Solana has become the undisputed leader in blockchain asset tokenization, and the numbers from 2025 tell a compelling story. With a staggering 140.6% year-to-date growth in real-world assets (RWAs) tokenized on Solana, the platform’s RWA market value has surged to $418 million, trouncing both Ethereum and the broader market average of 62.4% growth. This momentum is not just hype: it’s backed by hard data, institutional adoption, and technical prowess that gives Solana a unique edge.

Solana’s RWA Surge: Outpacing the Competition in 2025

According to Messari and multiple industry sources, Solana’s RWA sector has seen explosive expansion in 2025, with tokenized assets on Solana growing more than twice as fast as the overall market. The network’s current valuation for tokenized RWAs stands at $418 million as of July 29,2025 (OKX). For context, this is a leap from early-year figures and leaves competitors like Ethereum trailing in growth rate percentage.

This surge is not isolated; it reflects a broader shift toward blockchain asset tokenization as a mainstream financial mechanism. With McKinsey projecting $2 trillion in tokenized assets by 2030 and Standard Chartered even more bullish at $30.1 trillion by 2034, Solana’s early lead could prove decisive.

The Technical Edge: Why Institutions Choose Solana for Tokenization

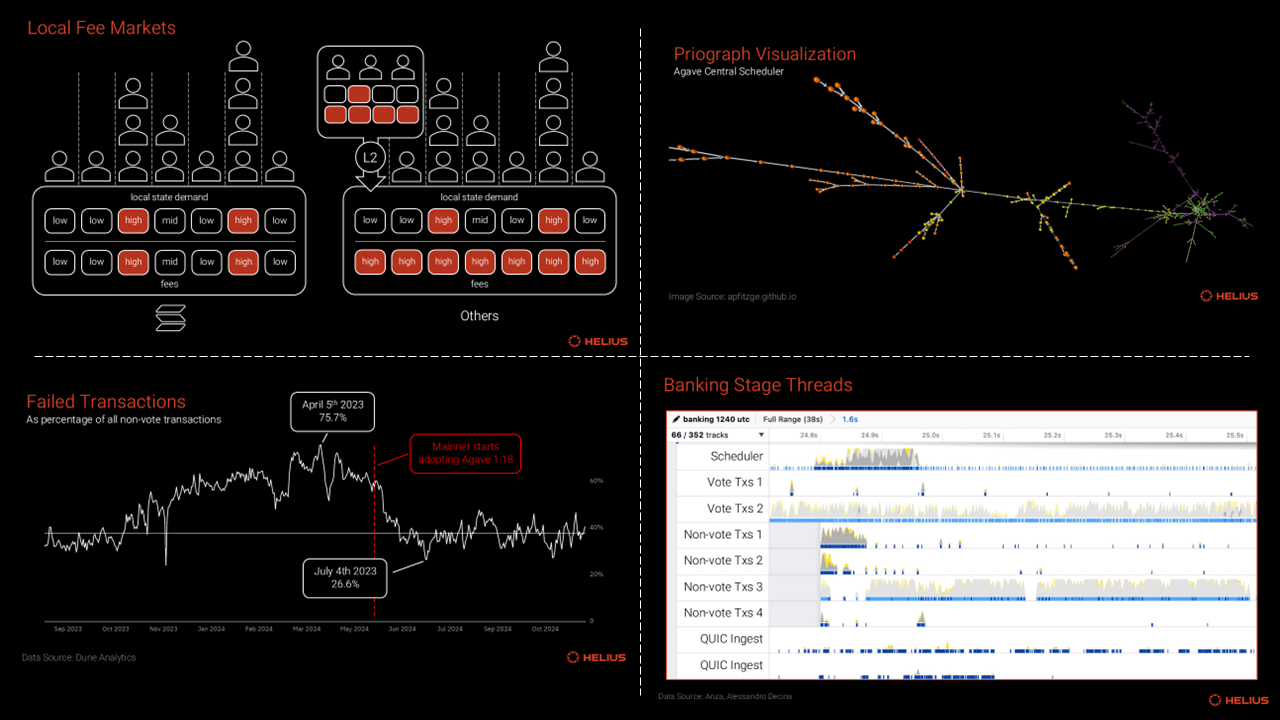

Solana’s technical architecture makes it uniquely suited for asset tokenization at scale. Capable of processing up to 65,000 transactions per second (TPS) with near-zero fees, Solana offers what legacy financial rails cannot: instant settlement and cost efficiency. This is not theoretical – it translates into real-world adoption by major players.

HSBC, Bank of America, and the Monetary Authority of Singapore have all partnered with Solana through R3’s integration initiatives (FT.com). These integrations enable global banks to tokenize bonds, equities, treasuries, and other RWAs directly on-chain – reducing friction while maintaining regulatory compliance.

