Solana DEX Volume Surge: Visual Breakdown of Top Platforms in July 2025

July 2025 will be remembered as the month Solana’s decentralized exchange (DEX) ecosystem stepped into the limelight. With total DEX trading volumes surpassing a jaw-dropping $1.4 trillion, Solana has not only rewritten its own record books but also forced the entire DeFi sector to take notice. This explosive growth was fueled by a perfect storm of institutional interest, surging user activity, and the irresistible allure of memecoin trading. As $SOL hovers at $189.81, the network’s major DEX platforms are basking in newfound attention, and none more so than Raydium, Orca, SolFi, and Meteora.

Solana’s $1.4 Trillion DEX Volume: A Visual Surge

Let’s put this in perspective: just a year ago, Solana’s monthly DEX volume was impressive but nowhere near today’s levels. Fast forward to July 2025 and we’re looking at a 140% year-on-year surge. The drivers? A thriving ecosystem of traders drawn by lightning-fast transactions, low fees, and an ever-expanding menu of assets, especially memecoins that have become legendary for their wild swings.

The leaderboard is clear: Raydium stands tall as the undisputed volume king, processing over $1.2 billion in trades within a single 24-hour window (source). But don’t overlook Orca, beloved for its intuitive interface and deep liquidity pools; SolFi, which has quietly carved out its own niche; and rising star Meteora, whose innovative features are winning over DeFi veterans and newcomers alike.

