Institutional capital is no longer waiting on the sidelines: Solana’s public blockchain is rapidly becoming the preferred rails for tokenized real-world assets (RWAs). As of July 2025, over $418 million in tokenized assets are live on Solana – a staggering 140.6% increase year-to-date, according to Cointelegraph. With Binance-Peg SOL trading at $159.05, down 3.2% in the last 24 hours, the price action reflects both heightened volatility and growing attention from TradFi giants.

Why Institutions Are Choosing Solana for Tokenization

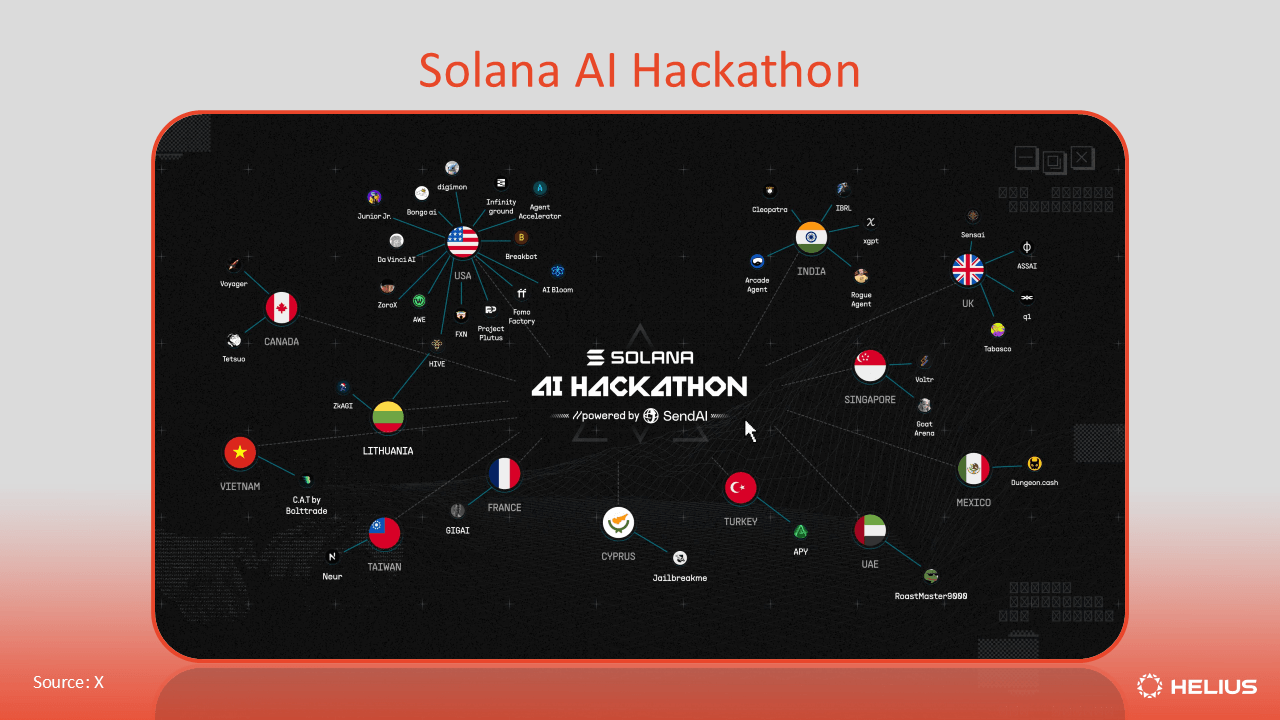

The calculus for institutional adoption is clear: high throughput, low fees, and composability make Solana a natural fit for large-scale asset tokenization. The R3 x Solana partnership is pivotal here. R3, whose Corda platform powers tokenization pilots at institutions such as HSBC and Euroclear, is now bridging its $10 billion and portfolio of private RWAs onto Solana’s permissionless network (AICoin). This technical integration unlocks regulated asset flows from legacy systems to DeFi markets.

According to a recent EY-Parthenon survey cited by R3, over half of institutional investment firms plan to invest in tokenized assets by 2026. Standard Chartered projects a jaw-dropping $30.1 trillion in demand for tokenized RWAs by 2034. The R3-Solana pipeline stands positioned to capture a significant slice of this capital migration.

Current Landscape: Tokenized Funds Flowing Onto Solana

The numbers are accelerating fast:

- BlackRock’s BUIDL Fund: In March 2025, BlackRock expanded its USD Institutional Digital Liquidity Fund (BUIDL) to Solana. BUIDL is a tokenized money market fund holding cash and short-term U. S. Treasuries; it reached a market cap of $25.2 million on Solana by July (Messari).

- Franklin Templeton’s BENJI Fund: BENJI arrived on Solana in February 2025 and tracks U. S. government securities with daily interest accrual – now holding $25.9 million on-chain (Messari).

- Ondo Finance: USDY (yield-bearing stablecoin) commands $177 million in circulation; OUSG (short-term Treasury exposure) has over $79 million live (Helius Blog).

