In mid-2025, the landscape of real-world asset (RWA) tokenization is undergoing a seismic shift, and Solana is rapidly emerging as the network of choice for institutional-grade digital assets. With over $15 billion in tokenized assets poised to enter the Solana ecosystem, the strategic partnership between R3 and the Solana Foundation is set to redefine what permissionless markets mean for both TradFi and DeFi participants.

Why $15B in Tokenized Assets Are Migrating to Solana

The numbers are staggering: from just $5 billion in 2022 to approximately $24 billion by mid-2025, RWA tokenization has exploded by over 380% (Helius). At the center of this growth is R3’s Corda platform, a trusted enterprise blockchain infrastructure adopted by financial heavyweights such as HSBC, Euroclear, and Bank of America. By integrating Corda with Solana’s public mainnet, these institutions can now tap into Solana’s high throughput, low fees, and global liquidity pools without compromising on compliance or data privacy.

This integration unlocks several key features:

- Real-time transaction validation on Solana, eliminating legacy notary bottlenecks while keeping sensitive data private.

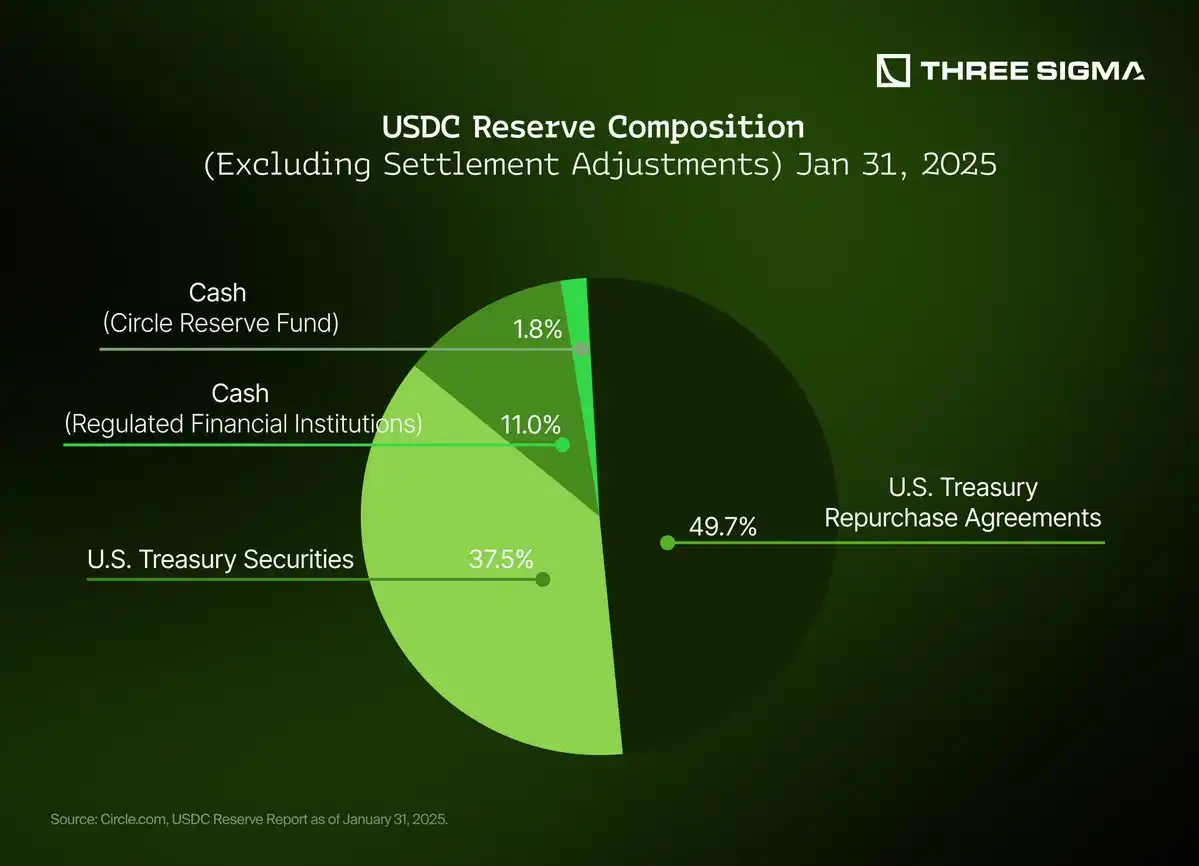

- Stablecoin settlement via USDC on Solana, enabling atomic delivery-versus-payment without intermediaries.

- A direct liquidity bridge, allowing regulated assets like equities and digital bonds to flow seamlessly onto public markets.

The ability to move institutional-grade RWAs onto a permissionless blockchain marks a major strategic pivot for R3. This move reflects an industry-wide trend: traditional finance is no longer content with siloed, permissioned ledgers. Instead, it seeks the efficiency gains and market access only public blockchains can provide.

