For years, moving USD into crypto has been a friction point, especially for users seeking fast, low-fee access to the Solana ecosystem. Backpack Exchange is changing that equation by delivering a seamless on/off ramp between USD, USDC, and Solana-native assets. In 2025, as Solana DeFi matures and Circle’s IPO puts stablecoins in the mainstream spotlight, Backpack’s approach stands out for its efficiency and regulatory clarity.

Backpack Exchange: The New Standard for USD to USDC On/Off Ramps

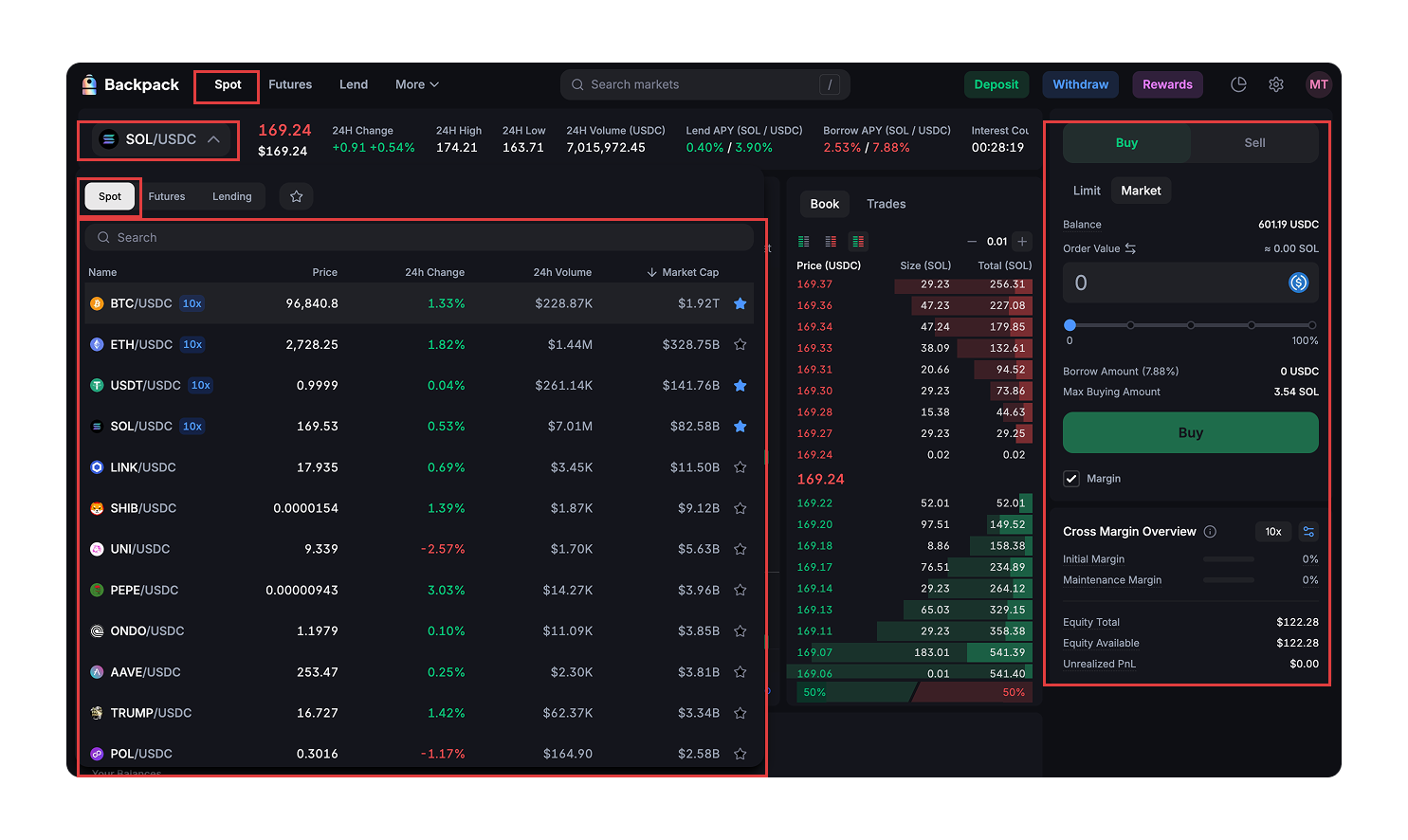

Traditional exchanges have long treated fiat-to-stablecoin conversion as an afterthought. Fees, delays, and manual steps frustrate both retail and institutional users. Backpack Exchange Solana flips this script by introducing Backpack USD, an internal unit of account that bridges fiat deposits and on-chain USDC at a true 1: 1 ratio. This means when you wire USD into your Backpack account (with zero transaction fees), it instantly becomes usable as USDC across the Solana ecosystem, no more waiting or hidden costs.

