In a move that redefines the boundaries between traditional finance and blockchain, Galaxy Digital Holdings Ltd. has partnered with Superstate to tokenize its Class A Common Stock (GLXY) on the Solana blockchain. This milestone is not just a technical feat, but a regulatory and market innovation: for the first time, a Nasdaq-listed public company’s SEC-registered equity is natively issued on Solana. As of September 8,2025, GLXY trades at $12.34, up 4.75% in the last 24 hours, reflecting both market optimism and the impact of this historic integration.

GLXY Tokenization: Bridging Equity Markets with Onchain Speed

The tokenization of GLXY shares leverages Solana’s high-speed, low-cost infrastructure to offer what legacy equity markets simply cannot: 24/7 trading access, near-instant settlement, and programmable compliance. Through Superstate’s Opening Bell platform, approved investors can convert their Galaxy Digital shares into on-chain tokens that maintain all rights and privileges of SEC-registered equity ownership.

This isn’t just about making shares digital; it’s about transforming how they’re held, transferred, and traded. Superstate acts as the SEC-registered transfer agent, updating the shareholder register in real time as tokens move between KYC-verified wallets. This ensures regulatory compliance while unlocking DeFi-native features like composability and programmability for equity holders.

Why Solana? The Strategic Rationale for Tokenized Equities

Galaxy’s choice of Solana is strategic: with its sub-second finality and negligible transaction costs, Solana offers a scalable platform for public company equities. The move demonstrates confidence in Solana’s security model and network effects within institutional circles. By issuing native SEC-registered equity onchain rather than wrapped or synthetic representations, Galaxy sets a precedent for regulatory-grade tokenization that others are likely to follow.

The implications are profound for both issuers and investors. For issuers like Galaxy Digital, tokenizing on Solana means broader investor access (including global markets outside standard trading hours), enhanced liquidity potential via DeFi rails, and reduced operational friction in settlement processes. For investors, especially those seeking diversification into digital asset equities, the ability to hold GLXY tokens directly in their wallets represents greater autonomy without sacrificing shareholder protections or rights.

How Tokenized GLXY Shares Work: From Nasdaq to Your Wallet

The mechanics are straightforward yet revolutionary: existing shareholders can opt to convert their traditional GLXY shares into tokenized equivalents through Superstate’s regulated platform after passing KYC requirements. These tokens represent actual Class A Common Stock, not derivatives or depositary receipts, preserving full voting rights and dividend entitlements.

Transfers occur instantly between verified wallets on Solana, with every movement reflected in Superstate’s real-time shareholder registry. Importantly, Galaxy has published the official contract address for tokenized GLXY to prevent counterfeits, a crucial step given rising concerns over fraudulent assets in DeFi ecosystems.

Galaxy Digital Holdings Ltd. (GLXY) Stock Price Prediction (2026-2031)

Forecasts reflect the impact of tokenized equity on Solana, market expansion, and evolving regulatory/industry dynamics.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $11.00 | $13.20 | $16.00 | +7.0% | Volatility from tokenized trading launch, new investor inflows offset by regulatory adjustments |

| 2027 | $12.00 | $14.50 | $18.50 | +9.8% | Growth from broader DeFi integration and increased adoption of tokenized shares |

| 2028 | $13.00 | $16.10 | $21.00 | +11.0% | Enhanced liquidity, potential for global investor access, and ongoing tech innovation |

| 2029 | $14.50 | $17.80 | $23.50 | +10.6% | Competitive advantage in digital asset markets, further regulatory clarity |

| 2030 | $15.50 | $19.50 | $26.00 | +9.6% | Mainstream adoption of tokenized equities, maturing DeFi infrastructure |

| 2031 | $16.50 | $21.00 | $28.50 | +7.7% | Stabilization of growth as industry matures, Galaxy becomes established leader |

Price Prediction Summary

GLXY is positioned for sustained growth driven by the pioneering move to tokenized, SEC-registered equity on Solana. The forecast anticipates above-market-average returns, with annualized average price appreciation of 7–11% through 2031. Maximum price scenarios reflect bullish adoption of tokenized shares and DeFi integration, while minimums account for regulatory or macroeconomic setbacks. Volatility is expected in early years as the market adapts to new trading models, but long-term prospects are positive given Galaxy’s leadership in digital finance innovation.

