Solana’s decentralized finance (DeFi) ecosystem has entered a new phase in 2025, with the launch of the USD1 stablecoin by World Liberty Financial (WLFI) marking a pivotal inflection point. As of September 2025, USD1 is trading at $0.9993, reflecting its robust dollar peg and growing market confidence. The stablecoin’s rapid integration into Solana’s high-speed, low-cost infrastructure is not just a technical upgrade; it signals a shift in capital flows, regulatory clarity, and user trust across Solana DeFi.

[price_widget: Real-time USD1 price and volume data]

USD1 Stablecoin Solana Launch: A Data-Driven Inflection Point

The arrival of USD1 on Solana was anything but subtle. In its first few months post-launch (April, September 2025), USD1’s circulating supply soared past $2.2 billion across multiple chains, with an initial $100 million minted directly on Solana. This surge is underpinned by WLFI’s strategic decision to back every token 1: 1 with U. S. dollars and Treasury bonds, audited monthly by BitGo Trust Company. Such transparency and regulatory alignment, especially with the U. S. GENIUS Act, have set a new standard for stablecoins in the ecosystem.

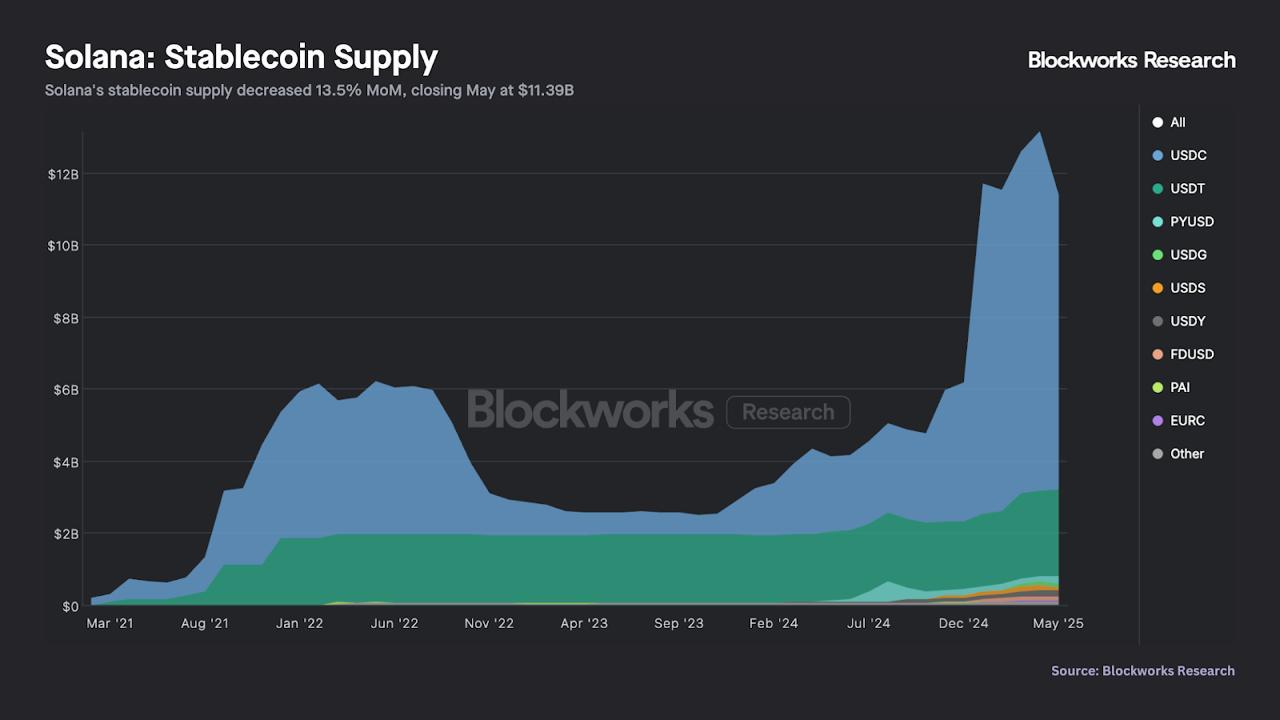

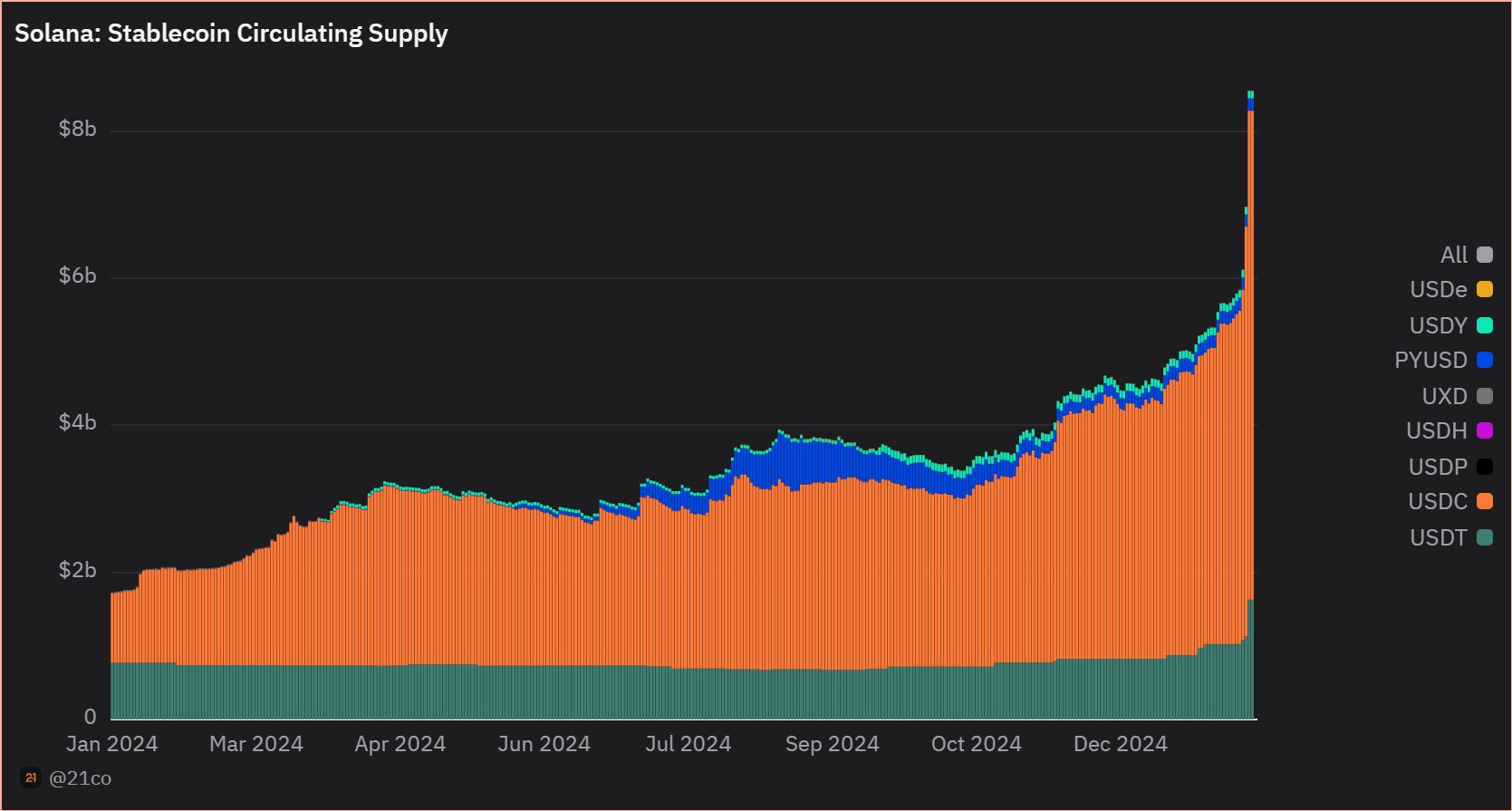

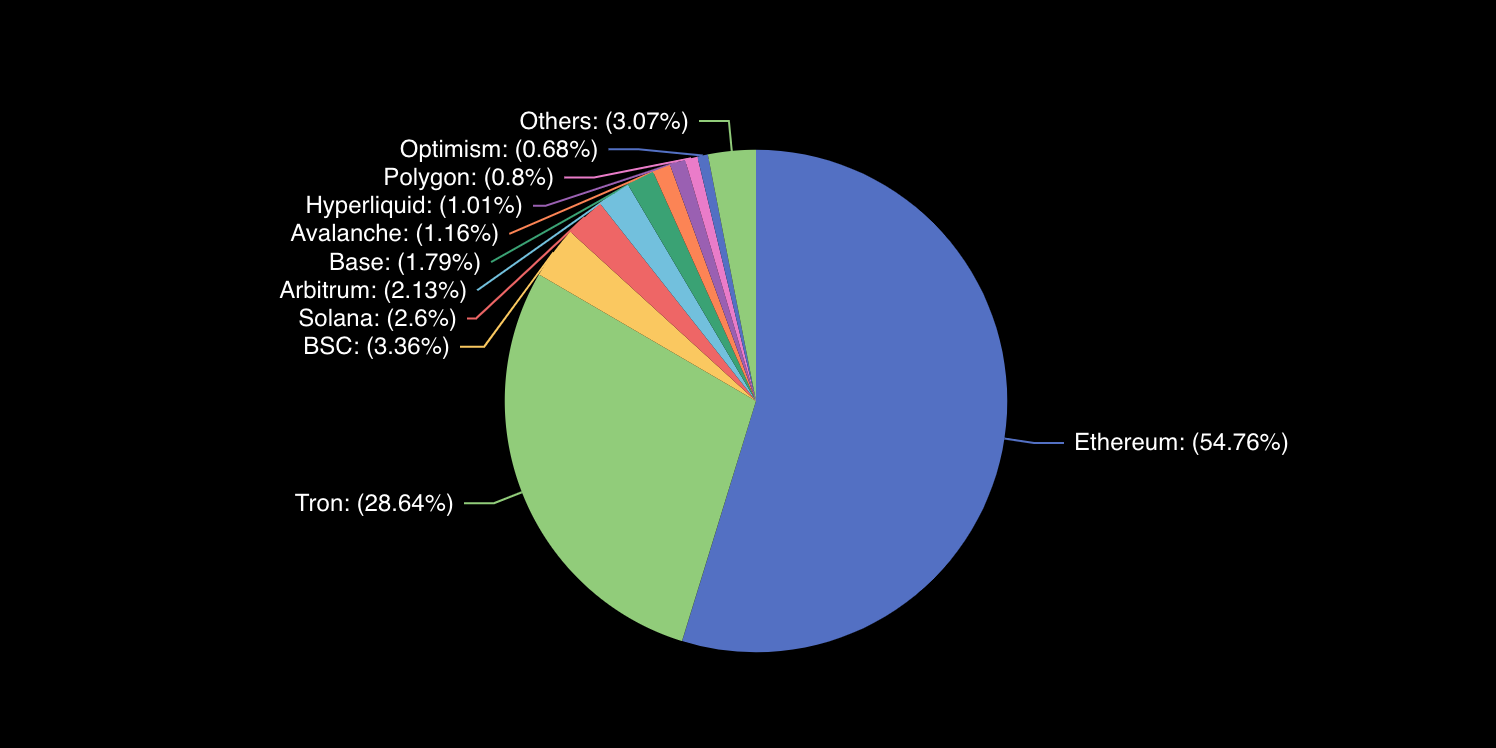

The move comes at a time when Solana’s total stablecoin supply has ballooned to $13.1 billion, up 154% year-to-date. This growth reflects both retail and institutional appetite for fast, cheap settlement rails, and now, with USD1’s compliance-first model, for regulatory peace of mind too.

Visual Analysis: Where Does USD1 Fit Among Solana Stablecoins?

To understand USD1’s disruptive potential, it helps to visualize its place in the broader market landscape:

Top Stablecoins on Solana: Market Cap & Growth (2025)

-

USD Coin (USDC): The leading stablecoin on Solana, USDC boasts the largest market capitalization, benefiting from deep liquidity and broad integration across DeFi platforms. Its supply on Solana has surged alongside the network’s 154% stablecoin market growth in 2025.

