How Tokenized Equities Are Changing DeFi on Solana: Kamino xStocks Integration Explained

Solana’s DeFi ecosystem is on fire in 2025, and the latest breakthrough comes straight from Kamino Finance. With the integration of xStocks, tokenized equities that mirror real-world shares, Kamino is rewriting the rules for decentralized lending. This isn’t just another feature update. It’s a seismic shift that’s bringing traditional finance assets and the wild world of DeFi together, all powered by Solana’s blazing-fast blockchain and Chainlink’s ultra-reliable data streams.

Tokenized Equities Arrive: What Are xStocks?

If you’ve ever dreamed of using your Apple or Tesla shares as collateral in DeFi, xStocks make it possible. These are digital assets issued as SPL tokens on Solana (and BEP-20s on BNB Chain), each backed 1: 1 by actual shares held with regulated custodians. The result? You get 24/7 trading, fractional ownership, and seamless onchain execution, all without leaving the crypto universe.

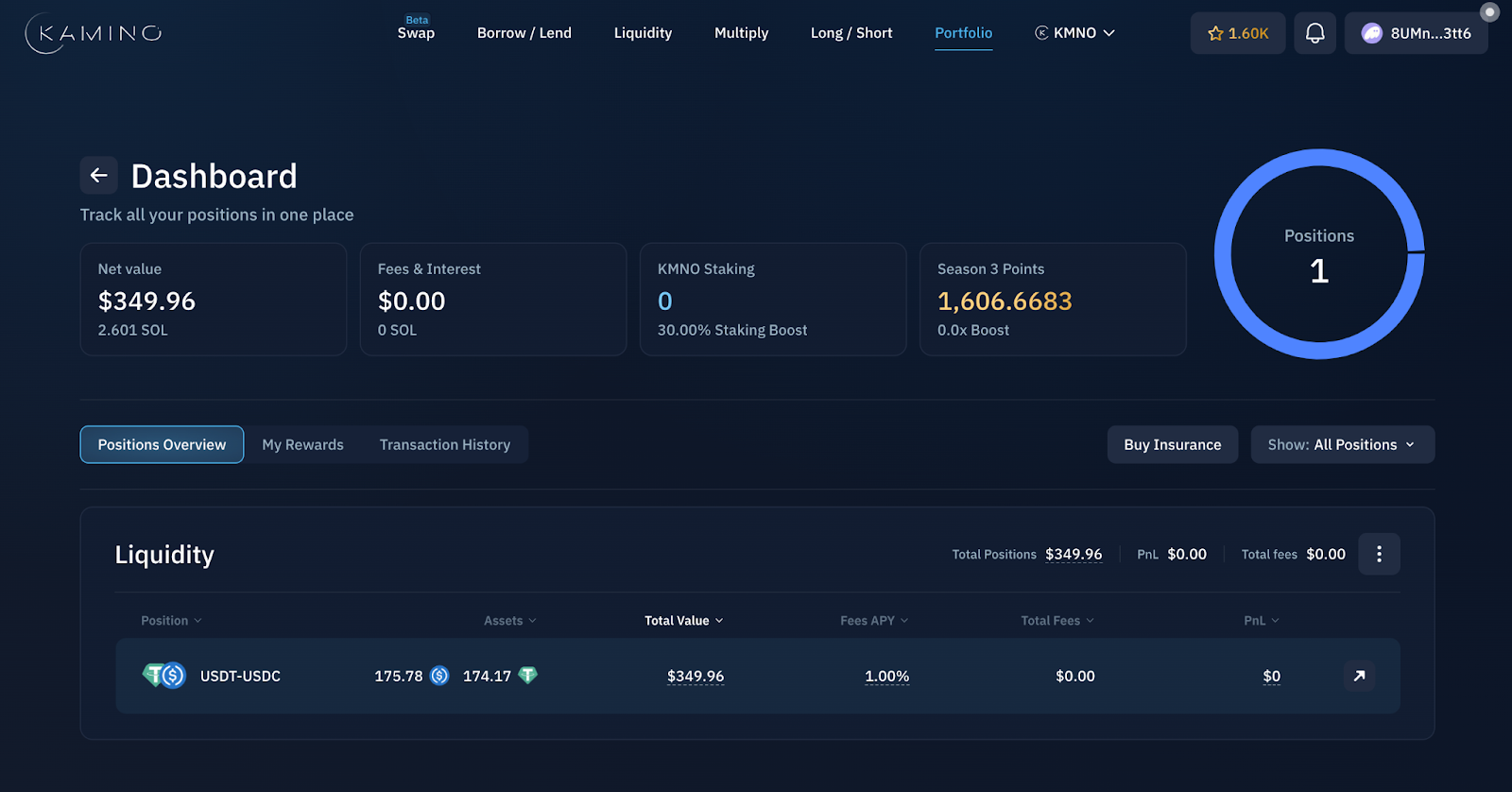

xStocks aren’t just theoretical anymore. They’re already live on major platforms like Bybit, Kraken, Raydium, Jupiter, and now Kamino Finance, the largest money market protocol on Solana with over $2 billion in liquidity. This is a big deal for anyone who wants to unlock value from their equity holdings while staying deep in the DeFi game.

How Kamino Finance Makes It Work

The magic behind this integration is Chainlink’s custom-built xStocks oracle. Forget stale price feeds, this system delivers sub-second updates for tokenized equities. That means when you deposit your xStock tokens as collateral on Kamino Lend, you’re guaranteed accurate, real-time valuations at all times. No more worrying about oracle lag or mispriced liquidations!

This level of precision is crucial when dealing with volatile markets or large loans. Kamino users can now borrow stablecoins against their tokenized equities with confidence, knowing that their collateral is being valued fairly and securely at every moment.

