The intersection of blockchain technology and economic transparency reached a new milestone in August 2025. The U. S. Department of Commerce, in a groundbreaking move, selected Pyth Network and Solana to publish official U. S. economic data – including the latest GDP figures – directly onchain. This collaboration is reshaping how financial information is accessed and used across the Solana ecosystem and beyond.

Pyth Network Solana Integration: Bringing Official Data Onchain

Traditionally, macroeconomic indicators like GDP have been released through government websites or news wires, often with limited accessibility and questionable transparency. Now, with Pyth Network’s decentralized oracle technology and Solana’s high-throughput blockchain, this vital data is not only public but also immutable and instantly accessible to anyone.

On August 29,2025, the first batch of official U. S. GDP data was published across nine major public blockchains, including Solana. This was made possible by Pyth Network’s robust aggregation protocol, which sources and verifies data from over 80 institutional providers before publishing it onchain. As a result, developers can now tap into real-time economic feeds for their dApps or DeFi protocols, a leap forward for both transparency and utility in the crypto space.

Market Response: PYTH Price Surges to $0.2206 After Milestone Announcement

The market has responded swiftly to these developments. Pyth Network (PYTH) is currently trading at $0.2206, reflecting a and $0.1035 ( and 0.8828%) surge in the last 24 hours alone (source). This sharp uptick follows confirmation that the U. S. Commerce Department will use Pyth’s infrastructure to deliver official macroeconomic data feeds, including historical quarterly GDP, on the blockchain (learn more).

This surge isn’t just speculation; it reflects growing confidence in decentralized data solutions as critical infrastructure for both traditional finance (TradFi) and decentralized finance (DeFi). The ability to verify and access government-issued statistics on an open blockchain removes layers of opacity that have historically plagued global markets.

Pyth Network (PYTH) Price Prediction 2026-2031

Professional Forecast Based on U.S. Economic Data Onchain Adoption and Market Trends

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.18 | $0.32 | $0.55 | +45% | Continued integration of U.S. economic data; possible volatility as market digests new use cases |

| 2027 | $0.26 | $0.41 | $0.80 | +28% | Expansion of DeFi products using onchain data, increasing institutional interest |

| 2028 | $0.31 | $0.53 | $1.10 | +29% | Further adoption in TradFi/DeFi; regulatory clarity boosts confidence |

| 2029 | $0.40 | $0.67 | $1.45 | +26% | PYTH establishes itself as a leading oracle for macro data; competition with Chainlink intensifies |

| 2030 | $0.55 | $0.86 | $1.85 | +28% | Global adoption of onchain macro data; new financial products and derivatives emerge |

| 2031 | $0.67 | $1.08 | $2.35 | +26% | PYTH reaches maturity in ecosystem integration; possible multi-chain dominance |

Price Prediction Summary

Pyth Network (PYTH) is poised for significant growth over the next six years, driven by its pioneering role in bringing official U.S. economic data onchain. The average price is projected to rise steadily, with strong upside potential if adoption accelerates and the technology becomes integral to DeFi and TradFi markets. However, price volatility and competitive risks remain, particularly from other oracle providers like Chainlink. Investors should watch for regulatory developments and real-world adoption as key catalysts.

Key Factors Affecting Pyth Network Price

- Adoption of onchain economic data by DeFi and traditional finance (TradFi) platforms

- U.S. government and regulatory stance on blockchain data delivery

- Expansion of developer ecosystem and new use cases (e.g., onchain derivatives, tokenized bonds)

- Competition from other oracle networks (notably Chainlink)

- Broader crypto market cycles and macroeconomic conditions

- Advancements in Solana and cross-chain interoperability

- Market sentiment and technological upgrades within Pyth Network

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

A Visual Guide: How Economic Data Flows from Government to Blockchain

The process begins with the U. S. Department of Commerce releasing official economic figures. These are supplied directly to Pyth Network’s network of trusted data providers, ranging from top financial institutions to analytics firms, which then aggregate and cryptographically verify each datapoint.

Once verified, this information is published onto Solana’s blockchain using its ultra-fast consensus mechanism, making it instantly available for any developer or user worldwide. The implications are vast: DeFi protocols can now automate risk management based on real-world economic conditions; analysts can audit historical releases; investors gain unprecedented clarity into market-moving events.

Key Advantages for Developers and Investors

- Transparency: Every release is timestamped, immutable, and publicly auditable.

- Speed: Thanks to Solana’s low latency, even high-frequency trading strategies can leverage up-to-the-minute macroeconomic indicators.

- Ecosystem Growth: New classes of dApps become possible, from tokenized government bonds to prediction markets powered by live economic metrics.

This dynamic partnership between Pyth Network, Solana, and the U. S. government signals a paradigm shift in how we interact with, and trust, official economic information in an increasingly digital world.

For developers and institutional players, the arrival of Solana onchain economic data is a game changer. By eliminating intermediaries and manual reporting lags, the ecosystem can now build products that react to U. S. GDP releases, unemployment statistics, or inflation figures in real time. This not only benefits sophisticated DeFi protocols but also opens the door for retail investors to access tools previously reserved for Wall Street insiders.

