In a move that is poised to reshape how capital markets interact with blockchain technology, Galaxy Digital Inc. has partnered with Superstate to tokenize its SEC-registered Class A common stock directly on the Solana blockchain. This is more than a technical milestone – it’s a regulatory and market first, establishing Galaxy Digital as the inaugural Nasdaq-listed company to bring real-world equity shares onto a major public blockchain. For investors and industry observers, this development signals the start of a new era for tokenized shares on Solana, one where traditional assets gain the speed, transparency, and programmability of decentralized finance.

The Mechanics: How Galaxy Digital Tokenizes SEC-Registered Shares on Solana

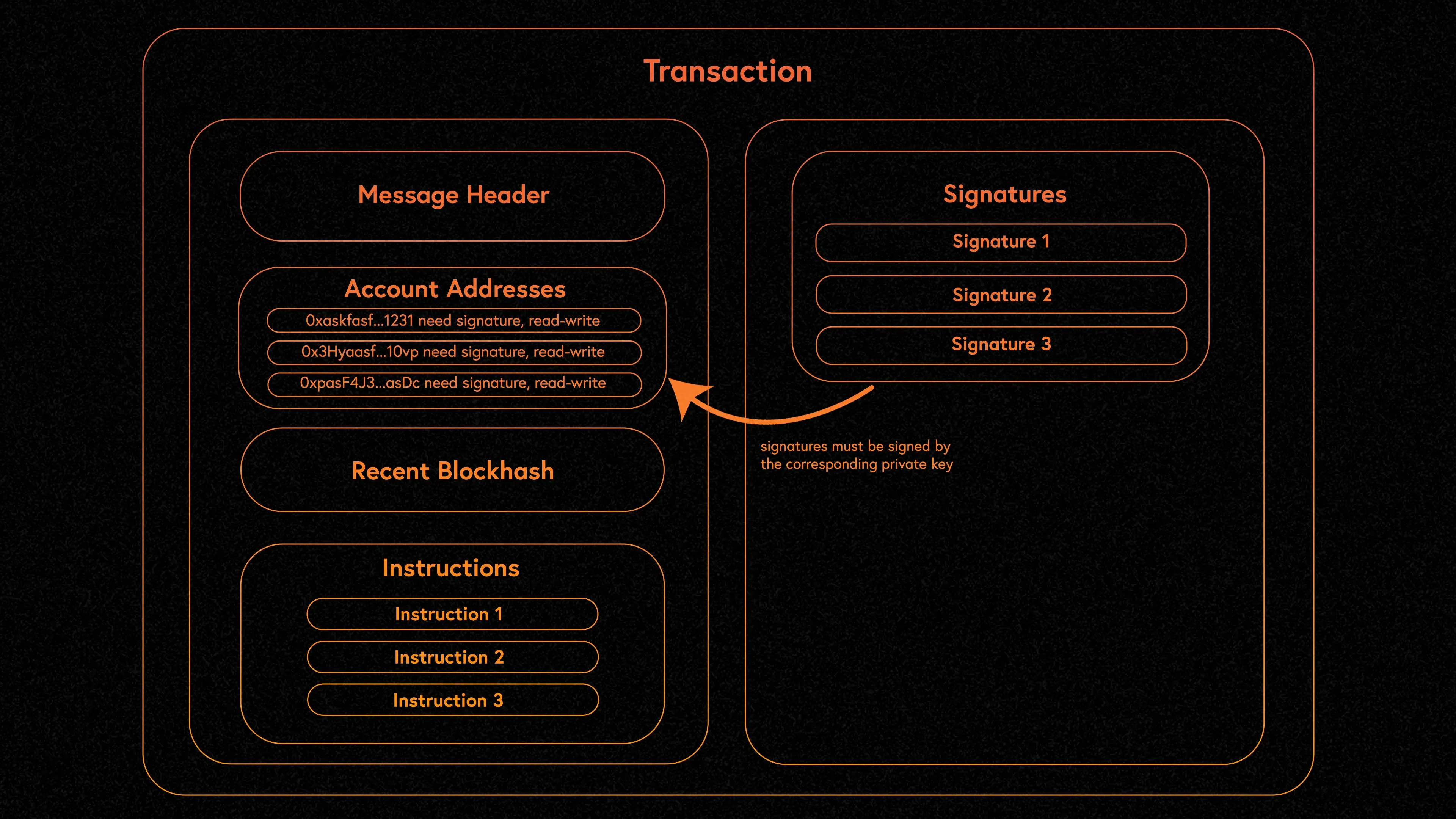

The process begins with existing shareholders of Galaxy Digital (Nasdaq: GLXY) who wish to convert their equity into digital tokens. Through Superstate’s Opening Bell platform, these investors can opt-in to have their legally registered shares represented as tokens on Solana. Importantly, this isn’t a synthetic or wrapped product – each tokenized share is backed 1: 1 by an actual SEC-registered share and confers all the same legal and economic rights as traditional stock ownership.

Superstate acts as the SEC-registered transfer agent, maintaining real-time records of legal ownership as tokens move across wallets. This ensures regulatory compliance while enabling the full benefits of blockchain settlement. The official contract address for these tokenized shares is 2HehXG149TXuVptQhbiWAWDjbbuCsXSAtLTB5wc2aajK; investors are strongly cautioned that any other address claiming to represent GLXY stock is fraudulent. For more details, see the official announcement at prnewswire.com.