This isn’t just a UX improvement; it’s a fundamental shift in capital efficiency. Backpack automatically converts any deposit, fiat or stablecoin, into Backpack USD at parity, allowing users to move value in and out of DeFi protocols or trading venues without worrying about slippage or off-ramp bottlenecks. According to Backpack’s own documentation, these conversions are instant and fee-free.

Capital Efficiency Meets Real-Time Settlement

One of the most innovative features of Backpack is its real-time profit and loss (PnL) settlement model. Instead of waiting hours, or even days, for positions to settle, unrealized PnL is realized every 10 seconds without affecting your position size. This unlocks immediate access to profits for spot trading, opening new positions, or withdrawals, key for active traders and DeFi power users.

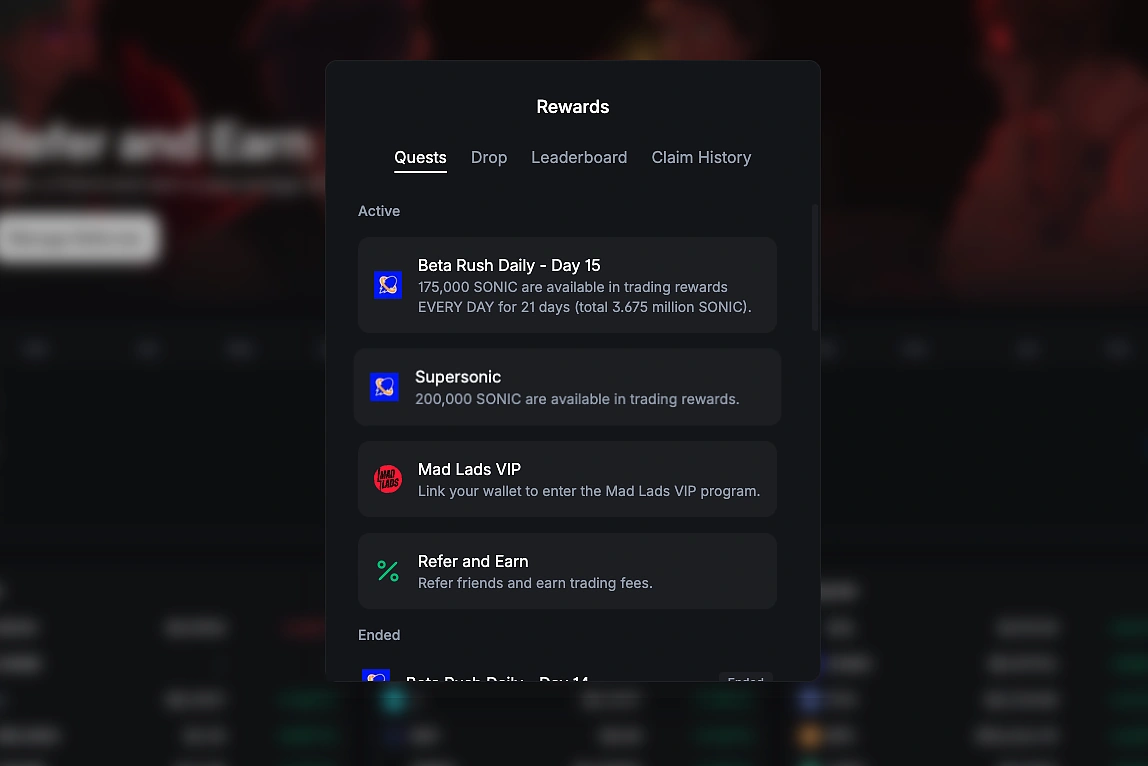

The impact is clear when you look at trading metrics: within five days of its pre-season beta launch in February 2024, Backpack Exchange clocked over $1 billion in daily volume. The SOL/USDC pair alone saw more than $800 million in 24-hour activity, outperforming legacy centralized exchanges by a wide margin (source). This isn’t just market hype; it’s evidence that efficient rails between USD and USDC drive real user adoption on Solana.

Regulatory Compliance Fuels Mainstream Adoption

The crypto industry is littered with platforms that move fast but break things, including compliance rules. Not so with Backpack Exchange. Securing a Virtual Asset Service Provider (VASP) license from Dubai VARA in October 2023 was just the start; by February 2024, Backpack had expanded into the U. S. , launching services across 12 states (details here). For users who care about regulatory clarity, and want assurance their fiat-to-crypto transfers won’t get stuck, this matters.