The transparency and reliability of these feeds are further bolstered by cryptographic proofs. Every figure published by Pyth is verifiable on-chain, with historical records accessible for audit at any time. This level of openness is unprecedented in the world of macroeconomic data, where revisions and opaque methodologies have long been sources of market uncertainty.

Solana Ecosystem 2025: Building on Onchain Macroeconomic Data

As more official datasets come online, expect a surge in innovation across the Solana ecosystem 2025. From insurance products that auto-adjust premiums based on economic cycles, to decentralized autonomous organizations (DAOs) governing treasuries with live macro inputs, the possibilities are multiplying. Tokenized assets and derivatives linked directly to government-verified statistics are already under development by leading teams.

Top 5 Use Cases for Onchain US GDP Data in Solana DeFi

-

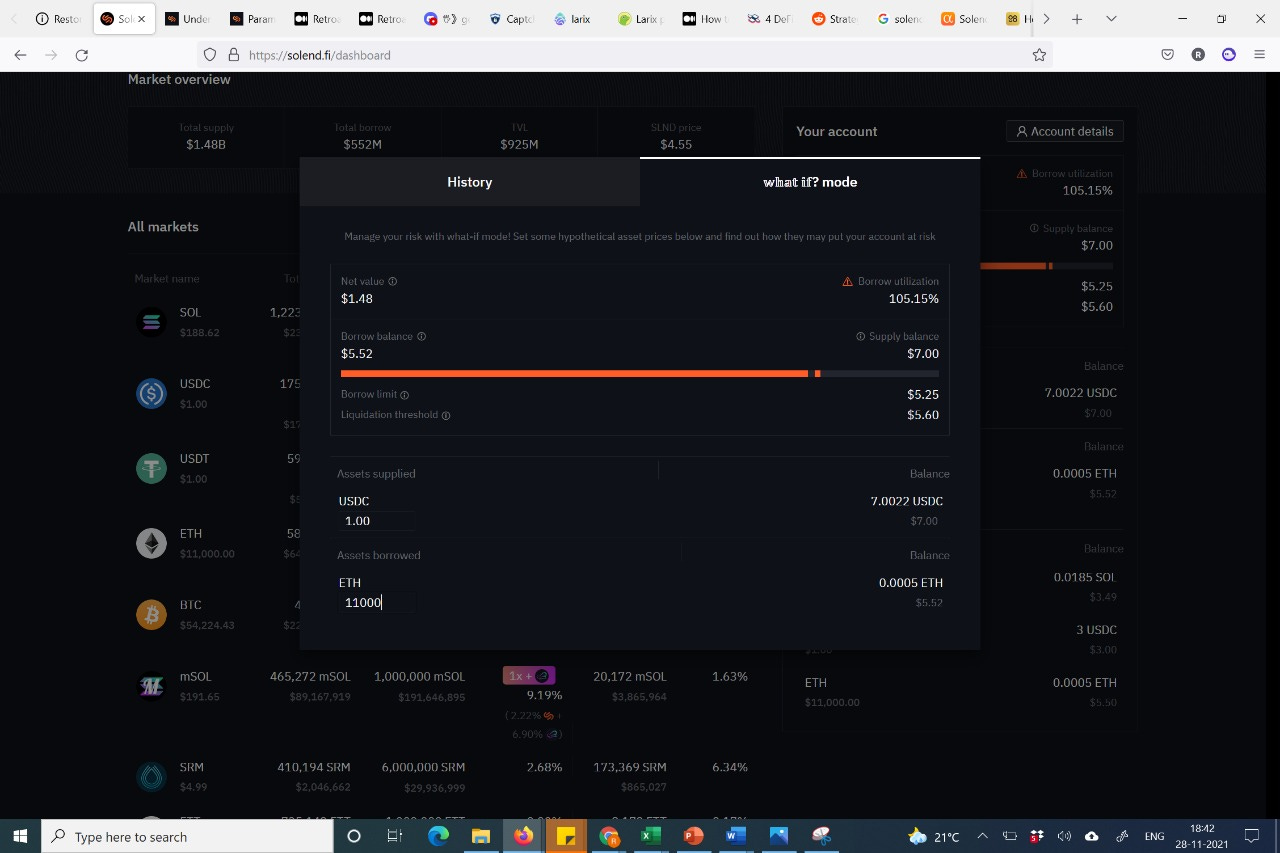

Dynamic Interest Rate Protocols: Solana-based DeFi platforms like Solend can use onchain US GDP data to adjust lending and borrowing rates in real time, reflecting macroeconomic growth or contraction.

-

GDP-Linked Stablecoins: Projects such as Mango Markets could issue stablecoins whose value or yield tracks official US GDP performance, enabling new hedging tools for users.

-

Onchain Prediction Markets: Platforms like Polymarket can offer prediction markets on future US GDP releases, settling contracts using tamper-proof onchain data feeds.

-

Risk Assessment for DeFi Insurance: Protocols such as InsurAce can incorporate GDP trends into risk models, optimizing coverage and pricing for users based on real economic conditions.