Solana (SOL) Price Prediction 2026–2031

Forecast Based on xStocks Integration, DeFi Growth, and Real-World Asset Adoption

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change vs. 2025 Avg. |

|---|---|---|---|---|

| 2026 | $120.00 | $185.00 | $275.00 | +12.6% |

| 2027 | $110.00 | $210.00 | $340.00 | +27.8% |

| 2028 | $130.00 | $245.00 | $410.00 | +49.0% |

| 2029 | $145.00 | $285.00 | $495.00 | +73.3% |

| 2030 | $165.00 | $335.00 | $600.00 | +103.7% |

| 2031 | $180.00 | $390.00 | $720.00 | +137.2% |

Price Prediction Summary

Solana’s integration of tokenized equities via Kamino and Chainlink is a strong catalyst for long-term growth. In the base case, SOL is projected to steadily appreciate as on-chain RWAs gain adoption and DeFi utility expands. The minimum scenario accounts for potential market corrections or regulatory headwinds, while the maximum scenario reflects a bullish outlook driven by mass adoption of tokenized assets, continued DeFi innovation, and expanding institutional interest. Year-over-year growth is expected to accelerate as the Solana ecosystem matures and global financial infrastructure increasingly leverages blockchain technology.

Key Factors Affecting Solana Price

- Adoption of tokenized equities and real-world assets on Solana DeFi platforms.

- Kamino’s role as a major lending protocol, increasing SOL’s utility and demand.

- Chainlink’s advanced oracle infrastructure, improving collateral reliability and unlocking new financial products.

- Market cycles typical to cryptocurrency, including periods of volatility and corrections.

- Potential regulatory changes in the US, EU, and Asia that could impact DeFi and tokenized asset markets.

- Competition from other smart contract platforms and RWA-focused blockchains.

- Macro-economic trends affecting risk appetite and global crypto investment flows.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why This Matters for Solana DeFi in 2025

The arrival of tokenized equities like xStocks isn’t just a novelty, it represents a massive leap forward for decentralized finance on Solana. We’re seeing the lines blur between traditional finance (TradFi) and DeFi as never before. According to recent data, there’s now over $25 billion in real-world assets (RWAs) locked on-chain, a number that’s only set to grow as more protocols embrace innovations like this (source).

What does this mean for users?

- Access to new collateral types: Your stock portfolio can now power your DeFi strategies.

- Deeper liquidity: More asset types mean bigger, healthier lending markets.

- CEX-like experience: Thanks to Chainlink Data Streams’ low-latency infrastructure, trading feels as smooth as any centralized exchange, without sacrificing decentralization.

This next-gen setup opens up advanced strategies: think leveraged yield farming using stocks as collateral or swapping between equities and crypto instantly within Solana’s lightning-fast ecosystem.

Kamino’s xStocks Integration: Real-World Impact and User Experience

With Solana trading at $164.40 (according to the latest market data), Kamino’s move to support xStocks as collateral is already making waves across the DeFi landscape. The protocol’s combination of deep liquidity, rapid execution, and robust security standards sets a new benchmark for what users can expect from decentralized lending platforms.

Here’s what stands out for everyday users and institutions alike:

Top Benefits of Using xStocks as Collateral on Kamino

-

Access to Real-World Assets 24/7: xStocks represent actual shares of major companies, issued as SPL tokens on Solana, enabling users to leverage real-world equities as collateral any time, day or night.

-

Instant, Accurate Collateral Valuation: Kamino uses Chainlink’s custom-built xStocks oracle to provide sub-second price updates, ensuring your collateral is always valued accurately and securely.

-

Fractional Ownership and Greater Flexibility: xStocks allow for fractionalized shares, so users can deposit any amount as collateral, making DeFi lending more accessible to everyone.

-

Enhanced Liquidity and Borrowing Power: By using tokenized equities as collateral, users can unlock liquidity without selling their stocks, borrowing stablecoins directly on Kamino’s $2B+ liquidity platform.

-

Seamless Integration with Solana DeFi Ecosystem: xStocks are compatible with major Solana DeFi platforms like Kamino, Jupiter, and Raydium, allowing users to move assets and strategies across protocols easily.

-

Bridging Traditional Finance and DeFi: This integration brings the benefits of traditional equities into the decentralized world, paving the way for innovative financial strategies and broader asset utilization.

The ability to borrow stablecoins against tokenized equities is a game-changer for portfolio management. Traders and investors can unlock liquidity without selling their favorite stocks, all while maintaining exposure to both traditional and crypto assets. Imagine leveraging your Apple or Tesla shares for yield farming or swapping into SOL, all with a few clicks, 24/7.

Chainlink Data Streams: The Secret Sauce

Let’s not overlook the technical marvel powering this ecosystem. Chainlink’s sub-second price feeds are critical for accurate collateral valuations and smooth liquidations, especially when markets move fast. This integration means Solana DeFi users get the best of both worlds: high-frequency TradFi data reliability and the composability of DeFi protocols.

What’s Next for Solana Tokenized Equities?

The floodgates are officially open. With major platforms like Raydium, Jupiter, Bybit, and Kraken all supporting tokenized equities, we’re witnessing the birth of a truly global onchain capital market (source). As more real world assets get tokenized, think bonds, commodities, even real estate, the opportunity set will only expand.

Pro tip: Keep an eye on governance updates from Kamino Finance and Backed Finance as they roll out new asset types and risk parameters throughout 2025.

This is just the start. In my view, integrating tokenized equities into Solana DeFi isn’t just about convenience, it’s about building a borderless financial system that empowers anyone with an internet connection. With Kamino leading the charge at $164.40 SOL, there’s never been a more exciting time to experiment with new strategies or diversify your onchain portfolio.