The Role of HSBC and Other Institutional Giants

HSBC’s involvement cannot be overstated. As one of R3’s flagship clients, HSBC has already demonstrated the viability of asset tokenization at scale. Its Digital Vault, built on Corda, has managed up to $20 billion in private market securities since launch (R3.com). More recently, HSBC became the first global bank to offer tokenized gold stored in its London vaults. Now, with Corda assets gaining access to Solana’s permissionless rails, we are witnessing a convergence that dramatically improves both settlement speed and cross-border accessibility.

This partnership is not limited to HSBC; it extends across an impressive roster including Euroclear and HQLAx. The result? A growing ecosystem where regulated finance meets DeFi innovation, without sacrificing regulatory rigor or operational security.

Solana Ecosystem 2025: Infrastructure Ready for Institutional Scale

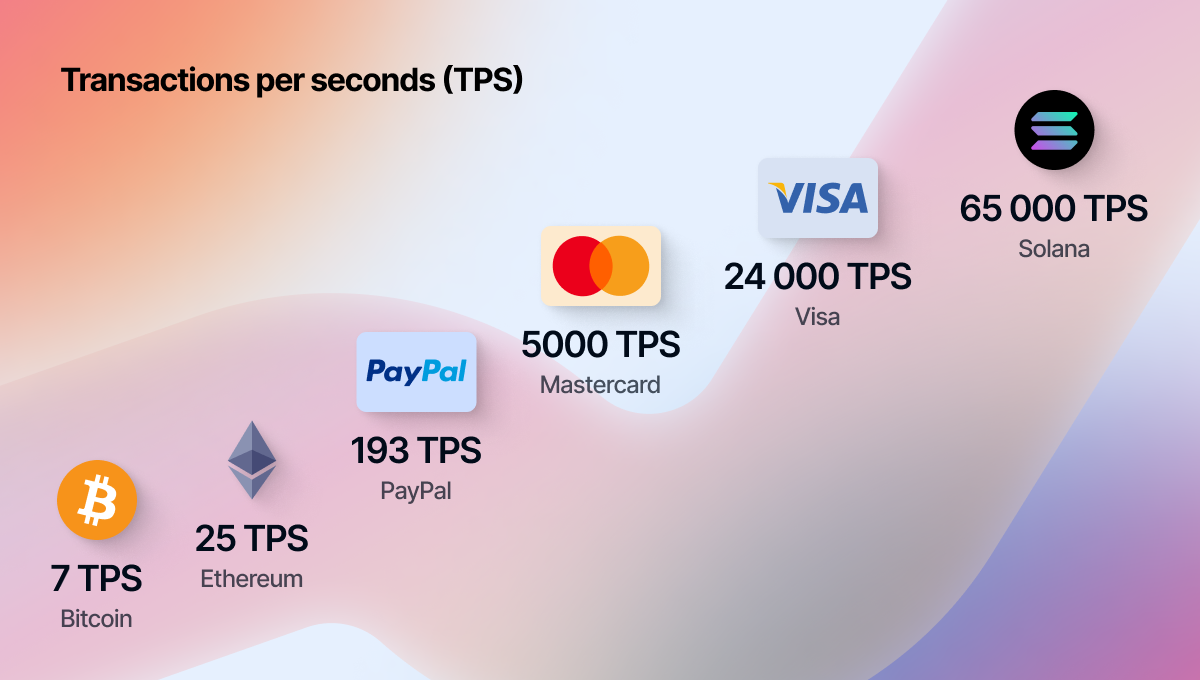

Solana’s technical advantages are well-documented: sub-second finality, parallel transaction processing via Sealevel runtime, and average fees measured in fractions of a cent. At its current price of $164.35 per SOL, despite minor short-term volatility (-0.0540% over 24h), this network remains one of the most cost-effective venues for large-scale asset issuance and secondary trading.

Solana (SOL) Price Prediction 2026-2031

Based on institutional adoption, RWA tokenization trends, and the R3 x Solana partnership

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $142.00 | $185.00 | $260.00 | +12.5% | Early RWA inflows, continued TradFi integration, moderate volatility |

| 2027 | $170.00 | $240.00 | $350.00 | +29.7% | Scaling of tokenized assets, more institutions onboard, regulatory clarity improves sentiment |

| 2028 | $210.00 | $295.00 | $440.00 | +22.9% | Broader adoption in DeFi/TradFi, stablecoin settlements increase, competitive pressure from other chains |

| 2029 | $245.00 | $355.00 | $560.00 | +20.3% | Permissionless markets mature, sustained RWA growth, global regulatory alignment |

| 2030 | $285.00 | $410.00 | $670.00 | +15.5% | Major financial products tokenized, Solana cements role in RWA sector, market cycles influence volatility |

| 2031 | $325.00 | $465.00 | $790.00 | +13.4% | Mainstream acceptance, new use cases (tokenized bonds, real estate), technological upgrades |

Price Prediction Summary

Solana is positioned for significant growth through 2031, driven by the integration of real-world assets (RWAs) and institutional partnerships such as R3 and HSBC. The average price is projected to rise from $185 in 2026 to $465 in 2031, reflecting growing adoption, technological improvements, and increased market confidence. However, volatility remains, and price swings between bullish and bearish scenarios are expected as the ecosystem matures.

