Before you throw your SOL at the next hyped Solana memecoin or gaming token, take a breath. Tokenomics—the economic blueprint behind every crypto asset—can make or break your investment. If you know how to analyze Solana tokenomics, you’ll avoid common traps and spot projects with real staying power. Let’s dig into what matters most.

Why Tokenomics Matter on Solana

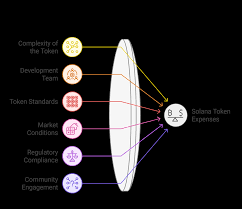

Solana’s blazing speed and low fees have spawned thousands of tokens, but not all are built to last. A project’s tokenomics determines everything from scarcity and inflation to incentives for users and developers. Whether you’re eyeing a new SPL token or an established DeFi protocol, understanding these mechanics is crucial for risk management.

Here’s why it matters:

- Scarcity drives value: Too many tokens flooding the market? Expect price dumps.

- Utility creates demand: Tokens with actual use cases (governance, staking, in-game spending) tend to hold value better.

- Fair distribution builds trust: Watch out for whales or insiders holding most of the supply.

The Core Components of Solana Tokenomics

If you want to analyze a Solana project before buying in, start with these core components:

Key Elements of Solana Tokenomics Analysis

-

Supply & Emissions: Assess the total and circulating supply, inflation rate, and token emission schedule to understand potential dilution.

-

Distribution & Vesting: Examine token allocation among teams, investors, and the community, and check vesting schedules to spot unlock risks.

-

Utility & Demand Drivers: Analyze the practical uses of the token, such as staking, governance, or paying fees, and factors that drive demand within the ecosystem.

Let’s break down each area so you know what red flags—and green lights—to look for.

Total Supply and Circulating Supply

This is where most investors trip up. Total supply is the max number of tokens that will ever exist; circulating supply is what’s actually available on the market right now. Projects like Jupiter and STEPN clearly display these stats because they know transparency attracts serious users.

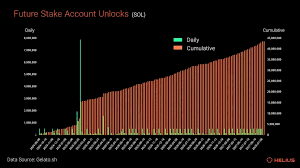

If a huge chunk of tokens are locked up (for team, investors, or future rewards), check when they’ll unlock. Massive unlock events can tank prices overnight—especially if early backers rush to sell.

Distribution and Vesting Schedules

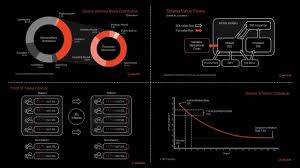

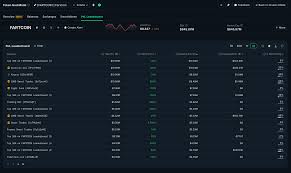

Savvy projects publish their distribution breakdowns: how much goes to founders, investors, community rewards, liquidity pools, etc. Vesting schedules—how quickly insiders can sell their tokens—are just as important. Look for charts or tables in whitepapers or dashboards like Solana Compass.

- No vesting? Early holders might dump at launch.

- Tight vesting? More gradual releases mean less shock to the market.

- Airdrops? These can build community fast but may cause volatility if everyone sells at once.

The Role of Utility and Demand Drivers

The best Solana tokens don’t just sit in wallets—they power ecosystems. For example:

- Marinade (MNDE): Used for liquid staking governance and rewards.

- BONK: The memecoin with real integrations across games and NFT platforms.

- Orca (ORCA): Powers swaps and yield farming on its DEX.

If a token has no clear use case—or its only function is speculation—think twice before aping in. Real demand means real staying power when hype fades.

This is just scratching the surface. Next up: advanced metrics (like emissions rates), governance models, and how community incentives shape long-term value on Solana… Stay tuned as we go deeper into actionable analysis techniques that separate hype from substance!

Advanced Metrics: Emissions, Burn Mechanisms, and Inflation

Once you’ve nailed the basics, dig deeper into how a Solana token’s supply changes over time. Emissions schedules reveal how quickly new tokens enter circulation—crucial for estimating inflation. Projects with aggressive emissions can suffer relentless sell pressure, especially if rewards far outpace organic demand.

Look for:

- Fixed vs. variable emissions: Does the project have a predictable release schedule or can emissions change with governance votes?

