How Remora’s Tokenized Stocks Are Revolutionizing Onchain Trading on Solana

Tokenized stocks have been the holy grail for onchain trading since the earliest days of crypto. But in 2025, Remora Markets has finally cracked the code for frictionless, regulated access to U. S. equities directly on Solana. This isn’t just a technical upgrade – it’s a paradigm shift in how global investors can interact with traditional finance assets, all while leveraging the speed and composability of Solana’s DeFi ecosystem.

Remora Markets: Bringing Wall Street to Solana’s DeFi Core

Remora Markets has gone live with a suite of tokenized U. S. equities, including giants like Tesla (TSLA), Nvidia (NVDA), and Circle (CRCL). What makes this launch notable is that these assets are not synthetic derivatives or IOUs – they are digitally represented shares backed 1: 1 by real equities held by regulated custodians in the UAE. Investors can deposit USDC to mint tokenized shares at real-time market prices, withdraw them to non-custodial wallets, and utilize them across Solana’s thriving DeFi protocols for lending, trading, or even yield generation.

This approach positions Remora at the intersection of regulatory compliance and crypto-native innovation. With monthly proof-of-reserves audits published transparently, users can verify that every tokenized share is fully backed. For those who have watched “real world asset” (RWA) narratives evolve from hype cycles to tangible products on Solana, Remora’s move is an inflection point reminiscent of stablecoins’ early days.

24/7 Trading and Fractional Ownership: Breaking Down Barriers

The legacy stock market is riddled with inefficiencies: limited trading hours, high minimums, geographic restrictions, and slow settlement times. Remora’s model obliterates these barriers by offering 24/7 access to tokenized stocks. Whether you’re in Singapore or São Paulo, you can trade TSLA or NVDA on your schedule, not New York’s.

Fractionalization is another game-changer. With tokenized equities on Solana, investors aren’t locked into buying whole shares; instead they can own as little as a fraction of a single Tesla share. This unlocks participation for smaller retail investors globally and enables new forms of portfolio construction previously impossible in traditional markets.

Key Benefits of Remora Markets Tokenized Stocks

-

24/7 Global Trading Access: Remora Markets enables users worldwide to trade U.S. equities like Tesla (TSLA) and Nvidia (NVDA) on Solana at any time, bypassing traditional market hours and regional restrictions.

-

Fractional Ownership of Major Stocks: Investors can purchase fractions of high-value shares, making blue-chip stocks accessible to a broader audience without needing to buy a full share.

-

Instant Settlement and Onchain Transfers: Trades settle instantly on Solana, allowing users to withdraw tokenized shares to non-custodial wallets and transfer them with minimal fees.

-

Integration with Solana DeFi Ecosystem: Tokenized stocks are fully compatible with Solana DeFi protocols, enabling use in lending, yield generation, and other decentralized finance applications.

-

Transparent, Audited Asset Backing: All tokenized assets are backed by regulated custodians in the UAE, with monthly proof-of-reserve audits ensuring transparency and investor confidence.

-

USDC Onramp and Real-Time Pricing: Users can deposit USDC to mint tokenized shares at up-to-date market prices, streamlining the process of entering and exiting positions.

Composability: The Secret Sauce of Solana Onchain Trading

The true magic happens when you plug these assets into the broader Solana ecosystem. Tokenized equities minted via Remora are fully interoperable SPL tokens, meaning they work natively with major DeFi protocols across the chain. Users can stake their NVDA or TSLA tokens as collateral for loans, provide liquidity to decentralized exchanges like Orca or Raydium, or even earn DeFi yield streams that are impossible in legacy brokerage accounts.

This composability isn’t theoretical, it’s already happening. As reported by MEXC.com, over $498 million in tokenized assets now reside on Solana, a testament to user appetite for real-world asset integration done right.

Remora’s launch also rewrites the playbook for onchain transparency and user trust. The assets are held by regulated custodians in the UAE, with monthly proof-of-reserve audits made public. This means every NVDA, TSLA, or CRCL token minted on Solana is verifiably backed by real shares, no smoke and mirrors. For institutions and compliance-focused investors, this level of auditability marks a new standard for tokenized equity products.

The implications reach far beyond just U. S. equities. With Solana’s lightning-fast finality and Remora’s regulatory approach, the infrastructure is now in place to tokenize everything from global blue chips to emerging market stocks, and even alternative assets like real estate or commodities. As more real-world assets (RWAs) are brought onchain, expect Solana to become the backbone for a new era of 24/7, borderless capital markets.

How Remora Compares: Solana’s Edge Over Ethereum RWAs

What sets Remora apart from earlier attempts at tokenized stocks on other blockchains? In a word: composability. Unlike siloed solutions that lock users into walled gardens or require complex bridges, Remora’s SPL tokens are natively compatible with Solana DeFi protocols. This enables powerful cross-protocol strategies such as using tokenized TSLA as collateral for loans or swapping NVDA instantly on DEXs, capabilities that remain clunky or expensive on Ethereum due to gas costs and fragmented liquidity.

