Solana’s August 2025 stats are not just impressive on paper, they signal a paradigm shift for the blockchain’s role in DeFi and broader crypto markets. With the Binance-Peg SOL price holding at $204.19, Solana has become the network to watch for both institutional players and retail investors seeking volatility-driven opportunity. Let’s break down the most critical performance metrics, using real data and visual context to understand why Solana is outpacing its rivals.

Solana App Revenue Hits All-Time High: $148 Million in August

The headline number for August is $148 million in app revenue, a record monthly haul that eclipses every other network. This figure represents a staggering 93% year-over-year increase, reflecting Solana’s growing dominance as a platform for high-throughput applications. The surge isn’t just about volume, it’s about quality of engagement, with users flocking to new DeFi primitives, games, and RWA tokenization protocols.

What’s especially notable is that this revenue comes amid fierce competition from other layer-1s and Ethereum layer-2s. Yet Solana’s low fees, high speed, and developer-friendly tooling continue to attract both established projects and experimental teams. For context, this performance significantly outpaces previous months, even during bullish periods, highlighting a structural shift rather than just cyclical enthusiasm.

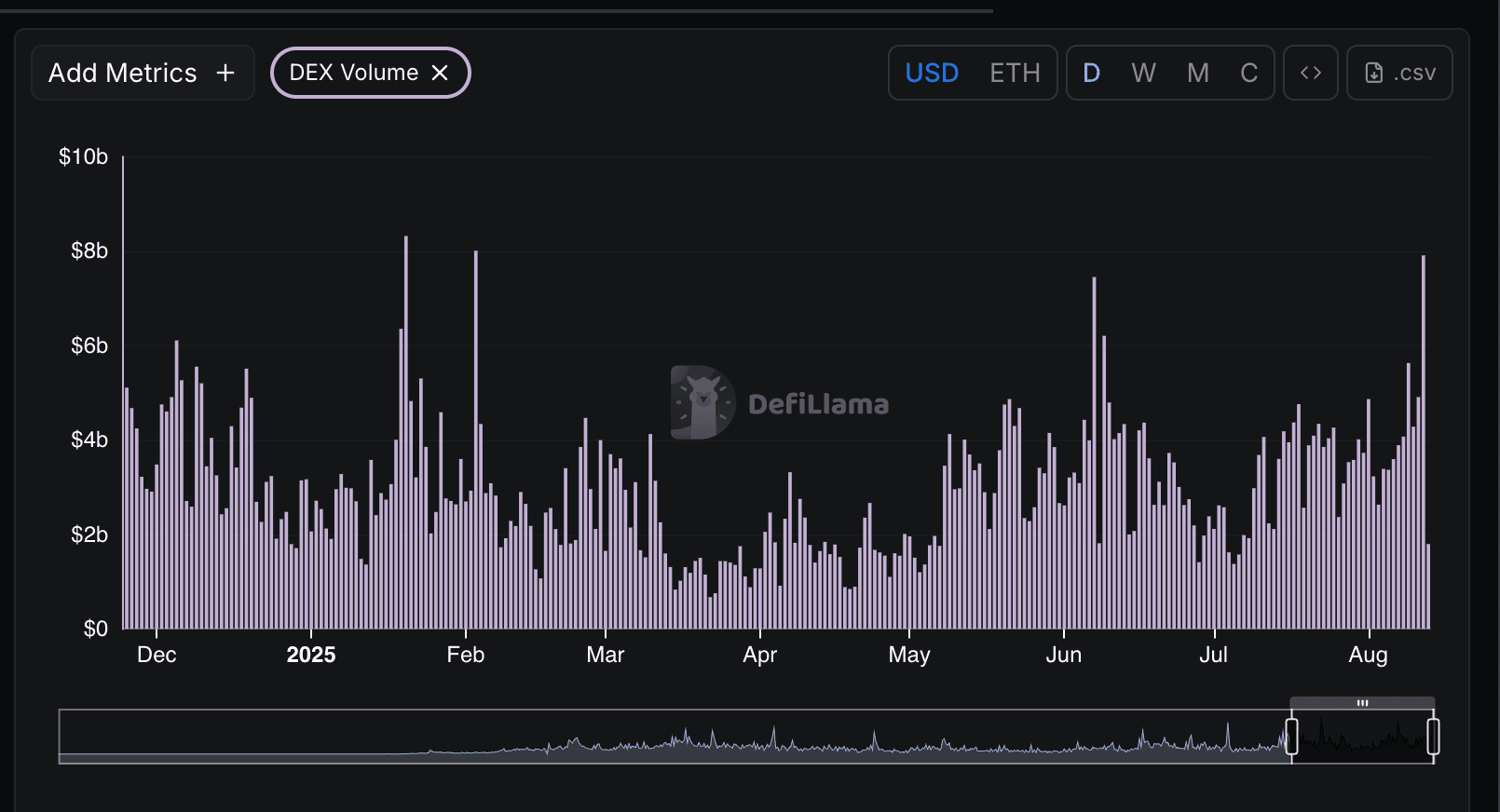

DEX Volume Surges: $144 Billion Matches May Peak

Solana’s decentralized exchange (DEX) ecosystem roared back to life in August with $144 billion in trading volume. This matches the previous surge seen in May 2025 and firmly establishes Solana as the second-largest DEX network by volume behind Ethereum. The market share gains are coming not only from flagship platforms but also from innovative prop AMMs, no-name automated market makers that processed over $47 billion on their own (Blockworks).

