Over the past year, Solana has emerged as a standout performer in the blockchain sector, not just for its speed and cost efficiency but for a headline-grabbing metric: Solana’s daily trade volume is closing in on NASDAQ’s. With Solana now processing approximately 35 million trades daily, it is rapidly narrowing the gap with NASDAQ’s 55 million daily trades, a feat that would have seemed improbable only a few years ago. But what does this mean for investors, technologists, and the future of decentralized finance? Let’s break down the numbers, visualize the trends, and examine why 2025 marks a pivotal point in the ongoing Solana vs NASDAQ narrative.

Solana vs NASDAQ: The Data Behind Daily Trades

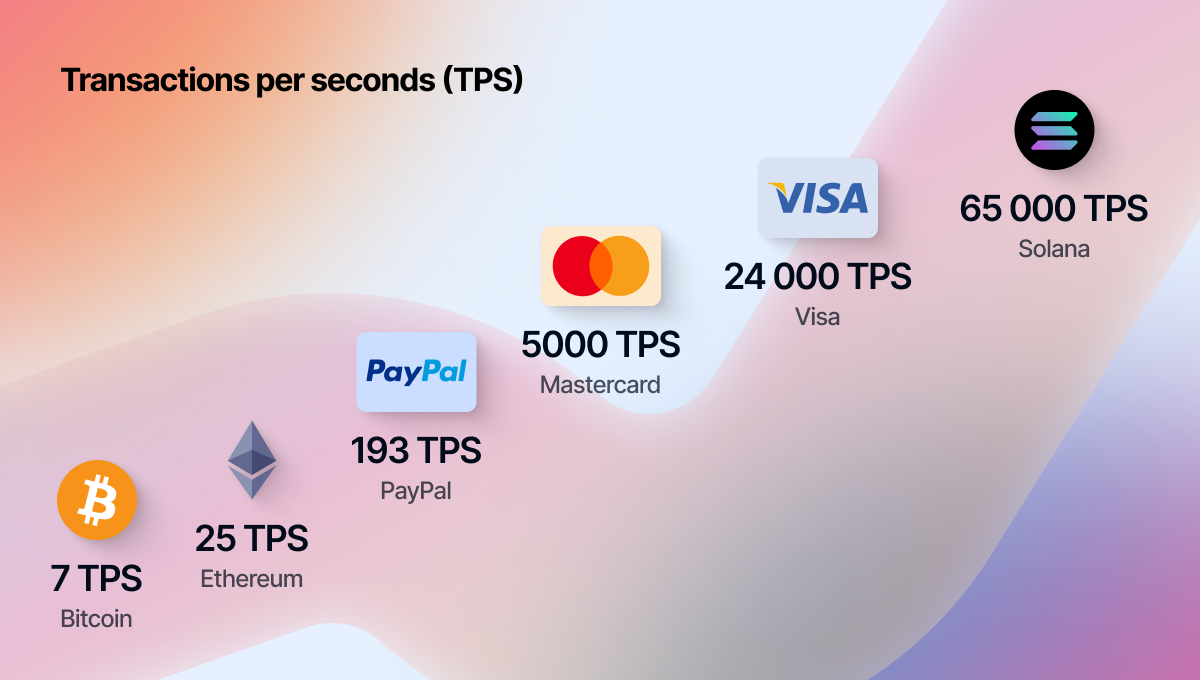

According to recent data from the Solana Foundation, Solana’s throughput has reached approximately 65,000 transactions per second (TPS) as of 2025. This dwarfs traditional financial systems like NASDAQ, which processes around 500,000 trades per day. Yet when we focus specifically on executed trading routes, actual buy/sell events, Solana is now regularly hitting 35 million trades daily. This is well within striking distance of NASDAQ’s reported 55 million daily trades.

The surge is even more remarkable when considering Solana’s decentralized nature. Unlike centralized exchanges or legacy stock markets, every trade on Solana occurs directly on-chain, transparent and verifiable by anyone. The network’s scalability and low transaction fees have made it a magnet for both retail traders and automated trading bots alike.

