including ETF approvals and cross-border frameworks

- Technological improvements in wrapped Bitcoin and cross-chain bridges

- Macro-economic cycles and global crypto adoption trends

- Potential competition from Ethereum, Avalanche, and emerging chains

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As Solana’s ecosystem matures, the integration of Bitcoin at scale is already reshaping user behavior. Liquidity providers are leveraging their wrapped BTC in automated market makers, while sophisticated DeFi protocols offer structured products and derivatives previously limited to Ethereum. The seamless composability between assets, combined with Solana’s unmatched transaction throughput, has allowed new financial instruments to flourish.

One of the most telling metrics is the volume of cross-chain swaps and lending activity involving Bitcoin on Solana. With TVL now above $12.4 billion, platforms like Jupiter, Kamino, and Marginfi have seen record inflows from both retail users and institutional desks. This isn’t just opportunistic yield-chasing; it’s a structural migration reflecting confidence in Solana’s reliability and developer ecosystem.

Risks and Resilience: Can Solana Sustain the Momentum?

Of course, rapid growth brings new risks. Cross-chain bridges remain a focal point for security concerns, with exploits elsewhere in crypto casting long shadows. However, recent upgrades to bridge protocols and insurance mechanisms have significantly reduced attack surfaces on Solana. The network’s resilience during periods of high volatility, processing over $364 billion in volume at its 2025 peak, has further solidified user trust (Gate.com).

Another challenge is sustainability: can incentives keep pace as more BTC enters the system? So far, fee markets have remained stable thanks to Solana’s unique architecture, but governance forums are actively debating how best to balance rewards with long-term network health.

What’s Next: Solana as Crypto’s Liquidity Superhighway

The $1 billion milestone for Bitcoin supply on Solana is more than a headline, it’s a signal that cross-chain composability is no longer theoretical. As ETF approvals normalize digital assets in traditional portfolios and institutional treasuries allocate billions to DeFi rails, expect even deeper integration between Bitcoin and the broader Solana ecosystem in 2025.

This trend will likely accelerate as new primitives emerge: think Bitcoin-backed stablecoins native to Solana or decentralized options markets powered by cross-chain liquidity pools. For developers and investors alike, the message is clear, Solana isn’t just keeping pace; it’s setting the tempo for the next era of blockchain finance.

Will you use wrapped Bitcoin on Solana for DeFi in 2025?

With Bitcoin’s supply on Solana surpassing $1 billion and BTC trading at $116,230, Solana is becoming a major hub for cross-chain DeFi. Would you consider using wrapped Bitcoin on Solana to access fast, low-fee decentralized apps and liquidity?