The Big Four: Raydium, Orca, SolFi and Meteora Take Center Stage

Top Solana DEX Platforms: July 2025 Standouts

-

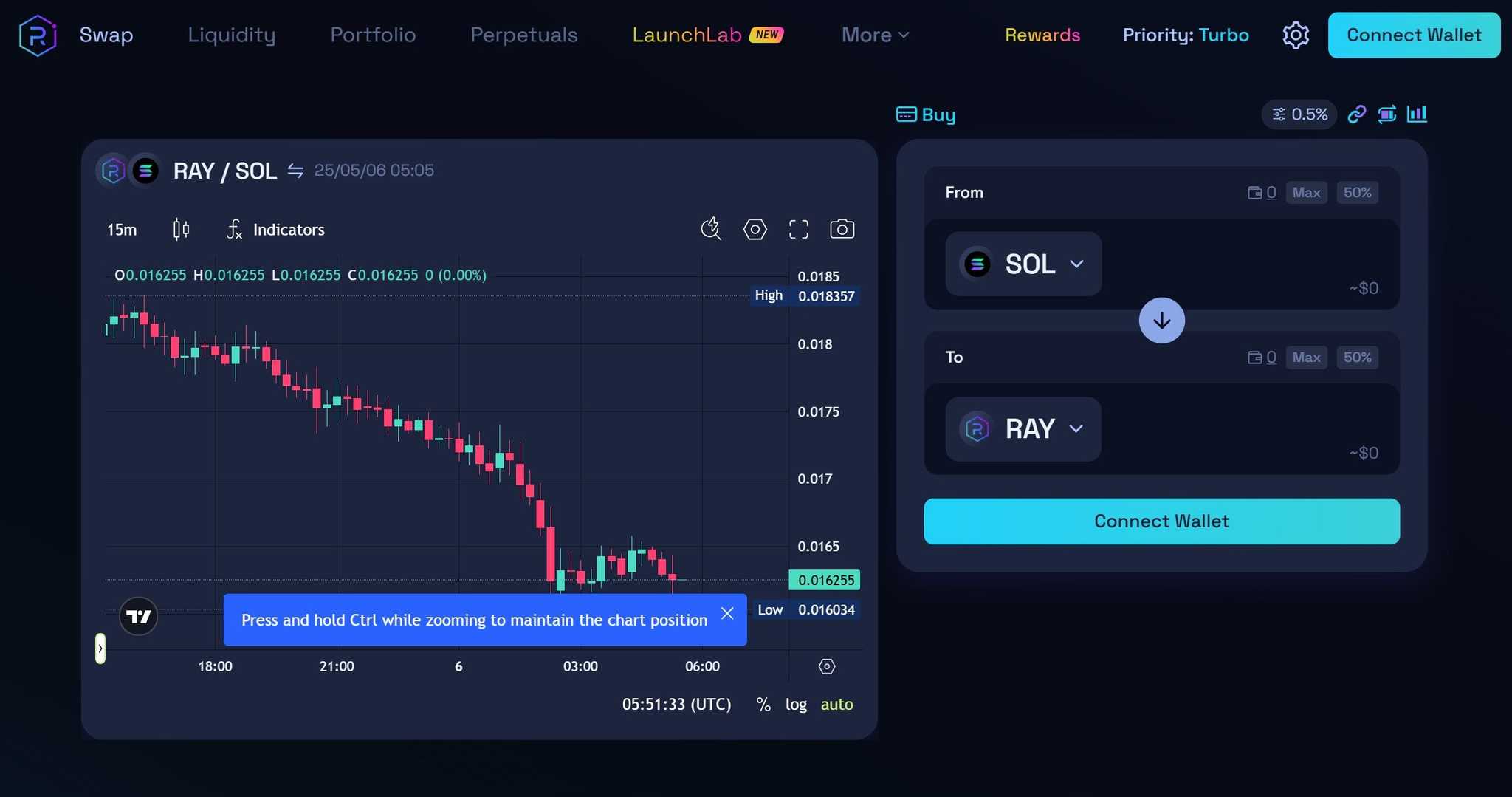

Raydium dominated July 2025 with over $1.2 billion in 24-hour trading volume, fueled by surging memecoin trades and institutional inflows. Its deep liquidity pools and lightning-fast swaps made it the go-to DEX as Solana’s total DEX volume soared to $1.4 trillion.