Key Milestones in Solana Ecosystem Growth (2024-2025)

The past twelve months have been packed with new records and ecosystem expansions:

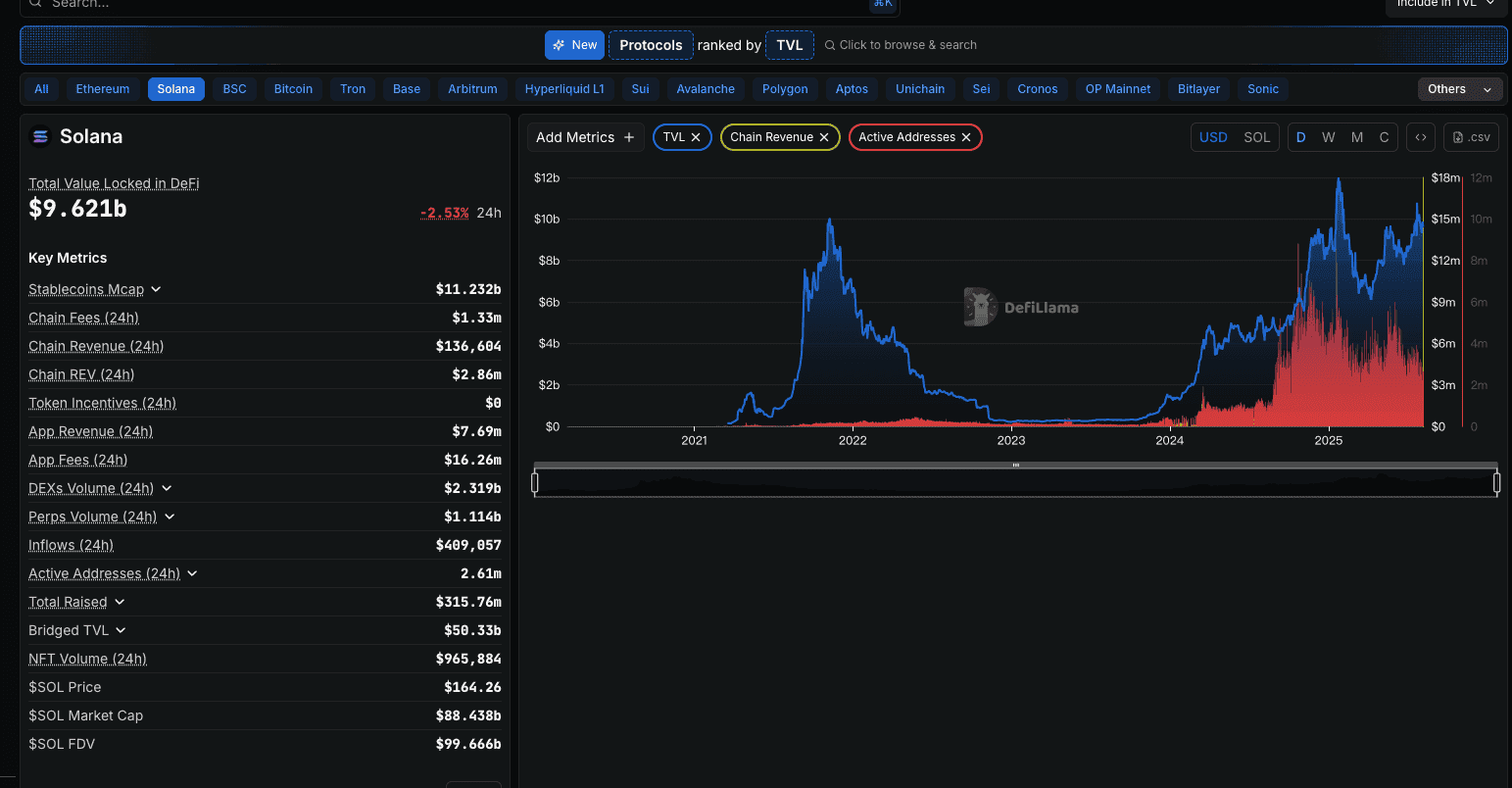

- July 2025: Decentralized exchange (DEX) volume on Solana soared to $1.4 trillion, a staggering 140% increase year-over-year (source).

- SOL Price Surge: As of August 16,2025, Solana’s native token ($SOL) is trading at $189.06, reflecting a robust 2.43% gain from the previous close.

- Ecosystem Valuation: The total value of projects built on Solana has crossed $250 billion in market capitalization this year.

- User Growth: Despite concerns over automated trading activity, especially following November 2024’s all-time high of $318 billion in transfer volume, the organic user base continues to expand as more DeFi protocols launch on-chain.

