Farming and trading Solana shitcoins in 2025 is a high-octane pursuit, blending technical know-how with the need for ruthless risk management. The Solana ecosystem is exploding with new tokens, airdrop opportunities, and smart wallet innovations, but the volatility and sheer number of scams mean you need a systematic approach. Here’s how to navigate this landscape with three actionable strategies that will help you maximize opportunities—and avoid the worst pitfalls.

![]()

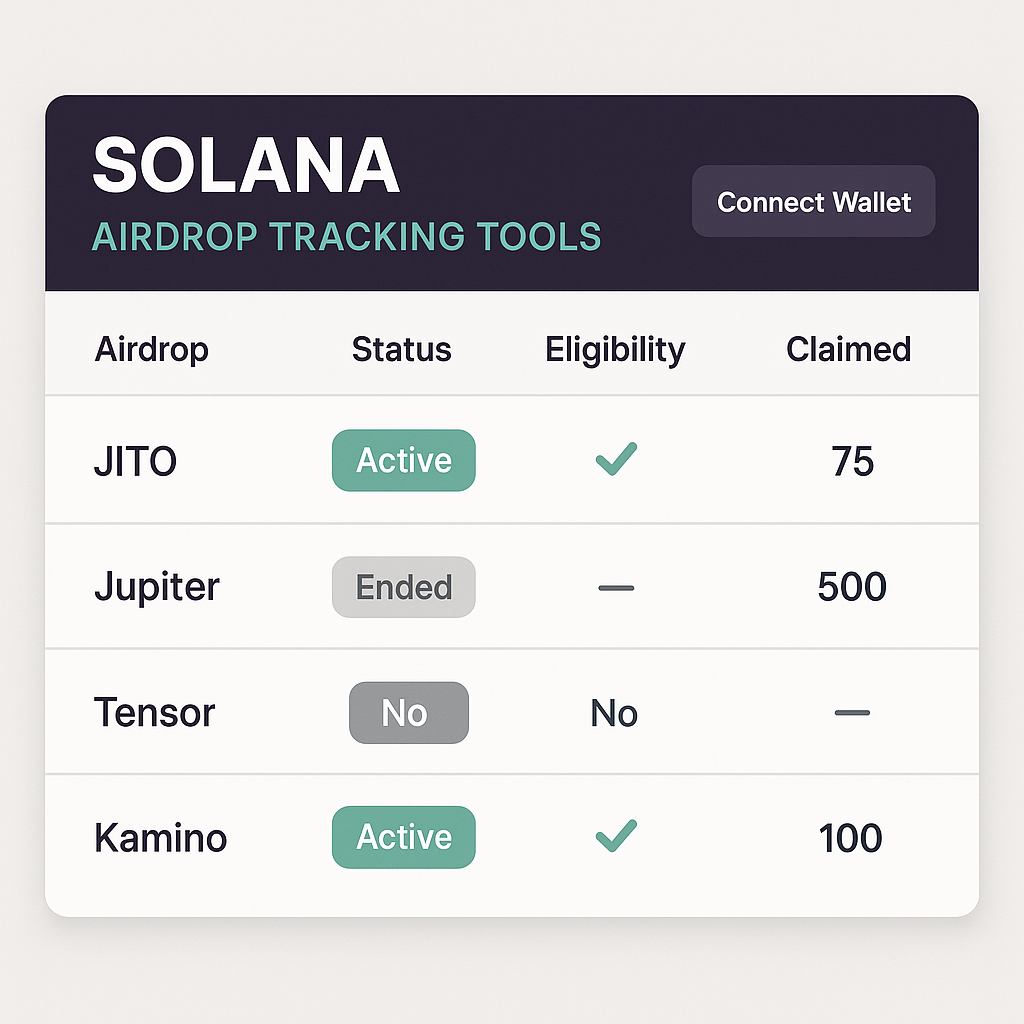

1. Leverage Early Airdrop Participation via Solana Ecosystem Tools

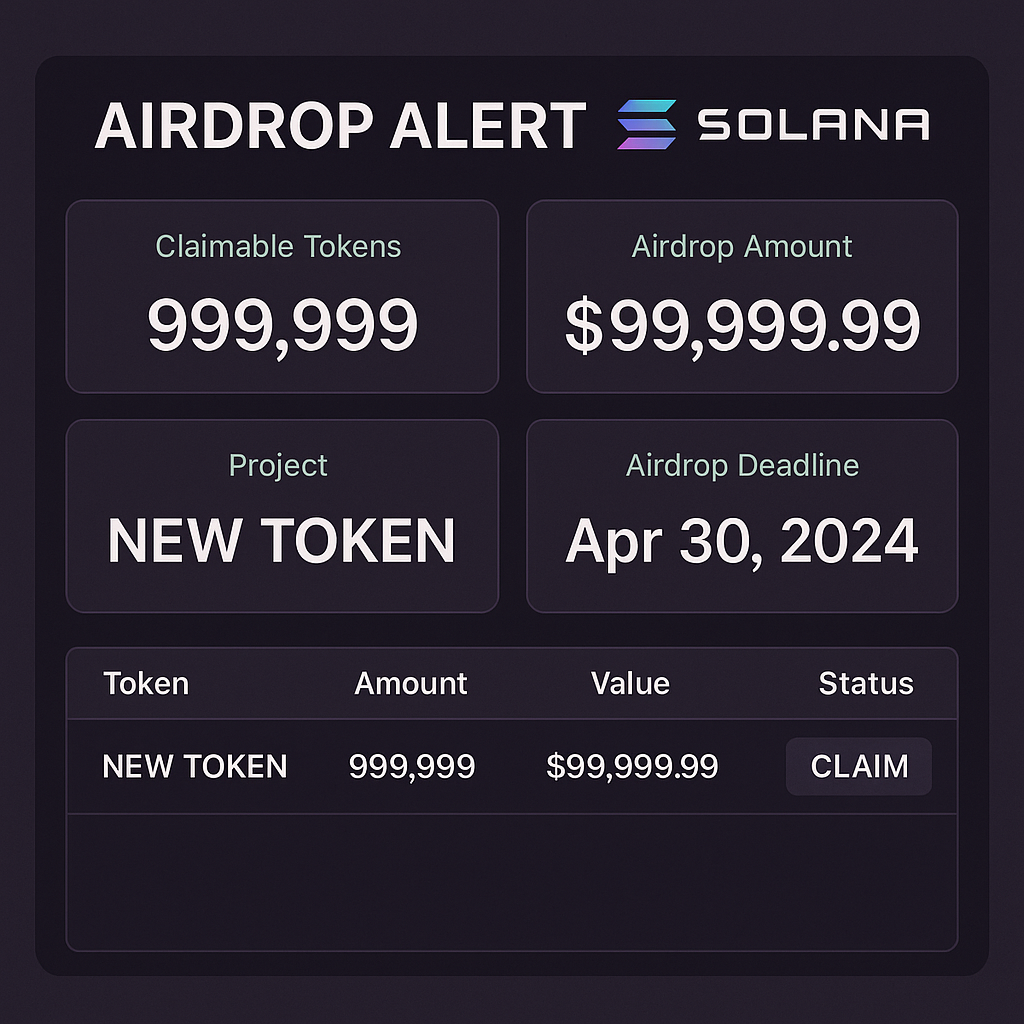

Getting in early on Solana shitcoin airdrops can yield outsized returns—if you know where to look and how to act. Platforms like Airdrop Alert, Solscan, and curated Twitter/X threads are your best friends for tracking upcoming drops. For example, Solaxy ($SOLX) has made waves as the first Layer 2 scaling solution for Solana, and its airdrop eligibility required tasks like staking SOLX, joining Discord servers, or providing liquidity on Raydium.

The key is proactive engagement—don’t just watch from the sidelines. Complete project-specific requirements early: stake tokens, interact with dApps, or add liquidity pools as instructed. This not only boosts your chances of qualifying but often puts you ahead of the inevitable post-airdrop dump.