- VanEck’s VBILL: Launched May 2025 with $8 million in tokenized T-bills (Helius Blog).

This influx signals deepening trust from global asset managers and highlights how permissionless markets can coexist with regulatory clarity.

The Visual Data: How $15B Is Set to Hit Solana’s Rails

The next inflection point comes from the R3-Solana integration itself: more than $10 billion in private RWAs are being primed for migration onto public chains via Corda-Solana bridges. This includes assets managed by blue-chip names like HSBC, Euroclear, and SDX – all seeking scalable solutions that meet compliance standards while leveraging DeFi liquidity.

Solana (SOL) Price Prediction 2026-2031: Post-Institutional Adoption Era

Forecasting SOL’s Price Trajectory Amid Rapid Tokenized Asset Growth and Institutional Integration

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $135.00 | $180.00 | $260.00 | +13% | Continued RWA inflows, stable TradFi partnerships |

| 2027 | $160.00 | $235.00 | $340.00 | +31% | Major TradFi expansion, regulatory clarity boosts adoption |

| 2028 | $200.00 | $295.00 | $430.00 | +26% | Wider tokenization, increased global adoption, tech upgrades |

| 2029 | $220.00 | $355.00 | $520.00 | +20% | Sustained growth, new DeFi/RWA products, network scaling |

| 2030 | $250.00 | $420.00 | $600.00 | +18% | Mainstream RWA integration, market cycle peak |

| 2031 | $220.00 | $370.00 | $520.00 | -12% | Post-cycle correction, competition intensifies |

Price Prediction Summary

Solana is poised for robust growth through 2030, driven by accelerating institutional adoption, the proliferation of tokenized real-world assets, and strong TradFi partnerships. The price outlook reflects both bullish scenarios (if institutional flows and tokenization exceed expectations) and bearish risks (regulatory setbacks or major competition). Peak average prices are expected around 2030 as RWA adoption matures, followed by a potential correction as market cycles play out.

Key Factors Affecting Solana Price

- Institutional adoption and RWA tokenization scale

- Partnerships with major financial firms (e.g., R3, BlackRock, Franklin Templeton)

- Regulatory clarity for tokenized assets and DeFi

- Solana’s network scalability and security improvements

- Competition from other smart contract blockchains (e.g., Ethereum, Avalanche, Sui)

- Macro market cycles and global economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This convergence isn’t just theoretical; it’s visualizable through the growing flows into existing tokenized funds and the imminent onboarding of major TradFi portfolios. As more institutions tokenize their balance sheets, expect the aggregate value of on-chain RWAs on Solana to multiply rapidly – potentially breaching the $15 billion mark within quarters.

Market participants tracking Solana’s RWA surge should pay close attention to the technical and regulatory advantages driving this institutional pivot. Solana’s composable architecture enables seamless integration of complex financial instruments, while its low-latency settlement appeals to compliance-minded institutions seeking real-time reconciliation. The R3 partnership is a case study in bridging private, permissioned asset systems with the open liquidity of public blockchains, an architecture that could set the industry standard for tokenized capital markets.

This isn’t just about onboarding legacy assets; it’s about unlocking new forms of market efficiency. For example, tokenized money market funds like BUIDL and BENJI can be traded 24/7, with instant settlement and composability into DeFi protocols. Ondo’s USDY and OUSG provide yield-bearing exposure to U. S. Treasuries with programmable features, something impossible in traditional custodial systems. Each new fund or asset class that migrates to Solana increases network effects, deepens liquidity pools, and accelerates the flywheel for further institutional adoption.

Key Benefits of Institutional Tokenization on Solana

-

High Throughput & Low Transaction Costs: Solana’s network processes transactions rapidly and at minimal cost, enabling institutions to tokenize and transfer assets efficiently at scale.

-

Proven Institutional Adoption: Major players like BlackRock (BUIDL Fund), Franklin Templeton (BENJI Fund), Ondo Finance (USDY, OUSG), and VanEck (VBILL) have launched tokenized funds on Solana, demonstrating strong institutional trust and real-world usage.

-

Robust RWA Ecosystem: Over $418 million in tokenized assets are active on Solana as of July 2025, with a 140.6% year-to-date increase, reflecting rapid ecosystem growth and liquidity for institutional participants.

-

Interoperability with TradFi Systems: The R3 Corda x Solana partnership enables seamless integration of traditional financial institutions’ private ledgers with Solana’s public blockchain, supporting regulated asset transfers and compliance.

-

Regulatory Progress & Compliance: Solana’s adoption by regulated entities and partnerships with compliance-focused platforms support institutions in meeting legal and operational standards for tokenized assets.

Regulatory clarity has also improved markedly in 2025, with global banks now actively piloting tokenization on public chains without sacrificing compliance. R3’s Corda integration ensures that KYC/AML standards are maintained even as assets flow into permissionless environments, a critical requirement for regulated entities like HSBC, Euroclear, and SDX. The result is a hybrid framework where institutional-grade security meets the programmability of DeFi.