-

Tether (USDT): USDT remains a dominant force on Solana, widely used for trading and payments. Its established presence supports high transaction volumes and cross-chain transfers, maintaining a significant share of Solana’s $13.1 billion stablecoin market.

-

USD1 (USD1): Launched by World Liberty Financial in April 2025, USD1 rapidly reached a market cap of $2.2 billion (latest price: $0.9993). Backed 1:1 by U.S. dollars and Treasuries and audited by BitGo Trust, USD1’s integration with Solana DeFi platforms like Raydium and Kamino Finance positions it as a fast-growing, transparent alternative. Analysts project USD1 could capture 5% of Solana’s stablecoin market by 2026.

-

UXD Protocol (UXD): UXD is a decentralized stablecoin native to Solana, backed by delta-neutral strategies. It offers algorithmic stability and is integrated with several Solana DeFi protocols, supporting the ecosystem’s diversity.

-

Parrot USD (PAI): PAI is an overcollateralized stablecoin issued by Parrot Protocol on Solana. It leverages crypto-backed reserves to maintain its peg, contributing to the network’s expanding DeFi options.

USD1 enters an arena dominated by USDC and USDT but differentiates itself via institutional partnerships (notably Abu Dhabi MGX’s $2 billion investment settled in USD1) and seamless integration with DeFi protocols like Raydium and Kamino Finance. Kamino’s dedicated USD1 vaults are already attracting liquidity providers eager for yield opportunities backed by transparent reserves.

This momentum is more than anecdotal; analysts project that USD1 could capture up to 5% of Solana’s stablecoin market share by 2026. That would translate into over $650 million in TVL routed through lending markets, DEXs, and cross-chain settlements, amplifying both liquidity depth and capital efficiency across the network.

The Institutional Domino Effect: From Capital Markets to Everyday DeFi

The most striking aspect of USD1’s rollout is how swiftly it has catalyzed new product launches on Solana:

- Raydium: Immediate listing for spot trading pairs and liquidity pools.

- Kamino Finance: Launch of specialized vaults supporting lending/yield strategies denominated in USD1.

- Jupiter Lend: Integration into lending markets as collateral, expanding risk management options for power users.

This institutional-grade infrastructure is unlocking use cases ranging from instant remittances to global e-commerce settlement, all without sacrificing speed or cost advantages unique to Solana’s architecture. Partnerships with payment giants like Visa and Stripe further cement this trajectory, as over 200 million monthly stablecoin transactions now flow through the network.

USD1 Stablecoin Price and Supply Prediction (2026-2031)

Forecast assumes continued regulatory compliance, market adoption on Solana, and stable macroeconomic conditions. All prices per 1 USD1 token. Supply estimates reflect market share growth within Solana’s DeFi ecosystem.

| Year | Minimum Price | Average Price | Maximum Price | Estimated Circulating Supply | % Change in Supply (YoY) | Notable Market Scenario |

|---|---|---|---|---|---|---|

| 2026 | $0.9965 | $0.9990 | $1.0030 | $3.0B | +35% | USD1 secures 5% of Solana’s stablecoin market; remains tightly pegged |

| 2027 | $0.9950 | $0.9988 | $1.0040 | $4.2B | +40% | Institutional adoption grows; increased use in DeFi lending |

| 2028 | $0.9940 | $0.9986 | $1.0050 | $5.3B | +26% | Regulatory clarity boosts supply; market volatility tests peg |

| 2029 | $0.9930 | $0.9985 | $1.0060 | $6.5B | +23% | USD1 expands to additional chains; minor depegs during stress events |

| 2030 | $0.9920 | $0.9984 | $1.0070 | $7.8B | +20% | Competition intensifies; USD1 maintains strong peg via audits |

| 2031 | $0.9910 | $0.9983 | $1.0080 | $9.0B | +15% | USD1 achieves 8% Solana market share; global regulatory standards adopted |

Price Prediction Summary

USD1 is projected to maintain a tight 1:1 peg to the US dollar due to strong regulatory compliance, institutional backing, and regular audits. Its integration with Solana and continued adoption across DeFi platforms will drive steady supply growth, with circulating supply potentially tripling by 2031. While minimum and maximum price ranges reflect minor deviations during extreme market events, average prices are expected to remain very close to $1.00, underscoring USD1’s stability. Supply growth is anticipated to slow as market saturation increases and competition intensifies.

