How Solana is Leading the Surge in Tokenized Stock Trading: Visual Insights & Market Data

Solana is rapidly emerging as the blockchain of choice for tokenized stock trading, reshaping how investors access and interact with traditional equities. With its lightning-fast transaction speeds and low fees, Solana provides a fertile ground for innovation that’s drawing both fintech startups and established financial giants into its orbit. The result? A new era where stocks, ETFs, and even private company shares are accessible 24/7 on-chain, with transparency and efficiency that legacy systems can’t match.

Solana’s Tokenized Stock Revolution: What’s Happening in 2025?

This year has been nothing short of transformative for Solana tokenized stocks. Key players are rolling out new products at a dizzying pace:

- Republic’s Mirror Tokens: In July 2025, Republic launched “mirror tokens” on Solana, letting everyday investors buy fractional exposure to private unicorns like SpaceX and Epic Games. This move is breaking down barriers to private markets once reserved for institutional whales.

- Kraken’s xStocks: May saw Kraken debut over 50 tokenized U. S. equities (think Tesla, Nvidia, Apple) as xStocks on Solana. These tokens are fully backed by real shares and tradable around the clock for clients outside the U. S. , sidestepping Wall Street’s rigid trading hours.

- Backed Finance Expansion: By June 2025, Backed Finance brought more than 60 xStocks to both centralized exchanges (like Bybit) and DeFi platforms built on Solana. This includes blue chips like Microsoft plus broad market ETFs such as SPDR S and P 500.

The momentum is palpable – these projects aren’t just experiments. They signal a lasting shift in how global markets might operate in the years ahead.

Market Data: SOL Holds Steady at $150.80

As of July 4,2025, Solana’s native token SOL trades at $150.80, reflecting a minor dip of -0.03% over the last day (with highs of $155.67 and lows of $149.69). Despite some recent volatility – including a reported 9% weekly drop in DEX volume bringing monthly cumulative trading to $62 billion (DeFiLlama) – Solana remains a powerhouse:

- 25.4% year-on-year surge in average monthly trading volume ($156 billion)

- Sustained dominance in DEX volume, surpassing all rivals since October 2024 (Helius report)

- Tokenized stock trading now live on Kraken, Bybit, and across multiple Solana DeFi protocols (Cointelegraph)

This robust ecosystem positions Solana as the backbone for next-gen financial infrastructure – not just another altcoin chasing hype cycles.

The Institutional Shift: Banks and ETFs Embrace Public Blockchains

The adoption wave isn’t limited to crypto-native firms or retail traders; major institutions are getting involved too:

- Banks and Asset Managers: In May 2025, global banks including HSBC and Bank of America began integrating with Solana via R3 partnerships. This collaboration enables them to tokenize assets like stocks or bonds directly onto public blockchains without sacrificing compliance or control.

- Spot ETFs Go Live: July marks another milestone with the launch of the REX Shares and Osprey Funds’ Solana spot ETF (ticker SSK), representing growing regulatory acceptance.

- Read more about how tokenized stocks on Solana are changing crypto trading in 2025 here.

This convergence between traditional finance and blockchain technology is accelerating thanks to Solana’s technical strengths – ultra-fast settlement times make it ideal for high-frequency equity trades or micro futures contracts that would choke slower chains.

Solana’s role in modernizing financial markets is impossible to ignore. With real-world assets like stocks now moving on-chain, the line between traditional and decentralized finance is blurring. The ecosystem’s relentless pace of innovation, paired with active institutional participation, sets Solana apart from legacy chains and newer competitors alike.

Visual Insights: How Tokenized Equities Work on Solana

Tokenized equities on Solana function by issuing digital tokens that represent ownership of real shares. These tokens can be traded peer-to-peer or on exchanges, mirroring the price action of their underlying assets. The process is transparent and auditable, every transaction is recorded immutably on-chain, with settlement times measured in seconds rather than days.

Top Benefits of Tokenized Stock Trading on Solana

-

24/7 Trading Access: Solana enables investors to trade tokenized stocks like Apple and Tesla around the clock, breaking free from traditional market hours and offering unmatched flexibility.

