Sanctum’s Rise: Why Liquid Staking is Exploding on Solana in 2025

2025 has become a watershed year for liquid staking on Solana, with Sanctum emerging as the protocol at the center of this seismic shift. As institutional and retail investors alike search for yield and flexibility in an increasingly competitive DeFi landscape, Sanctum’s innovations are driving a new era in Solana staking. With liquid staked SOL reaching a record 57 million (13.6% of total supply) and Solana’s TVL surging to an all-time high of $12.27 billion, it’s clear that the appetite for liquid staking is not just growing – it’s exploding.

Sanctum Solana: The Engine Behind Liquid Staking’s Boom

Sanctum isn’t just another staking protocol – it is rapidly becoming the backbone of Solana’s infinite-LST future. By introducing the Infinity liquidity pool, Sanctum allows users to swap between millions of different Liquid Staking Tokens (LSTs) with deep liquidity and minimal slippage. This innovation supports instant unstaking, making capital far more agile than traditional locked staking models.

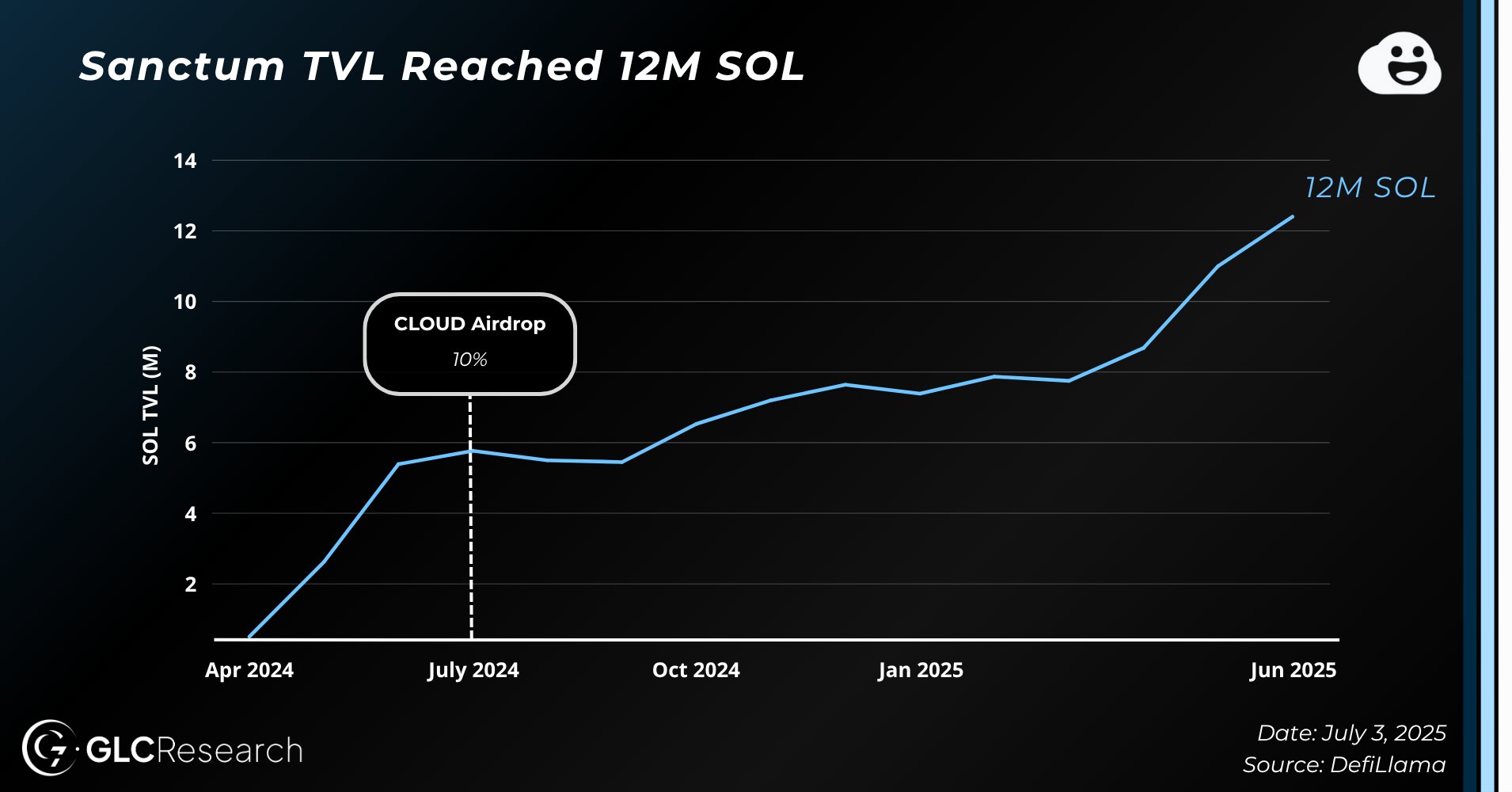

The protocol’s rise is reflected in its numbers: Sanctum now holds $2.894 billion in TVL, outpacing many competitors and establishing itself as a cornerstone among Solana DeFi protocols. The launch of its governance token, CLOUD, in July 2024 (with staking live since January 2025), has further cemented user engagement and given early adopters a powerful voice in protocol evolution.

Solana TVL Growth: Institutional Adoption Meets DeFi Innovation

This year has seen an unprecedented influx of capital into the Solana ecosystem, with TVL nearly tripling from $4.63 billion in September 2024 to over $12.27 billion today (source: DeFiLlama). A significant driver? Liquid staking – especially as institutions signal their intent to participate.

The launch of the first Solana liquid staking ETF in July 2025 was a watershed moment, explicitly integrating LSTs into fund management strategies. Public companies like DFDV have also begun allocating to LSTs on-chain, reflecting growing confidence in both the security and composability of Sanctum-powered assets.

The CLOUD Token: Governance and Yield at Scale

CLOUD isn’t just another governance token; it sits at the heart of Sanctum’s incentive machine. With a total supply capped at 1 billion, CLOUD rewards both early stakers and active participants who help steer protocol development. Since January 2025, CLOUD staking has introduced new layers of yield generation while aligning long-term interests between users and protocol stewards (source: coincap7. com).

