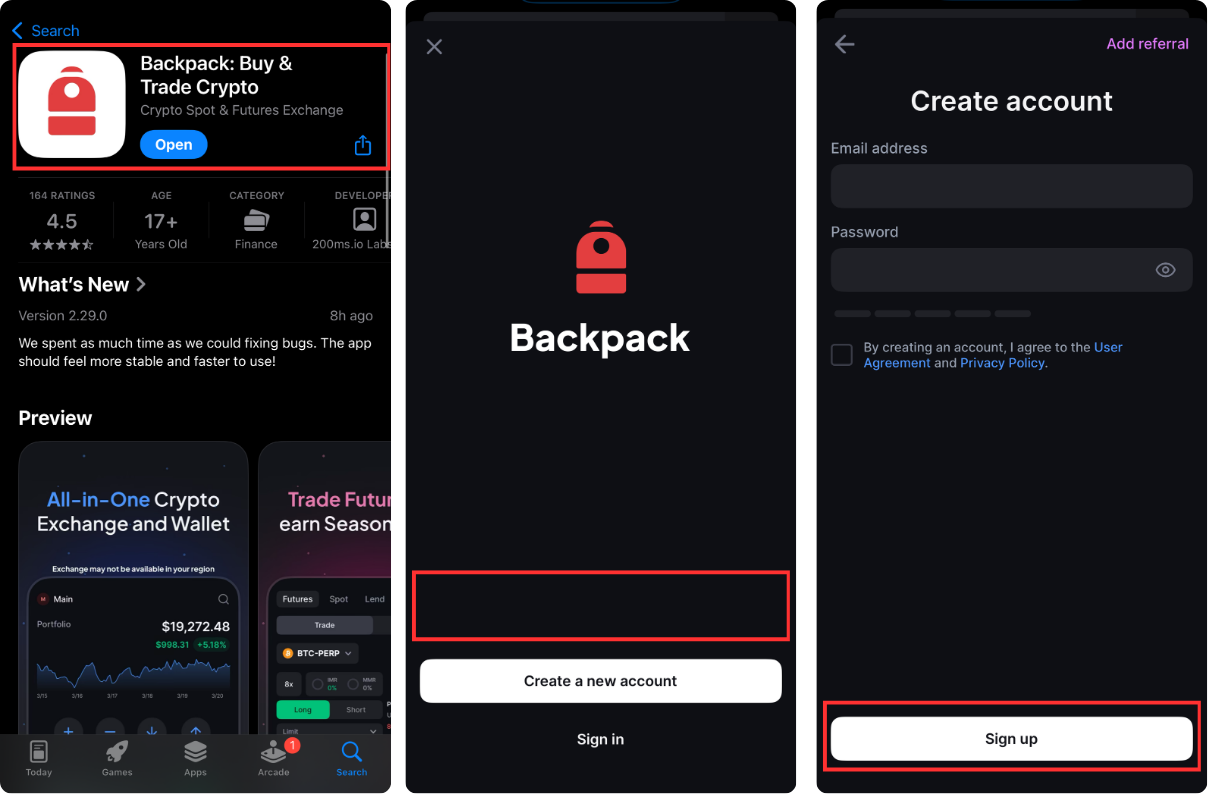

Backpack Lending has rapidly emerged as a transformative force within the Solana DeFi 2025 landscape, driving both innovation and unprecedented growth. In the past year, Solana’s decentralized finance sector has seen a remarkable surge in total value locked (TVL), propelled primarily by Backpack’s bold approach to lending, dynamic user incentives, and robust infrastructure. With the current price of Binance-Peg SOL (SOL) at $184.76, and lending volumes repeatedly breaking all-time highs, it’s clear that Solana’s DeFi ecosystem is entering a new era defined by both scale and sophistication.

Backpack Lending: The Engine Behind Solana’s 50% TVL Surge

The numbers are striking. In May 2025 alone, Solana DeFi value grew by 50% in a single month, an expansion closely tied to Backpack Lending’s aggressive rollout of high-yield products and flexible leverage options. According to Mitrade, this momentum was catalyzed by Backpack’s enhancement of its SOL asset lending service in August 2024, which offered lenders an APY as high as 12.24%. For context, these rates far outpace traditional finance yields and even many competing crypto protocols.

This surge is not just anecdotal or speculative; it is visually evident in analytics dashboards tracking Backpack Lending’s supply and borrow metrics. The platform has consistently shattered previous records since early 2024 – a trend that has become central to any serious discussion about Solana ecosystem growth. For investors seeking capital efficiency or passive income from their SOL holdings, Backpack has become the default gateway.

Visual Analytics: Making Sense of $533M ATHs in Lending

The impact of visual analytics cannot be overstated in the current cycle. As Backpack Lending hit an all-time high (ATH) of $533 million supplied and borrowed, data-driven dashboards began circulating widely on social media and community channels. These visuals have provided retail investors and institutions alike with transparent evidence of Solana DeFi’s explosive expansion – demystifying complex flows with intuitive charts that highlight everything from leverage ratios to APY dynamics.

This transparency is more than cosmetic; it builds trust in an industry where opacity can breed risk aversion. By making granular data accessible, Backpack has fostered a culture of informed participation – one where users can calibrate risk based on up-to-the-minute figures rather than outdated reports or hearsay.

User Incentives: The Points System Fueling Active Participation

No discussion of Backpack Lending would be complete without addressing its innovative points system. Launched alongside its pre-season beta in February 2024, the program rewards users according to trading volume – effectively gamifying liquidity provision while building long-term loyalty among participants. By April 2024, the fourth week’s points distribution had already demonstrated tangible benefits for active traders; by July 2024, Season Two was underway with even greater engagement.