Key Factors Affecting Galaxy Digital Holdings Ltd. Stock Price

- Adoption rate of tokenized equities and 24/7 trading

- Galaxy Digital’s financial performance and earnings growth

- Regulatory developments around blockchain-based securities

- Liquidity and investor access enabled by Solana integration

- Competition from other digital asset platforms and fintechs

- Macro-economic conditions and digital asset market trends

- Technological advancements in blockchain and DeFi

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Market Impact: Liquidity Meets Compliance

This launch is more than symbolic; it signals a new era where regulated equities can tap into decentralized liquidity pools while maintaining full compliance with securities laws. Early indications suggest increased order flow during off-market hours, a testament to pent-up demand for always-on exposure to digital asset firms like Galaxy Digital.

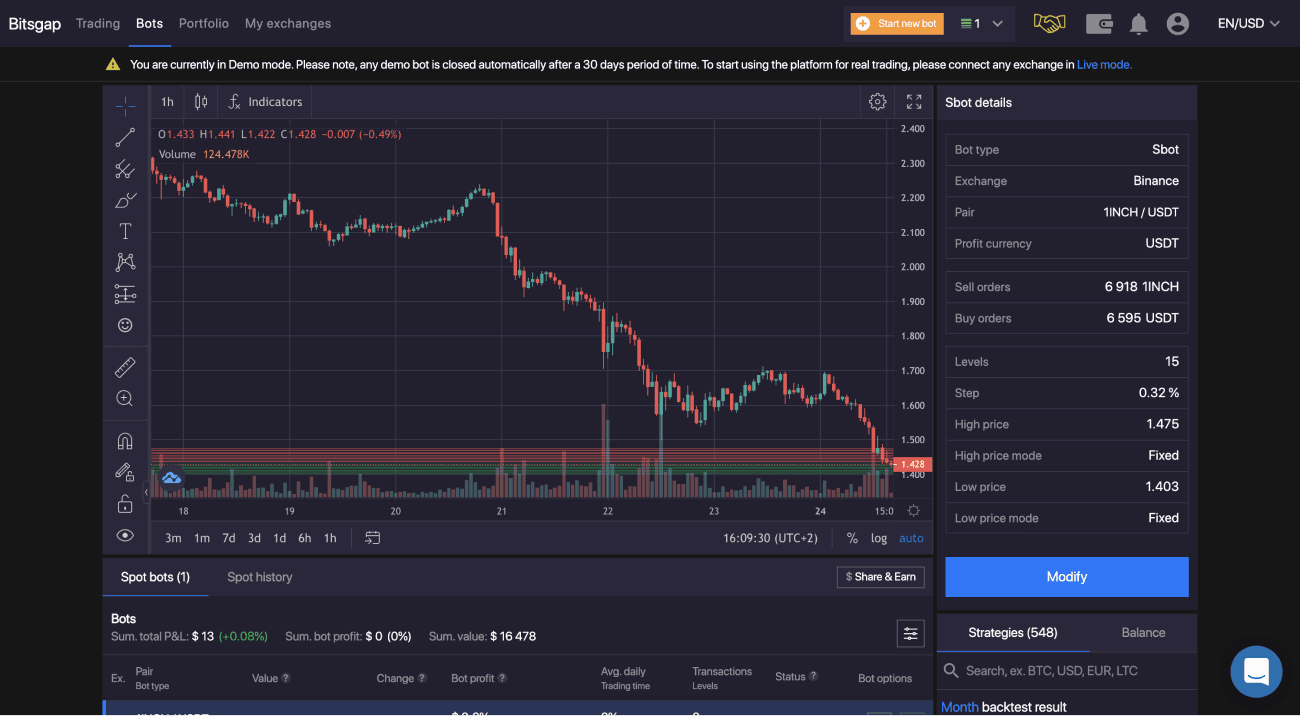

If you’re looking to understand the technical workflow or see how this process unfolds visually, from share conversion to wallet custody, our visual guide breaks down each step:

GLXY’s tokenization on Solana is already yielding tangible benefits. The most immediate is 24/7 market access, which means investors are no longer bound by the rigid schedules of legacy exchanges. This continuous trading window is especially attractive to global investors seeking exposure to digital asset equities in real time, regardless of their local market hours.