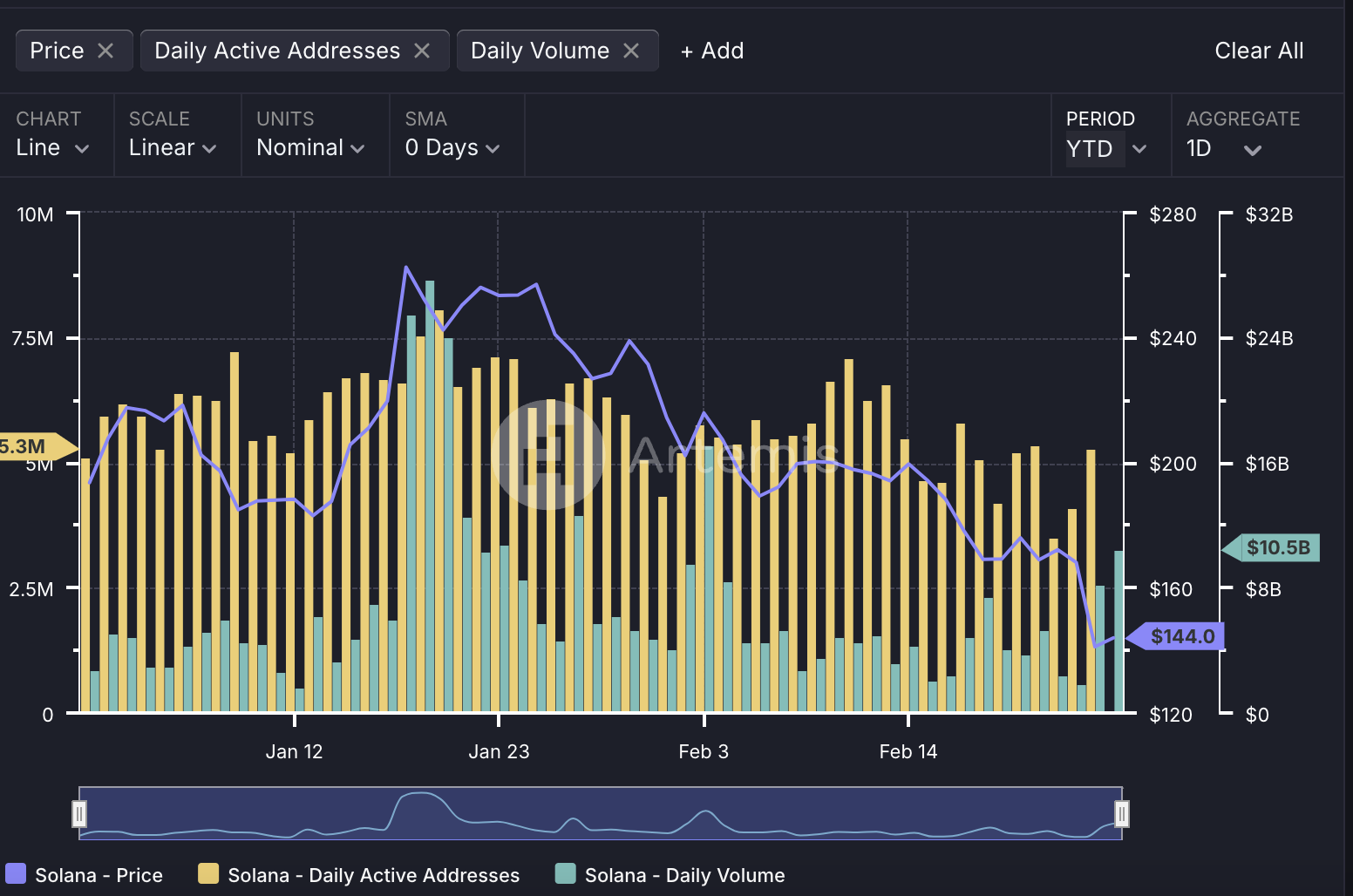

What Comes Next: Price Action and Ecosystem Implications

With Binance-Peg SOL currently at $159.05, price action remains tethered to both macro crypto sentiment and tangible progress in institutional adoption. While short-term volatility persists (SOL down 3.2% over 24 hours), the long-term chart structure is increasingly bullish as on-chain fundamentals strengthen. Technical traders should watch for breakout volume coinciding with major RWA onboarding events, these are likely to be inflection points for both price discovery and ecosystem growth.

Charts never lie: as more blue-chip RWAs migrate onto Solana rails, expect price action to reflect not just speculative flows but real-world utility and institutional demand.

For ecosystem builders and investors alike, the message is clear: follow the capital flows. As more than $15 billion in tokenized assets prepares to hit Solana’s rails, driven by partnerships with R3, BlackRock, Franklin Templeton, Ondo Finance, VanEck, HSBC, Euroclear, and SDX, the network is cementing its role as a foundational layer for next-generation finance.

The momentum behind Solana institutional adoption is now undeniable. The confluence of technical innovation, regulatory progress, and TradFi partnerships suggests that what we’re witnessing isn’t just another crypto narrative, it’s a structural shift in how capital markets will operate this decade.