Solana Shitcoin Farming: Airdrop Maximization Checklist

-

Leverage Early Airdrop Participation via Solana Ecosystem Tools: Track upcoming Solana shitcoin airdrops using platforms like Airdrop Alert, Solscan, and Twitter/X threads. Engage with new projects by completing tasks such as staking SOLX, joining Discords, or providing liquidity on Raydium to maximize your eligibility for high-potential airdrops.

-

Utilize Smart Wallets (e.g., Phantom, Backpack) for Secure and Efficient Trading: Set up multiple smart wallets to separate farming, trading, and long-term holding activities. Use features like in-wallet swap aggregators (Jupiter), custom token lists, and transaction simulation to reduce slippage and avoid scams while trading Solana memecoins.

-

Implement Robust Risk Management and Exit Strategies: Allocate only a small portion of your portfolio to high-risk shitcoins. Set clear profit targets and stop-loss levels for each trade. Regularly monitor token liquidity on DEXs like Raydium or Orca, and stay updated on project developments to avoid rug pulls or sudden price crashes.

Keep an eye on social media too; Twitter/X remains ground zero for real-time updates and alpha leaks about new projects. Many teams announce snapshot dates or bonus rounds exclusively through their channels.

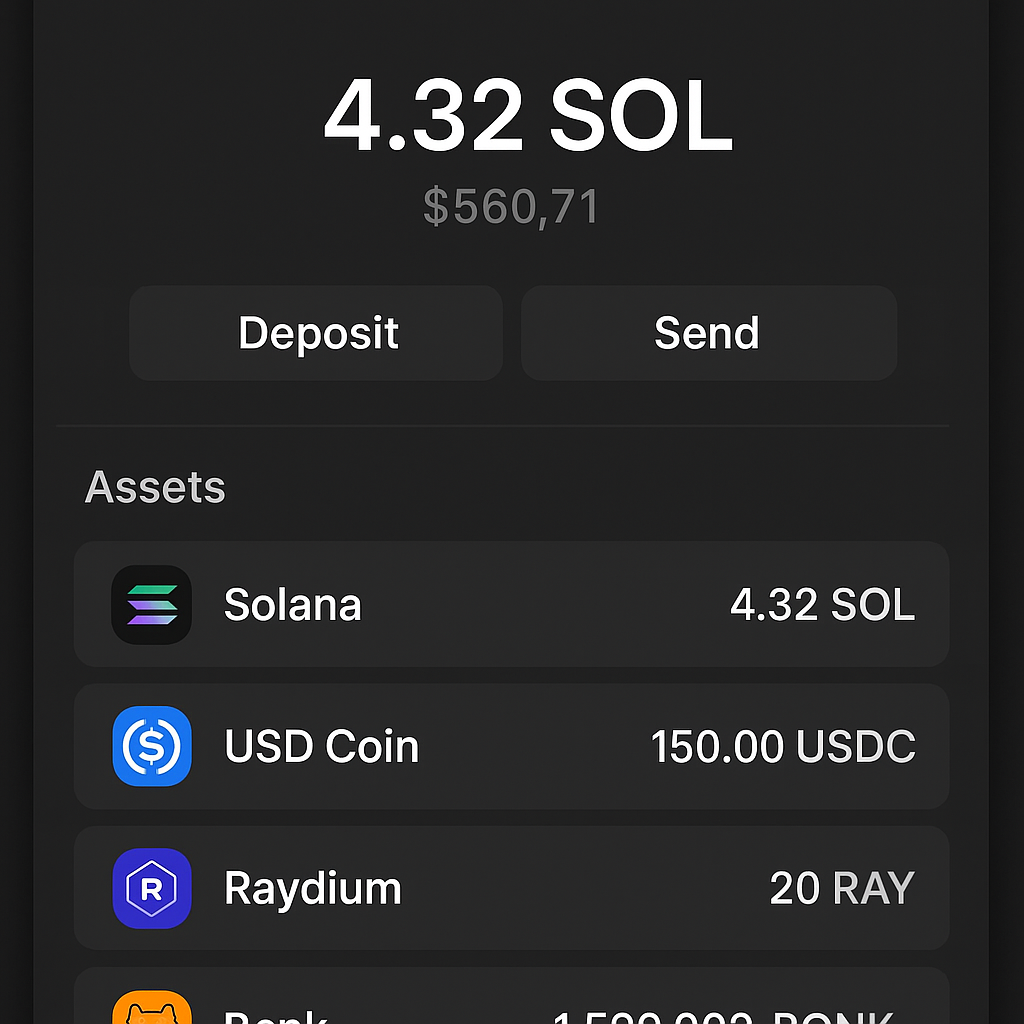

2. Utilize Smart Wallets (Phantom, Backpack) for Secure and Efficient Trading

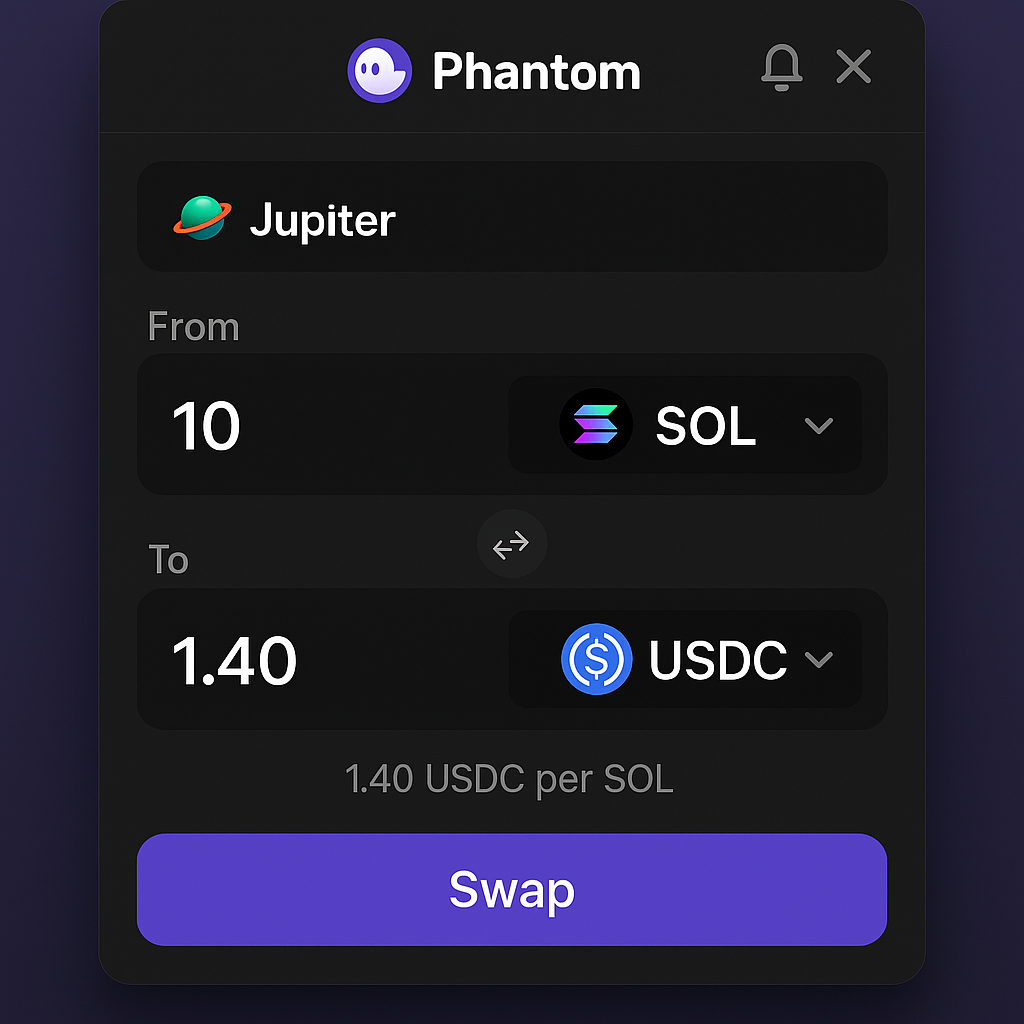

With hundreds of new tokens launching weekly on Solana DEXs like Raydium and Jupiter, wallet hygiene is non-negotiable. Set up multiple smart wallets—for farming, active trading, and long-term holding—to compartmentalize risk and streamline your workflow. Phantom and Backpack are top choices thanks to features like:

- In-wallet swap aggregators: Instantly compare prices across Raydium, Orca, Jupiter.