-

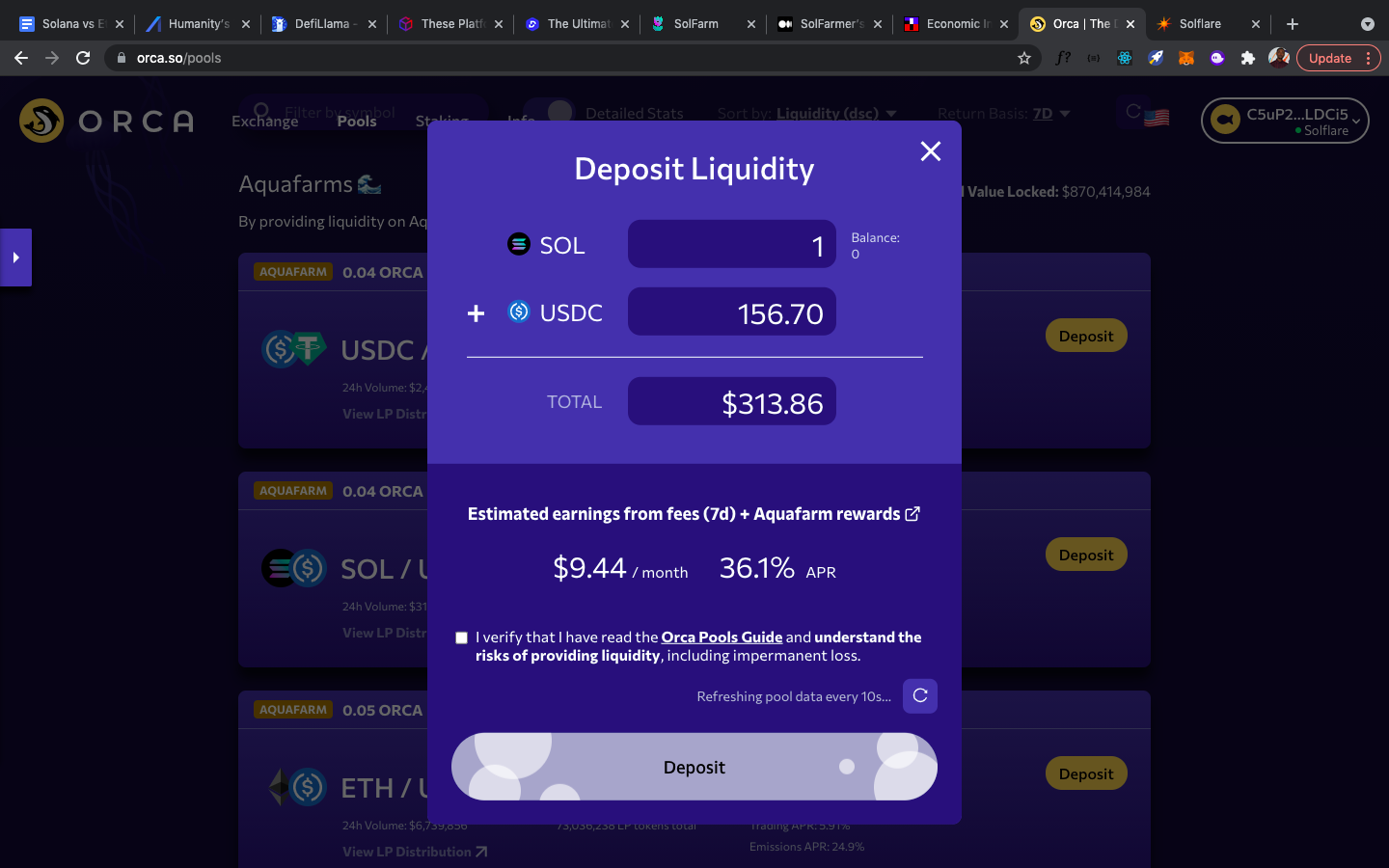

Orca continued to attract a massive user base in July, offering an intuitive interface and efficient swaps. Its strong community engagement and reliability helped drive Solana’s daily transaction count above 125 million.

-

SolFi emerged as a rising star, gaining traction with innovative DeFi features and seamless integrations. Its growing ecosystem contributed to the record-breaking DEX activity on Solana this month.

-

Meteora made waves as a key player in July 2025, boosting trading activity with dynamic liquidity solutions and attracting both retail and institutional traders to the Solana DeFi scene.

What sets these four apart from the rest?

- Raydium: The powerhouse of Solana DEXs, Raydium continues to dominate thanks to its hybrid order book/AMM model and robust partnerships. Its role in driving memecoin mania, think TRUMP token, is impossible to ignore (source).

- Orca: Known for user-friendly swaps and deep liquidity on major pairs like SOL-USDC and SOL-memecoins. Orca has become a gateway for new users discovering DeFi on Solana.

- SolFi: While less flashy than Raydium or Orca, SolFi’s focus on stability and risk management appeals to institutional players seeking reliable execution in volatile times.

- Meteora: The disruptor of 2025, Meteora brings advanced analytics tools and cross-chain capabilities that attract sophisticated traders hungry for an edge.

The numbers speak volumes: Between July 14 and July 20 alone, these four platforms handled over $22 billion in trading activity (source). That’s more than most chains see in an entire quarter!

What’s Powering This Unprecedented Growth?

The magic behind this surge isn’t just hype, it’s a confluence of tangible factors:

- Institutional Influx: The debut of a dedicated SOL staking ETF plus high-profile partnerships (like R3 for real-world asset tokenization) have brought heavyweight capital into the ecosystem.

- User Activity at All-Time Highs: Over 125 million daily transactions, with new wallets popping up at record speed.

- The Memecoin Effect: Trading frenzy around tokens like TRUMP has sent volumes soaring, especially on Raydium where these assets find their deepest liquidity.

- NFT Integration and Gamification: Platforms are weaving NFTs into trading experiences, keeping users engaged well beyond simple swaps.

SOL Price Watch: Above $180 as Ecosystem Expands

This momentum has propelled $SOL to trade consistently above $180 throughout July, with current prices at $189.81. While day-to-day fluctuations remain (with recent highs at $205.92), market sentiment is overwhelmingly bullish as capital continues to flow into both blue-chip tokens and experimental new projects across these top DEXs.

Solana (SOL) Price Prediction 2026-2031

Forecast based on July 2025 DEX volume surge, institutional adoption, and market trends

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $145.00 | $210.00 | $285.00 | +11% | Continued institutional inflows and steady DeFi growth support new all-time highs, but volatility remains due to potential regulatory headwinds. |

| 2027 | $170.00 | $260.00 | $340.00 | +24% | Mainstream adoption of Solana-based assets and further ETF approvals drive bullish sentiment; competition from Ethereum and L2s tempers upside. |

| 2028 | $190.00 | $300.00 | $410.00 | +15% | Expansion of real-world asset tokenization and global DeFi integration boost SOL demand. Macro uncertainty could cause wider price swings. |

| 2029 | $210.00 | $335.00 | $480.00 | +12% | Network scalability upgrades increase throughput, attracting new institutional partners. Bearish macro or regulatory shocks could test support. |

| 2030 | $230.00 | $375.00 | $560.00 | +12% | Widespread DeFi and NFT mainstreaming solidifies SOL as a top-3 asset. New DEX innovations and token utility drive further growth. |

| 2031 | $260.00 | $420.00 | $650.00 | +12% | Solana achieves near-ubiquitous DeFi presence; bullish scenario sees SOL challenging Ethereum’s market cap, but competition remains fierce. |