Key Factors Affecting USD1 Stablecoin Price

- Regulatory compliance under the GENIUS Act and regular third-party audits enhance trust and stability.

- Partnerships with DeFi protocols (e.g., Raydium, Kamino Finance) boost adoption and utility.

- Expansion to additional blockchains could further increase supply and market share.

- Potential black swan events (e.g., regulatory crackdowns, macroeconomic shocks) may cause brief depegs.

- Competition from other stablecoins (USDC, USDT, PYUSD) could pressure market share and adoption.

- Institutional adoption and large-scale transactions (e.g., MGX investment) drive demand and legitimacy.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The question facing investors isn’t whether USD1 will persist, it’s how quickly it can scale its share of capital markets while maintaining its hard peg at $0.9993. With monthly audits, transparent reserves, and regulatory clarity as core pillars, all signs point toward deepening adoption both within crypto-native circles and among traditional institutions seeking compliant digital dollars on-chain.

For users and builders alike, USD1’s presence on Solana is already reshaping DeFi behaviors. Liquidity providers are gravitating toward USD1 pools for their transparency and auditability, while traders benefit from lower slippage and tighter spreads. Yield farmers now have access to Kamino’s dedicated USD1 vaults, which offer competitive returns with an added layer of regulatory reassurance, a rare combination in today’s market.

What sets USD1 apart isn’t just the technology or compliance layer, but the clear network effects emerging from its institutional acceptance. The $2 billion settlement by Abu Dhabi’s MGX using USD1, as reported by Mint Ventures, signals a new era for dollar-backed assets on-chain, where stablecoins aren’t just liquidity tools, but foundational rails for global capital movement.

Solana DeFi 2025: The Road Ahead for Capital Markets

With Solana’s stablecoin market capitalization at $13.1 billion and growing, the stage is set for a more diverse, resilient ecosystem. The emergence of USD1 brings several key implications:

- Diversification of risk: With multiple compliant stablecoins, users are less exposed to single-issuer or regulatory shocks.

- Enhanced institutional trust: Audited reserves and regulatory alignment make Solana more attractive to funds and enterprises seeking transparent digital dollars.

- Accelerated product innovation: Protocols can build novel lending markets, derivatives, and payment solutions leveraging the unique features of USD1.

This momentum is further amplified by ongoing collaborations with legacy financial players. Visa and Stripe’s involvement in processing over 200 million monthly stablecoin transactions on Solana demonstrates how blockchain rails are quietly underpinning mainstream finance. As USD1 cements its position alongside USDC and USDT, expect even greater composability across DEXs, DAOs, and cross-border payment corridors.

Key Takeaways: What Investors Should Watch

Top 3 Strategic Advantages of Using USD1 in Solana DeFi

-

1. Enhanced Stability and Regulatory ComplianceUSD1 is fully backed 1:1 by the U.S. dollar and U.S. Treasury bonds, with monthly audits by BitGo Trust Company. It complies with the U.S. GENIUS Act, providing users with a transparent and secure stablecoin option on Solana.

-

2. Seamless Integration with Leading Solana DeFi PlatformsUSD1 is actively supported by major Solana DeFi protocols like Raydium and Kamino Finance. Users can access trading, yield farming, and dedicated USD1 vaults for lending and liquidity management, enhancing DeFi opportunities.

-

3. High-Speed, Low-Cost Transactions and Growing Institutional AdoptionLeveraging Solana’s high-performance blockchain, USD1 enables fast, low-fee transactions. Its adoption is further validated by large-scale settlements, such as the $2 billion MGX investment on Binance settled in USD1, signaling strong institutional trust.

The next year will be critical for measuring how much market share USD1 can realistically capture, and whether its regulatory-first approach becomes the blueprint for future stablecoins. For now, its price stability at $0.9993, robust audit trail, and rapid protocol integrations suggest that it will remain a cornerstone asset within Solana’s expanding capital markets landscape.

The transformation underway isn’t just about a new stablecoin; it’s about setting higher standards for transparency, compliance, and utility in digital finance. As always in crypto markets: clarity breeds confidence, and confidence attracts capital.