- Custom token lists: Filter out scam tokens by whitelisting known projects.

- Transaction simulation: Preview swaps before committing to avoid frontruns or malicious contracts.

This setup not only minimizes exposure if one wallet gets compromised but also makes it easier to track profits/losses per strategy. Always use hardware wallet integration when possible for additional security layers.

3. Implement Robust Risk Management and Exit Strategies

The allure of 100x gains from memecoins can be blinding—but sustainability comes down to disciplined risk management. Allocate only a small portion (think 1-5%) of your overall portfolio to high-risk shitcoins; keep the rest in blue chips or stablecoins. For every trade or farmed token:

- Set clear profit targets: Plan exit points before FOMO kicks in.

- Use stop-losses: Protect against sudden rug pulls or market dumps by automating exits if price drops below predefined levels.

- Monitor liquidity closely: Thin order books on Raydium or Orca can make it impossible to exit large positions without massive slippage—avoid illiquid pools unless you accept the risk.

- Stay updated on project developments: Join Discords/Telegram groups so you’re not blindsided by dev team drama or stealthy changes that signal impending trouble.

If you’re serious about playing this game long-term, treat every position as expendable—never bet more than you can afford to lose in this wild west corner of DeFi.

Managing your exposure to Solana shitcoins is a continuous process—not a one-off decision. The most successful traders in 2025 aren’t those who ape into every meme token, but those who systematically review their positions, cut losers quickly, and let winners run while protecting profits. Use DEX analytics tools to monitor liquidity depth and sudden volume spikes. If you see liquidity draining or suspicious contract changes, don’t hesitate to pull out. Remember: the faster you react, the less likely you’ll get caught in a rug pull or flash crash.

Essential Risk Management Rules for Solana Shitcoin Trading

-

Leverage Early Airdrop Participation via Solana Ecosystem Tools: Track upcoming Solana shitcoin airdrops using platforms like Airdrop Alert, Solscan, and Twitter/X threads. Engage with new projects by completing tasks—such as staking SOLX, joining Discords, or providing liquidity on Raydium—to maximize your eligibility for high-potential airdrops.

-

Utilize Smart Wallets (e.g., Phantom, Backpack) for Secure and Efficient Trading: Set up multiple smart wallets to separate farming, trading, and long-term holding activities. Use features like in-wallet swap aggregators (Jupiter), custom token lists, and transaction simulation to reduce slippage and avoid scams while trading Solana memecoins.

-

Implement Robust Risk Management and Exit Strategies: Allocate only a small portion of your portfolio to high-risk shitcoins. Set clear profit targets and stop-loss levels for each trade. Regularly monitor token liquidity on DEXs like Raydium or Orca, and stay updated on project developments to avoid rug pulls or sudden price crashes.

Community sentiment can shift rapidly. Stay tuned to project Discords and Telegrams, but also set up Twitter/X alerts for major dev or influencer accounts in the Solana ecosystem. Often, early warnings about exploits or team disputes appear on social media before official announcements.

For those wanting to automate some of these strategies, consider using trading bots that interface with Solana DEX APIs. However, bots are only as good as your parameters—never let automation lull you into complacency regarding risk.

Putting It All Together: Your 2025 Solana Shitcoin Playbook

To thrive in this environment:

- Scout early airdrops using trusted trackers and social channels.

- Segment your activity across multiple smart wallets with robust security practices.

- Pace yourself with disciplined risk controls, profit-taking plans, and active monitoring of both liquidity and project health.

This approach won’t guarantee moonshots—but it will keep you in the game when others get rekt by poor planning or emotional trades. As always in crypto, your best edge is staying informed and acting decisively when conditions change.

If you’re ready to start farming and trading Solana shitcoins in 2025, make these strategies your foundation. The market will only get faster—and more ruthless—from here. Stay sharp, stay skeptical, and remember: sometimes the best play is sitting on your hands until the next real opportunity emerges.