Bullish Crypto Exchange Migrates to Solana: Impact on Stablecoin Adoption and Trading Infrastructure

The landscape of institutional crypto trading is undergoing a pivotal shift as Bullish, a leading institutional crypto exchange, announces its migration to the Solana blockchain. On July 9,2025, Bullish revealed it will adopt Solana-native stablecoins for its core trading and clearing operations. This move is not just a technical upgrade; it signals a broader realignment in the competitive race to build scalable, efficient trading infrastructure for the next era of digital finance.

Bullish Solana Migration: Why Now?

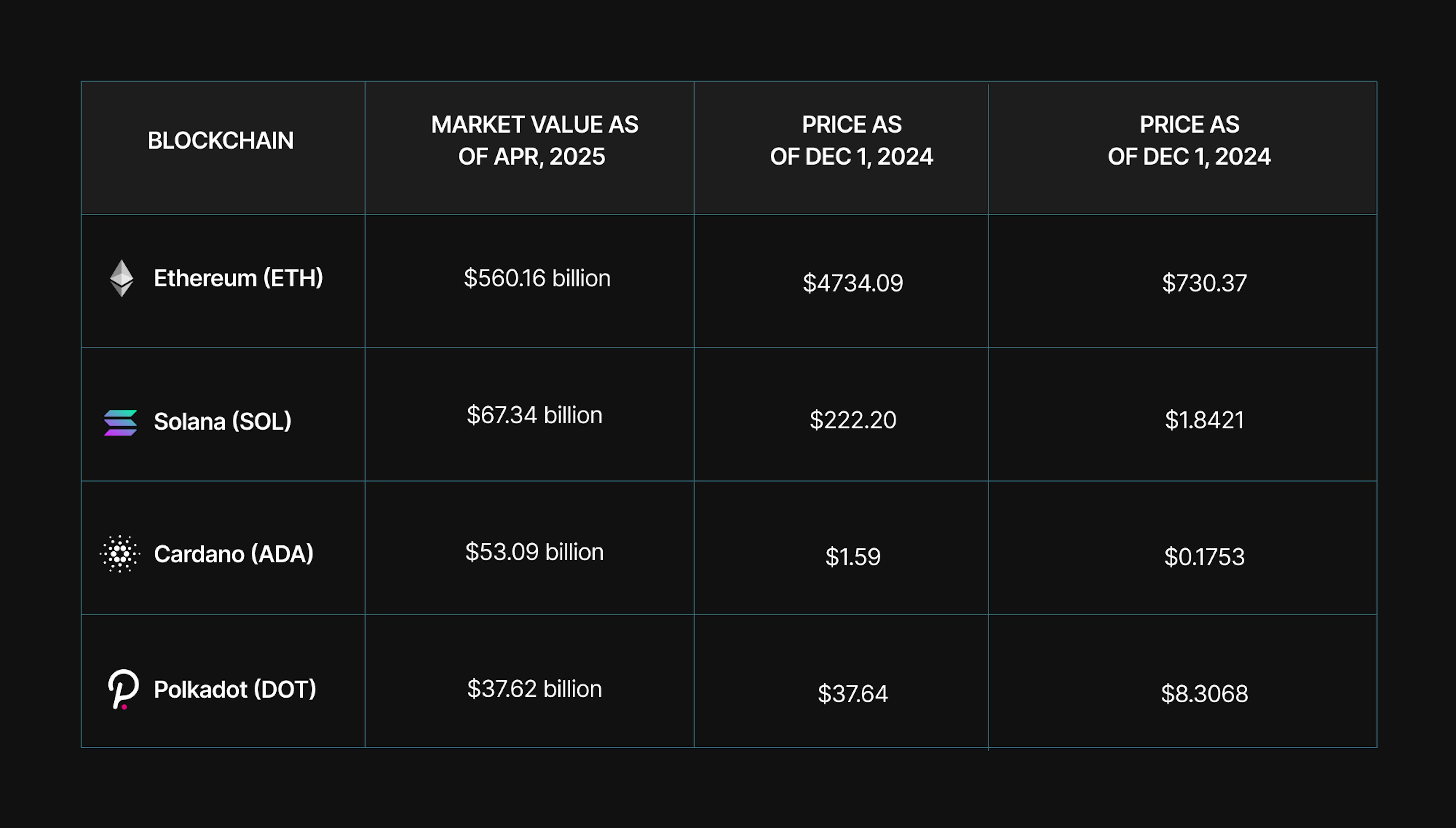

Bullish’s decision to migrate key infrastructure to Solana comes at a time when Solana’s ecosystem is experiencing explosive growth. In 2025 alone, Solana’s stablecoin supply surged by 156%, exceeding $13 billion and reflecting deepening liquidity and demand for on-chain dollar equivalents. The timing is strategic: with SOL currently priced at $158.86 (up $5.81 in the last 24 hours), market confidence in Solana remains robust despite recent volatility.

