Solana has become the epicenter of institutional and retail attention in 2025, with a staggering $1.4 billion in inflows reported over recent weeks. This dramatic surge is more than just a headline – it’s a critical signal of deepening buy pressure and growing conviction in the Solana ecosystem as it trades at $186.85 as of August 25,2025. Amid a volatile trading range between $213.05 and $186.64, this influx of capital is reshaping both short-term sentiment and long-term price outlooks.

Institutional Inflows: The Catalyst Behind Solana’s Momentum

The narrative shift is clear: institutional adoption is no longer speculative. The launch of the REX-Osprey Solana and Staking ETF (SSK) in July 2025 ignited a wave of capital, unlocking over $316 million in new inflows alone (source). Pending ETF applications are poised to amplify this effect even further. Recent data shows that weekly inflows have topped $39 million, while exchange turnover ratios remain robust at 5.63% – just under Bitcoin’s but signaling strong on-chain activity.

This influx isn’t merely passive investment; it’s fueling active ecosystem growth across DeFi protocols, NFT marketplaces, and Layer-2 scaling solutions built on Solana’s high-throughput architecture.

Visualizing Buy Pressure: What the Charts Say About $186.85 SOL

From a technical perspective, the current price action around $186.85 is pivotal. After testing support at $144 earlier this quarter, bulls have managed to defend higher lows despite macro volatility (source). With resistance tested at $213.05 during the latest rally, traders are watching for sustained closes above this level to confirm a breakout pattern targeting the next psychological threshold at $200 and beyond.

The convergence of institutional flows and technical setups creates a unique environment where momentum can accelerate rapidly if buyers maintain control above key moving averages.

Solana Price Predictions for 2025: Bullish Scenarios Take Center Stage

The consensus among analysts leans bullish but with measured caution due to network risks and regulatory uncertainty:

- Coinpedia: High target of $400, average around $325

- AMB Crypto: Range between $188.86-$283.29, average at $236.07

- InvestingHaven: Bullish scenario up to $650, citing chart patterns like cup-and-handle formations

- Caveat: Key supports remain at $144; if macro risk-off sentiment returns, downside could test these levels again (source)

Solana (SOL) Price Prediction Table: 2025-2030 Analyst Comparison

Analysis incorporates leading analyst forecasts, bullish/bearish scenarios, and key market drivers following the recent $1.4B inflow and ETF developments.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-on-Year % Change (Avg) | Key Scenario/Insight |

|---|---|---|---|---|---|

| 2025 | $144.00 | $236.00 | $400.00 | – | Major inflows, ETF launch, high volatility |

| 2026 | $130.00 | $265.00 | $500.00 | +12% | ETF expansion, DeFi/NFT growth, regulatory uncertainty |

| 2027 | $150.00 | $295.00 | $650.00 | +11% | Network upgrades, increased adoption, competition rises |

| 2028 | $180.00 | $330.00 | $780.00 | +12% | Mainstream adoption, scaling solutions, global regulation |

| 2029 | $210.00 | $370.00 | $920.00 | +12% | Institutional inflows, interoperability, macroeconomic factors |

| 2030 | $250.00 | $415.00 | $1,100.00 | +12% | Mature ecosystem, cross-chain dominance, regulatory clarity |

Price Prediction Summary

Solana’s price outlook for 2025-2030 remains optimistic, supported by strong institutional inflows, potential ETF approvals, and continued growth in DeFi and NFT sectors. While bullish scenarios point toward significant upside, bearish risks such as network issues or adverse regulations could limit gains. Year-over-year growth is projected to be steady, with average prices rising from $236 in 2025 to $415 by 2030 if adoption trends continue.

Key Factors Affecting Solana Price

- Institutional inflows driven by ETFs and new financial products

- Network upgrades and Solana’s ability to scale securely

- Adoption in DeFi, NFT, and real-world use cases

- Regulatory developments in key jurisdictions (US, EU, Asia)

- Competition from other high-performance blockchains (e.g., Ethereum, Avalanche)

- Overall market cycles and macroeconomic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The interplay between these forecasts and real-time buy pressure underscores why disciplined risk management remains essential for anyone trading or investing in Solana right now.

As we move deeper into Q3 2025, Solana’s ability to absorb $1.4 billion in inflows without a major breakdown at $186.85 signals robust demand even as short-term volatility persists. The ETF-driven capital rotation is not just supporting price, it’s also strengthening Solana’s network effects, fueling developer activity, ecosystem innovation, and cross-chain integrations that reinforce its value proposition.