This expansion coincides with broader stablecoin adoption following Circle’s blockbuster IPO ($CRCL up 279%) and underscores why compliant on/off ramps are essential for onboarding new capital into Solana DeFi in 2025.

Multichain Bridged USDC (Fantom) Price Prediction 2026-2031

Professional outlook based on market, regulatory, and technological trends for USDC bridged on Fantom, considering Solana ecosystem innovations and stablecoin sector growth.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.0470 | $0.0505 | $0.0530 | +2.2% | Stablecoin sector remains steady; regulatory clarity post-Circle IPO supports trust and peg stability |

| 2027 | $0.0450 | $0.0500 | $0.0540 | -1.0% | Potential depegging risks from cross-chain liquidity fragmentation; increased competition among stablecoins |

| 2028 | $0.0440 | $0.0498 | $0.0550 | -0.4% | Bearish scenario: Regulatory restrictions on multichain bridges; Bullish scenario: Improved bridge security and Solana/Fantom adoption |

| 2029 | $0.0430 | $0.0499 | $0.0560 | +0.2% | Gradual integration of real-world assets; persistent arbitrage keeps prices near $1 on mainnet but bridged assets may see discounts |

| 2030 | $0.0410 | $0.0485 | $0.0570 | -2.8% | Bearish: Declining demand for bridged USDC on Fantom; Bullish: Renewed DeFi activity on Fantom or multi-chain resurgence |

| 2031 | $0.0400 | $0.0480 | $0.0580 | -1.0% | Long-term: Bridged USDC faces existential risk from native multichain solutions, but price remains stable if adoption persists |

Price Prediction Summary

Multichain Bridged USDC (Fantom) is projected to maintain a slight discount to $1 parity due to persistent market, regulatory, and liquidity risks associated with bridged stablecoins. The average price is expected to fluctuate between $0.0480 and $0.0505 through 2031, with min/max ranges reflecting both bearish depegging scenarios and bullish adoption trends. While innovations like Backpack Exchange and Circle’s IPO enhance trust and efficiency for native USDC (especially on Solana), bridged versions on Fantom may continue to trade at a discount as users favor native stablecoins and regulatory scrutiny increases.

Key Factors Affecting USD Coin Price

- Growth of native USDC on Solana and other chains may reduce demand for bridged versions on Fantom

- Circle IPO and regulatory clarity can boost stablecoin adoption and reduce depegging risk

- Security and reliability of cross-chain bridges are pivotal—any exploit or regulatory clampdown could widen discounts

- Competition from other stablecoins and new multichain protocols can impact market share and price stability

- Adoption of Solana/Fantom DeFi and real-world asset integrations may influence bridged stablecoin utility

- Macro crypto market cycles and overall liquidity will affect stablecoin premiums/discounts across ecosystems