The Flippening Debate: Is Organic Activity Fueling Growth?

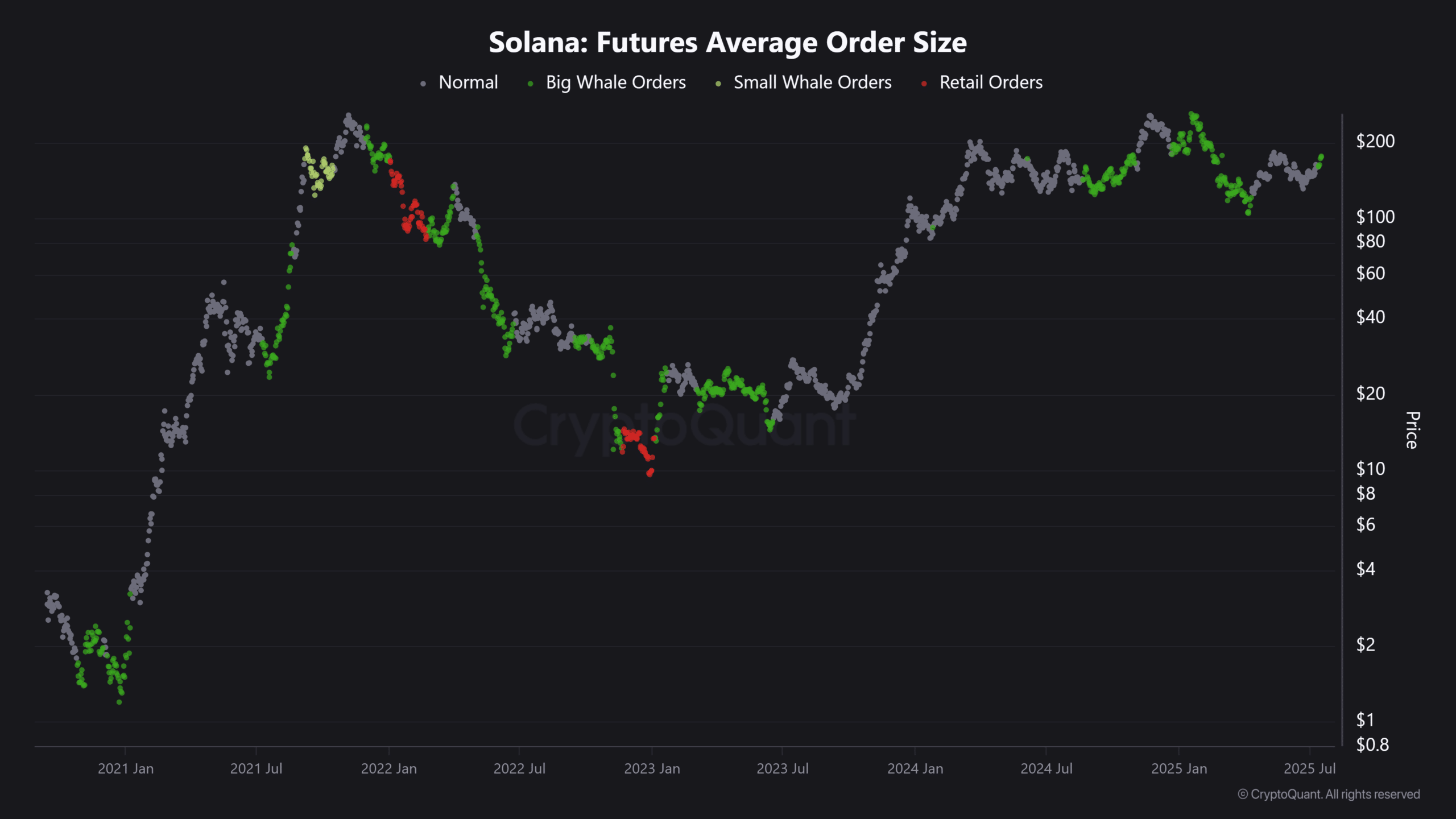

A crucial question arises: how much of this explosive trade volume is organic versus bot-driven? In November 2024, analyses suggested that automated bots accounted for a significant share of activity during peak periods (source). Still, even after accounting for non-organic trades, the sheer scale of human-driven transactions remains impressive compared to other blockchains, and even some traditional markets.