Price Prediction Summary

Solana’s rapid DEX volume growth and increasing institutional participation position it for continued price appreciation through 2031. Average annual growth rates are strong but moderate year-over-year, reflecting maturing markets and rising competition. Minimum and maximum price ranges account for both bullish adoption scenarios and potential regulatory or macroeconomic setbacks.

Key Factors Affecting Solana Price

- Sustained DEX volume growth and user activity on Solana platforms

- Institutional adoption via ETFs and real-world asset partnerships (e.g., R3)

- Technological upgrades improving scalability and transaction speeds

- Regulatory clarity or uncertainty in the US and globally

- Competition from Ethereum, L2s, and emerging blockchain ecosystems

- Mainstream DeFi and NFT adoption trends

- Potential for new killer apps or shifts in crypto market cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Zooming out, the July 2025 DEX surge is more than just a numbers story, it’s a testament to Solana’s evolving culture and technical prowess. The network’s ability to process massive transactional loads without breaking a sweat has become its calling card. This reliability is exactly what institutional players crave, and it’s why the likes of Raydium and Orca are seeing not only retail but also professional money pour in.

How Each Platform Shapes the Solana DEX Landscape

Raydium isn’t just leading in volume; it’s setting the tone for innovation. Its hybrid model, blending order book depth with AMM efficiency, gives traders flexibility and speed that few other chains can match. Raydium’s role as a launchpad for new tokens and its deep integration with Solana’s NFT scene have turned it into a hub for both speculation and serious capital allocation.

Orca, meanwhile, has captured hearts (and wallets) with its playful UI and focus on community-driven pools. Newcomers flock here for simplicity, while power users stick around for the granular control over swaps and liquidity provision. It’s no wonder Orca consistently ranks as one of the most active DEXs by unique wallets.

SolFi may operate under the radar compared to its flashier peers, but its commitment to security and transparency has made it a favorite among risk-averse traders and institutions. With advanced risk management tools, SolFi offers peace of mind during volatile market swings, a hidden engine powering Solana’s credibility.

Meteora, the upstart disruptor, is making waves with cross-chain features that let users tap into liquidity beyond Solana. Its sophisticated analytics dashboard gives traders an edge in fast-moving markets, while gamified rewards keep engagement high. In many ways, Meteora embodies the spirit of DeFi in 2025: agile, data-driven, and always evolving.

Community Pulse: What Traders Are Saying

Across Discord servers and Crypto Twitter, sentiment toward these platforms is electric. Users praise Raydium’s reliability during memecoin launches; others highlight Orca’s seamless mobile experience or Meteora’s analytics for giving them an edge over whales. The consensus? If you’re trading on Solana in 2025, you’re likely touching at least one (if not all) of these four platforms every week.

Which Solana DEX did you use most in July 2025?

Solana’s DEX trading volume hit a record $1.4 trillion in July 2025, with platforms like Raydium, Orca, SolFi, and Meteora leading the way. Let us know which DEX was your go-to this month!

What Comes Next for Solana DEXes?

The $1.4 trillion milestone isn’t just a high-water mark, it’s fuel for even greater ambition across the ecosystem. Expect to see:

- More cross-chain integrations: As Meteora demonstrates success bridging assets from other networks, look for Raydium and Orca to follow suit.

- Advanced trading features: Options markets, perpetuals, and on-chain derivatives will become standard as user sophistication grows.

- Diversification of assets: Beyond memecoins and blue-chips, think real-world assets tokenized via R3 partnerships or NFT-backed collateral pools.

- User experience upgrades: Gamification elements pioneered by Meteora could become baseline expectations across all major DEXs.

The path ahead feels wide open, and fiercely competitive, as each platform pushes boundaries to capture new flows in an ever-expanding DeFi universe.

If July was any indication, Solana’s DEX ecosystem is only just getting started. The race between Raydium, Orca, SolFi, and Meteora will define not just trading volumes, but also how decentralized finance feels for millions of users worldwide.