The impact is measurable: BlackRock recently expanded its BUIDL tokenized Treasury fund onto Solana, bringing over $25.2 million in fresh assets onto the network (Elevenews). This institutional confidence underscores why capital allocators are increasingly favoring Solana over slower or costlier alternatives.

Solana (SOL) Price Prediction 2026-2031

Forecast based on Solana’s RWA leadership, institutional adoption, and current $185.09 price (July 2025)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Yearly Change (%) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $155.00 | $210.00 | $330.00 | +13% | Continued RWA growth, moderate market upswing |

| 2027 | $170.00 | $265.00 | $425.00 | +26% | Mainstream RWA adoption, increased institutional inflows |

| 2028 | $190.00 | $320.00 | $540.00 | +21% | Tech upgrades, regulatory clarity, competition intensifies |

| 2029 | $220.00 | $390.00 | $700.00 | +22% | Global tokenization boom, new financial products on Solana |

| 2030 | $250.00 | $480.00 | $900.00 | +23% | McKinsey’s $2T RWA estimate nears, Solana market cap surges |

| 2031 | $280.00 | $575.00 | $1,120.00 | +20% | Mature RWA market, Solana solidifies top-tier blockchain status |

Price Prediction Summary

Solana’s price outlook for 2026-2031 is robust, reflecting its dominant role in real-world asset tokenization, rapid institutional adoption, and technical leadership. The base case scenario projects a steady, double-digit annual growth rate, with average prices rising from $210 in 2026 to $575 by 2031. Bullish scenarios see SOL potentially exceeding $1,100 if RWA adoption accelerates and global financial markets embrace tokenization. Bearish scenarios remain above 2025 lows, reflecting Solana’s strong fundamentals and network effects.

Key Factors Affecting Solana Price

- Explosive growth in real-world asset (RWA) tokenization on Solana

- Major institutional adoption and partnerships (e.g., HSBC, BlackRock, Bank of America)

- Technical advantages: high throughput, low fees, scalability

- Regulatory clarity enabling broader tokenization use cases

- Competition from Ethereum and emerging RWA blockchains

- Global macroeconomic conditions affecting crypto markets

- Developer ecosystem and ongoing protocol upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

User Adoption Explodes Alongside Developer Activity

The downstream effect of institutional adoption is clear on-chain activity. In just one month during Q2 2025, the number of unique wallets holding tokenized stocks on Solana shot up by 684%. That kind of exponential user growth signals both speculative interest and genuine utility being unlocked through DeFi protocols built atop Solana’s infrastructure.

The developer ecosystem has responded accordingly. A thriving community continues to roll out new DeFi primitives tailored for RWAs – from fractionalized real estate markets to instant-settlement bond trading platforms. The result? An increasingly liquid secondary market for traditionally illiquid assets like private credit or fine art.