This synergy between governance incentives and robust utility is powering sustained demand for both SOL and LSTs across the network.

Solana (SOL) Price Prediction 2026-2031

Professional forecast based on Solana’s liquid staking boom, Sanctum’s growth, and evolving institutional adoption

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $185.00 | $245.00 | $310.00 | +10.1% | Continued institutional inflows, LST adoption expands, but macro uncertainty keeps volatility high |

| 2027 | $200.00 | $275.00 | $350.00 | +12.2% | ETF maturity, Sanctum ecosystem matures, regulatory clarity improves |

| 2028 | $225.00 | $315.00 | $400.00 | +14.5% | Global LST standards, Solana tech upgrades, increased DeFi integration |

| 2029 | $250.00 | $360.00 | $460.00 | +14.3% | Mainstream institutional adoption, multi-chain LSTs, broader DeFi/TradFi bridge |

| 2030 | $280.00 | $410.00 | $540.00 | +13.9% | Solana ecosystem rivals Ethereum in TVL, new use cases for LSTs, robust global regulatory frameworks |

| 2031 | $320.00 | $470.00 | $630.00 | +14.6% | Solana as a default LST platform, cross-ecosystem adoption, potential for global ETFs |

Price Prediction Summary

Solana (SOL) is positioned for steady growth from 2026 to 2031, bolstered by the explosive rise of liquid staking protocols like Sanctum, ongoing institutional adoption, and a maturing regulatory environment. While volatility remains, the increasing integration of LSTs, ETF products, and DeFi innovations provide strong tailwinds for SOL. The average price prediction rises from $245.00 in 2026 to $470.00 by 2031, with bullish scenarios potentially reaching as high as $630.00.

Key Factors Affecting Solana Price

- Rapid adoption of liquid staking and LST protocols (e.g., Sanctum, bbSOL)

- Growth in Total Value Locked (TVL) and network activity

- Mainstream and institutional adoption via ETFs and fund products

- Technological advancements (e.g., Sanctum Infinity, Solana upgrades)

- Regulatory clarity and global frameworks for staking and DeFi

- Competition from other L1s and evolving market dynamics

- Potential for new Solana-based financial products and enterprise solutions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pushing Toward Infinite-LST Composability

The real magic behind Sanctum lies in its modular approach to LST issuance – enabling white-label solutions so exchanges, DAOs, or even public companies can create custom-branded LSTs without sacrificing liquidity or security (source: Blockworks/LinkedIn). As more players enter this space, expect exponential growth not only in TVL but also in market cap diversity across Solana liquid staking protocols.