This dynamic has fueled debates about a potential “flippening, ” where blockchain-based networks could surpass legacy financial institutions in key metrics like trade count or volume. While some skepticism remains warranted due to automation effects, there is little doubt that Solana’s infrastructure is now capable of rivaling traditional giants like NASDAQ.

Solana (SOL) Price Prediction 2026-2031

Professional forecast based on current market trends, adoption, and risk factors. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $155.00 | $210.00 | $285.00 | +11% | Potential consolidation after rapid 2025 growth; regulatory headwinds possible |

| 2027 | $170.00 | $240.00 | $325.00 | +14% | Broader DeFi adoption, scaling upgrades; competition from Ethereum/Layer-2s |

| 2028 | $185.00 | $270.00 | $365.00 | +13% | Improved real-world use cases, but macro volatility risk |

| 2029 | $210.00 | $310.00 | $420.00 | +15% | Bullish scenario: institutional adoption, possible ETF/integration |

| 2030 | $235.00 | $350.00 | $485.00 | +13% | Mainstream finance integration, high throughput advantage shines |

| 2031 | $260.00 | $395.00 | $550.00 | +13% | Mature DeFi/TradFi bridge, regulatory clarity, strong network effects |

Price Prediction Summary

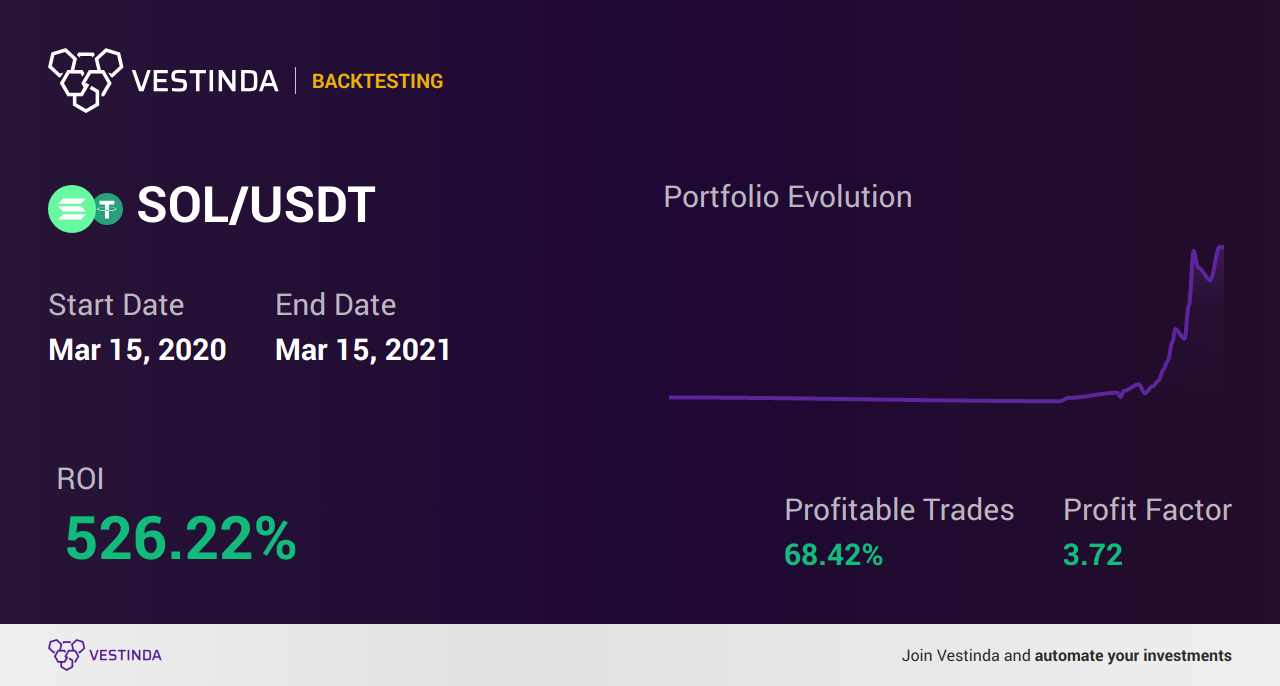

Solana (SOL) is projected to maintain a strong position in the blockchain ecosystem, leveraging its high throughput, low fees, and growing DeFi/DEX activity. While periodic corrections and regulatory risks may cause volatility, Solana’s technical and adoption trajectory supports continued price appreciation over the next six years. The minimum and maximum price ranges reflect both bullish innovation cycles and the potential for market corrections or external shocks.