Settlement speed is another game-changer. Traditional equity trades can take two or more days to fully settle, introducing counterparty risk and operational drag. On Solana, GLXY tokens settle nearly instantly, with transfers reflected in Superstate’s registry in real time. This efficiency not only reduces risk but also opens the door for new DeFi-native applications, such as automated market makers (AMMs) and programmable compliance checks, that can operate seamlessly with regulated equities.

Regulation and Security: Protecting Investors Onchain

One of the most significant aspects of this initiative is its regulatory rigor. By working directly with Superstate as an SEC-registered transfer agent, Galaxy ensures that all tokenized share movements adhere strictly to securities laws. Only approved, KYC-verified investors can hold and transfer GLXY tokens, maintaining a closed loop that satisfies both compliance officers and forward-thinking DeFi advocates.

The publication of an official Solana contract address for GLXY further reduces the risk of fraudulent tokens, a perennial concern in open blockchain environments. For investors accustomed to traditional custodianship models, this blend of onchain autonomy and regulatory oversight offers a compelling middle ground between security and innovation.

Key Investor Benefits of SEC-Registered Equity on Solana

-

24/7 Market Access: Investors can trade GLXY tokenized shares at any time, beyond traditional stock market hours, thanks to Solana’s always-on blockchain infrastructure.

-

Near-Instant Settlement: Transactions settle almost immediately on Solana, reducing the typical waiting period associated with conventional equity trades.

-

Full Shareholder Rights Preserved: Tokenized GLXY shares represent actual Galaxy Digital Class A Common Stock, ensuring holders maintain all legal rights and protections of SEC-registered equity.

-

Enhanced Liquidity Potential: On-chain shares can be integrated with DeFi platforms and Automated Market Makers (AMMs), potentially increasing liquidity and trading opportunities for investors.

-

Direct Wallet Ownership: Approved investors hold and transfer their tokenized shares within personal crypto wallets, providing greater control and reducing reliance on intermediaries.

-

Real-Time Shareholder Register Updates: Superstate, as the SEC-registered transfer agent, ensures that the shareholder register is updated instantly as tokens move between verified wallets.

-

Regulatory Compliance and Security: The tokenization process is fully SEC-registered, combining the transparency and programmability of blockchain with robust investor protections.

What Comes Next? The Roadmap for Tokenized Equities

The introduction of GLXY tokenized shares on Solana could serve as a blueprint for other public companies considering similar moves. Galaxy’s CEO Mike Novogratz has signaled interest in expanding compliant trading options through AMMs, potentially paving the way for regulated secondary markets operating around the clock. If successful, this model could redefine how capital markets function, blending traditional investor protections with the composability and transparency native to blockchains like Solana.

For now, all eyes are on performance metrics such as liquidity depth during off-hours, settlement reliability, and investor adoption rates. As more companies explore tokenization, especially those in fintech or digital assets, the lessons from Galaxy’s pioneering effort will shape industry standards across both Wall Street and Web3 ecosystems.

Final Thoughts: The Future Is Programmable

Tokenizing SEC-registered equities like GLXY on Solana represents more than just a technical upgrade, it’s a paradigm shift in how capital markets interact with blockchain technology. By merging trusted regulatory frameworks with programmable assets and instant settlement, Galaxy Digital and Superstate have set a new standard for what’s possible at the intersection of finance and crypto infrastructure.

As institutional adoption accelerates and regulatory clarity improves, expect to see an expanding universe of tokenized assets trading natively on high-performance chains like Solana, each step bringing us closer to a truly global, always-on financial system where compliance meets composability.