As the Solana ecosystem matures, Sanctum’s architecture is setting a new standard for what’s possible in liquid staking. The protocol’s V2 upgrade, launched in late August 2025, introduced even more efficient routing and deeper integrations with other DeFi protocols, further reducing friction for both retail and institutional users. This has directly contributed to the protocol’s TVL surge and growing influence among Solana DeFi protocols.

We’re also witnessing a broader shift in how capital flows within the network. Bybit’s bbSOL, which has hit $400 million in TVL as of September 2025, showcases how exchange-issued LSTs are thriving thanks to Sanctum’s white-label infrastructure (source: AInvest). This modularity means that any entity can tap into Solana’s robust staking rewards while maintaining flexibility over branding and fee structures.

What Sets Sanctum Apart? Composability and Infinite-LST Liquidity

Sanctum isn’t just about scale, it’s about composability. By allowing millions of LSTs to be issued and traded seamlessly, the protocol unlocks a future where every DAO, exchange, or treasury can deploy their own staking derivatives without fragmenting liquidity. The Infinity pool ensures that all these assets remain deeply liquid and easily swappable for SOL or other LSTs at any time.

Sanctum’s Key Innovations in Solana Liquid Staking

-

Infinity Liquidity Pool: Sanctum introduced the Infinity liquidity pool, a multi-LST pool that enables seamless swaps between a wide range of liquid staking tokens (LSTs) on Solana. This design supports millions of LSTs natively, providing deep liquidity and facilitating instant unstaking for SOL holders.

-

White-Label LST Issuance: Sanctum offers a white-label issuance service that allows clients to launch their own liquid staking tokens (LSTs) on Solana, accelerating ecosystem growth and diversity of staking options.

-

CLOUD Governance Token and Staking: In July 2024, Sanctum launched its governance token, CLOUD, with a total supply of 1 billion tokens. CLOUD staking, introduced in January 2025, empowers users to participate in protocol governance and earn additional rewards.

-

Institutional-Grade Infrastructure: Sanctum’s scalable infrastructure has enabled integration with the first Solana staking ETF (launched July 2025), supporting mainstream institutional adoption and fund management with liquid staking.

-

Record TVL Growth: As of September 2025, Sanctum holds $2.894 billion in total value locked (TVL), underscoring its rapid ascent and critical role in Solana’s liquid staking landscape.

This approach directly addresses one of DeFi’s core problems: capital inefficiency due to siloed liquidity. With Sanctum, every new LST strengthens the network rather than diluting it, a flywheel effect that accelerates TVL growth and yields for everyone involved.

Looking Ahead: The Roadmap for Liquid Staking on Solana

The momentum behind Solana liquid staking in 2025 shows no sign of slowing down. As Binance-Peg SOL continues to trade at $222.54, with intraday volatility reflecting healthy market activity (high: $225.57, low: $215.14), risk-managed exposure through LSTs is becoming an essential strategy for sophisticated investors.

Expect continued innovation from Sanctum as it rolls out new primitives designed to enhance cross-chain compatibility and integrate with emerging on-chain funds, especially as institutional adoption deepens following ETF launches and public company allocations (source: Stock Titan). The next phase could see permissionless strategies where users can deploy automated vaults or structured products built atop Sanctum-powered LST liquidity.

The Takeaway for Investors and Builders

If you’re navigating the rapidly evolving world of Solana DeFi protocols, understanding Sanctum’s role is no longer optional, it’s essential. The protocol is not only driving record TVL but also unlocking a new paradigm in yield generation, governance, and composability across the entire network.

This is a pivotal moment. As more capital flows into liquid staking solutions, and as price action around $222.54 SOL remains robust, the opportunities for risk-adjusted yield have never been more attractive on Solana.

Volatility is opportunity, if you know where to look.