Top Reasons Solana Outperforms Ethereum for Tokenized Equities

-

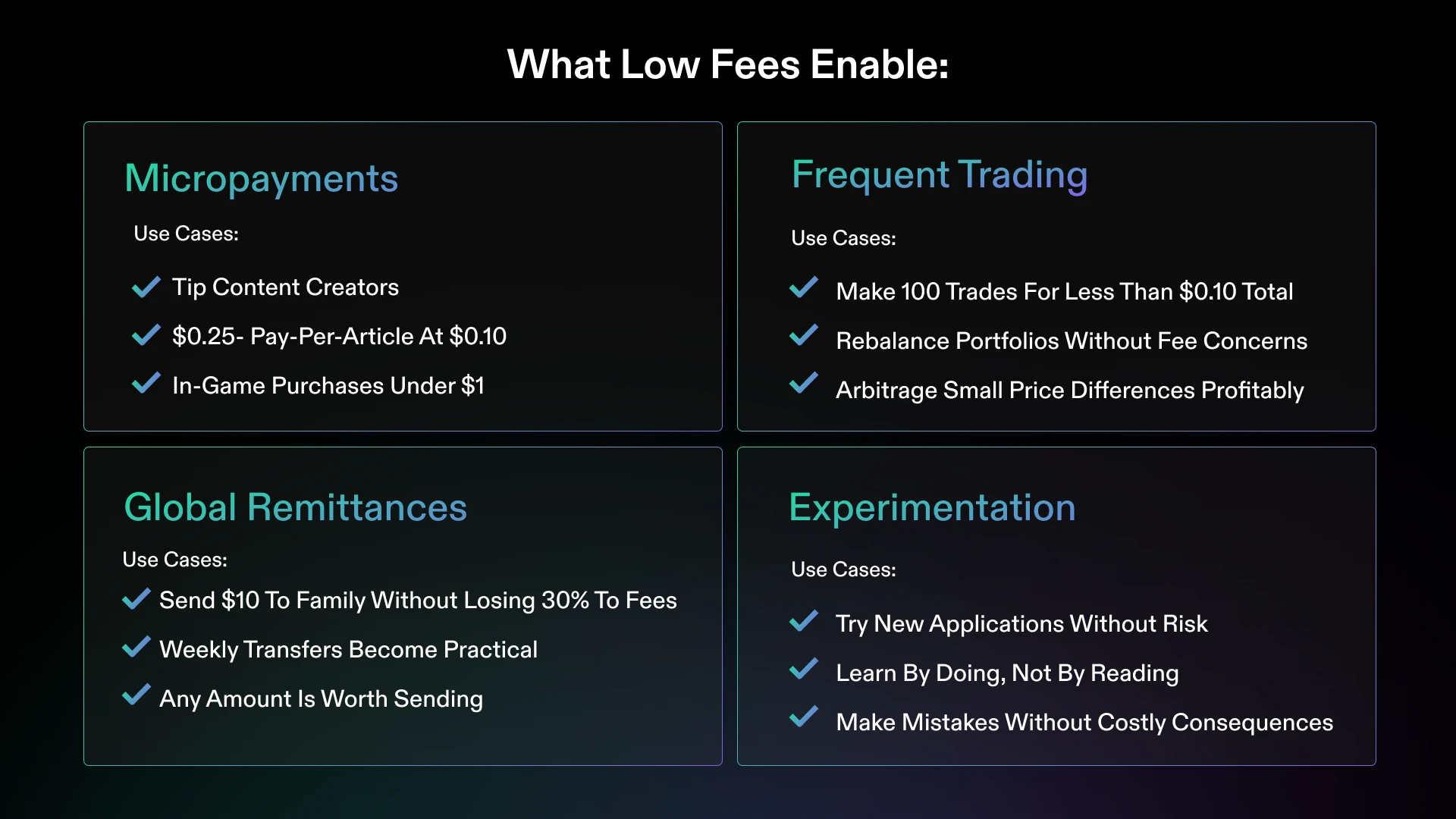

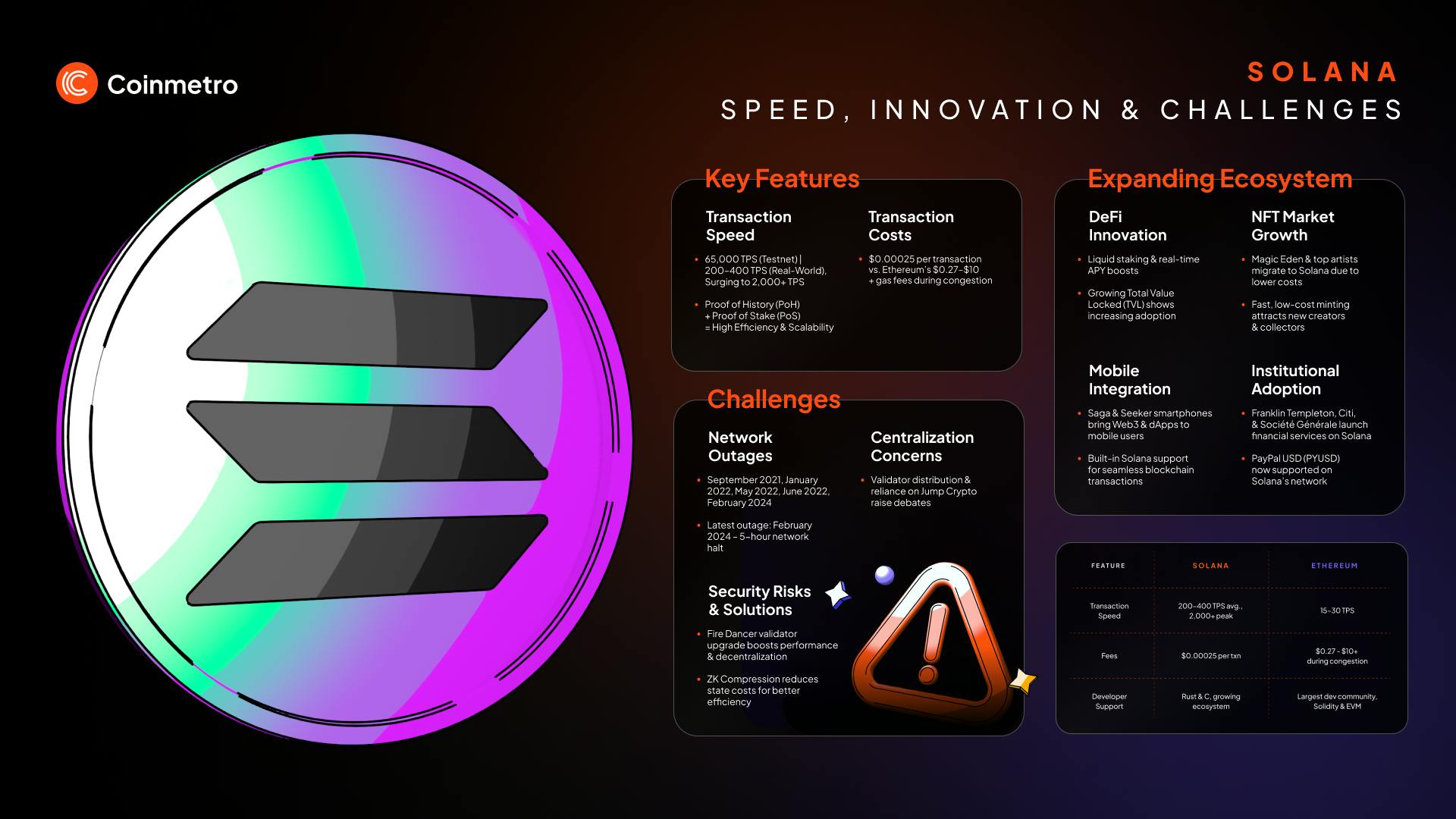

Ultra-Low Transaction Fees: Solana consistently offers transaction fees that are a fraction of a cent, making high-frequency trading and micro-transactions of tokenized stocks like Tesla (TSLA) and Nvidia (NVDA) economically viable for all users.

-

High Throughput and Fast Settlement: Solana’s network processes thousands of transactions per second, enabling near-instant settlement for trading tokenized equities, whereas Ethereum often struggles with congestion and slower confirmation times.

-

24/7 Trading Access: Platforms like Remora Markets leverage Solana’s always-on infrastructure to offer round-the-clock trading of tokenized U.S. equities, a feature not natively available on Ethereum-based solutions.

-

Seamless DeFi Integration: Tokenized stocks on Solana are fully composable with its DeFi ecosystem, enabling users to trade, lend, or earn yield using protocols like Orca, Jupiter, and Step Finance—capabilities that are often fragmented or cost-prohibitive on Ethereum.

-

Scalability for Global Adoption: With approximately $498 million in tokenized assets now on Solana, the network demonstrates its ability to scale and support a rapidly growing real-world asset (RWA) market, attracting both retail and institutional participants.

-

Enhanced Transparency and Compliance: Remora Markets utilizes regulated custodians in the UAE and provides monthly proof-of-reserve audits, ensuring transparency and regulatory alignment—features that are increasingly prioritized in the tokenized asset space.

Moreover, Solana’s sub-second settlement times mean traders avoid the latency and slippage endemic to slower chains. For arbitrageurs and active managers, this opens up new alpha opportunities across both crypto-native and traditional asset classes.

What Comes Next? The Roadmap for Onchain Equities

Looking ahead, Remora is poised to expand its asset roster well beyond U. S. tech giants. As regulatory clarity improves globally and demand for RWAs accelerates, expect to see listings for European blue chips, Asian growth stories, and even thematic baskets, all tradable 24/7 via Solana wallets.

This innovation isn’t happening in isolation; it’s part of a broader wave reshaping capital markets infrastructure from the ground up. As more platforms follow Remora’s lead and integrate with major protocols like Step Finance (details here), liquidity will deepen and composability will compound, creating a flywheel effect that drives further adoption.

For investors who have felt locked out by legacy gatekeepers, or simply want to put their capital to work around the clock, Remora Markets represents not just an incremental improvement but a wholesale reinvention of what stock ownership means in the digital age.