By leveraging Solana’s high-speed, low-cost architecture, Bullish aims to deliver near-instantaneous settlement and dramatically reduced transaction costs for institutional clients. The move also aligns with mounting pressure from traditional finance players seeking transparent, auditable rails for stablecoin-based transactions. (Source)

Impact on Stablecoin Adoption and Institutional Flows

The integration of Solana-native stablecoins into Bullish’s operations could act as a catalyst for even greater adoption across the institutional sector. Stablecoins have become the backbone of digital asset trading due to their price stability and utility as collateral. With Bullish making them central to its settlement layer, the door opens wider for large-scale funds and family offices that demand both speed and regulatory clarity.

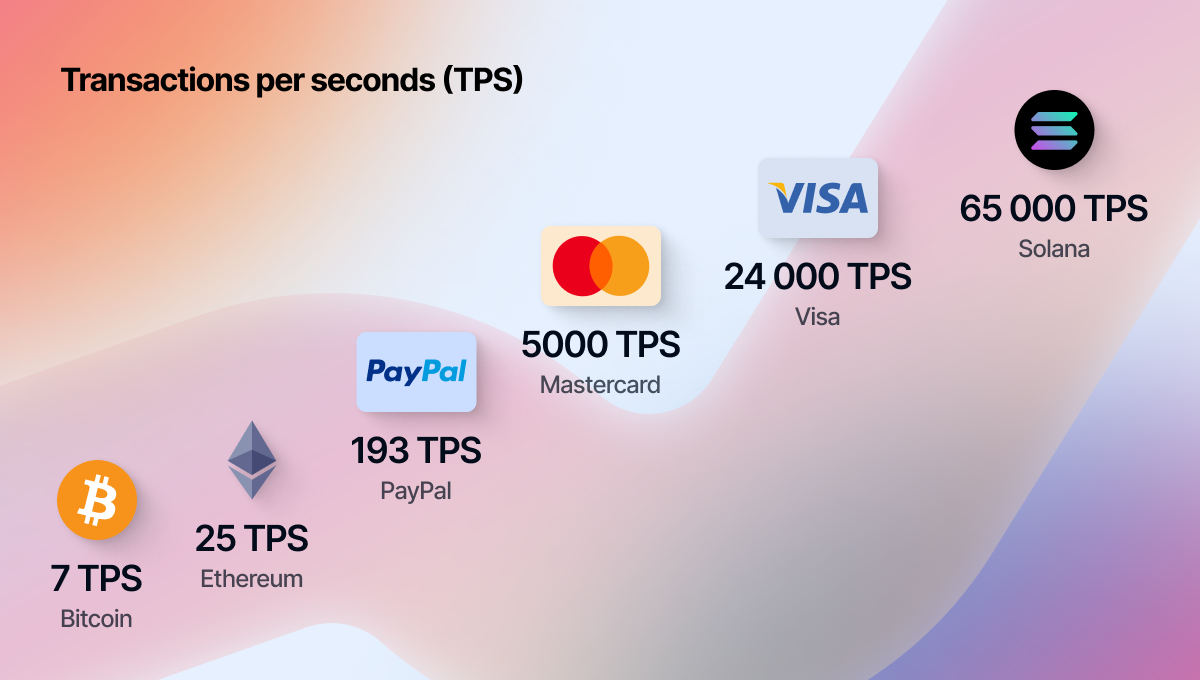

This partnership also validates Solana’s growing reputation as an institutional-grade blockchain. The network’s ability to handle thousands of transactions per second at negligible fees stands in stark contrast to legacy blockchains where congestion and high costs remain persistent issues. As more exchanges follow Bullish’s lead, we may witness a virtuous cycle of liquidity inflows that further solidifies stablecoins’ role in the global financial system.

Solana Trading Infrastructure: Building for Scale

One underappreciated aspect of this migration is its effect on trading infrastructure itself. By adopting native stablecoins on Solana, Bullish can streamline everything from custody solutions to real-time risk management tools – all while operating at web-scale speeds. This technological leap could make complex financial products like perpetuals or cross-margin positions more accessible and capital-efficient for institutions.