What sets this cycle apart is the velocity and diversity of new capital. Unlike previous rallies dominated by retail fervor, today’s flows are diversified across institutional funds, DeFi treasuries, and strategic venture bets. This broad base acts as a shock absorber against sudden sell-offs and creates a feedback loop where higher prices attract more liquidity and attention.

Key Drivers for Solana’s Ecosystem Growth

Key Growth Drivers for Solana in 2025

-

ETF Adoption Accelerates Institutional Inflows: The launch of the REX-Osprey Solana + Staking ETF (SSK) in July 2025 has attracted $316 million in inflows, with additional ETF applications pending. This institutional access is a major catalyst for Solana’s liquidity and price support.

-

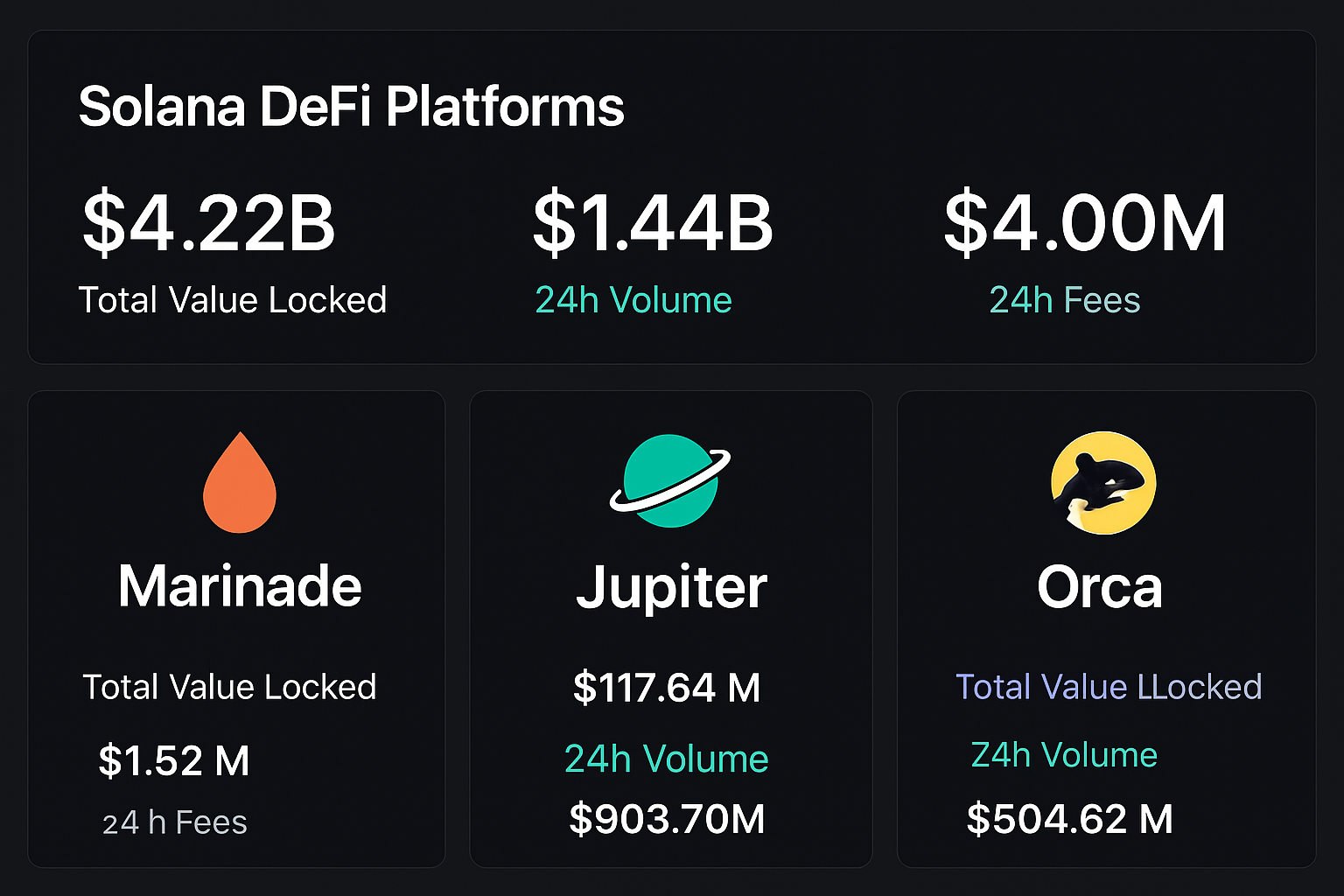

DeFi Ecosystem Expansion: Solana’s decentralized finance (DeFi) sector continues to grow, with platforms like Marinade Finance, Jupiter Exchange, and Orca driving increased total value locked (TVL) and user activity. This expansion supports sustained buy pressure and network utility.