-

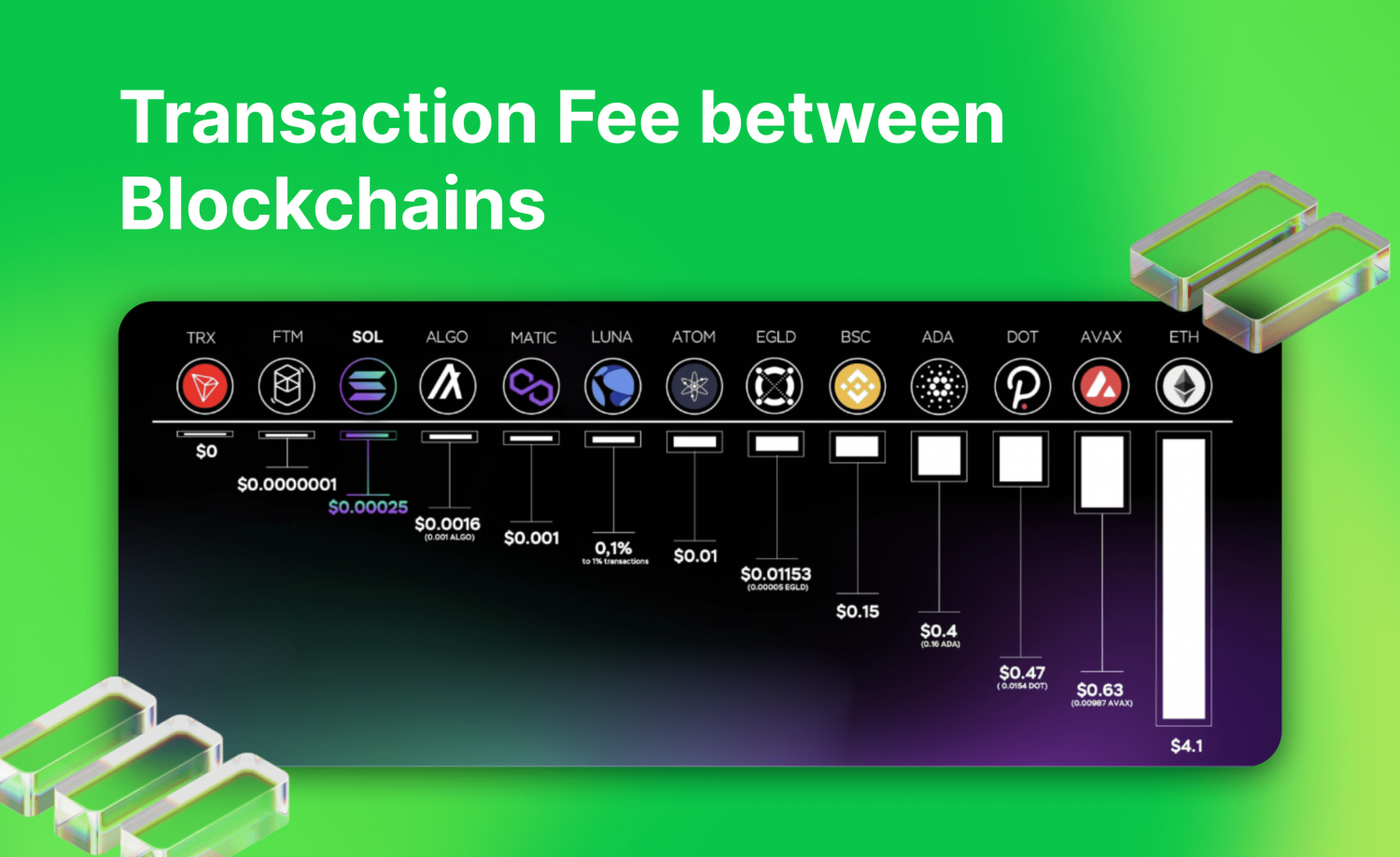

Lower Transaction Costs: By leveraging Solana’s high-speed, low-fee blockchain, tokenized stock trades incur significantly reduced fees compared to traditional brokers.

-

Fractional Ownership: Platforms like Republic’s Mirror Tokens on Solana allow investors to buy fractions of high-value stocks or private shares, democratizing access to assets like SpaceX and Epic Games.

-

Seamless Integration with DeFi: Backed Finance’s xStocks and other tokenized equities are available on Solana-based DeFi platforms, letting users trade, lend, or stake stocks in a decentralized ecosystem.

-

Global Accessibility: With tokenized stocks now live on major exchanges like Kraken and Bybit via Solana, investors worldwide can participate without geographic barriers.

-

Institutional Adoption: Partnerships with major banks and financial institutions through R3 highlight growing trust in Solana for asset tokenization, paving the way for mainstream financial integration.

For investors, this means more flexibility and access:

- 24/7 Trading: No more waiting for market open, trade equities any time, any day.

- Fractional Ownership: Buy a slice of high-priced stocks or private companies without breaking the bank.

- Lower Fees: Solana’s low network costs reduce barriers for both retail and institutional traders.

The technical architecture behind these innovations is robust. With Solana’s high throughput and sub-second finality, even large-scale trading operations are feasible without bottlenecks or prohibitive fees. This efficiency is why firms like Backed Finance and Republic chose Solana as their launchpad for tokenized equities in 2025.

“Solana’s speed and scalability are game-changers for tokenizing traditional assets. We’re seeing a genuine migration of liquidity from old rails to new. ”

Challenges Ahead: Regulation and Market Maturity

No disruptive technology comes without hurdles. Regulatory clarity remains a work in progress, the arrival of spot ETFs like SSK signals progress, but global harmonization is still needed for widespread adoption. Market participants must also navigate custody solutions, compliance standards, and potential volatility as this new asset class matures.

Yet the momentum is clear: as more blue-chip stocks and ETFs become available as tokens, and as DeFi platforms integrate these products, Solana cements its status as a foundational layer for the future of equity trading.

What’s Next? The Roadmap for Tokenized Markets on Solana

The coming months will likely see even broader adoption:

- More Private Markets: Expect additional mirror tokens representing pre-IPO tech firms or alternative assets.

- Diversification into Micro Futures and Staking ETFs: New financial products will continue to blur lines between crypto-native and traditional investments.

- Tighter Institutional Integration: As banks ramp up blockchain pilots, expect increased liquidity and new use cases built directly atop Solana’s rails.

If you’re tracking trends in Solana tokenized stocks, keep an eye on DEX volumes (currently at $62 billion monthly), major ETF launches like SSK, and the expanding list of blue-chip equities available through xStocks integration. These milestones aren’t just headlines, they’re signals that public blockchains are finally ready to underpin real financial markets at scale.