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

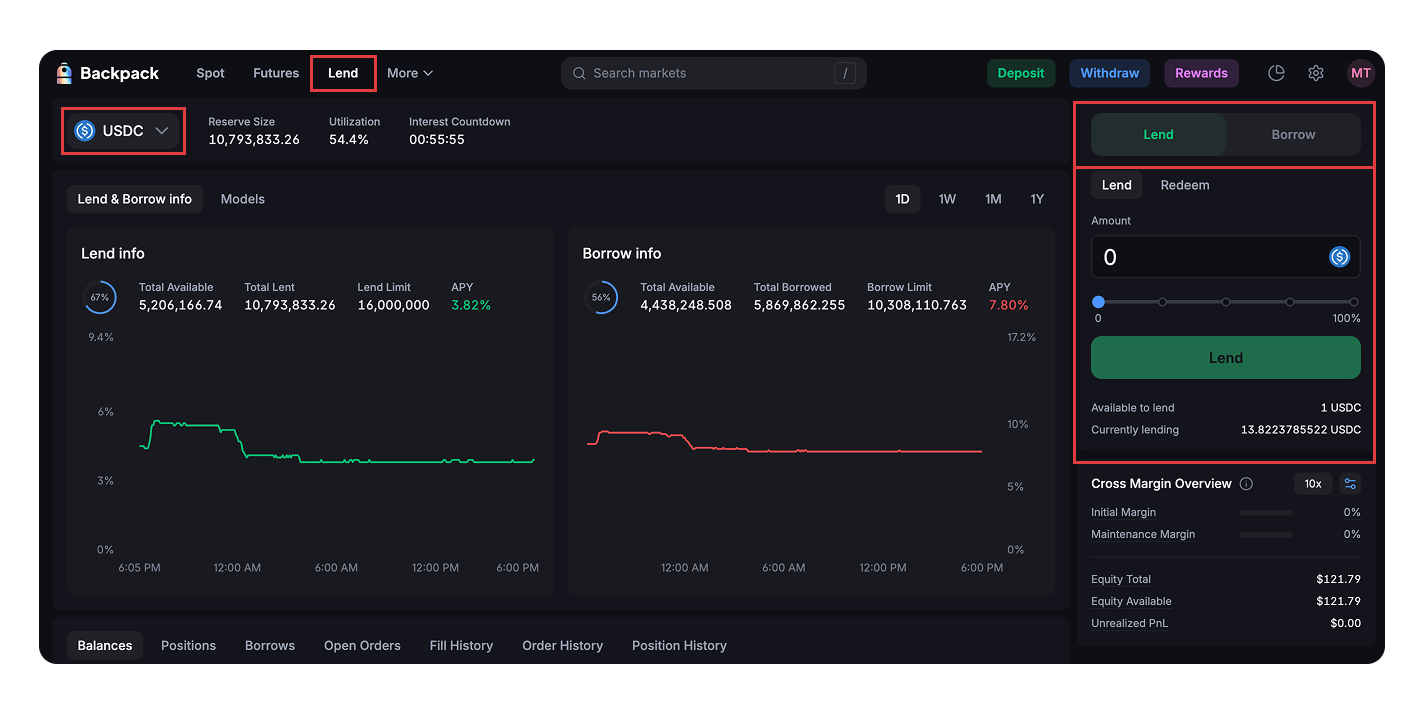

Backpack’s approach to on/off ramping isn’t just about speed or convenience, it’s about unlocking the full composability of Solana DeFi in a way that legacy exchanges can’t match. With no minimums or maximums on lending, users can deploy capital with maximum flexibility, whether they’re parking idle USD for a 5.50% APY or leveraging SOL collateral at nearly 7% yield. This open, permissionless ethos is central to Solana’s vision for scalable, user-friendly financial infrastructure.

For power users and institutions, the real-time settlement and instant access to profits means new risk management strategies are possible. Instead of locking up capital in slow-moving legacy rails, traders can move between spot and derivatives markets with unprecedented agility. This is especially relevant as Solana-native protocols continue to mature and as USDC maintains its dominant role in on-chain liquidity.

Why Backpack’s Multi-Chain Model Sets a New Benchmark

The future of stablecoins isn’t siloed, cross-chain compatibility is table stakes for next-gen platforms. Backpack Exchange’s multi-chain support ensures that users aren’t boxed into a single ecosystem. They can bridge assets between Solana, Ethereum, and other chains without worrying about slippage or fragmented liquidity. As Circle pushes USDC onto more networks post-IPO, this flexibility will be non-negotiable for serious DeFi participants.

Key Benefits of Backpack Exchange Over Traditional Fiat Ramps

-

Seamless USD to USDC Transfers with Backpack USD: Backpack Exchange introduces Backpack USD, enabling instant, fee-free conversion between fiat and USDC at a 1:1 rate. This eliminates manual steps and streamlines the user experience.

-

Zero-Fee USD Bank Transfers: Users can deposit and withdraw USD via wire transfer directly to and from their bank accounts and Solana wallets with no transaction fees, a significant cost advantage over traditional fiat ramps.

-

Instant Access and Real-Time Settlement: Backpack’s real-time profit and loss settlement model allows unrealized gains or losses to be realized every 10 seconds, letting users access profits immediately for trading or withdrawal—maximizing capital efficiency.

-

High Liquidity and Competitive Trading Volume: Backpack Exchange achieved over $1 billion in daily trading volume within days of launch, with the SOL/USDC pair alone surpassing $800 million—ensuring deep liquidity and tight spreads for users.

-

Regulatory Compliance and Expanded Access: Backpack Exchange holds a VASP license from Dubai VARA and operates in 12 U.S. states, providing a compliant and accessible platform for on-chain USD to USDC transfers.

Crucially, Backpack’s transparent fee structure (zero transaction fees on USD wire transfers) and automated conversions remove the guesswork from moving money onchain. For anyone frustrated by hidden costs or opaque pricing at other exchanges, this is a welcome change, and it gives Solana DeFi projects a competitive edge when onboarding mainstream users.

Solana DeFi 2025: The Road Ahead

With Multichain Bridged USDC (Fantom) currently trading at $0.0494, price stability remains critical for institutional adoption and composable lending strategies across protocols (see official docs). As more capital flows into stablecoins post-Circle IPO and regulatory frameworks mature globally, platforms like Backpack are positioned to set the standard for compliant, efficient capital movement across blockchains.

The bottom line? Volatility is opportunity, but only if you have reliable rails connecting fiat with on-chain assets, and in 2025, no one does it better than Backpack Exchange on Solana.