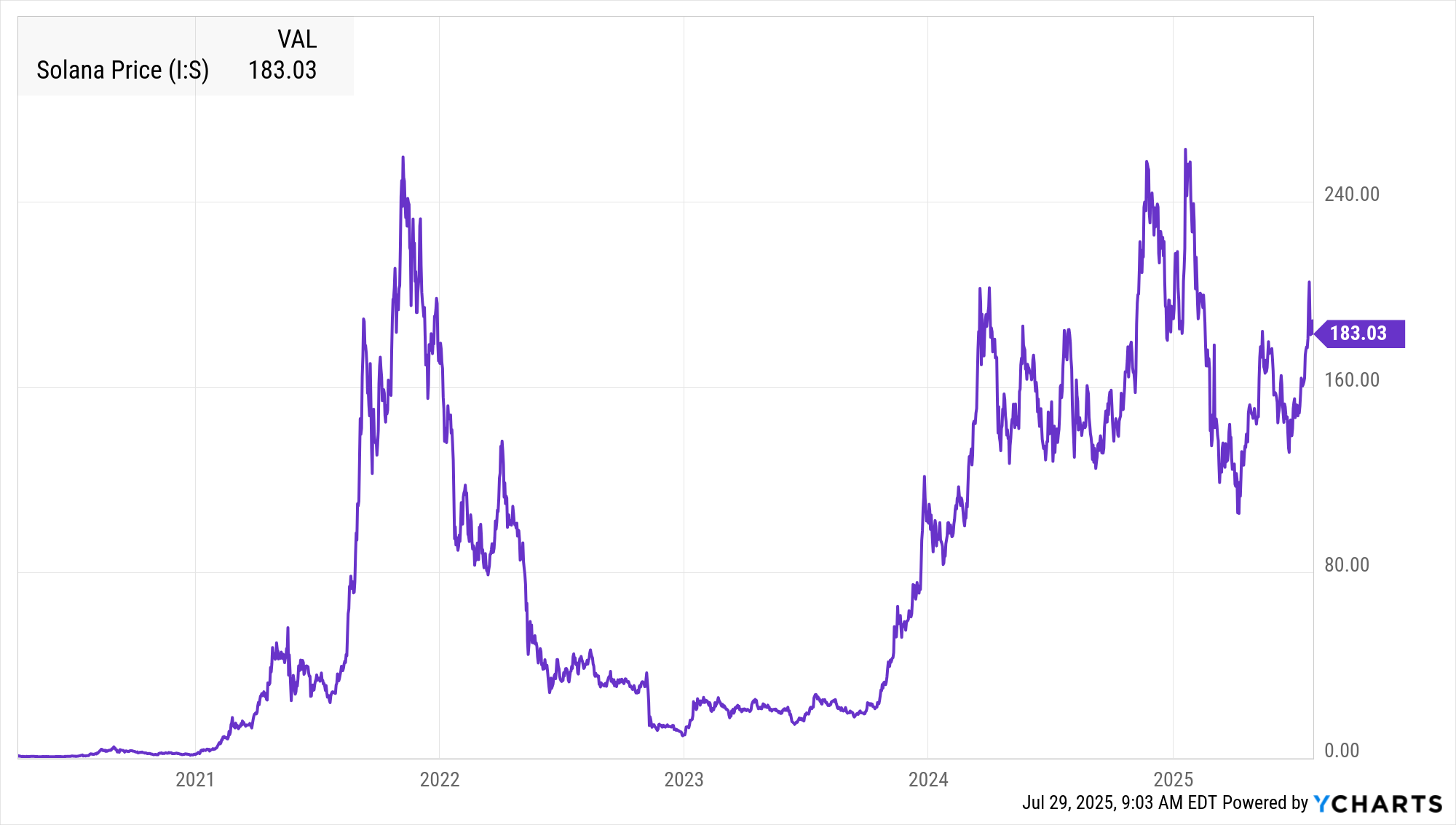

The numbers don’t lie: Solana’s lead in RWA tokenization is accelerating, not plateauing. As of July 29,2025, the Binance-Peg SOL (SOL) price sits at $185.09, reflecting both market confidence and increasing on-chain utility. This price level is underpinned by a surge in real economic activity, not just speculative flows, a crucial distinction as blockchain moves from hype cycles to tangible adoption.

Key Drivers Behind Solana’s Tokenization Dominance

Several factors distinguish Solana in the crowded field of blockchain asset tokenization:

Top Reasons Solana Leads in RWA Tokenization

-

Unmatched Transaction Speed and Scalability: Solana can process up to 65,000 transactions per second with near-zero fees, enabling efficient and cost-effective real-world asset (RWA) tokenization at scale.

-

Significant Market Growth in 2025: Solana’s RWA sector surged by 140.6% in 2025, reaching a total value of $418 million in tokenized assets, far outpacing the broader RWA market’s 62.4% growth.

-

Major Institutional Adoption: Leading financial institutions like HSBC, Bank of America, and the Monetary Authority of Singapore have partnered with Solana via R3’s integration for asset tokenization initiatives.

-

Expansion of BlackRock’s Tokenized Treasury Fund: BlackRock has brought over $25.2 million to Solana by expanding its BUIDL tokenized Treasury fund onto the network, demonstrating institutional confidence.

-

Rapid User Adoption: The number of unique wallets holding tokenized stocks on Solana increased by 684% in a single month, reflecting explosive growth in user participation and trust.

-

Thriving Developer Ecosystem: Solana’s robust and active developer community accelerates innovation, supporting the launch of new RWA tokenization projects and tools.

-

Low Transaction Costs: Solana’s near-zero transaction fees make it highly attractive for institutions and individuals looking to tokenize and trade real-world assets without prohibitive costs.

- Throughput and Cost: Near-zero fees and industry-leading TPS make it viable for high-frequency financial products.

- Institutional Integration: Direct partnerships with global banks and asset managers drive real-world use cases.

- Developer Ecosystem: Rapid rollout of DeFi protocols designed specifically for RWA markets increases liquidity and user engagement.

- User Growth: A 684% increase in unique wallets holding tokenized stocks demonstrates robust retail interest.

This ecosystem effect compounds: every new institutional player or protocol adds network value, attracting even more users and developers. It’s a virtuous cycle that has propelled Solana’s RWA sector to outpace not only Ethereum but also the aggregate market by a wide margin (OKX).

What’s Next for Solana Real World Assets?

The roadmap for Solana real world assets extends far beyond current milestones. As regulatory frameworks mature and more traditional assets become eligible for on-chain representation, expect further acceleration. The next phase will likely see:

- Tokenized private credit markets, opening yield opportunities previously locked away from retail investors.

- On-chain settlement for commodities and alternative assets, making global trading more efficient than ever before.

- Tighter integration with legacy financial systems, as evidenced by ongoing work with central banks and payment networks.

The feedback loop between institutional capital, developer innovation, and user adoption is set to intensify. For anyone tracking blockchain asset tokenization or seeking exposure to this secular trend, the data points to one conclusion: Solana is setting the pace, and there’s little sign of it slowing down.