- Burn mechanics: Are tokens destroyed (burned) through transaction fees or special events? This can offset inflation and support price stability.

- Deflationary features: Some tokens implement regular burns or buybacks to reduce supply over time—check if this is just marketing spin or actually coded in the protocol.

The best Solana projects provide transparent dashboards (sometimes live on-chain) so you can monitor these metrics in real time. If you’re not seeing clear data, that’s a red flag.

Governance and Community Incentives

A token’s role in governance isn’t just about voting—it’s about aligning incentives for everyone involved. On Solana, serious projects let holders steer protocol upgrades, fee parameters, or even treasury management. The more power users have, the more likely they’ll stick around for the long haul.

But watch out: “Governance” in name only is common. If voting power is concentrated among insiders, your voice won’t matter. Check recent proposals on forums or tools like Realms to see who actually participates—and who holds sway.

Top Community Incentives in Solana Projects

-

Staking Rewards: Earn passive income by locking tokens, supporting the network, and receiving regular payouts.

-

Governance Participation: Token holders can vote on project proposals, giving them a direct say in future developments.

-

Exclusive Access: Holding tokens may unlock early access to new features, NFT drops, or private communities.

-

Liquidity Mining: Provide liquidity to decentralized exchanges and earn additional tokens as incentives.

-

Airdrops & Loyalty Bonuses: Receive bonus tokens for long-term holding or active participation in the ecosystem.

Liquidity: Can You Actually Sell?

No matter how compelling the tokenomics look on paper, low liquidity can trap you in an illiquid asset. Check trading volumes on decentralized exchanges like Raydium, and review how much of the supply sits in liquidity pools versus wallets. Thin order books are a warning sign—especially for newer memecoins or microcap tokens.

If a project touts huge future plans but has barely any trading activity today, proceed with caution. Even solid fundamentals mean little if there’s no exit route when you need it most.

Red Flags & Common Mistakes to Avoid

The Solana ecosystem moves fast—and so do bad actors looking to exploit hype cycles. Here are some classic warning signs:

- No public team or history of rug pulls? Move on—transparency matters.

- Poorly documented tokenomics? If details are vague or hidden behind buzzwords, assume the worst until proven otherwise.

- Silly high APYs? Unsustainable yields often mean massive dilution ahead; always check where those rewards come from.

- Lack of external audits? Code and economic models should be reviewed by third parties—especially for DeFi protocols handling user funds.

Practical Steps Before You Buy Any Solana Token

- Check contract addresses and verify authenticity via explorers like Solscan.

- Dive into official docs/whitepapers for distribution charts and vesting schedules.

- Analyze trading volume and liquidity pool depth on DEXes such as Raydium or Orca.

- Review governance structures—who decides what? Is it truly decentralized?

- Watch community channels (Discords, Twitter) for transparency around unlocks and emissions updates.

Summary Table: Key Tokenomics Factors to Compare Before You Buy

| Factor 🔍 | Why It Matters 💡 |

|---|---|

| Total & Circulating Supply | Affects scarcity & price impact from unlocks/releases |

| Distribution & Vesting Schedules | Tells you who controls supply—and when they can sell |

| Utility & Demand Drivers | Sustains value beyond speculation; powers real use cases |

| Emissions/Burn Mechanisms | Dilution vs deflation; impacts long-term price dynamics |

| Liquidity Depth & Trading Volume | Your ability to buy/sell without slippage risk |

| Governance Participation | User alignment; decentralization of decision-making |

| Audits/Transparency | Cuts down risk of bugs/rugs/bad economics |

Want to Test Your Knowledge?

Solana Tokenomics: Good vs Bad Features Quiz

Test your knowledge on what makes Solana tokenomics strong or weak. Choose the best answer for each scenario!

If you’re aiming to thrive in the fast-paced world of Solana tokens—from memecoins to blue-chip DeFi—you need more than FOMO-fueled conviction. Dig into real numbers, study distribution charts, grill founders about utility and emissions plans—and never underestimate the power of community-driven governance. The next cycle will reward those who do their homework now.

Which aspect of Solana tokenomics confuses you the most?

Understanding tokenomics can be tricky! Let us know which part of Solana’s tokenomics you find hardest to grasp.