-

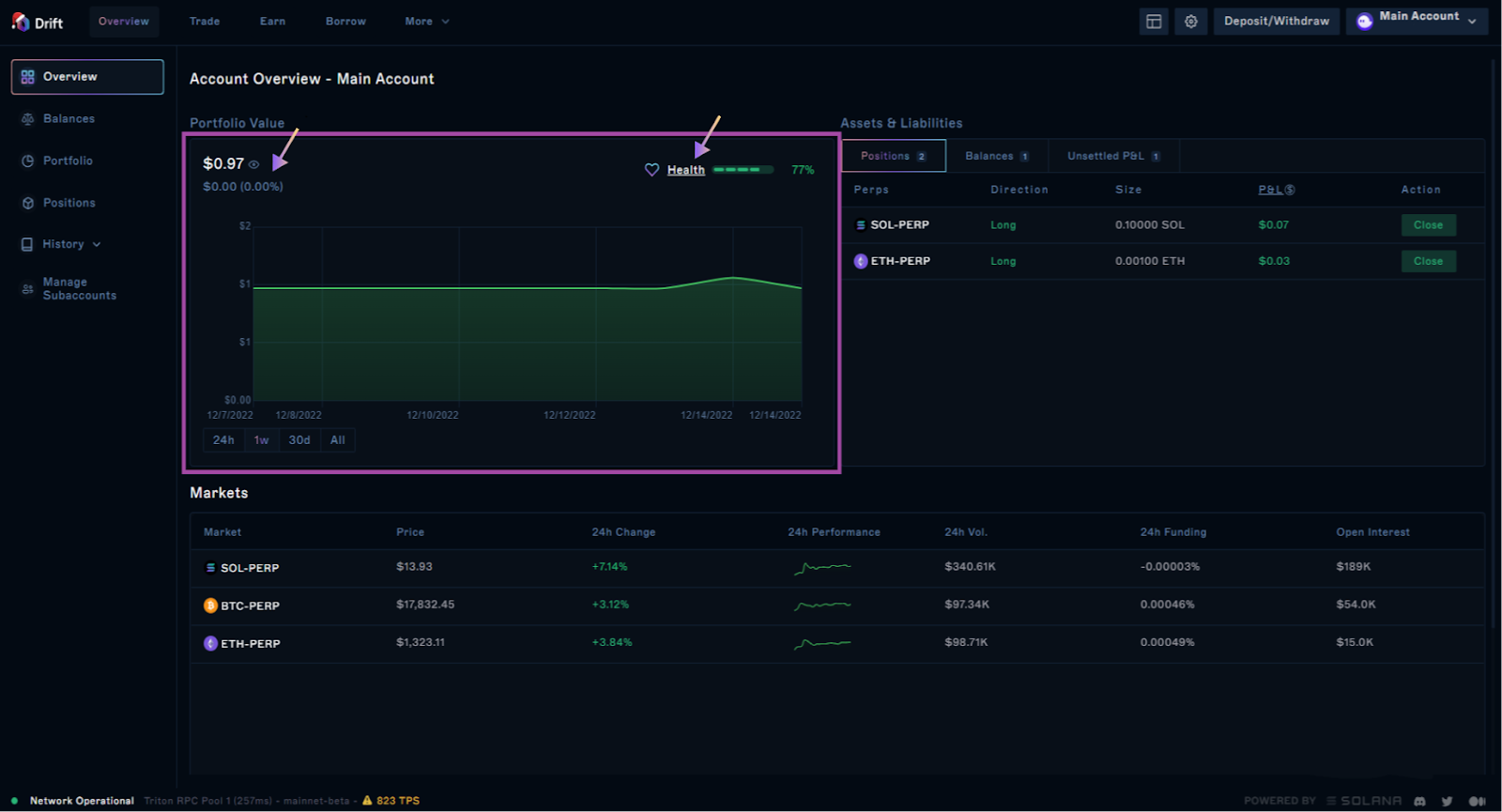

Macro-Driven Automated Trading Strategies: Trading platforms like Drift Protocol can build algorithmic strategies that automatically react to GDP data, enabling sophisticated macro-driven DeFi trading.

This integration also sets a new benchmark for global governments considering blockchain adoption. The U. S. Commerce Department’s embrace of public ledgers demonstrates both regulatory confidence and recognition that distributed networks can serve as trusted public infrastructure.

What’s Next for Pyth Network and Solana?

The immediate focus is on expanding coverage beyond GDP to encompass inflation rates, employment figures, and other high-impact indicators. As demand grows for real-time macroeconomic feeds in decentralized apps, expect further partnerships between government agencies and oracle networks like Pyth.

Pyth Network (PYTH) remains at $0.2206, underscoring sustained market optimism as this data revolution unfolds (source). For those building or investing in Web3 finance, keeping an eye on how these integrations evolve will be critical.

Ultimately, this fusion of government transparency with cutting-edge blockchain infrastructure marks a milestone not just for crypto users but for anyone who values open access to economic truth. The next wave of financial products will be smarter, faster, and fairer – all powered by live data you can trust.