Key Factors Affecting Solana Price

- Continued inflow of tokenized real-world assets (RWAs) onto Solana

- Expansion of institutional partnerships (e.g., R3, HSBC) and TradFi integration

- Regulatory developments impacting tokenization and blockchain adoption

- Solana’s technological advancements (scalability, low fees, stablecoin infrastructure)

- Competition from other blockchains targeting RWA sector (e.g., Ethereum, Avalanche)

- Global macroeconomic conditions and crypto market sentiment

- Potential for new use cases (tokenized bonds, real estate, stablecoin settlements)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The integration with Corda brings not just capital inflows but also a new class of compliant financial products, tokenized funds, digital bonds, even equity instruments, all accessible on-chain. For investors seeking exposure beyond traditional crypto assets or memecoins within the Solana ecosystem 2025, this marks an inflection point where blue-chip finance meets open infrastructure.

Regulatory clarity remains an ongoing challenge, but the R3-Solana partnership is designed to accommodate both global standards and local compliance requirements. By leveraging Solana’s permissionless architecture, financial institutions can offer their clients 24/7 access to tokenized assets, real-time settlement, and unprecedented transparency, all while maintaining strict data confidentiality through Corda’s privacy features. This dual-layer approach is attracting a new wave of institutional participants who previously viewed public blockchains as too risky or inefficient for regulated assets.

For market participants, the implications are profound. With tokenized assets from trusted issuers like HSBC and Euroclear now able to circulate on Solana, secondary market liquidity is set to deepen significantly. This opens the door for new trading strategies, automated lending protocols, and innovative DeFi primitives that leverage real-world collateral, features that have long been promised but rarely delivered at scale in previous cycles.

Key Benefits for Investors and Institutions

Key Benefits of Tokenization on Solana for Investors

-

Enhanced Liquidity and Market Access: Tokenized assets on Solana can be traded 24/7, enabling both retail and institutional investors to access global liquidity pools and secondary markets with fewer barriers.

-

Faster and More Efficient Settlements: Solana’s high-performance blockchain enables near-instant settlement of tokenized assets, reducing counterparty risk and freeing up capital for both retail and institutional participants.

-

Lower Transaction Costs: Solana’s network offers significantly lower fees compared to traditional financial rails and even other blockchains, making it cost-effective for investors to transfer and trade tokenized assets.

-

Direct Access to Real-World Assets (RWAs): Through integrations like R3’s Corda and partnerships with institutions such as HSBC, investors can access tokenized versions of equities, bonds, gold, and funds directly on Solana.

-

Atomic Delivery-Versus-Payment (DvP) Settlement: Using Solana-based stablecoins like USDC, investors benefit from atomic DvP, ensuring simultaneous transfer of assets and payments without intermediaries.

-

Increased Transparency and Security: All tokenized asset transactions are recorded on Solana’s public ledger, providing verifiable audit trails and reducing the risk of fraud for all market participants.

The convergence of TradFi and DeFi on Solana creates several tangible advantages:

- Enhanced Market Access: Broader participation in global markets as tokenized assets become available 24/7.

- Faster Settlement Cycles: Real-time clearing reduces counterparty risk and capital lockup.

- Cost Efficiency: Near-zero transaction fees at current SOL prices ($164.35) make large-scale operations viable.

- Programmable Compliance: On-chain rules ensure regulatory adherence without manual intervention.

This paradigm shift also introduces new risks, smart contract vulnerabilities, evolving regulatory frameworks, and potential liquidity fragmentation across chains. However, the collaborative efforts between R3, Solana Foundation, and leading financial institutions suggest a measured approach that prioritizes both innovation and resilience (Helius). As more RWAs migrate to public blockchains, robust governance models will be essential for sustaining trust at scale.

What Comes Next: The Roadmap for Permissionless Markets

The next phase will see further integration of legacy financial products with decentralized protocols. Expect to see advancements in cross-chain interoperability, enabling assets issued on Corda or other enterprise platforms to move seamlessly between multiple public blockchains, and the rise of programmable asset management tools tailored for institutional clients. Already, pilot projects are underway exploring tokenized repo markets and instant settlement of syndicated loans using Solana’s infrastructure (Tokenpost).

The competitive landscape will also intensify as Ethereum Layer-2s and alternative L1s race to match Solana’s throughput and cost advantages. Yet with its unique blend of speed, scale, and regulatory engagement, as evidenced by this $15B and migration, Solana is positioned as the network where permissionless meets institutional-grade finance.

The numbers tell a clear story: when blue-chip institutions move billions in real-world assets onto a public blockchain at $164.35 per SOL, it signals not just technical readiness but a fundamental shift in global capital markets.