This DEX activity is more than just raw numbers; it reflects deep liquidity, tight spreads, and robust arbitrage across spot and perpetual futures markets. While there are ongoing debates about the role of bots versus organic traders (CryptoRank), what matters for investors is that volumes remain steady even as trader counts fluctuate, pointing to a resilient core of liquidity providers keeping markets efficient.

Transaction Growth Driven by Perpetual Futures and RWA Tokenization

If you want to understand where DeFi is heading, look no further than transaction growth on Solana. In August 2025, perpetual futures trading and real-world asset (RWA) tokenization reached all-time high transaction counts, driving overall network activity to new peaks. These aren’t just speculative surges; they represent genuine user demand for composable financial products that can be settled instantly at scale.

The numbers tell the story: 2.9 billion transactions processed in August, up 46% year-over-year and more than four times the combined total of all other networks (CryptoRank). With DeFi total value locked (TVL) climbing from $8.5 billion to $9.5 billion over the month, and stablecoin supply holding steady between $10 billion and $13 billion, the ecosystem shows no signs of slowing down.

Solana (SOL) Price Prediction: 2026-2031

Based on August 2025 performance, DeFi growth, and ecosystem metrics

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change (Avg YoY) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $160.00 | $210.00 | $280.00 | +2.9% | Post-cycle correction, consolidation, potential regulatory headwinds |

| 2027 | $185.00 | $245.00 | $340.00 | +16.7% | Recovery phase, DeFi & stablecoin growth, increased adoption |

| 2028 | $230.00 | $295.00 | $410.00 | +20.4% | Bullish momentum, major tech upgrades, expanding real-world assets |

| 2029 | $265.00 | $340.00 | $480.00 | +15.3% | Market expansion, new partnerships, rising institutional interest |

| 2030 | $305.00 | $390.00 | $570.00 | +14.7% | Mainstream adoption, regulatory clarity, Solana ecosystem matures |

| 2031 | $350.00 | $445.00 | $680.00 | +14.1% | Peak cycle, global DeFi integration, strong competition with Ethereum |

Price Prediction Summary

Solana (SOL) is positioned for steady, long-term growth following its robust performance in August 2025. While short-term corrections are possible post-2025 highs, the network’s strong fundamentals—rising DeFi TVL, record transaction volumes, and app revenues—suggest a progressive uptrend. By 2031, SOL could reach an average price of $445.00, with bullish scenarios extending above $680.00 if adoption and technology trends accelerate.

Key Factors Affecting Solana Price

- Continued growth in DeFi TVL and DEX volumes

- Expansion of real-world asset tokenization on Solana

- Sustained high transaction throughput and network reliability

- Stablecoin liquidity and ecosystem health

- Regulatory clarity and global crypto policy evolution

- Competition from Ethereum and emerging L1/L2 solutions

- Potential for major network upgrades and scalability improvements

- Market sentiment and macroeconomic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Visualizing Solana’s Momentum: Key Metrics at a Glance

Solana’s August 2025 Performance Highlights

-

Solana App Revenue: $148 million in August 2025, setting a new monthly record for the network. This surge reflects robust dApp adoption and increased on-chain activity across the Solana ecosystem.

-

Solana DEX Volume: $144 billion in decentralized exchange trading volume during August 2025, matching the previous May surge. This milestone underscores Solana’s growing dominance in DeFi trading and liquidity provision.

-

Solana Transaction Growth: Perpetual futures and RWA tokenization reached all-time high transaction counts, driving overall DeFi activity to new peaks. This highlights Solana’s innovative edge and rising user engagement in advanced financial products.

This confluence of record-breaking app revenue, DEX volume resurgence, and explosive transaction growth creates an environment ripe for innovation, and risk-managed opportunity, for those who know where to look.

Solana’s August 2025 stats are not just impressive on paper, they signal a paradigm shift for the blockchain’s role in DeFi and broader crypto markets. With the Binance-Peg SOL price holding at $204.19, Solana has become the network to watch for both institutional players and retail investors seeking volatility-driven opportunity. Let’s break down the most critical performance metrics, using real data and visual context to understand why Solana is outpacing its rivals.