Solana (SOL) Price Prediction 2026-2031 (Post-Bullish Migration)

Forecast based on institutional adoption, stablecoin integration, and evolving market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Potential YoY Change (%) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $110.00 | $185.00 | $260.00 | +16% (avg) | Adoption-driven growth, but potential post-bull run correction |

| 2027 | $125.00 | $220.00 | $310.00 | +19% (avg) | Continued institutional integration, ETF approval likely |

| 2028 | $140.00 | $260.00 | $370.00 | +18% (avg) | Stablecoin dominance, increased DeFi usage |

| 2029 | $160.00 | $300.00 | $430.00 | +15% (avg) | Mainstream adoption, regulatory clarity boosts sentiment |

| 2030 | $190.00 | $355.00 | $500.00 | +18% (avg) | Global financial integration, Solana as key infra layer |

| 2031 | $220.00 | $410.00 | $580.00 | +15% (avg) | Matured ecosystem, cross-chain and RWAs expansion |

Price Prediction Summary

Solana is positioned for robust growth following Bullish’s migration and the surge in institutional stablecoin adoption. While short-term volatility remains likely, especially after strong rallies, the long-term outlook is bullish, with the potential for SOL to become a foundational asset in institutional and DeFi infrastructure. Minimum prices reflect possible bear market retracements, while maximum prices factor in optimistic adoption and technology scenarios.

Key Factors Affecting Solana Price

- Institutional stablecoin adoption and volume growth

- ETF approval and traditional finance inflows

- Solana’s continued technical improvements and scalability

- Global regulatory clarity, especially in the US and EU

- Competition from other high-throughput blockchains (e.g., Ethereum, Sui, Aptos)

- Potential for new DeFi and real-world asset (RWA) integrations

- Macro crypto market cycles (halving events, liquidity cycles, etc.)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The implications ripple far beyond just one exchange: if Bullish succeeds in demonstrating superior performance metrics on Solana, other market makers and prime brokers may be compelled to follow suit. The result? A new standard for how digital assets are traded, cleared, and settled – one that privileges speed without sacrificing security or transparency.