Solana (SOL) Price Prediction 2026-2031

Professional outlook based on DeFi growth, Backpack Lending, and market trends as of August 2025

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $145.00 | $205.00 | $265.00 | -8% to +15% | Potential market consolidation after 2025 ATH surge, but DeFi adoption remains strong |

| 2027 | $170.00 | $245.00 | $325.00 | +10% to +20% | Renewed bull cycle driven by continued DeFi innovation and institutional adoption |

| 2028 | $190.00 | $290.00 | $400.00 | +15% to +23% | Broader blockchain adoption, improved scalability, and regulatory clarity add momentum |

| 2029 | $225.00 | $335.00 | $470.00 | +12% to +18% | Strong ecosystem growth, but possible mid-cycle correction dampens extremes |

| 2030 | $260.00 | $380.00 | $530.00 | +13% to +16% | Mainstream DeFi usage, Solana network upgrades, and increased TVL drive expansion |

| 2031 | $310.00 | $445.00 | $625.00 | +15% to +20% | Mature DeFi sector, cross-chain integrations, and global adoption push new highs |

Price Prediction Summary

Solana is poised for continued growth through 2031, fueled by expanding DeFi use cases such as Backpack Lending, robust network upgrades, and increasing institutional interest. While volatility and corrections are likely, long-term trends suggest higher average and maximum prices, especially as regulatory clarity and blockchain adoption advance.

Key Factors Affecting Solana Price

- Backpack Lending’s sustained growth and innovative features (higher leverage, points system) boosting DeFi TVL and SOL demand

- Solana’s low fees and high throughput attracting new projects and users

- Rising institutional participation and mainstream DeFi adoption

- Potential for regulatory clarity or new frameworks impacting growth and sentiment

- Competition from other Layer-1 blockchains (e.g., Ethereum, Avalanche)

- Macro market cycles, including potential crypto-wide bull/bear phases

- Ongoing network upgrades and ecosystem expansion (NFTs, GameFi, cross-chain integrations)

- Global economic conditions and investor risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This blend of competitive yields and social incentives is unique among major DeFi platforms on Solana or any other chain. It helps explain why Backpack continues to attract new capital at record speed while cementing its position at the heart of Solana’s ongoing ecosystem growth.

For newcomers and seasoned DeFi users alike, Backpack’s approach offers a compelling case study in how platform incentives and transparency can reshape network effects. The points system doesn’t just reward high-frequency traders; it democratizes access, giving smaller participants a real stake in the protocol’s success. This creates a virtuous cycle: more activity yields more rewards, which in turn drives additional liquidity and deeper market depth for Solana-based assets.

Distinctive Features of Backpack Lending on Solana

-

High-Yield SOL Lending: Backpack offers lenders an annual percentage yield (APY) of up to 12.24% for SOL asset lending, providing some of the most competitive returns in the Solana DeFi space as of August 2024.

-

Multiply Feature with Up to 7.5x Leverage: Users can access the innovative Multiply feature, allowing for leveraged positions up to 7.5x, surpassing the previous 5x limit and enabling more advanced capital strategies.

-

Rapid Growth and Record TVL: Backpack has contributed to a 50% increase in Solana’s DeFi total value locked (TVL) within a month, reflecting its significant role in the ecosystem’s expansion.

-

Points-Based User Incentives: The platform rewards active users with a points system tied to trading volumes, fostering engagement and loyalty through regular distributions and seasonal campaigns.

-

Seamless Integration with Solana’s Fast, Low-Fee Network: Backpack leverages Solana’s ultra-fast transactions and minimal fees, making lending and borrowing efficient and accessible for both new and experienced DeFi users.

At the same time, Backpack’s integration with Solana’s fast, low-cost infrastructure has been instrumental. Solana’s sub-second block times and minimal transaction fees allow for the rapid execution of complex lending strategies, something that remains out of reach for many Ethereum-based competitors still grappling with congestion and high gas costs. This technical edge is especially important as leverage options expand; Backpack’s Multiply feature now supports up to 7.5x leverage, empowering sophisticated users while maintaining robust risk controls.

Market Context: Solana Lending ATHs and Ecosystem Growth

Zooming out, the broader picture is equally bullish. As of August 2025, Solana DeFi continues to attract both retail and institutional capital at an accelerating pace. The current Binance-Peg SOL (SOL) price stands at $184.76, reflecting sustained demand even as markets consolidate after a historic bull run earlier in the year. According to Yahoo Finance, Backpack Exchange reached $1 billion in daily trading volume just days after its beta launch, a testament to pent-up demand for reliable, user-friendly DeFi venues on Solana.

Crucially, this momentum is not being driven by speculation alone. High APYs from lending services, combined with transparent analytics and gamified rewards, are encouraging longer holding periods and more thoughtful risk management among users. As highlighted by AlphaGrowth’s recent coverage, lending acceleration has been a primary driver behind Solana’s 50% monthly TVL jump (Mitrade). For many investors, this marks a decisive shift from yield-chasing to value creation through active protocol participation.

What Comes Next?

The next phase for Backpack Lending, and by extension, Solana DeFi, will likely hinge on further product innovation and continued user education. As visual analytics become more sophisticated and accessible, expect even greater alignment between protocol health metrics and community sentiment. Platforms that can maintain transparency while iterating quickly will be best positioned to capture outsized market share as competition intensifies across Layer 1 ecosystems.

As always in crypto markets: patience is profit, but so is vigilance.

If you’re considering entering or expanding your position within Solana DeFi 2025, keep a close eye on platforms like Backpack that are setting new standards for both performance and accountability. With ATH visuals circulating widely on social channels, and new records being set almost monthly, the story of Solana lending is still being written in real time.