Solana App Revenue Hits All-Time High: $148 Million in August

The headline number for August is $148 million in app revenue, a record monthly haul that eclipses every other network. This figure represents a staggering 93% year-over-year increase, reflecting Solana’s growing dominance as a platform for high-throughput applications. The surge isn’t just about volume, it’s about quality of engagement, with users flocking to new DeFi primitives, games, and RWA tokenization protocols.

What’s especially notable is that this revenue comes amid fierce competition from other layer-1s and Ethereum layer-2s. Yet Solana’s low fees, high speed, and developer-friendly tooling continue to attract both established projects and experimental teams. For context, this performance significantly outpaces previous months, even during bullish periods, highlighting a structural shift rather than just cyclical enthusiasm.

DEX Volume Surges: $144 Billion Matches May Peak

Solana’s decentralized exchange (DEX) ecosystem roared back to life in August with $144 billion in trading volume. This matches the previous surge seen in May 2025 and firmly establishes Solana as the second-largest DEX network by volume behind Ethereum. The market share gains are coming not only from flagship platforms but also from innovative prop AMMs, no-name automated market makers that processed over $47 billion on their own (Blockworks).

This DEX activity is more than just raw numbers; it reflects deep liquidity, tight spreads, and robust arbitrage across spot and perpetual futures markets. While there are ongoing debates about the role of bots versus organic traders (CryptoRank), what matters for investors is that volumes remain steady even as trader counts fluctuate, pointing to a resilient core of liquidity providers keeping markets efficient.

Transaction Growth Driven by Perpetual Futures and RWA Tokenization

If you want to understand where DeFi is heading, look no further than transaction growth on Solana. In August 2025, perpetual futures trading and real-world asset (RWA) tokenization reached all-time high transaction counts, driving overall network activity to new peaks. These aren’t just speculative surges; they represent genuine user demand for composable financial products that can be settled instantly at scale.

The numbers tell the story: 2.9 billion transactions processed in August, up 46% year-over-year and more than four times the combined total of all other networks (CryptoRank). With DeFi total value locked (TVL) climbing from $8.5 billion to $9.5 billion over the month, and stablecoin supply holding steady between $10 billion and $13 billion, the ecosystem shows no signs of slowing down.

Solana (SOL) Price Prediction 2026-2031

Professional outlook based on current 2025 market performance, DeFi growth, and adoption trends

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $160.00 | $210.00 | $275.00 | +2.8% | Potential post-bull cycle retracement; consolidation after 2025 highs; regulatory clarity needed for upside |

| 2027 | $175.00 | $245.00 | $320.00 | +16.7% | Renewed DeFi and RWA adoption; institutional interest grows; increased competition from L2s |

| 2028 | $200.00 | $285.00 | $380.00 | +16.3% | Bullish cycle resumes; improved scalability; more enterprise and CBDC pilots on Solana |

| 2029 | $240.00 | $340.00 | $455.00 | +19.3% | Global regulatory frameworks mature; major TradFi integrations; DEX/DeFi dominance strengthens |

| 2030 | $290.00 | $410.00 | $540.00 | +20.6% | Widespread adoption of tokenization and on-chain apps; Solana solidifies position in top 3 blockchains |

| 2031 | $340.00 | $500.00 | $650.00 | +22.0% | Potential for exponential growth as blockchain tech becomes mainstream; risks from new challengers remain |

Price Prediction Summary

Solana (SOL) is well-positioned for continued growth through 2031, with strong fundamentals in DeFi, transaction throughput, and network revenue. While some volatility and cyclical corrections are expected, the overall trend points to progressive price appreciation, especially if Solana maintains its technology edge and ecosystem expansion. Both bullish and bearish scenarios are considered, reflecting possible regulatory, competitive, and macroeconomic challenges.

Key Factors Affecting Solana Price

- Sustained DeFi and DEX growth on Solana network

- Scaling improvements and sustained low fees

- Regulatory clarity in major markets (US, EU, Asia)

- Adoption of Real World Asset (RWA) tokenization

- Competition from Ethereum L2s, new L1s, and emerging chains

- Macroeconomic factors (interest rates, global liquidity)

- Potential for major security incidents or network outages

- Network decentralization and validator health

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Visualizing Solana’s Momentum: Key Metrics at a Glance

Solana’s August 2025 Performance Milestones

-

Solana App Revenue: $148 million in August 2025, setting a new monthly record for the network. This surge reflects increased user engagement and the growing adoption of Solana-based applications across DeFi, NFTs, and gaming.

-

Solana DEX Volume: $144 billion in decentralized exchange trading volume during August 2025, matching the previous May surge. This figure underscores Solana’s dominance in on-chain trading and liquidity provision.

-

Solana Transaction Growth: Perpetual futures and RWA tokenization reached all-time high transaction counts, driving overall DeFi activity to new peaks. This highlights Solana’s capacity for high throughput and its appeal for innovative financial products.

This confluence of record-breaking app revenue, DEX volume resurgence, and explosive transaction growth creates an environment ripe for innovation, and risk-managed opportunity, for those who know where to look.