-

NFT Market Resurgence: Solana’s NFT ecosystem, featuring collections such as Mad Lads and Solana Monkey Business, is experiencing renewed interest. Rising transaction volumes and new launches on platforms like Magic Eden are contributing to network activity and fee generation.

-

Developer Incentives and Ecosystem Funding: Solana Foundation and SuperteamDAO have ramped up grants, hackathons, and accelerator programs in 2025, attracting top talent and fostering new dApps. This ongoing investment in developer support is crucial for long-term network growth.

-

Technical Upgrades and Network Reliability: Recent upgrades, including Firedancer (a new validator client) and improvements to transaction throughput, have enhanced Solana’s scalability and stability. These advancements address past network outages and boost investor confidence.

Technically, the market is at an inflection point. The defense of $186.85: despite testing a low of $186.64: suggests buyers are absorbing supply aggressively. If SOL can close decisively above $213.05, it will likely trigger algorithmic buying from momentum traders targeting the $250-$275 zone referenced by several analysts (source). Conversely, failure to hold above $186 could open the door to a retest of the critical $144 support noted by Verified Investing.

From a risk management perspective, traders should watch for:

- Volume spikes: Confirming real accumulation versus short squeezes

- Divergence on momentum indicators: Especially if price approaches resistance with weakening RSI or MACD

- ETF news flow: Pending approvals or regulatory setbacks can quickly shift sentiment

Actionable Takeaways: Trading Solana’s Buy Pressure in 2025

The next few weeks will be pivotal for SOL traders and long-term investors alike. Here are actionable strategies based on current market structure:

- Aggressive bulls: Consider scaling into positions on pullbacks above $186.85 with stops below $180 to manage risk.

- Swing traders: Watch for confirmed breakouts above $213.05 with volume; initial targets at $250-$275 per harmonic projections (source).

- Cautious investors: Monitor ETF-related headlines closely, any delays or denials could spark volatility down to structural supports at $144.

Solana (SOL) Price Prediction 2026-2031

Professional outlook based on 2025 inflows, ETF activity, technical levels, and market trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $160.00 | $220.00 | $350.00 | +18% | Continued ETF inflows and adoption, but potential volatility from regulatory actions |

| 2027 | $180.00 | $270.00 | $450.00 | +23% | Maturing DeFi/NFT ecosystem, scaling upgrades, and institutional capital drive growth |

| 2028 | $200.00 | $340.00 | $600.00 | +26% | Mainstream adoption accelerates, but competition intensifies; network upgrades critical |

| 2029 | $225.00 | $400.00 | $750.00 | +18% | Potential for new ATHs as blockchain use cases expand; regulatory clarity improves |

| 2030 | $250.00 | $460.00 | $900.00 | +15% | Global acceptance, improved interoperability, but macro risks and tech disruption persist |

| 2031 | $280.00 | $520.00 | $1,050.00 | +13% | Solana solidifies its position among top blockchains; steady growth amid sector consolidation |

Price Prediction Summary

Solana’s strong 2025 inflows, ETF momentum, and rising institutional interest set a bullish foundation for the coming years. While price targets show significant upside potential, the range between minimum and maximum predictions reflects ongoing risks from market cycles, competition, and regulatory shifts. Progressive adoption, network upgrades, and expanding use cases are likely to fuel steady growth, with periodic corrections and volatility.

Key Factors Affecting Solana Price

- Sustained institutional inflows via ETFs and funds

- Network upgrades and scalability improvements

- Adoption in DeFi, NFTs, and real-world applications

- Regulatory developments and global crypto policy

- Competition from other Layer 1 blockchains (e.g., Ethereum, Avalanche)

- Market sentiment and macroeconomic conditions

- Solana network stability and security advancements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The bottom line: As long as Solana maintains its position near $186.85, backed by relentless inflows and institutional conviction, the path of least resistance remains up, provided macro headwinds don’t derail risk appetite across crypto markets.