Key Factors Affecting Solana Price

- Sustained high DEX/trading activity and ecosystem growth.

- Continued technology upgrades and network scalability.

- Regulatory clarity and global crypto policy evolution.

- Potential for increased institutional adoption (e.g., ETFs, integration with TradFi).

- Competition from other smart contract blockchains (Ethereum, Layer-2s, new entrants).

- Macroeconomic environment, risk appetite, and market cycles.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Visualizing Trade Volume Trends: July-August 2025

The momentum hasn’t gone unnoticed by analysts or investors. July saw DEX volumes hit unprecedented highs at $1.4 trillion while SOL maintained price stability above $180 throughout early August, a sign of increasing investor confidence even amid volatility across broader crypto markets.

What stands out in this new era is the rapid acceleration of decentralized finance trends and how they are reshaping expectations for both speed and transparency. Solana’s ability to handle massive trade volumes at low cost is not just a technical achievement, but a signal of shifting market structure. The network’s composability allows DeFi protocols, NFT marketplaces, and even gaming platforms to interact seamlessly, creating an ecosystem where liquidity and user activity reinforce each other.

For those tracking the so-called “Solana flippening, ” it’s important to look beyond raw numbers. NASDAQ remains the gold standard for regulated equity trading, with deep liquidity and robust safeguards. However, Solana’s open architecture means anyone can build or access complex financial tools without traditional gatekeepers. This democratization is drawing in a younger, tech-native generation of traders who value 24/7 access and programmable assets.

Risks and Considerations: Automation, Bots, and Real-World Impact

No discussion would be complete without acknowledging the risks. Automated trading bots have inflated on-chain statistics at times, especially during periods of high incentive rewards or airdrops. While these bots can provide liquidity, they also raise legitimate concerns about wash trading or market manipulation. For investors and developers alike, distinguishing between organic growth and artificial volume is critical for assessing long-term sustainability.

Key Drivers Behind Solana’s 2025 Trade Volume Surge

-

Unmatched Transaction Throughput: Solana processes up to 65,000 transactions per second (TPS), far outpacing traditional systems like NASDAQ and enabling high-frequency trading and rapid settlement.

-

Surge in Decentralized Exchange (DEX) Activity: In July 2025, Solana’s DEX volume surpassed $1.4 trillion, reflecting explosive growth in on-chain trading and liquidity.

-

Low Transaction Fees: Solana’s network offers consistently low fees, making it attractive for both retail and institutional traders seeking cost-effective execution compared to other blockchains and traditional markets.

-

Expanding Ecosystem and User Base: The Solana ecosystem’s value exceeded $250 billion in 2025, driven by new protocols, DeFi projects, and NFT platforms that increase user engagement and trading activity.

-

Algorithmic and Automated Trading: A significant portion of Solana’s trade volume is attributed to algorithmic trading bots, which leverage the network’s speed and scalability for high-frequency strategies.

-

Strong Token Performance: As of August 16, 2025, SOL is trading at $189.06 (up 2.43% in 24h), attracting more traders and liquidity to the network.

-

Institutional Interest and Partnerships: Growing adoption by institutional investors and partnerships with major DeFi protocols have further boosted Solana’s daily trade volumes.

The regulatory landscape also looms large over these developments. As Solana edges closer to traditional finance benchmarks like NASDAQ in daily trades, questions about compliance, security standards, and investor protections will only intensify. Policymakers are watching closely as decentralized platforms begin to rival, or even outpace, the infrastructure underpinning global equity markets.

What Does This Mean for the Future?

The implications stretch far beyond headline numbers. If current trends persist, 35 million daily trades on Solana versus 55 million on NASDAQ, 2025 could be remembered as the year blockchain networks became truly competitive with legacy finance in both scale and reliability. The next phase may see further convergence: tokenized stocks on-chain, hybrid exchanges blending DeFi with traditional assets, or entirely new asset classes native to blockchains like Solana.

Clarity in complexity: As we move deeper into 2025, expect more institutional players to experiment with on-chain settlement layers while retail users continue embracing programmable finance at record rates.

For now, Solana’s combination of technical prowess, ecosystem growth, and relentless innovation positions it as a bellwether for decentralized markets worldwide, one that investors can no longer afford to ignore.