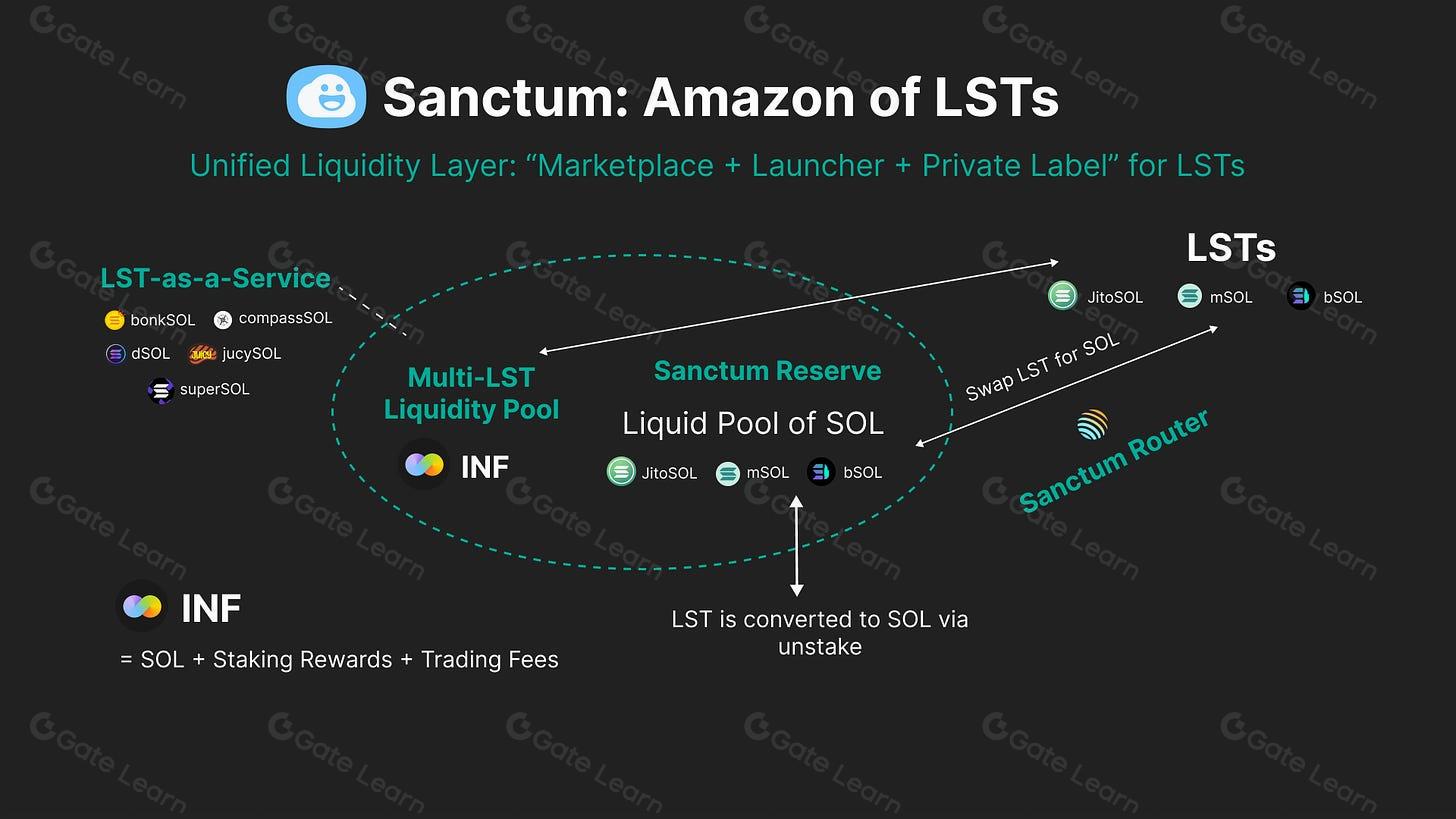

Looking at the broader Solana ecosystem in 2025, Bullish’s migration is part of a larger trend where decentralized finance (DeFi) and traditional finance (TradFi) are converging on chains that can reliably deliver institutional-grade throughput. The surge in Solana’s total value locked (TVL) and the influx of stablecoin liquidity underscore the blockchain’s growing appeal for serious capital allocators. This isn’t just about lower fees; it’s about building an infrastructure layer that can support everything from high-frequency trading desks to automated market makers and structured products.

Market data supports this thesis. Between December 2023 and August 2024, SOL rallied by 230% alongside a 160% jump in stablecoin inflows, with current stablecoin supply now topping $13 billion. These metrics highlight real demand for scalable rails. As of July 10,2025, SOL trades at $158.86, reflecting resilience even after a volatile first half of the year. The prospect of a Solana ETF approval, now seen as highly likely, adds another layer of potential institutional adoption on the horizon.

Key Benefits for Exchanges and Institutions

Key Benefits for Institutions Using Solana-Native Stablecoins

-

Ultra-fast Settlement Speeds: Solana’s high-throughput blockchain enables near-instant settlement of stablecoin transactions, streamlining institutional trading and clearing operations.

-

Significantly Lower Transaction Costs: Solana-native stablecoins offer minimal network fees, reducing operational expenses for institutions compared to Ethereum-based alternatives.

-

Enhanced Scalability for High-Volume Trading: Solana’s architecture supports high-frequency trading and large transaction volumes without congestion, ideal for institutional-grade infrastructure.

-

Improved Transparency and Auditability: On-chain stablecoin transactions on Solana provide real-time transparency, enabling better compliance and audit trails for institutional investors.

-

Robust Ecosystem and Growing Liquidity: With stablecoin supply on Solana surpassing $13 billion in 2025, institutions benefit from deep liquidity and a rapidly expanding DeFi ecosystem.

The competitive landscape is also shifting. With Bullish setting a precedent, other exchanges will need to rethink their own tech stacks or risk being left behind as clients demand faster settlement times and greater transparency. For institutions, the ability to move large sums efficiently, without getting bogged down by network congestion or high gas fees, could be a decisive factor in choosing which venues to trade on.

This migration is not without challenges. Regulatory scrutiny around stablecoins continues to evolve, especially as they become more deeply embedded in core financial plumbing. However, Bullish’s partnership with the Solana Foundation signals confidence that compliant frameworks can be built atop next-generation blockchains.

What Comes Next for Solana Trading Infrastructure?

If Bullish’s experiment proves successful, we’ll likely see a domino effect across both centralized and decentralized exchanges integrating Solana-native stablecoins. Expect innovations in cross-chain settlement protocols, new custody solutions tailored for institutional needs, and an expanded suite of programmable financial products leveraging Solana’s composability.

For traders and investors watching from the sidelines, this is a pivotal moment to reassess how infrastructure choices shape market access and liquidity dynamics. The days when blockchain selection was an afterthought are over, performance now matters as much as brand loyalty or user experience.

Final Takeaways

- The Bullish-Solana partnership could accelerate mainstream stablecoin adoption among institutions.

- Solana’s technical edge positions it as a credible backbone for next-generation trading infrastructure.

- Sustained growth in TVL and stablecoin supply signals lasting demand, not just speculative froth.

- The current SOL price of $158.86 anchors renewed optimism despite recent volatility.