Why Solana? Speed, Accessibility, and 24/7 Markets

The choice of Solana isn’t arbitrary. With its sub-second settlement times and negligible transaction costs, Solana provides an ideal foundation for high-frequency asset transfers. As of September 4,2025, Binance-Peg SOL trades at $210.39, reflecting both robust network demand and institutional confidence in its infrastructure.

- 24/7 Market Access: Unlike legacy markets constrained by business hours, tokenized GLXY shares can be traded around-the-clock.

- Near-Instant Settlement: Blockchain eliminates multi-day clearing cycles; transfers finalize in seconds.

- Transparency and Efficiency: On-chain records provide real-time auditability while reducing operational friction for issuers and investors alike.

The Investor Experience: Onboarding and Security

This innovation isn’t limited to institutional players; approved retail investors who complete KYC verification can participate as well. Once verified through Superstate’s platform, shareholders receive their tokenized GLXY directly into their compatible cryptocurrency wallets – blending traditional equity rights with DeFi-style self-custody.

Security remains paramount: Only tokens issued from the official contract address are recognized as legitimate equity; others are explicitly flagged as scams by Galaxy Digital. This clarity is critical in an ecosystem where digital asset fraud remains a persistent risk factor.

The Road Ahead: AMMs and Regulatory Evolution

This initiative is just the beginning. Galaxy Digital and Superstate have signaled plans to enable regulatory-compliant trading of tokenized equities via Automated Market Makers (AMMs), aligning with broader SEC innovation agendas like Project Crypto. If successful, this could foster deeper liquidity pools and democratize access to public equities globally – all underpinned by the speed and efficiency of Solana’s architecture.

What sets this tokenization apart from prior attempts is its full legal equivalence to traditional stock. Unlike synthetic tokens or wrapped derivatives, these GLXY tokens are actual SEC-registered shares, carrying voting rights, dividends, and all shareholder privileges. This distinction not only satisfies regulatory scrutiny but also creates a new benchmark for trust in blockchain-based capital markets.

Key Benefits of Holding Tokenized GLXY Shares on Solana

-

24/7 Market Access: Investors can trade tokenized GLXY shares at any time, beyond traditional stock market hours, increasing flexibility and potential liquidity.

-

Near-Instant Settlement: Transactions settle rapidly on the Solana blockchain, reducing delays and counterparty risk compared to legacy equity settlement systems.

-

Full Shareholder Rights Preserved: Tokenized GLXY shares are actual SEC-registered Galaxy Digital Class A Common Stock, granting holders the same legal and economic rights as traditional shareholders.

-

Enhanced Transparency and Efficiency: On-chain ownership and transfers provide real-time, transparent records and streamline operational processes for investors.

-

Direct Wallet Ownership: Approved investors can securely hold and transfer tokenized shares within their own cryptocurrency wallets, increasing control over their assets.

-

Robust Security Measures: Official tokenized shares are only recognized via Galaxy Digital’s published Solana contract address, helping protect investors from fraudulent tokens.

-

Potential for Automated Market Maker (AMM) Trading: Future regulatory-compliant AMM trading could further enhance liquidity and provide innovative trading options for tokenized equities.

For investors, the implications are significant. The ability to self-custody shares in a digital wallet means more control and flexibility over one’s assets. Transfers between approved wallets happen nearly instantly, and with Solana’s current price at $210.39, the underlying network has demonstrated both scalability and institutional-grade reliability, critical factors as more real-world assets move on-chain.

Challenges and Considerations for Widespread Adoption

Despite the promise, several hurdles remain before tokenized equities become routine across global markets. Regulatory harmonization across jurisdictions is still evolving. While Galaxy Digital’s partnership with Superstate ensures SEC compliance in the U. S. , cross-border transfers or listings may require additional frameworks. Moreover, investor education remains essential: understanding wallet security, contract address verification (always 2HehXG149TXuVptQhbiWAWDjbbuCsXSAtLTB5wc2aajK), and on-chain asset management will be new terrain for many traditional equity holders.

Operationally, liquidity is another key variable. While 24/7 trading is theoretically possible, market depth initially depends on how many shareholders opt-in and how quickly secondary trading venues emerge. The planned integration with AMMs could be transformative here, potentially allowing tokenized shares to trade alongside stablecoins or other crypto assets in decentralized pools.

A Glimpse Into the Future of Solana Capital Markets

The launch of GLXY tokenized shares on Solana represents more than a technical breakthrough, it signals a philosophical shift toward programmable capital markets where compliance and innovation coexist. As more companies observe Galaxy Digital’s experience, and as regulatory clarity continues to evolve, we can expect an acceleration of similar initiatives across sectors ranging from real estate to fixed income.

This experiment will be closely watched by exchanges, regulators, and DeFi innovators alike. If successful at scale, it could catalyze a migration of trillions of dollars in traditional assets onto public blockchains, unlocking programmability, composability, and global access previously unimaginable in legacy systems.

Key Takeaway: Tokenizing SEC-registered shares directly on Solana isn’t just an incremental upgrade for capital markets, it’s a foundational leap that could redefine how we invest, trade, and govern public companies in the digital age.